Slow Down, Don’t Panic

2014-11-10ByDengYaqing

By+Deng+Yaqing

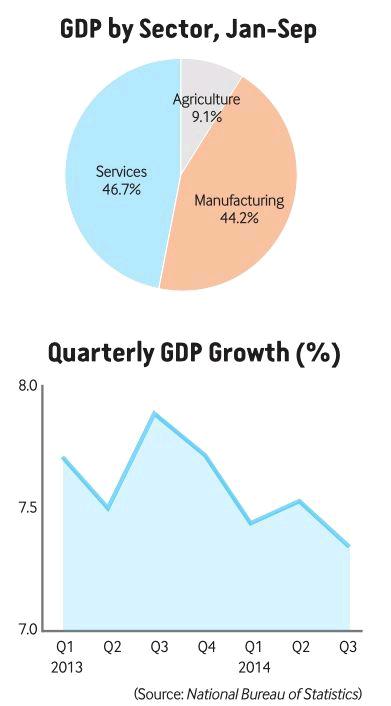

Chinas economy grew at 7.3 percent in the third quarter of 2014, maintaining a steady pace despite a complicated external and internal economic environment. In the first nine months, the Chinese economy expanded 7.4 percent overall.

“Although there is a slight drop from the previous quarter, the 7.3-percent growth is still within a reasonable range. Given that the economy is in the midst of a slowdown and ongoing structural adjustment as well as dealing with undigested stimulus policies, achieving such a result in no way represents the picking of low-hanging fruit,” said Sheng Laiyun, spokesman for the National Bureau of Statistics (NBS), at a press conference on October 21.

“Although the GDP has grown at a slower pace, employment data are inspiring. From January to September, more than 10 million jobs have been created in urban areas, achieving the full-year target set for employment ahead of time,” said Sheng.

“We are fully confident in the prospects of Chinas economy. In face of the challenges, China will maintain its zeal to realize its economic goals this year,” said Chinese Premier Li Keqiang when meeting with the heads of delegations who came to Beijing to attend the 21st Finance Ministers Meeting of the Asia-Pacific Economic Cooperation on October 21.

Why the slowdown?

The slowdown is part of the inevitable throes of structural adjustment, the repercussions of which have “gone beyond expectations,” said Sheng. The reduction of overcapacity and the adjustment of the property market have significantly affected the production, consumption and investment of related enterprises, eroding GDP growth.

Prior to the breakout of the 2008 global financial crisis, overcapacity had already taken shape as a major economic problem in China. Since 2002, fixed assets investment had expanded at a pace as fast as 20 percent for three years running. When the production capacity was unleashed in 2005, prices of steel, cement and electrolytic aluminium began to steadily drop. According to incomplete statistics from the China Iron and Steel Association, while Chinas steel production capacity is 1 billion tons, the total demand is roughly 700 to 800 million tons.

Li Yang, Vice President of the Chinese Academy of Social Sciences (CASS), said that excessive investment has resulted in the current level of overcapacity, while the slowdown is a result of the elimination of investment of bad performance. “China should put its investment mechanisms and environment in order by shepherding excessive capacity into sectors such as infrastructure investment, and unveil some financially supportive policies to help more private enterprises realize potential.”

Aside from that, while traditional advantages like low labor costs have faded, new growth points have not yet been activated. After several years of explosive growth, the old pattern of resource- and labor-intensive development can no longer sustain growth, and an array of problems such as excess capacity and air pollution have severely hindered economic and social progress. At the same time, novel technologies such as new energy are incubating another round of global scientific and technical revolution.

“At the critical stage of transformation and upgrading, new elements are wrestling with old ones, which still possess the upper hand. Therefore, downward pressures cant be ignored,” said Sheng, who advised remaining calm, continuing to intensifying reforms and restructuring and making incremental preemptive adjustments.

For now, the government should resist the temptation to adopt large-scale stimulus policies, and concentrate on accelerating the pace of reforms and stabilizing economic growth, in order to lay a solid foundation for future development, said Niu Li, an economist at the State Information Center (SIC), a government think tank.

A ‘new normal

Despite a slowdown in the third-quarter economic growth, “some profound changes are already taking effect,” said Sheng, who perceives the “new normal” of Chinas economy in terms of industrial structure, demand structure, income, regional development, resource and environment cost.

According to statistics from the NBS, in the first three quarters, the service indus- try contributed 46.7 percent to the GDP, a 1.2-percentage-point year-on-year increase, and 2.5 percentage points higher than that of the manufacturing industry. Emerging industries such as e-commerce, logistics and express delivery have come along in leaps and bounds.

