Address forms in Chinese audit opinions

2014-02-22ZiyeZhao

Ziye Zhao

Institute of Accounting and Finance,School of Accountancy,Shanghai University of Finance and Econom ics,China

Address forms in Chinese audit opinions

Ziye Zhao

Institute of Accounting and Finance,School of Accountancy,Shanghai University of Finance and Econom ics,China

A R T IC L E I N F O

Article history:

Received 16 November 2013

Accep ted 3 November 2014

Availab le online 26 November 2014

JEL classif cation:

G 11

L20

M 42

Address forms

A lthough form s of address are w idely used in textual and other types of disclosure,em pirical evidence of their efects is rare.China p rovides a unique setting in which to test theeconom ic consequenceso f the form sof add ressused in audit reports.From 2003 to 2011,about60%o f auditorssurveyed addressed their clients by their real names in audit opinions,while the others used honorif cs.Based on a sam p le of Chinese audit opinions,I report the fo llowing fndings.First,theannouncement of an auditopinion thatuses the client’s real nam e elicits a greaterm arket response than the announcem en t o f an op inion featuring an honorif c form o f address.Second,the ef ects of real-name forms of address are stronger in f rm s with weak board governance.Third,the association between audit fees and audit risk factors,such as loss-making,is stronger in f rms that are add ressed by their real names in audit reports.I conclude from these fndings that the forms of address used in audit opinions may reveal p rivate in fo rm ation on audit quality.The resu lts of this study are consistent w ith the power-so lidarity efect described by socio linguists.

©2014 Sun Yat-sen University.Production and hosting by B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons. org/licenses/by-nc-nd/3.0/).

1.Introduction

D igital indicators arew idely used in fnancial reports to communicate private in formation.In addition to numerical in formation,textual information plays an important ro le in corporate disclosure.W ith the development of computer technologies,the textual analysis o f fnancial reports has become increasingly common in developed capitalmarkets.However,powerfu l tools for analyzing textual information are rare in China. For example,no emotion-m apping dictionary is availab le for usew ith Chinese f nancial reports.Therefore, Chineseaudit reportsp rovidea uniqueopportunity to exam ine the consequencesof dif erent formso f address. Due to the traditional politeness p rincip le embedded in the Chinese language,twomain typeso f address can be observed in audit opinions.From 2003 to 2011,about 60%o f clients surveyed were add ressed by their realnam es,while the otherswere addressed using honorif cs(‘guı`go¯ng sı¯’).The clear distinction between these two types o f addressmakes it easy to empirically analyze forms of address in Chinese audit opinions.

In ancient China,particular stylesofw ritingwere used to communicate po litical opinions.In a classic text entitled Ch¯un qi¯u,Confuciusused subtlewords to convey pro foundmeanings.The aim of this research was to determ inewhether auditors select formso f address to disclose specif c information about audit quality.I test two hypotheses,based respectively on the theorieso f audit quality and socio linguistic theory.I fnd that audit opinions thataddressclientsby their realnamesyield greatermarket returns than opinions featuring honorif c formso f add ress.Ialso f nd that theef ectsof form sof addressaremorepronounced in f rmsw ithweak board governance.Finally,the relationship between audit feesand audit risk factors,such as loss-making,isstronger in f rm s addressed by their real nam es in audit opinions than f rm s add ressed using honorif cs.Viewed collectively,these fndings suggest that independent aud ito rshave a greater incentive to add ress clien tsby their real nam es.The results are consistent w ith the power-so lidarity ef ect described by sociolinguists.

This study contributes to the literature in the follow ing ways.First,it provides further evidence on textual disclosure via formsof address.The results show that the rulesof the Chinese language af ect communication between a company and its investors.Second,the f ndings of this paper suggest that investors distinguish between‘clean’opinions by textual diferences,as the imperative of client confdentiality prevents potential investors from view ing unaudited fnancial reports.This conclusion may shed light on the insu f ciency o f in formation in the existing audit-report system.Finally,the resu ltsof the study indicate that digital indicators such asboard independence are related to the consequenceso f textualinformation,suggesting that textualand numerical information interact.

