The Price of Equal Pensions

2015-01-29ByWangJun

By+Wang+Jun

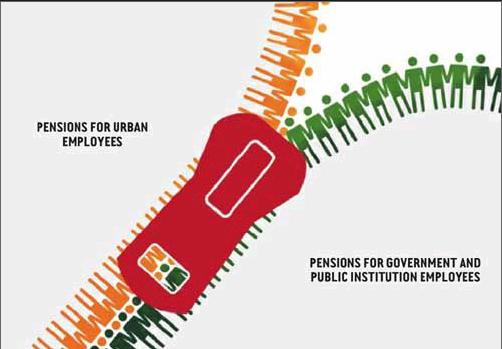

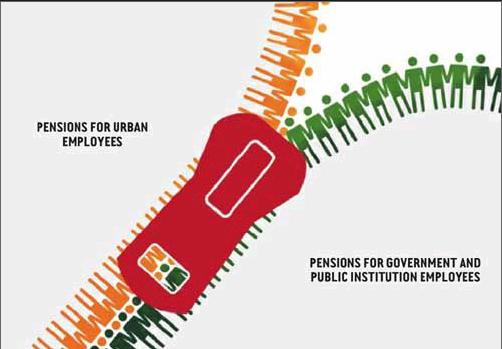

Chinas long-held dual pension system will break. Vice Premier Ma Kai, when reporting to the bi-monthly session of the Standing Committee of the 12th National Peoples Congress on December 23, 2014, said that the country will reform the pension system for government employees and those who work for public institutions and implement the same pension system with urban employees.

Ma said that under the Central Governments arrangement, several departments have drafted a plan for the reform based on extensive studies. The draft was then approved at the executive meeting of the State Council and by the Standing Committee of the Political Bureau of the Central Committee of the Communist Party of China (CPC). The reform comes from the constructive nature of the changes that will build a pension system for Party, government and public institutions with the same qualities as that for enterprises, and the reform will be carried out nationwide simultaneously with the reform of the salary system.

Under the current dual pension system, employees in government bodies and public institutions dont need to pay for their pensions, and the government supports fully them. However, employees in various types of enterprises have to pay 8 percent of their salary into a pension account. After retirement, urban employees usually get a pension equal to 40-60 percent of their final salary, but employees in government bodies and public institutions can get 80-90 percent of their final salary.

“The pension reform plan has been approved and is expected to be revealed soon, which means a significant step forward for pension reform,” said Lu Xuejing, Dean of the Department of Labor and Social Security of Capital University of Economics and Business.

Nie Riming, a researcher with the Shanghai Institute of Finance and Law, thinks the highlights of Mas report are the simultaneous implementation of pension system reform for both government employees and those in public institutions, as well as the establishment of a nationwide universal pension system.

At great cost

According to a report of the 21st Century Business Herald, a business newspaper based in Guangzhou, south Chinas Guangdong Province, there are 7 million government employees and 30 million public institution employees in China. Breaking the dual pension system means these 37 million people will be included into the pension system for urban employees.

A huge cost will be needed to unite the pension system for such a large number of people. In a paper written in 2013 by Lu Mingtao, a doctoral candidate from the Department of Economics of the Chinese Academy of Social Sciences (CASS), supposing the dual pension system was applicable to the retirees in and before 2010 and the new pension system is applicable to the retirees since 2011, the government has to pay 3.9 trillion yuan ($637.25 billion) for government employees and 5.2 trillion yuan ($849.67 billion) for employees of public institutions. In 2010, the countrys total fiscal revenue was 8.31 trillion yuan ($1.36 trillion).

Another estimate made by Nie shows that the government needs to pay 3.7 trillion yuan($604.58 billion) to employees of public institutions and 4.5 trillion yuan ($735.29 billion) to government employees.

How does China cover such high a cost? Nie offers two suggestions—either the government fully fills in the gap with fiscal revenue or the pension fund for urban employees will be used temporarily to make up for the gap. “These two options both face heavy financial pressure,” said Nie. “The governments fiscal revenue obviously cannot afford this sum of money.”

Some experts have thrown their support behind the decision to break the dual pension system. “In the short term, the reform will hurt some people, but in the long term, the reform will benefit all,” said Cheng Jie, an associate researcher with the Institute of Population and Labor Economics of the CASS. “By incorporating 37 million people into a large pool of hundreds of million people and relying on the resources of the whole society, the country will have a much stronger capability of sharing risks. Cheng also thinks the same as the cost of reforming state-owned enterprises, the financial gap for pension reform should also be mainly covered by government fiscal revenue.

Su Hainan, Vice President of the China Association for Labor Studies, thinks that since the reform will be carried out nationwide simultaneously, the Central Government will not make local governments to assume all the costs of pension reform. “If all costs were assumed by local governments, it would be highly likely that the reform wouldnt succeed in some areas,”Su said.

Zheng Bingwen, Director of the Center for International Social Security Studies of the CASS, said the pension reform this time will be carried out nationwide, and the transfer payment by the Central Government will cover the reform cost.

Regional gaps

In his report, Ma said China will promote the establishment of a national uniform pension program for urban employees based on the improvement of uniform management at provincial levels. Endowment insurance for non-employed urban and rural residents will be managed by provincial governments.

According to figures from the Financial and Economic Affairs Committee of the 12th National Peoples Congress, currently, among the 31 provinces, autonomous regions and municipalities, only six have established uniform pension programs for urban employees—Beijing, Tianjin, Shanghai, Tibet, Qinghai and Shaanxi.

Mas report said that because of differentiated financial affordability and different balances in the pension fund pools, pension standards differ remarkably among regions.

According to Nies estimation, in 2012, south Chinas Guangdong Province had the highest pension fund balance, standing at 387.96 billion yuan ($63.39 billion), while Tibet had the lowest, which was only 2.46 billion yuan ($401.96 million). In the same year, the average pension in Guangdong was 1,924 yuan ($314.38), and nine working people supported one retiree, while in northeast Chinas Heilongjiang Province, the average pension was 1,488 yuan ($243.14), and only one and a half working people supported a retiree, imposing a heavy burden on the working employees.

“To establish a national uniform program, provinces and municipalities that have high balances of pension funds will have to fill in the gaps for those with low balances, and well-developed provinces will certainly not be willing to do this,” said Nie. “It will be very difficult to establish a unified national program.”

“Every problem involved will be difficult,”said Yang Yansui, Director of the Employment and Social Security Research Center of Tsinghua University, adding that the Third Plenary Session of the 18th CPC Central Committee has made clear requirements for the pension insurance system: placing basic pension under unified national planning, pushing forward the reform of pension insurance system for government bodies and public institutions, and progressively raising the retirement age.