Reining in Executive Pay

2014-09-23ByWangHairong

By+Wang+Hairong

Mai Boliang, CEO of China International Marine Containers Group Ltd. (CIMC), has made headlines the past two years as having the highest salary of any CEO of centrally administered enterprises listed in Chinas yuan-denominated A-share market.

Centrally administered state-owned enterprises (SOEs) include the 113 SOEs directly administered by the State-Owned Assets Supervision and Administration Commission of the State Council (SASAC), which are in strategically important industries such as aerospace, energy, shipping, food and mineral trading, telecommunication, steel and auto production as well as construction. They also include large stateowned financial institutions, and SOEs directly administered by government ministries, such as China Railway Corporation and China Post.

In 2013 alone, Mai made 8.69 million yuan ($1.42 million), the highest not only among SOEs but all other companies listed in the A-share market that had disclosed their executives pay. In 2012, he pocketed 9.98 million yuan ($1.6 million), also the topmost of CEOs of centrally administered SOEs in the A-share market.

In 2013, the average annual income of urban employees working for non-private organizations was 52,379 yuan ($8,380), and that of urban employees in the private sector was 32,706 yuan ($5,233), according to the National Bureau of Statistics.

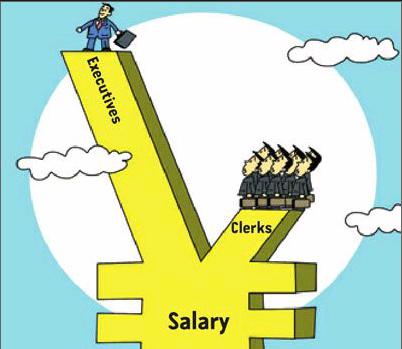

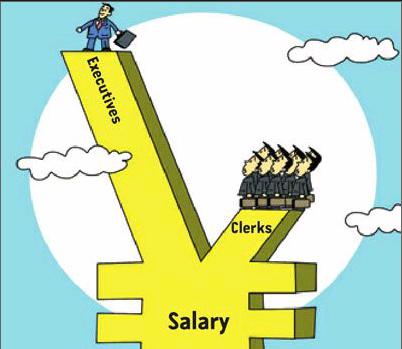

Data from iFind, a Zhejiang-based major financial data provider, show that 323 A-share listed centrally administered companies had disclosed the salaries and bonuses of their general managers in 2013, which averaged 773,000 yuan ($123,680), 14.8 times and 23.6 times as much, respectively, as the average of employees in urban non-private organizations, and those in urban private sectors.

CEOs making more than 1 million yuan($163,000) annually mostly worked in sectors like manufacture, finance, real estate and the wholesale and retail industries.

In addition to high salaries, many top executives at major SOEs hold vice-ministerial or ministerial-level administrative ranks in the government and enjoy other fringe benefits such as transportation subsidies and communication allowances.

Controversy

At Guba.eastmoney.com, a bulletin board system for shareholders, some netizens commenting on Mais pay in late August were divided in their responses.

A netizen called Mais whopping salary “blatant robbery.”

“An ordinary worker earns less than 40,000 yuan ($6,500), while he [Mai] gets so much,”the netizen commented. “If people in povertystricken areas know this, what will they think of him?”endprint

The CEOs are “using their power and the countrys resources to make colossal personal gains,” remarked netizen Laomao xsx.

A netizen known as Shanghai Shareholder asked, “Has his company grown as fast as his salary? What about its stock price? “

Some netizens disagreed. “Whether it is robbery or not, we should look at performance and returns,” a netizen named Chad Luzili remarked, “I believe in this company, and I am waiting for returns [on my investment]. I believe in talented people.”

“To tell the truth, Mai deserves an annual salary of 10 million yuan ($1.6 million). That is not too much,” said a netizen identified as a shareholder in Guangzhou, capital city of Guangdong Province.

“I do not care how much he makes as long as he helps me earn more,” said netizen Shareholder Ge.

In 1982, Mai joined the CIMC in the Shekou Industrial Zone of Shenzhen City, as a technician. The company was set up in 1980 jointly by China Merchants Group, a centrally administered SOE based in Hong Kong and Denmarkbased East Asiatic Company, shortly after China implemented its reform and opening-up policy.

Cultural differences led to clashes in management philosophies between Chinese and Western managers. In 1986, the company was on the verge of bankruptcy.

By 1987, the company was restructured, and the number of employees was slashed from 330 to 59. Mai was appointed vice general manager. With support from Chinese shipping giant COSCO Group, the CIMC began to produce containers. In 1991, Mai was appointed the CIMCs general manager at the age of 33, a position that he has kept for 23 years.

