Alibaba IPO Looms

2014-05-08ByZhouXiaoyan

By+Zhou+Xiaoyan

Alibaba Group Holding Ltd., Chinas largest e-commerce vendor, confirmed on March 16 that it will initiate its longawaited initial public offering (IPO) in the United States. The news sent shockwaves across the U.S. financial community as it is bound to bring a huge windfall to U.S. underwriters and investors.

“The decision will make Alibaba a more global company and enhance its transparency, as well as allowing it to continue to pursue our long-term vision and ideals,” the Hangzhoubased e-commerce giant said in a statement.

The company, however, did not specify which bourse it will choose to float its shares, or give a detailed timetable.

Although Alibaba is an e-commerce juggernaut in China, it is not so well known in the United States.

Blending many of the functions of eBay, Amazon and PayPal, Alibaba stands out as unique among Chinese Internet companies. Even though it doesnt directly sell products online, it is highly profitable because merchants who use its websites pay for advertising and other additional services.

Alibaba operates two of the nations most popular online shopping services—Taobao.com, a customer-to-customer (C2C) marketplace for numerous startup businesses, and Tmall.com, a business-to-customer(B2C) platform.

The business empire has thrived in years past as Chinese consumers increasingly flock to online marketplaces rather than traditional brick-and-mortar stores.

In the fiscal year ending on March 31, 2013, the two platforms total transaction value exceeded 1 trillion yuan ($163 billion), according to Alibaba.

