Outlook for China’s Copper Rod&Copper Wire Markets-Part I

2014-04-13

Along with its economic development,China is growing in its demand for copper material, and the Chinese copper processing industry has got into the period of rapid expansion. During 2001-2009, output of copper material was growing by nearly 20% annually in this country. In 2009, fueled by the national economic stimulus policy, the output hit a high of 22.2%. Since 2009, it has been growing by nearly 12%annually.

In China, main producing areas of copper material are concentrated in well-developed southeastern coastal areas, with East China taking up more than 60%of the total output.

Overcapacity, product structure adjustment and industry upgrading will become main challenges encountered by Chinese copper material enterprises in the future.

According to statistics, at present production scale of wire and cable ranks second in China’s mechanical manufacturing industry. There are as many as 7,000 enterprises in this sector,providing more than 2,000 wire and cable products at l00,000-plus specifications.

In China, wire and cable manufacturing is largely concentrated in East China, South Central China and North China.East China is a remarkable region in the cable industry,holding a market share of some 50%. This region witnesses rapid enterprise development and fierce competition.

East China accounts for 53.6%of enterprises in this industry, mainly concentrated in Jiangsu,

Zhejiang, Anhui, Shandong and Shanghai. In China,enterprises are also most concentrated in these areas.

In China, enterprises above the designated size are concentrated in Jiangsu, Guangdong,Zhejiang, Anhui, Shandong, Hebei, Liaoning and Shanghai.

In recent years, wire and cable manufacturers in East China have achieved fast expansion in asset size, which indicates China’s wire and cable manufacturing still has great potential in the region.

In East China, South Central China and North China, quite a few industry clusters and production bases have emerged: power cable enterprise group in Yixing of Jiangsu and Ningjin of Hebei; communications optical cable enterprise group in Wujiang of Jiangsu and Fuyang of Zhejiang; RF cable enterprise group in Lin’an of Zhejiang; special cable enterprise group in Wuwei of Anhui;electronic cable enterprise group in Dongguan of Guangdong, and winding wire enterprise groups in Zhejiang and Guangdong.

In terms of enterprise size, some leading players are also concentrated in East China.They include medium- and high-voltage power cable makers such as Jiangsu Baosheng,Jiangsu Yuandong, Jiangsu Shangshang,Qingdao Hanhe and Wuxi Jiangnan;communications optical cable makers such as Jiangsu Hengtong, Jiangsu Yongding, Zhejiang Fuchunjiang and Zhejiang Futong; winding wire makers such as Tongling Jingda and Fuzhou Dartong.

At present, the top 20 enterprises in China’s wire and cable industry account for nearly 20%of the industry’s total output value and sales revenue. They are largely distributed in Jiangsu, Guangdong and Shandong. In the past few years, despite fast growth, industry concentration has not risen. Nonetheless,industry concentration is quite high in some specialized products. For instance, output value of the top 20 manufacturers in the areas of optical cable and magnet wire takes up 50% of the total of the industry.production capacity of copper rod hit 5.10 million tons. In 2012, newly increased production capacity of copper rod was some 240x104t/a. Moreover, in the next three years production capacity of copper rod is expected to grow by l 7.6%on average annually.

During 2005-2011, China’s output of copper wire averaged by 11.5%annually.In 2012,