The rem ainder of the paper is organized as fo llow s.Section 2 p rovides background in form ation on the topic under study,such as a review of the relevan t literatu re in the f elds of aud it quality and sociolinguistics. In Section 3,I describe the study’smethodology,with attention to the research sample and model.Section 4 provides the resu lts o f tests o f the consequences of diferent forms o f add ress.I conclude the paper w ith a summary of the fndings and their implications for future research.

2.Address forms in audit reports:background and relation to past research

Despite important research on the inform ation content of English-language text,evidence of the ef ectso f formso fadd ress is rare.China providesa uniquesetting in which to analyze the formsof add ressused in audit reports.Ipropose thatauditors’choice of add ressaf ects themarket reaction to audit reports.Thishypothesis is based on three assumptions.First,as an unaudited fnancial report cannot be observed by investors, auditors have an incentive to reveal in formation on audit quality.Second,common guidelines formodes o f add ressare accepted by allstakeho lders in China’s capitalmarket.Third,there is some variation in the forms of address used in aud it reports,due to power-related m otives and the Chinese tradition o f po lite language.

2.1.Are all clean opinions the same?

I focuson clean op inions because they are not d if eren tiated by num erical info rm ation.The aud it quality o f a clien t f rm that receives a clean opinion depends on the quality o f the clien t’s unaudited fnancial report. However,investors cannot observe unaudited fnancial reports,due to client con fdentiality.Auditors issue clean opinions to three types of clients.Firms in the f rst category receive clean opinions in return for highquality unaudited reports.Second,f rms thato fer poor-quality unaudited reportsbutaccept allo f their auditors’suggestions for adjustment also receive clean opinions.Firmso f the third type,which o fer poor-quality reportsand refuse tomake allo f the adjustments proposed by auditors,receive clean opinionsonly if the risk of litigation is low.Clearly,the audit quality o f the second type of f rm ishigher than that o f the third type. However,it is dif cu lt to evaluate the auditquality of f rms in the f rst category.Investorscannot diferentiate between f rms that receive clean opinions in return for high-quality reportsbecause the audit service isunobservab le.Som e researchers argue that auditors are under pressu re to issue unm odifed op inions becausem odif ed opinions have a huge negative ef ect on clien ts(Sun and W ang,1999;Zhao,2007;Sim unic and W u, 2009).However,o ther researchers point ou t thataud ito rshave an incentive to circum ven t pressu re from investorsand regulators,and thusengage in collaborative governancew ith independent directors(Zhao and Zhou,2013).Approxim ately 90%o f the sam p led aud it opinions issued in China from 2003 to 2011 were clean. Ihypothesize thatauditors issuing clean opinionsand of ering high-quality serviceshavean incentive to reveal in formation to themarket.Therefore,diferent types of clean opinion have distinct consequences.

2.2.Information-conveying function of corporate textual disclosure

Several aspectsof textualdisclosure,such as readability,tone and keyword frequency,are sub ject to managers’discretion.According to past research,managers’reporting incentivesafect the consequenceso f textual disclosure.First,the short-term market returns to an earnings-release announcement are positively related to the levelof op tim ism conveyed in the textual content of the earnings-release report(Henry,2008;Demersand Vega,2011;Davis et al.,2012).Loughran and M cDonnald(2011)fnd a sim ilar association between market returns and optim ism in the text of 10-K Securities and Exchange Comm ission f lings.Second,the level o f optim ism exp ressed in an earnings report is positively associated w ith fu ture m arket returns(Feldm an et al.,2009).Third,De Franco et al.(2011)f nd a positive relationship between the readability o f analysts’reportsand the stock-turnover rate.Finally,Loughran and M cDonnald(2011)fnd evidence to suggest that the trading vo lume of small investors is positively associated w ith the readability of their annual reports. Taken together,these f ndings indicate that textual disclosure p rovides investorsw ith private information.

M erk ley(2011)f nds thatwhen a company’s fnancialperformance is in decline,itsmanagement is likely to disclosemore information on research and development in the texto f fnancial reports to assure themarketo f the long-term value of the company.Second,Nelson and Pritchard(2007)fnd that the greater the litigation risk faced by a f rm,themore cautionary languagemanagersuse.Third,them ispricing o f changesof accruals is larger when a f rm d isclosesm ore info rm ation on com petition in its annual report(Liet al.,2011).