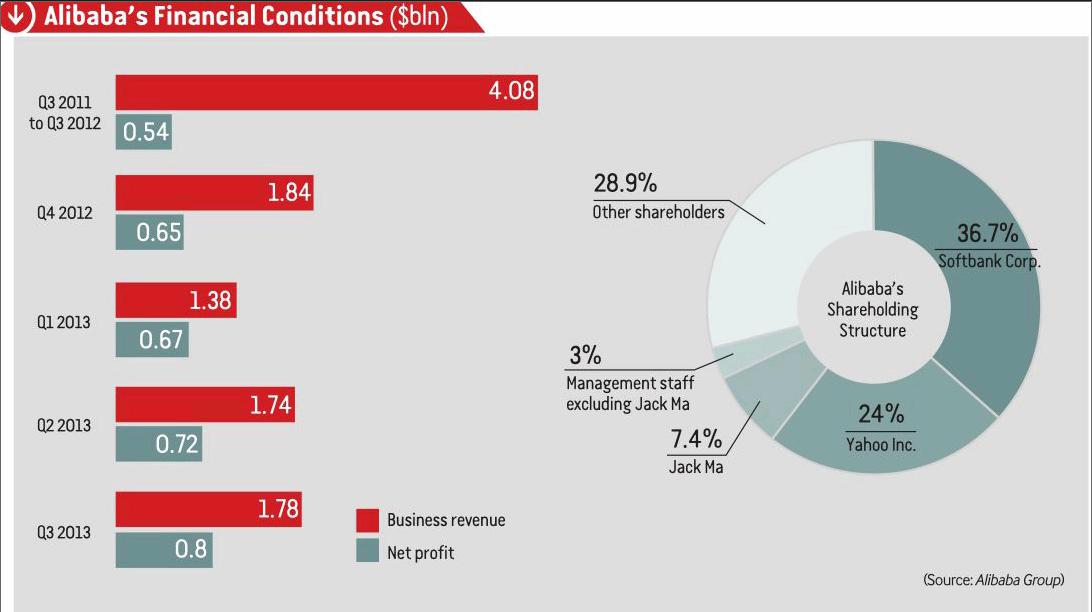

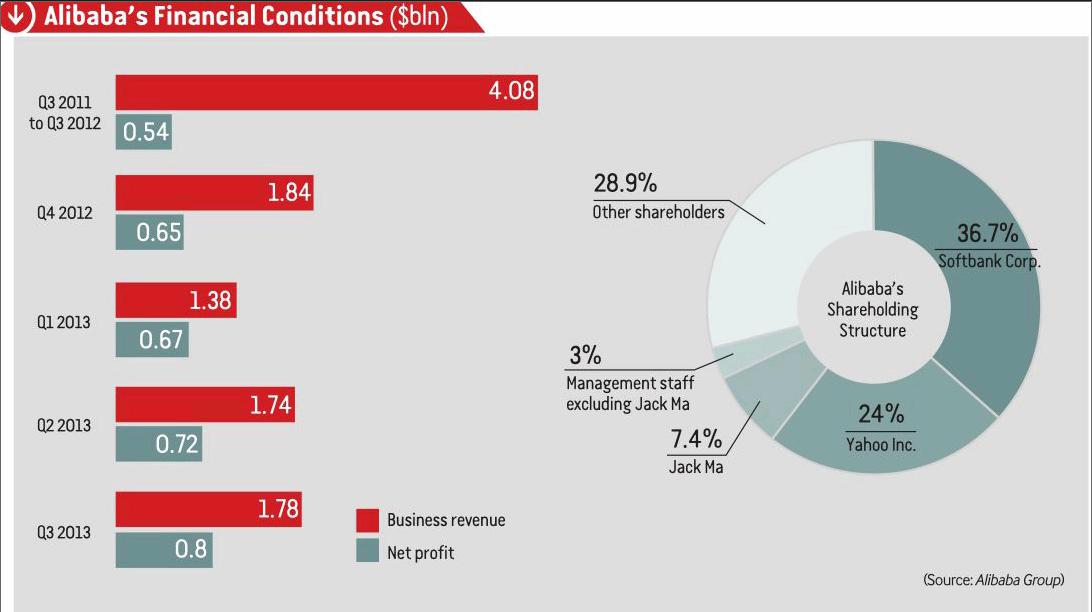

Based on an average formulated by 12 analysts, Alibaba is estimated to have a market value of $141 billion. With that valuation, and Yahoo selling half its stake, as previously agreed, the IPO could raise more than $17 billion, according to Reuters.

Feng Pengcheng, Director of the China Research Center for Capital Management at the Beijing-based University of International Business and Economics, told Beijing Review that his forecast of market value stood at $150 billion-$160 billion, while he expects the IPO to raise $15 billion-$16 billion.

The companys proposed U.S. listing is the most anticipated IPO since social networking site Facebook raised $16 billion in 2012. If successful, it will be the largest U.S. IPO ever launched by a Chinese company and one of the biggest IPOs in U.S. history.

Why the U.S.?

Early in July 2013, Alibaba was reported to have almost finished their IPO preparations, and the only thing that remained to be decided was where to list—the United States or Hong Kong.endprint

Hong Kong was supposed to be top choice for Alibaba.

Hong Kong regulators, however, refused to approve Alibabas partnership structure, in which a group of insiders, including founder Jack Ma, control the board despite owning a minority share. Such a corporate structure is allowed in New York and already used by Internet giants Facebook and Google, among others.

The Hong Kong exchanges rules prohibit dual classes of shares and other arrangements that give shareholders more than one vote per share as it defies the “one-share-one-vote”standard applied in Hong Kong.

Alibaba pinned its hopes on a review of Hong Kongs shareholding rules that would keep the door open for a listing in the city. The public consultation, however, moved quite slowly.

While Alibaba waited for Hong Kong regulators to make a decision, smaller Chinese Internet companies such as JD.com and Sina Weibo were forging ahead with their own U.S. listing plans.

JD.com, Chinas second largest e-commerce company following Alibaba, announced a U.S. listing of its shares on January 30.

On March 15, Chinas twitter-like microblogging service Sina Weibo filed to raise $500 million via a U.S. IPO.

Finally, after nearly one year of talks with Hong Kongs regulatory stock exchange officials, Alibaba lost patience.