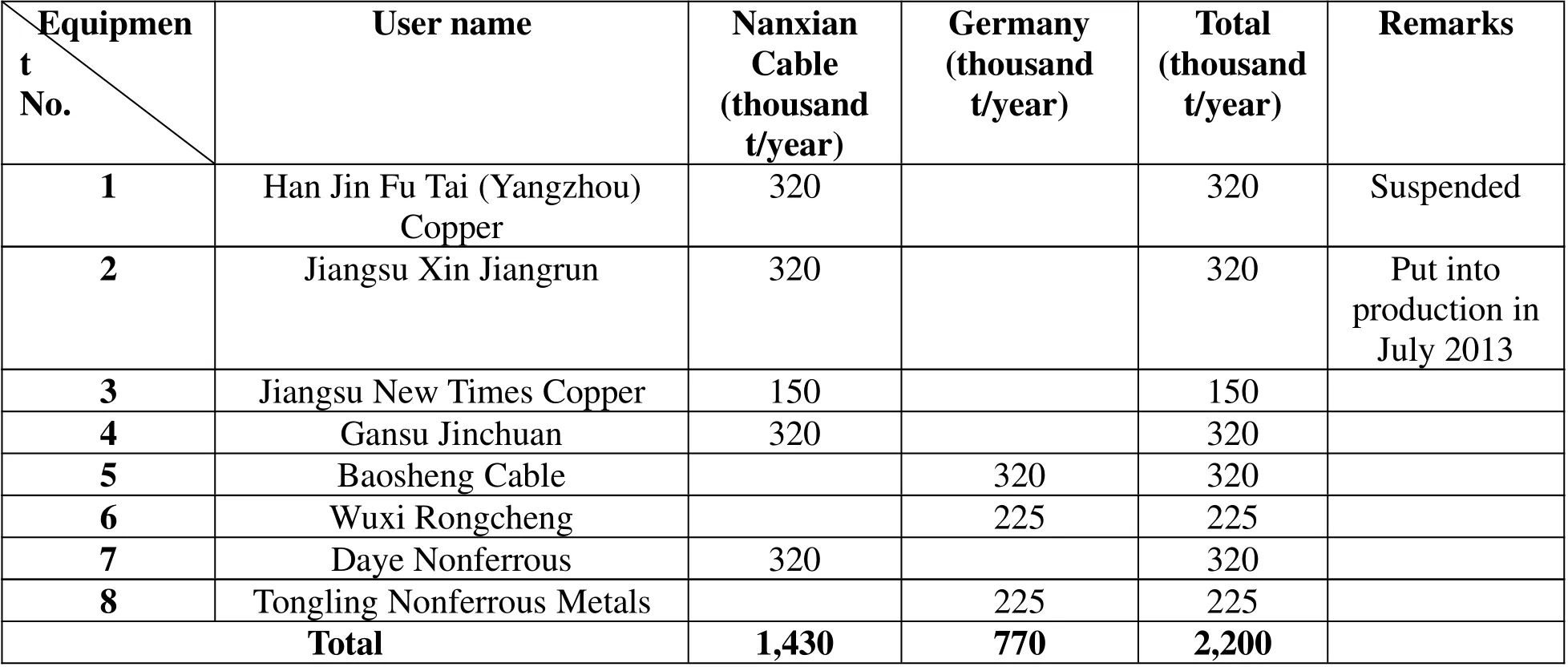

Table 1 Statistics for Copper Rod Makers that Started Production Before 2013

For details on copper rod makers that started production before 2013, refer to Table l; for details on copper rod makers under construction in 2013,see Table 2;for details on copper rod enterprises under planning in 2013,see Table 3.

15 Shandong Yanggu Xiangrui 320 320 16 Zhejiang Honglei 150 150 Not in production 17 Chinalco Kunming Copper 225 225 18 Jiangwu New Materials(Ganzhou)120 120 Lafarga Italy 19 Hebei Da Seamless Copper(Baoding)80 80 20 Wuhu Xinke Copper 50 50 New line.The old line was closed.21 Jiangxi Copper(Zengcheng of Guangzhou)400 400 22 Zhejiang Jintian 150 150 23 Zhongguanr un 150 150 An old line from South Korea 24 Wuhu Xinke(Xinsheng)150 150 25 Ningbo Shimao 225 225 Total 2,563 2,090 2,500 4,093

