Alliance Between Giants

2014-12-01ByDengYaqing

By+Deng+Yaqing

As a Chinese proverb goes, if two brothers are of the same mind, their sharpness can cut through metal. Recently, China CNR Corp. Ltd. (CNR) and China CSR Corp. Ltd. (CSR), the worlds two largest railway transportation equipment manufacturers, have decided to undergo a merger to compete in the global arena.

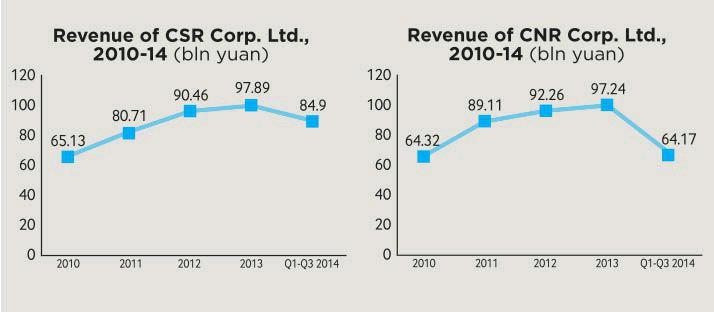

In recent years, as great progress has been made in Chinas high-speed railway and subway equipment industry, CNR and CSR have entered a period of explosive growth.

In China, the two giants now preside over the entire bullet train market, 80 percent of the freight train market and the bulk of the metro vehicle market. In the overseas market, the two are also gaining ground by virtue of reliable technologies, rich domestic operating experience and low prices.

According to the Worldwide Market for Railway Technology released by German railway transportation authority, the top seven manufacturers are CNR, CSR, Canadas Bombardier, Germanys Siemens, Frances Alston, Americas General Electric and Japans Kawasaki. The sales revenue of CNR and CSR is equivalent to that of the rest of the other five railway transportation equipment manufacturers combined.

Both companies are capable of producing CRH380 high-speed trains, which have safely run more than 400 million km and been dubbed the champion of the top 10 high-speed trains in the world.

After finishing the impending merger, the new conglomerate, with estimated annual revenue of $33.6 billion and net profit of $1.44 billion, will pose a great challenge to Western rivals like Alston and Siemens.

Without a doubt, China has developed a whole set of sophisticated high-speed rail and train technologies and is prepared to promote the Chinese standard worldwide.

Competitiveness

CNR has exported its products to more than 90 countries and regions. In the first half of this year, CNR won overseas orders worth $1.54 billion, a year-on-year increase of 178.18 percent.

According to statistics from SCI Verkehr, a German leading strategic consultancy, CNR maintained the first place in the field of global railway transportation equipment in 2011, 2012 and 2013, accounting for 22.4 percent of the global subway vehicle market in the past five years.

On October 22, CNR MA, a joint venture between China Changchun Railway Vehicles Co. and CNR, won a $567-million contract to supply 284 rail cars for the city of Bostons subway system.

Although many global railway transportation equipment manufacturers, such as Canadian Bombardier and Japanese kawasaki Heavy Industries Group, competed for the order, CNR MA offered the lowest quotation among the six bidders, equivalent merely to little more than half of the quote made by Bombardier, according to the Massachusetts Department of Transportation.

In terms of manufacturing experience, product performance, quality and price, CNRs products, which can run 129,000 km per year with a service life of 30 years, are far ahead of other competitors.

In fact, as early as 2008, Shenyang Locomotive & Rolling Stock Co. Ltd. under CNR had established a joint venture with Wabtec Corp., focusing on the research and development of world-class railway braking products. Last year, CNR set up a welding structure research and development center with University of Michigan.

CSR has also fixed its eyes on the American market. Following CNRs good news in the United States, CSR announced that it has submitted an intention to bid to the California High-Speed Rail Authority to participate in the construction of its high-speed rail network. By the end of August, the value of overseas contracts signed by CSR had surpassed $3.5 billion, with its products exported to 84 countries and regions such as Australia, Singapore, India and South Africa.

Wang Mengshu, a tunnel and railway expert at the Chinese Academy of Engineering, said that the merger will eliminate “in-fighting” be- tween the two in the exploration of the global market, improve the image of Chinese enterprises, facilitate technological innovation and boost international competition.