Alibabas choice is a blow to Hong Kongs financial industry, in terms of lost prestige, fees and trading volumes.

Hong Kongs loss is the U.S. financial industrys gain. The deal has the potential to bring in about $300 million in advisory fees alone for the banks involved, based on an estimated 1.75 percent commission.

Feng said Alibaba is more likely to choose New York Stock Exchange (NYSE) over the Nasdaq, although the latter used to be the bourse that hi-tech firms prefer when floating onto the stock market.

In 2013, the number of hi-tech firms that chose to be listed in NYSE surpassed that in Nasdaq for the first time, among which was the high-profile IPO of Twitter.

“Due to several technical glitches that occurred in the Nasdaq during the past two years and NYSEs relentless efforts to court hi-tech firms, many have chosen NYSE over Nasdaq. So far as I know, the NYSE also made publicity efforts to court Alibaba. So I think it will win over Alibaba in the end,” Feng told Beijing Review.

Pros and cons

Analysts called Alibabas move to list in the United States timely, given the slow erosion of its dominance by Tencent Holdings Ltd., which has rolled out mobile payment services via its WeChat instant messaging app and offers services that overlap with Alibabas.endprint

Feng told Beijing Review the U.S. listing will turn Alibaba into a world-famous company, and help it combat competitors.

“The three leading Chinese Internet companies—search engine Baidu, Alibaba and Tencent—are in fierce competition to grab as much market share in the mobile Internet arena as possible. After the IPO, Alibaba will raise a large amount of capital that can be used to further expand its territory,” said Feng.

“Mobile Internet business layout requires hefty investment. Being listed is just like loading up on bullets to get ready for the fight. The impending IPO will definitely increase the competitiveness of Alibaba so that it can lock horns more aggressively with Baidu and Tencent,” he said.

Every coin has two sides, however. A listing in New York means strict scrutiny from U.S. regulators and class-action lawyers. The company also has to live with more pressure from investors in terms of profitability, said analysts.

Feng said Alibaba will face challenges from three areas.

“Firstly, Alibaba will be required to disclose information to investors, which could be used by its competitors against it in future competition. Secondly, getting listed means Alibaba has to face more pressure in profitability. Some strategic plans that are good for the companys long-term development but bad for short-term financial performances may have to be abandoned due to profitability concerns,” Feng said. “Besides, the United States has the strictest scrutiny over its financial markets compared to anywhere else in the world.”

Alibaba is likely to become a frequent target of class-action lawsuits once it gets listed in the United States.

Alibabas C2C website Taobao.com was frequently rocked by allegations that some small retailers on its website were selling counterfeits. Although Alibaba adopted various measures, they failed to have the desired effect and negative news reports on the website were a frequent occurrence.

In the United States, class-action lawsuits have a low threshold and can yield high profits. Many institutions and investors that rely on this system to make a living had their eyes on Chinese companies that were recently listed in the United States, said Sun Feiran, a lawyer from the Shanghai-based DeBund Law Offices.

Most startup businesses in the C2C platform Taobao.com lack legal expertise. The small vendors who sell counterfeits or steal other sellers pictures will be targeted by Alibaba in the near future, said analysts.

“I think the prospectus of Alibaba will mention this risk,” said Sun. “Alibaba will impose harsher punishment on sellers that are engaged in any copyright infringement or sales of counterfeits. If it doesnt do anything about those sellers, it will lead to the destruction of the company after it gets listed. Apparently, some small sellers will be weeded out and the good ones will be kept.”

Sun also thinks Alibabas Singles Day online shopping festival may be canceled.

Dubbed Singles Day, November 11 means massive discounts for online shoppers in China and has become the countrys biggest online shopping festival, similar to Cyber Monday. On November 11, 2013, Alibaba reported a transaction value as high as 35 billion yuan ($5.6 billion).

“Too many discounts may lead to antidumping lawsuits,” said Sun. “Alibabas U.S. lawyers may suggest the company cancel the shopping festival.”endprint