Ma Jun, chief economist of the Research Bureau of the People Bank of China, held that the service industry, which has created more jobs than the manufacturing industry, is expanding its territory and playing an increasingly important role in Chinas economic development.

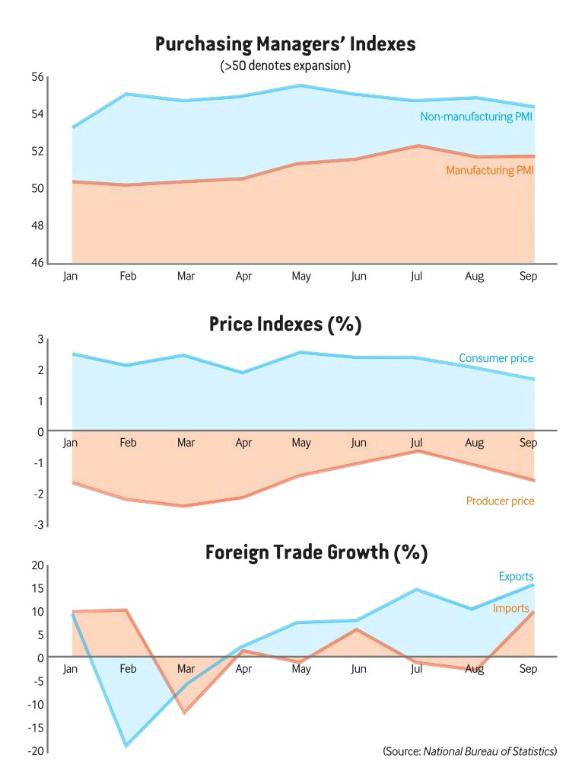

Since the beginning of this year, investment growth has slackened and export growth has shown a tendency to shift gears. Meanwhile, consumption has performed well by contributing 48.5 percent to the GDP in the first three quarters, up 2.7 percentage points year on year.

“In the past, attempts at economic restructuring always focused on propelling the expansion of key and strategic industries. In the era of the ‘new normal, structural adjustment is oriented to meet the requirement of the market and peoples livelihood first and foremost,” said Ma, predicting that when per-capita GDP surpasses $7,000, consumer preferences will edge from manufactured goods to service products.

In the first three quarters, the growth of per-capita disposable income rose by 8.2 percent, 0.8 percentage points higher than the GDP growth and 0.1 percentage point higher than the fiscal revenue growth. Moreover, it even outpaced the growth of corporate profits.

Beyond that, the coordinated development of east, central and west China and the reduction of resource and environment costs reflect a more scientific pattern of development. From January to September, the energy consumption per unit of GDP witnessed a decline of 4.6 percent, according to Sheng.

“From a macroeconomic perspective, efforts should be made to advance the balanced development of domestic consumption. More investment should be made in promoting high-end manufacturing, modern services, ecological environmental protection, and infrastructure construction, as well as bolstering social insurance and meeting the rigid housing demand,” said Li Xuesong, Deputy Director of the Institute of Quantitative & Technical Economics at the CASS.

Looking ahead

Niu from the SIC forecast that the economy will continue to expand at the same pace in the fourth quarter, and generally speaking, the full-year target of 7.5 percent or so is still in the cards.

Sheng predicted that Chinas economy will grow at a stable and faster pace in the fourth quarter. While ongoing industrialization and urbanization will continue to provide impetus for Chinas economy, the further development of central and west China as well as the upgrading of the consumption structure will bring about more opportunities, said Sheng. Moreover, the Chinese Government is energetically promoting reforms and innovation, which will also greatly jack up the economy.

The World Economic Outlook Report released by the International Monetary Fund on October 7 predicted Chinas economic growth will linger at 7.4 percent in 2014 and slow down to 7.1 percent in 2015.

“The sluggish credit growth will continue to affect investment, and at the same time, the housing market will be stagnant as it is,”said the report.

UBS Securities economist Wang Tao believed the property market will maintain its downward trend next year, because the recent decline is really a result of supply exceeding demand.

The East Asia and Pacific Economic Update published by the World Bank on October 6 predicted Chinas GDP growth will level off at 7.4 percent in 2014 and drop to 7.2 percent in 2015. As it stated, the Chinese Government has taken a series of measures to contain local government debts, crackdown on shadow banking, eliminate overcapacity, and in particular to curb environmental pollution, which if left unchecked will further pull down the growth of investment and the output of the manufacturing industry.

These measures and policies will put the Chinese economy on the track of more sustainable development, the report said.