The company was listed on the Shenzhen Stock Exchange in 1994. According to the CIMC, since 1996, its container output and sales have been maintaining a leading position in the world. The CIMC has also probed into new fields like modular building and container house refurbishment. Currently, the company has grown into a multinational corporation with over 150 subsidiaries and 63,000 staff members across China, North America, Europe, Asia and Australia.

According to an interview with Mai in South Reviews, a Guangdong-based magazine, it was not easy for the company to gain access to overseas markets. In 2000, a Japanese client ordered 500 products from a Japanese producer, 500 from a South Korean producer and 500 from the CIMC. In the beginning, the customer did not trust the quality of the CIMCs products.Mai suggested the customer randomly choose one product from each of the three producers, cover the producers name on every product, and then invite 20 Japanese experts to inspect and grade the products.endprint

The experts gave the CIMCs product a score of 86, and the other two scores of 67 and 87. From then on, CIMCs products have been accepted in the Japanese market.

To motivate employees, the CIMC implements a performance-based incentive system that does not set “a ceiling or a floor,” Mai said.

In 2010, as the container market recovered from the global financial crisis, the company raked in a net profit of 2.85 billion yuan ($464.57 million), more than doubling that of the previous year. In that year, Mais pay jumped 10-fold to reach 5.96 million yuan ($953,600). In 2011, CIMCs net profit grew by 28 percent while his pay increased by 61 percent, reaching 9.57 million ($1.53 million).

Critics say that Mais remuneration seems not to match his companys performance. In 2012, the companys net profit plummeted by 47.25 percent, but Mais salary still increased by 4 percent.

This problem has been found in a number of publicly listed centrally-administered companies. Some companies annual reports revealed that even when the companies suffered huge losses, their executives remuneration kept soaring.

For instance, in 2013, China Merchants Energy Shipping Co. Ltd. incurred a loss of 2.18 million yuan ($349,440), yet CEO Xie Chunlins salary leaped from 180,000 yuan ($28,800) in 2012 to 850,000 yuan ($136,600) in 2013, according to Liu Xiangli, a research fellow with the Institute of Industrial Economics of Chinese Academy of Social Sciences.

The payment system of many listed companies is flawed; as a result, executives pocket a hefty income even when their companies are suffering losses, said Yang Jian, Director of the Financial Information Center of Renmin University of China. That is a failure of the companies governance system, Yang added.

In 2003, SASAC was founded to manage the 100-plus key state-owned enterprises. The SOEs once suffered from a dearth of talent because of low wages. To invigorate SOEs once again, in 2004, SASAC introduced performancebased incentive pay for corporate executives.

Currently, the income of some SOEsexecutives is extraordinarily high because executives are given the right to set their own pay level, said Pi Haizhou, a well-known financial commentator.

Simply rewarding SOEs executives for their companies performance is not reasonable, said researcher Liu. She said that their performance to a large extent depends on their historical advantages in scale, resources and government support. For instance, they can obtain land and loans at a cost much lower than private companies. Besides, SOEs executives are mostly government-appointed and do not shoulder market risks.endprint

When measuring executives performance, the performance of the industries and market situation should also be taken into consideration, said Pi.

Some SOEs are monopolies, whose competitiveness does not have much to do with their executives management ability; hence, their high salaries should be regulated, whereas executives in competitive industries who have helped their companies grow should be rewarded with appropriately high pay, economist Ma Guangyuan told China Youth Daily.

Pi suggested that executives pay plan should be submitted to supervising government departments for approval and be supervised by the public.

Reform decisions

On August 29, Chinas top leadership, the Political Bureau of the Communist Party of China approved plans to regulate exorbitant salaries of executives of centrally administered SOEs.

At that meeting, the central leadership decided to standardize SOEs income distribution so that their pay level would be appropriate, pay structure reasonable, pay management standardized and supervision effective. Unreasonably high or excessive salaries would be adjusted.

It was decided that the salary system should differentiate between CEOs according to business types and executives recruitment methods, as well as the income gaps between executives and ordinary employees. Executives in different industries would also have their pay properly adjusted to promote social justice.

However, so far, no detailed measures on adjusting executive pay have been disclosed.

The Central Governments meeting also approved another document on curbing SOE executives expenses, such as spending on official receptions, vehicles and overseas trips.

“Deepening the reform of the payment system for executives of major SOEs is an important part of Chinas efforts to establish a modern corporate system and push forward the reform of the income distribution system,” read a statement released after the meeting.endprint