“Fourteen years ago, the then Ministry of Railways split the China National Railway Locomotive and Rolling Stock Industry Corp. into two separate companies to stimulate market competition. Now, China is competing with international railway transportation manufacturers, and the challenge in front is how to give a full play to its overall strength, promote the brand image of Chinas high-speed trains, and export the Chinese standard,” said Sun Zhang, a railway expert at Tongji University.

Why the merger?

Since last October, Chinese Premier Li Keqiang has promoted Chinese-made high-speed trains to a number of countries such as Australia, Britain and the United States. However, the overlap of CNR and CSRs businesses has greatly fueled cutthroat competition between the two.

Li Jin, Vice President of China Enterprise Reform and Development Society told The Beijing News that mergers of state-owned enterprises usually take the form of a high-per- forming company acquiring another moribund company, and the case of CNR and CSR is quite different, for the two are neck and neck.

The move aims to change the in-fighting situation and reduce waste of resources, so that Chinese bullet train manufacturers can have a louder say in the overseas market and spread the Chinese brand and standard on a larger canvas. For this reason, the merger will quickly weld the two into a community of shared interests, according to the Chinese Listed Companies Public Opinion Center.

In addition to the elimination of price competition, the move will also propel management and technological progress. Wang said that the subordinate factories of CNR and CSR may undergo a restructuring to focus on the research and development of different high-speed trains, such as those running in highland and severely cold regions. If the two continue going out of their way to vie for construction projects, stagnant technological progress and low prices will easily breed corruption.

“If the two train giants team up with each other, their bargaining power will be significantly enhanced,” said Sun, noting that since CNR and CSR are skilled in the manufacturing of locomotives and motor train units respectively, the two will complement each others advantages after joining hands.

As Wang Zhigang, Assistant Director of the Research Center of the State-owned Assets Supervision and Administration Commission of the State Council, argued that the merger is not just a corporate reorganization, but an attempt to promote the “Chinese high-speed train” on the international stage.

“The competitiveness of Chinese-made high-speed trains lies in their standard and brand as well as their speed,” said Wang.

China CNR Corp. Ltd.

Incorporated on June 26, 2008, CNR has been listed on the Shanghai Stock Exchange since December 2009 and on the Hong Kong Stock Exchange since May 2014.

As a leading company in Chinas rolling stock industry and an important member of the worldwide rail transportation equipment manufacturing industry, CNR directly holds 26 subsidiaries established on the mainland and three subsidiaries incorporated in Hong Kong, South Africa and the United States.

CNR focuses primarily on the manufacturing and refurbishment of rolling stock, including high-speed multiple units, locomotives, passenger coaches, freight wagons, rapid transit vehicles, and railway engineering machinery. CNR also engages in the manufacturing of mechanical and electric products, clean energy and environmental protection equipment. In addition, its business also encompasses trading of raw materials, finance leasing of rolling stock, machines and equipment, and a project management contracting service for urban rail and other related projects with the aim of providing future cities with systematic solutions.

China CSR Corp. Ltd.

Incorporated on December 28, 2007, CSR went public in Shanghai and Hong Kong in August 2008, and has established 17 wholly owned and shareholding subsidiaries in 10 provinces and cities.

CSR boasts a complete system of independent development, massive manufacturing and standard service of railway locomotives, passenger trains, freight wagons, bullet trains, metro vehicles and relevant parts.

As Chinas largest metro vehicle manufacturer, CSR owns Chinas largest electric locomotive R&D and manufacturing base, a globally leading bullet train R&D and manufacturing base, an industrially leading large-power diesel locomotive and diesel engine R&D and manufacturing base, a domestically leading high-grade bus enterprise, a globally leading rail wagon R&D and manufacturing base, and three designated mass transit vehicle localization enterprises.

CSR uses proprietary rail transit equipment technologies to develop and expand the market for extended products, including electric vehicles, wind generation equipment, automotive parts, marine crankshafts and diesel engines, large-power semiconductor devices and construction machinery.

(Source: CNR & CSR)