OPINION Call It a Comeback

2014-03-11

OPINION Call It a Comeback

Chinese companies have had a tough time finding a warm welcome in U.S. markets over the past few years. The global economic downturn and high-profile accounting missteps have dampened investors interest in funding initial public offerings (IPOs) from the East. But with the hotly anticipated debut of Chinese e-commerce company Alibaba on U.S. financial markets, investors are feeling the magic once again.

The IPO of Alibaba, expected in the first half of 2014, is expected to raise $10 billion to $15 billion, the biggest IPO since Facebooks debut in 2012. The listing would help the company triple its annual revenue of $5 billion by 2016, overtaking Wal-Mart as the worlds biggest retail network.

Alibaba is the biggest listing in a surge of Chinese-based IPOs that have been backed up over the past two years due to concerns over fraud and allegation of financial irregularities. As concerns ease, 2013 may be known as a turning point in the trading markets.

The eight Chinese companies that listed on U.S. exchanges in 2013 raised about $800 million and produced an average return of 61 percent, according to Renaissance Capitals report. Their success is easing investors fears over overstated financials and fraudulent accounting.

The momentum is expected to carry into this year, with more than 20 Chinese companies expected to list on the U.S. exchanges, according to PricewaterhouseCoopers.

Alibabas rival and Chinas second-largest e-commerce company, JD.com, signaled its own intentions to list on U.S. markets on January 30, filing a placeholder of up to $1.5 billion in preparation for an IPO. JD.com is expected to raise $4 billion to $5 billion with a U.S. listing.

The United States “will be a logical place to invest, knowing that China in the long run will be a viable partner and a player in global markets,” said analysts at Renaissance Capital, a Greenwich, Connecticut-based re- search and investment firm that focuses on IPOs, in a new report. “People are trying to get in at the very initial stage of this happening.”

The investment relationship is not just a one-way street. As American money funnels into Chinese companies, billions of dollars were funneled last year into U.S. companies by Chinese investors. Excluding bond purchases, Chinese investment in the United States set a record last year at over$14 billion, rising more than 50 percent from 2012, according to conservative think tank partners The American Enterprise Institute and The Heritage Foundation. The recordbreaking investment pushed the United States past Australia as the leading target for Chinese funding. Since 2005, the United States has received about $60 billion in Chinese non-bond investment.

Furthermore, more than 70 percent of investment last year from China came from private enterprises. Chinese companies are becoming big employers of Americans, according to Rhodium, providing more than 70,000 full-time jobs in 2013. Leading employers were Huawei Technologies, Lenovo and Smithfield (a U.S. pork processor acquired last year by Shuanghui in a $7.1 billion deal).

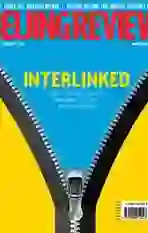

This unparalleled investment on both sides points to the solidity of relations between China and the United States on all levels—diplomatically, financially and even in matters of national security. More than ever, the two countries are intertwined with a mutual interest in maintaining friendly relations. This type of balanced relationship is what the world needs. Its a new era of global relations, in which the economic rise of a country is not a threat to its neighbors, but rather a positive development for all. nendprint