It isworth m en tioning thatm anagers are also likely to provide obfuscato ry inform ation when f rm perfo rm ance declines.As dem onstrated by Li(2008),f rm sw ith m ore com p licated annual reportshave less persisten t positive earnings.Consisten tw ith this result,Tam a-Sweet(2009)fnds thatm anagers releasem ore op tim istic in formation when they p lan to exercise their stock options,suggesting an opportunistic incentive for textual reporting.

2.3.Analysis based on theories of sociolinguistics and audit quality

Audit quality is traditionally believed to depend on auditors’competence and independence(DeAngelo, 1981).Clearly,investors w ill respond to textually disclosed information on auditor competence or auditor independence.As shown by socio linguists,people use language to defne their relationships w ith others. The term‘forms of add ress’denotes the words used by speakers to designate the people w ith whom they are talking.Such words can be used to communicate information about the relationship between speaker and addressee.Ervin-Tripp(1972)proposes that an add ress system is composed of a series o f choicesmade by speakers.Fo r exam p le,a faculty m em ber who w ishes to add ress the dean by his f rst nam e w ill check whether expectations of statusmarking exist before using this form o f address.The relative formality o f the relationship between the facu lty member and the dean w ill also af ect the former’s choice o f address. Zhang(2009)posits that in China,choicesof formsof add ressare d riven by psycho logical aswell as cu ltural factors.Accordingly,the authorsof Chinese literary works use distinct formso f add ress to convey particu lar in formation.

