Set Out With A Bang or A Whimper?

2015-01-29BydengYaqing

By+deng+Yaqing

Tang yan, a 35-year-old man who only just began his stint in entrepreneurship in 2011, surprised the corporate world when his firm Momo, a Chinese social media service provider, went public on the NASDAQ on December 11.

The location-based application that allows users to send text, photos or videos to people nearby priced 16 million American depositary shares at $13.5 per share and opened at $14.25 a share, raising $216 million on its first day of trading on the NASDAQ. Far from the end of the story, Tang said he plans to open Momo offices in the United States to expand business.

Allowing users to establish personal social networks by searching for adjacent strangers based on peoples current locations via their mobile devices, Momo had attracted 180.3 million users by September 30, 2014.

“Our efforts in the past years have paid off, and we take pride in Momos listing in the United States,” said Tang, who formerly served as the editor in chief of NetEase, one of Chinas major Web portals.

In the social media sector that has been dominated by Tencents friend-based instant messaging app WeChat, the rise of Momos popularity is considered a great success. Nicknamed as “the best hook-up app,”Momo ranked third, attracting 64.3 million active users in the third quarter of 2014, second only to WeChat and QQ, according to Analysys International, a Beijing-based market research firm.

Tang believed clear positioning makes the foundation of Momos success. “Many social networking platforms are based on real social relations, while Momo helps people create new contacts entirely online,” said Tang, who hopes to realize long-term viability after getting listed.

However, after the record high of $17.48 per share registered on its first day of trading, Momo began to lose steam, and for the first time, dropped below its offering price to $13.29 per share on December 17.

Uncertainties

Just a day ahead of Momos initial public offering (IPO), NetEase issued a statement accusing Tang of dereliction of duty and misuse of company resources to benefit an advertising firm where his wife was working, and violating his contracts with NetEase by utilizing the information and technological resources provided by the website to establish his own company during his employment at NetEase.

Luo Lan, an industry analyst with Analysys International, noted that NetEases conduct may affect investors confidence in the emerging star, because the personal and professional ethics and leadership styles of company founders are major concerns in IPOs.

Aside from that, a transformation is urgently needed. In April 2012, Mike Sui, a mixedrace comedian, first posted his 12 Beijingers video which attracted 5.17 million hits, in which Momo was referred to as “a magical tool to get laid.” “The nickname has done more harm than good to Momo. For one thing, it fueled a dramatic growth of users. For another, female users may face moral pressures,” said Tang, who has spent millions of dollars to reverse the image of Momo as a one-night-stand app.

Amidst the governments anti-pornography campaign, the investigations against QvodPlayer and Sina indicated the anti-pornography efforts have been diverted to cyberspace. As many Internet companies are striving to transform, the “best one-night-stand app” Momo also faces great challenges and risks, said Ding Daoshi, Director of SooToo Institute, a research institution on Chinas Internet economy.

“Although Momo manages to cater to some users and has accumulated a substantial user base, a transformation is inevitable under the current policy circumstances,” said Zhang yi, CEO of iiMedia Research, noting that the speed of transformation will affect the companys survival.

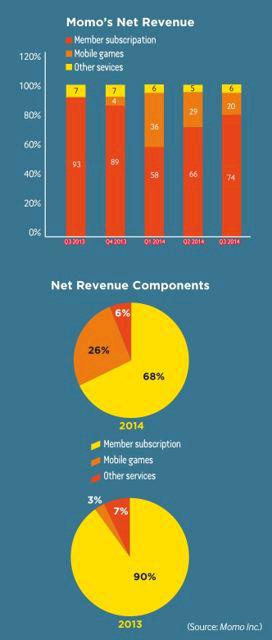

Momos prospectus submitted to the U.S. Securities and Exchange Commission shows that its main operating profits come from membership fees, which accounts for more than 70 percent in each quarter. In addition, of the 180 million sign-ups, only 2.3 million are paying members. In the future, Momo should focus on enhancing user engagement and developing new business, said Luo.

In fact, online gaming has begun to rise as another major source of income. According to Momos prospectus, in the second half of 2013, its mobile gaming product only generated revenues of $92,000; in the first half of 2014, it soared to $4.44 million. Beyond that, the company also shows an intention to tap into onlineto-offline business.

A way out

As Momos largest institutional shareholder, Chinas e-commerce giant Alibaba, a New york Stock Exchange-listed company, holds a 21-percent stake. In its prospectus, Momo expressed an intention to monetize user traffic through cooperating with Alibaba to place targeted advertisements of merchants on Alibabas marketplaces, and cooperate with online classified website 58.com by providing users easy access to their marketplaces.

Luo said Alibabas merchant resource superiority will complement Momos strength in location-based social contacts. In the days to come, their teaming up will brace Momo to expand location-based services.

According to its financial report, the company witnessed a loss of $14.6 million in the third quarter of 2014, sparking suspicions over its long-term profitability. Currently, Momo still relies on a conventional profit model of mobile Internet encompassing membership fees, mobile game operation and advertisements, which is not sufficient to cover its costs.

“To reach a revenue balance, Momo needs to explore new sources of income. By joining hands with Alibaba and 58.com, it is likely to stand out in terms of location-based marketing,” said Luo, who firmly believes Momos future profit growth lies in its cooperation with Alibaba and 58.com.

Chen xiaohua, chief strategy officer of 58.com, held that Momos information flow can be rendered into commercial profits through the channel of 58.com. Mobile Internet companies generally achieve profitability through mobile gaming or advertising. While Momos strength lies in mobile gaming, 58.com has developed its own advertisement alliance, which provides users with location-based advertising services.