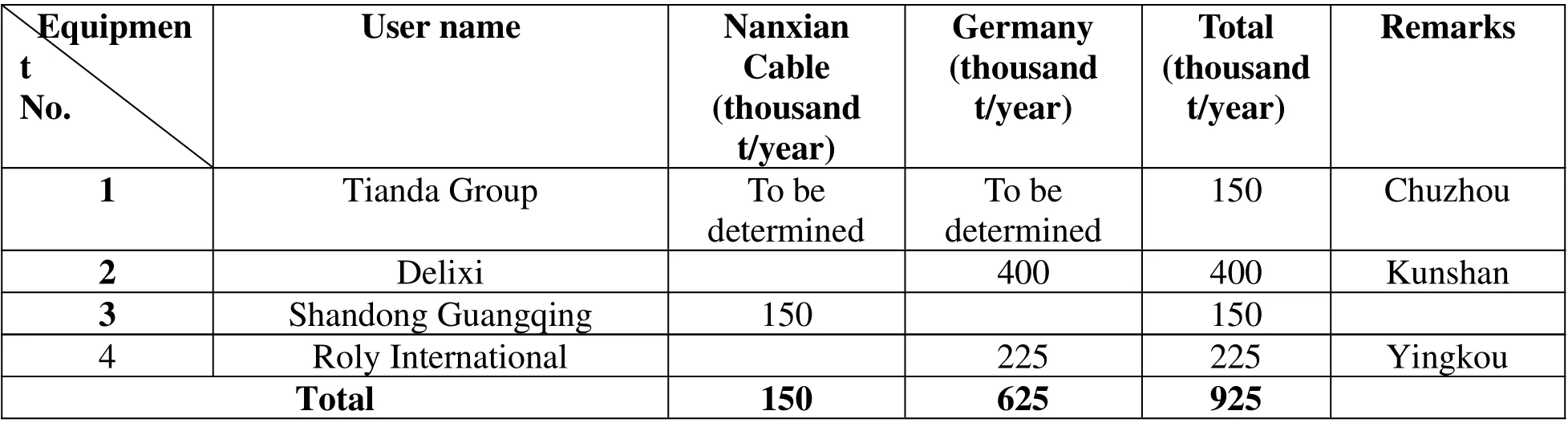

Table 2 Statistical Table for Copper Rod Makers under Construction in 2013

Table 3 Statistics for Copper Rod Production Lines in 2013

In the next decade, China’s wire and cable industry will be growing by 8%-l0% or faster.Demand in this industry largely stems from the following factors:

First of all, urbanization trend is an important factor supporting the industry’s long-term development.

In the thirty years of reform and opening up,urbanization rate rose from l7.9% in l978 to 45.7% in 2008, up by 27.8 percentage points.Remarkable achievements have been made.However, compared with the level of 78% in developed countries, there is still a great potential. At the Central Economic Working Conference held at the end of 2009,urbanization was taken as the focus of boosting domestic demand and restructuring the economy, and brand-new meaning and mission was given to urbanization.Urbanization and the resultant industrialization trend will bring about long-lasting rigid demand for the power cable industry, ensuring the sustainable development and growth of the industry. Thanks to the urbanization process, the construction industry became one of China’s pillar industries at the beginning of the 21st century. It will bring about opportunities for building wire and other wire and cable for electrical installation.Demand for cable in high-rise buildings:During the 12th five-year plan period, China needs at least 2,250 km of flat cable or l2,750 km of round rubber cable for elevators.Demand for cable in the urban construction industry: Along with the standardization of architectural design and construction, usage of BV lines is growing, and the cross section of the products is larger than before. Widely used are products with cross section of 2.5mm2 and above. Sometimes the cross section of power lines used for commercial high-rises can reach 240-300mm2. To meet the flame-resistance requirement of buildings, each year there will be demand for 80,000-90,000 km of flameretardant cable and 11,000-15,000 km of fireproof cable,far more than the current usage.

Secondly,strong smart grids will provide broad market demand and innovation space for the industry.

The overall objectives for power grids during the 12th five-year plan period: build a unified strong smart grid that is safe, reliable,economic, efficient, clean, environmentally friendly, transparent, open and friendly, with IT-powered, automated, interactive features,with UHV power grid as backbone grid, power grids at all levels develop in a coordinated manner, and realize the upgrading from traditional power grid towards modern power grid. In 2015, complete strong northwest and northeast sending-end power grids and North China, East China and Central China UHV receiving-end power grid, and dramatically improve optimal configuration capability for power grid resources. In major cities, form a strong grid pattern with 500(330) kV, 220 kV main power grids and 220 kV, 110(66) kV divisional power supply. For rural power grids,complete 110 kV(66 kV)main power grid with 220 kV transformer substation as hub, county power grid, and achieve dual power supply for major users. Basically form smart grid operation control and interactive service system, and make major breakthroughs in key technologies and equipment. Major changes in the construction scale and development mode of power grids will bring about huge market demand and innovation space for the industry.Thirdly, the power cable industry will benefit from investments in railways and subway projects.

In 2010, to stimulate the economy, China implemented the policy of boosting domestic demand. Infrastructure including railways and rail transit attracted as much investment as in 2009. At the national railway work conference,it was pointed out that in 2010 China planned to invest 823.5 billion yuan in fixed assets in the railway sector, including 700 billion yuan in investment in capital construction. In the next three years, China will start to build a number of new railway lines. 26,000 km of new railways will be put into use, and annual investment is some 700 billion yuan. As of the end of 2009, about 27 cities were planning to develop urban rail transit; 22 cities’ rail transit planning had been approved by the State Council. According to the 22 cities’ planning,around 2015 79 rail transit lines will be built,and these lines are 2,259.84 km long in all,with a total investment of 882 billion yuan.The total mileage is longer than the total of rail transit lines currently in operation and those under construction. The above investment in railways and subway projects will generate gigantic orders for the power cable industry,becoming a major impetus for the rapid development of the industry over the next few years.