2.3.1.Power-solidarity ef ect and politeness principle

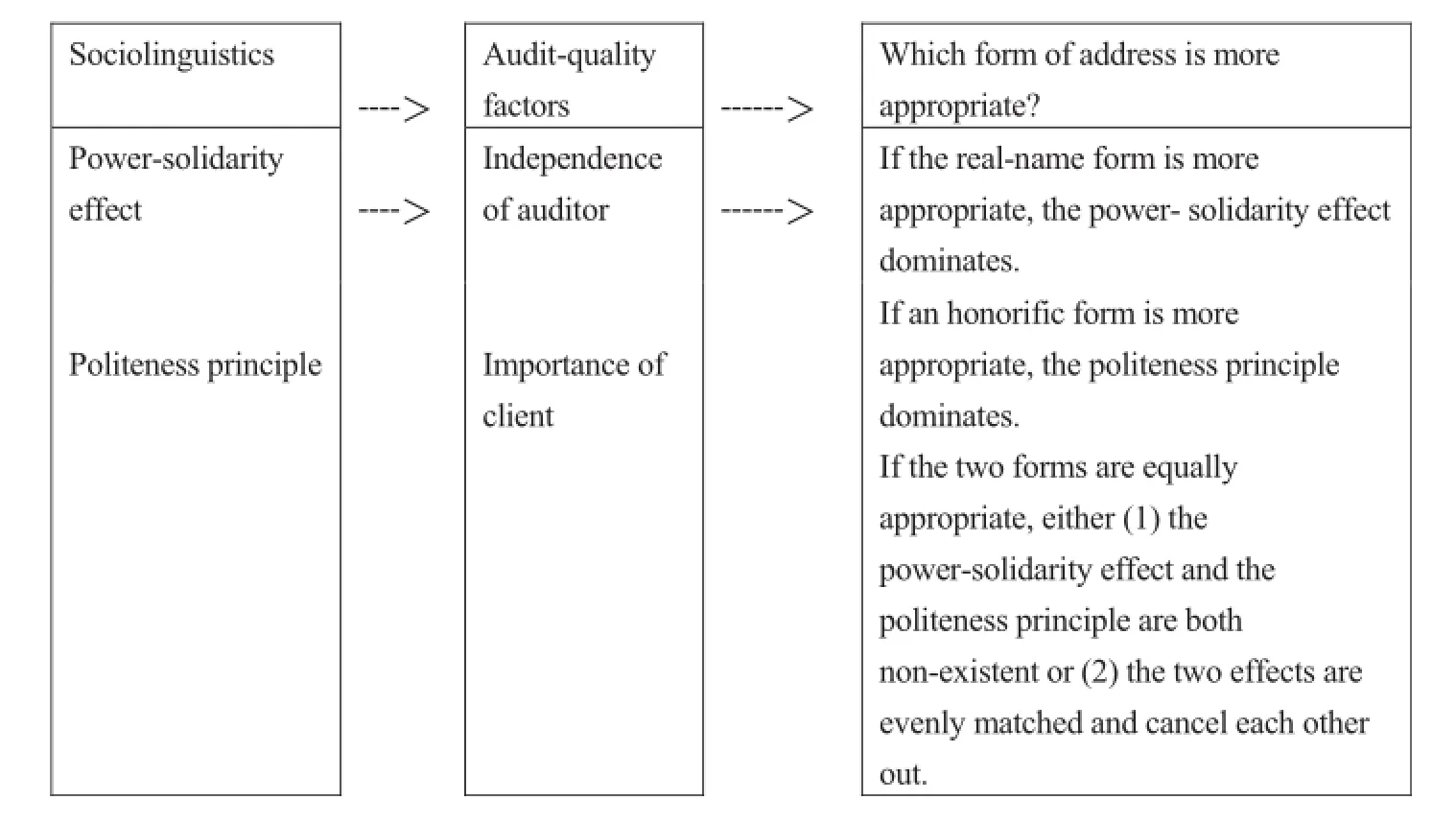

Two socio linguistic theories help to exp lain the consequences o f diferent form s of add ress in audit opinions.The f rst is the power-solidarity theory suggested by Brown and Gilman(1960),according to which the use of real-name forms of add ress represents a relationship o f equal power between auditor and client. Based on thisassum ption,Ihypothesize that the use of realnames in auditopinions indicatesa greater degree o f aud ito r independence.The second usefu l sociolinguistic theory is the po liteness p rincip le p roposed by Brown and Levinson(1978),who suggest that speakers use honorif cs to add ress peop le of higher status. A ccord ingly,aud ito rs m ay use hono rif c form s to suggest that clients are im portant.A lthough investo rs respond positively to both auditor independence and client importance,an event studymay help to determ inewhich o f the two factors is dom inant.For exam p le,if them arket returnson audit op inionsw ith realnam esare higher than those on audit opinions w ith honorif c form s of add ress,the power-solidarity efect can be assumed to bemore p ronounced in Chinese audit opinions.However,if there is no diference in themarket returns on these two types o f add ress,it can be assumed either that the power-so lidarity efect and the politeness princip le are non-existent,or that these two efects are evenly matched and cancel each other out.The fu ll set of permutations leading to these resu lts is presented in the follow ing f gure(see Fig.1).

‘Auditor independence’refers to the likelihood o f auditors reporting a breach in its client’saccounting system.The theoretical p robability o f reporting a breach usually decreases in p ractice,because a client can impose costs on an auditor by term inating the audit service.Therefore,auditor independence is assumed to be positively related to characteristics such as aud it size(DeAngelo,1981;D ye,1993).‘Opinion shopp ing’describes the practice of searching for an aud ito r w illing to com p ly w ith the clien t’s needs by issuing an unqualifed opinion.This phenom enon is o f concern to bo th regulato rs and investors.Investo rs require in formation on auditor independence to evaluate a f rm’s audit quality,even when the f rm has received a clean opinion.Ihypothesize that auditors’choice o f formso f add ress p rovides in formation on auditor independence,for two reasons.First,formso f addressareo f concern to clientswhen auditors issue clean opinions. Second,socio linguistic theories suggest that diferent form s of address refect dif erent relationships between clients and auditors.

