Hailing Cabs with Smartphones

2014-03-28byZiMo

by+Zi+Mo

Early this year, Chinese cab driv- ers and riders received a special New Year gift: On January 10, Didi Taxi, a taxi hailing app, announced it would reward passengers 10 yuan for paying cab fare with WeChat Payment up to three times daily, and give cabdrivers the same amount, up to five times a day, in 32 Chinese cities. Several days later, another taxi hailing app, Kuaidi, partnered with Alipay to offer a similar incentive, creating a battle between Chinas two most popular taxi hailing apps.

Car Wars

Liu Yu, an employee of a Beijing real estate company, travels daily to a housing fund management center or a bank to help clients with loan affairs. “I usually take a taxi on such errands,” he explains. “Because both places are near my company, a single trip costs only 4 or 5 yuan after deducting the 10 yuan rebate. So, Ill happily use the apps incentive as long as possible.”

Taxi drivers stand to benefit even more.“I use both apps,” one driver revealed.“With them, I can earn about 100 yuan of extra income a day from 10 deals, which works out to more than 3,000 yuan a month, a sum almost equal to what I used to earn in a month.”

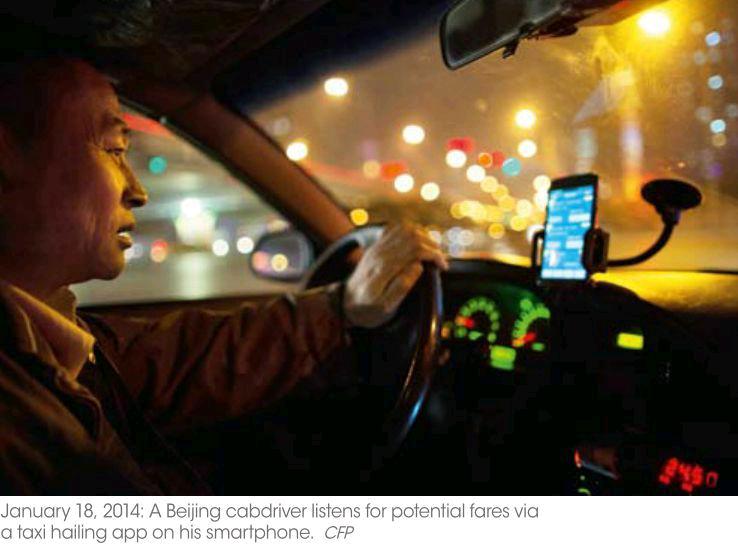

The ubiquity of the mobile internet and smartphones is changing traditional ways of hailing a cab. A quick click on a smartphone app not only eases stranded passengers despair while they futilely attempt to secure a cab during rush hour, but also reduces drivers downtime. According to the Didi Taxi manager in Hangzhou, about a quarter of the citys 17,000 cabdrivers now completely depend on taxi hailing apps to find fares.

Although Chinas first taxi hailing software, Yaoyao Taxi Booking, emerged as early as the end of 2011, the mobile taxi app market didnt boom until 2013. That year, dozens of taxi hailing apps were released. Despite the fact that none of them have turned a profit yet, the battle between apps is already heating up.

Many have invested huge sums to secure market shares. In the beginning, taxi hailing apps only offered incentives to cabdrivers, but now passengers also benefit from the promotions. The apps with the deepest pockets managed to survive the fierce competition, and Kuaidi and Didi Taxi ultimately emerged as the market frontrunners. According to the Report on Chinas Taxi Hailing App Market for the Third Quarter of 2013 released by EnfoDesk, a major market research and consulting company, by the third quarter of last year, Kuaidi controlled 41.8 percent of the countrys taxi hailing app market, and Didi Taxi 39.2 percent. The report also showed that the number of taxi app users reached 20 million in China.

Despite the convenience for both passengers and drivers, the promotional campaigns featuring fat incentives for cabdrivers have also generated negative consequences. Hungry for bonuses, drivers are more inclined to pick up passengers using the apps. In cities where the supply of cabs is short of demand, this will undoubtedly make it harder to get a cab without the app. Some passengers have already found it harder and harder to hail a cab the traditional way. Taxi hailing apps are ruining former equality amongst consumers, resulting in a worsening “information gap” between various passengers. Moreover, some cabdrivers employ more than one phone in order to benefit from as many online bookings as possible and even operate their phones while driving, which can cause traffic accidents.

Proxy War

In fact, fueling the competition between Kuaidi and Didi Taxi is a bigger battle between Chinas two internet giants: Alibaba and Tencent.

Taxi hailing apps are considered an important portal for internet companies to provide location-based (LBS) and onlineto-offline (O2O) services. Yang Quan, chief analyst with Shenzhen Warring Strategy Public Relations Consultants Co., Ltd., believes that the popularity of taxi hailing apps evidences consumers high demand for transportation, as well as an important model for O2O service in daily life. “Internet-based services, such as group buying, have already won recognition among consumers, and most of them have seen a stable market landscape,” he explains. “Taxi hailing apps have become the latest battlefield in which internet giants are squaring off.”

In 2013, Kuaidi secured two capital injections from Alibaba, with total amounts close to $100 million. Didi Taxi acquired capital of $118 million after three rounds of financing, of which $45 million came from Tencent. Essentially, the battle between Kuaidi and Didi Taxi stems from wrestling between Chinas two major thirdparty payment tools – Alibabas Alipay and Tencents WeChat Payment.

The latest statistics from iResearch Consulting Group show that the size of Chinas third-party mobile payment market eclipsed 1,200 billion yuan in 2013, increasing by 707 percent over the previous year. Offline services have become an important “battlefield” for internet-based payment service providers. A major reason Alibaba and Tencent are backing the apps on such a large scale is that they both intend to expand their strength in the mobile app market and nurture mobile usershabits about paying with their respective products.

The tremendous investments have already been seeing rewards. Statistics released by Tencent show that Didi Taxi handled 5 million transactions via WeChat Payment from January 10 to February 7, and it enabled an average of 1 million a day during the seven-day Spring Festival holiday, of which 68 percent were paid through WeChat Payment. According to Zhao Dong, chief operating officer of Kuaidi, the quantity of Kuaidis daily transactions has exceeded 1 million, of which 60 percent were paid via Alipay.

However, industry insiders believe that taxi hailing apps should continue upgrading their products according to userschanging needs and develop a profitable business model rather than invest huge sums to blindly secure market shares.