Brown and G ilman(1960)propose that p ronoun usage is governed by power and so lidarity semantics. Brown and Ford(1961)identify a naturalp rogression in the formso f addresschosen by English speakers from mutual titlew ith f rstname tomutual f rstname,indicating that power diferencesbetween levelso f society are less im po rtan t in m odern social interactions.A ccording to Sco tton and Zhu(1983),honorif cs such as‘lo shı¯’(‘teacher’)were retained in Chinese fo rm s of add ress after 1949.Such honorif c titles convey respect for the add ressee,indicating that power diference is still important in China.W ith the development o f China,the popularity of honorif c titles continues to depreciate and add ressesbased on the solidarity efect,such as‘to´ng zhı`’(com rade),are supported by the governm ent.As discussed in these literatures,I expect that real name add ress suggestsa smaller power diferentialbetween auditor and client.Ialso hypothesize that themore balanced the auditor–client relationship,themore independent the auditor is likely to be.

In China,words such as‘guı`’(‘esteemed’)are used in honorif c forms o f address to convey the speaker’s respect.For examp le,the Chineseword‘guı`xı`ng’means‘your esteemed name’in English.In contrast,words such as‘b’are used in self-abasing formso f add ress.For examp le,the Chineseword‘b re´n’means‘your humble friend’in English.Bo th hono rif cs and self-abasing fo rm s of address can positively afect face,which is consisten tw ith the politeness p rincip le p roposed by Brown and Levinson(1978).Therefo re,Ihypo thesize thatthe use of honorif cs to add ress clien ts in aud it opinions provides in form ation on the im po rtance o f the clients. An im portant client is likely to elicit greater efort from an auditor,leading to higher audit quality.

Figure 1.Paths lead ing to three possible sets of resu lts o f the event study.

2.3.2.Forms of address in China:tradition and modernity

Changes in forms o f address in China,whether arising from cultural,commercial or historical developments,may have important organizational consequences.The authors of Ch¯un qi¯u,one of themost famous textso f the Pre-Qin era,used forms of add ress to exp ressopinions on political events.For example, when references to the king of Qiare downgraded from‘qı´ho´u’(‘K ing Qi’)to‘qı´re´n’(‘Guy Qi’),the reader in fers that the king’s behavior is contrary to thewelfare o f his people.1See Xiong(2007),Spiritof Chinese people in the Spring and Autumn:im perialpower and academia in traditional contextof China,Xi an:ShaanxiNormal University General Publishing House Co.,Ltd.,105–111.

In modern China,political and business organizations select forms of address that both maxim ize the power-so lidarity ef ect and con form to the po liteness p rinciple.For examp le,when a facultymember w ishes to addresshis superior,themost common form of add ress comprises position title and last name.According to the theory o f power so lidarity,position titles reveal info rm ation on power d if erence,and m ay thus lead to bureaucratic delay.The localgovernm en t o f Shanghaihas released an of cial docum en t that deals specif cally w ith formso f add ress.The General Of ce o f the Communist Party of China ShanghaiM unicipal Comm ittee requires members of the Communist Party,especially party cad res,to add ress each other as‘to´ng zhı`’(‘com rade’)in of cial docum ents.The governm ent is clearly concerned that forms o f add ress featuring titles such as‘secretary’or‘m inister’will lead to bureaucratic and organizational inef ciencies.

Formso fadd ressare also of concern to commercialorganizations.Before1999,the company Lenovo experienced steady grow th due to itsexceptional performance.W ith the expansion of the company’smanagement hierarchy and personnel,the p robability of amanager’sbeing addressed by hisor her lastname accompanied by the word‘zoˇng’(‘chief of cer’)signif cantly increased.The Chief Executive Of cer o f Lenovo,Yuanqin Yang,was concerned that the com pany’s cohesion wou ld be com prom ised by the power ef ect of this fo rm o f address.He thus estab lished two form s of add ress for him self:‘lo ya´ng’(‘O ld Yang’)and his f rst nam e. H is goalwas to elim inate the power efect and create a fam ily cu ltu re for the com pany.2See h ttp://tech.sina.com.cn/new s/it/1999-11-1/10141.shtm l.Huawei,another Chinese company,responded positively to the restructuring of forms of add ressat Lenovo.A special reportwas pub lished in an internal newspaper named‘M anagem ent Op tim ization’on the decision to imp lement Lenovo’s reforms at Huawei.3See h ttp://iye.net.blog.163.com/blog/static/3148921200861933851979/.These two cases indicate that forms of add ress concern both the governm ent o f China and Chinese companies.

2.4.Research opportunities provided by China

China p rovidesa uniqueopportunity for textualanalysisof the formsof addressused in auditopinions for two reasons.First,the dif erence between the two types of address is very clear.Therefore,the variab le capturing‘form of add ress’isnot ambiguous.In addition,the tests can be conducted in the absence of an emotion-mapping dictionary for theChinese language.Second,more than 10,000 auditopinionsusing identifab le fo rm s of add ress were issued from 2003 to 2011,p roviding a su f ciently large sam p le to capture the whole m arket.In addition,the ratio of real nam es to honorif cs is about 6:4,which allow sm e to exam ine not on ly the consequences of form s of address,bu t also them oderating efects o f aud ito r and client characteristics.

2.4.1.Forms of address in Chinese audit opinions

About 90%of China’s listed com panies receive standard unqualifed aud it opinions.There is no variation in digital indicators in these opinions,p roviding a clean setting in which to exam ine the consequenceso f different form sof add ress.The fo llow ing tab le providesexamp lesof the forms of address used in Chinese audit opinions.

As shown in Table 1,the f rst company is addressed by its full name,whereas the second company is add ressed as‘guı`go¯ng sı¯’(‘your esteemed company’).In the United States,auditors add ress their clientsby their realnamesor useabbreviations(such as‘your company’).The abbreviated form would be translated as‘n go¯ng sı¯’if the po litenessp rinciplewere neglected,which would have no positiveef ecton face.Fo llow ing the Chinese politeness princip le,however,the abbreviation is transform ed into an honorif c(‘guı`go¯ng sı¯’).‘Guı`go¯ng sı¯’m eans‘your esteem ed com pany’in English.This unique setting enablesm e to d ivide fo rm s of address in Chinese audit op inions into two categories.

Table 1 Form s of address used in Chinese aud it opinions.

2.4.2.Distribution of forms of address in China from 2003 to 2011

Before 2003,allauditorsadd ressed their clients using honorif cs(‘guı`go¯ng sı¯’).In 2003,regulators revised the standards for independent audit and recommended a new style for the text o f audit opinions.The guidelineson the new standardsp rovidean examp le of a clean opinion inwhich a real-name add ress isused.Forms of addressare thussub ject to auditors’discretion,as thisexample isprovided only for guidance;theuseo f real names isnotmandatory.Since2003,two formsof add resshave been used in Chinese audit opinions.The follow ing tab le presents the distribution of forms of add ress since 2003.

As shown in Table 2,the p ropo rtion o f real-nam e fo rm s of add ress increased every year between 2003 and 2009.In 2006,therewas a particularly substan tial increase in the relative use of real-nam e form s of address. However,the p ropo rtion o f honorif c addresses has fuctuated around the 30%level since 2006.On average, the audit opinions that use honorif csaccount for approximately one third of the fu ll samp le.Thus,it is clear that real nameswere favored by auditors during the research period.

2.4.3.Forms of address in audit opinions:habit or choice?

If auditorsnever change the style in which they add ress their clients,the variation in add ress formsmay be driven by habit rather than choice.To rule out this possibility,I conduct several tests o f the distribution o f forms o f add ress.Table 3 presents the distribution by year and CPA f rm.The resu lts indicate that about63%(13.07+19.79+30.21)o f the CPA f rm s used diferen t form s of address for d if erent clients in the sam e year.Next,Icheck the distribution o f formso f addressby CPA f rm and the f rst-signing auditor.Of the 2,659 resulting observations,586 use diferent formso f add ress,which accounts for 22%o f the samp le.Defning an auditor as the f rst-signing auditor in a CPA f rm in a year gives6025 observations,ofwhich 587 use diferent formso fadd ressduring thesamp le period.The results indicate that thevariation in formsof add ress isat least partly d riven by auditor choice.Table 3 also reveals that 12%of the CPA f rms so lely used honorif cs in their opinions between 2003 and 2011,which may indicate that variation in forms o f add ress is partly d riven by auditors’habits.These habit-driven observations weaken the dif erence between the consequences o f the two forms o f add ress.

Table 2 Distribution of forms of address used by certifed public accounting(CPA)f rm s from 2003 to 2011.

Table 3 Proportion o f real-nam e form s of address used by CPA f rm s du ring the samp le period.

3.Research methodology

3.1.Research model

Asdiscussed in the previous section,Ihypothesize that themarket reaction to audit opinionsusing clients’real names is higher if the power-so lidarity ef ect dom inates.To testm y hypothesis,I build the fo llow ing m odel to exam ine the consequences of fo rm s of address.

CAR[-3,3]denotes themarket response to the announcemento f an auditopinion over theshort-term w indow o f[-3,3].The cumu lative abnormal returns are calcu lated using either themarketmodel(RCAR[-3,3])or m arket-adjusted returns(ACAR[-3,3]).The capital asset pricingmodel(CAPM)is as follows.

where DR denotes f rms’daily returns including the reinvestment of cash dividends.M R denotes the tradab le value-weighted dailymarket returns including reinvestment of cash dividends.Both items are extracted from theChina Stock M arket Accounting Research database.Iestimatebeta over 120 trading daysbefore theevent w indow.Observations are deleted if the ad justed R2o f themarketmodel is negative.

ARF isa dummy variab le that takes the value of 1 if an auditor addresses the client by its realname,and 0 otherw ise.Thus,β1is designed to capture the consequencesof formsof address.If the power-solidarity ef ect dom inates,β1is expected to be signif cantly positive.Conversely,β1is expected to be signif can tly negative if the po liteness princip le is dom inan t.

UE denoteschange in earnings from t-1 to t divided by totalassets,which capturesunexpected earnings. Size is the natural logarithm of total assets in year t. Industry and Year are dummy variab les to control for industry and year efects.

If the characteristicsof auditorsor clientsaf ect the choice o f the form of add ress,the coef cientβ1may capturemarket returns that are unrelated to the form of address.Therefore,Iuse the fo llow ing treatment-ef ect m odel to dealw ith the potential endogeneity of variab le ARF.

where TO isa dummy variable that takesa valueo f 1 if f rms change their auditors in t,and 0 otherw ise.RSB denotesauditors’ranking based on clients’totalassets.ROA is the net income in year t divided by totalassets in t-1.LOSS isequal to 1 if a f rm su fersa loss in year t,and 0 otherw ise.SP isequal to 1 if a f rm’s ROA lies in the w indow[0,0.01],and 0 otherw ise.ARTA denotes accounts receivable in year t divided by total assets in t-1.INVTA is inventory in year t divided by total assets in t-1.GROW denotes the change in sales from t-1 to t divided by total assets in t-1.BELOW denotes below the line items divided by total assets in t-1.OCFTA signif esnet cash fow from operating activities divided by totalassets in t-1.STATE is equal to 1 if the f rm is a state-owned com pany,and 0 o therw ise.D INDEP is equal to 1 if the proportion o f independent d irecto rs to allm em bers o f the board is higher than 1/3,and 0 otherw ise.COM is equal to 1 if a f rm sets up all four comm ittees,and 0 otherw ise.DE is the debt to asset ratio.

To determ inewhether the in formation conveyed in forms of address is related to corporate governance,I build the fo llowingmodel to exam ine themoderating ef ects of DINDEP and COM on the consequenceso f forms o f address.As noted in the previous paragraph,DINDEP and COM cap ture f rms’board quality.A signif cantly negative coef cient of DINDEP*ARF or COM*ARF indicates that themarket returns to audit opinions in which clients are addressed by their real names are higher when corporate governance isweak.

Finally,Iuse the fo llow ing m odel to test the efects of form s of add ress on the relationship between audit fees and corporate risk facto rs.

Here,LFEE is the natural logarithm o f audit fees in year t.LOSS,SP,ARTA,BELOW and OCFTA are corporate risk facto rs.SEO,an aud ito r risk factor,is a dumm y variable equal to 1 fo r f rm swhose retu rns on equity are in the range[0.06,0.065].Past research has shown thatallo f these six risk factorsare of concern for auditors(Zhang et al.,2006;Wu,2012;Zhu and Sun,2012).

3.2.Sample and data

M y sam p le is com posed o f Chinese audit reports issued between 2003 and 2011.I focus solely on clean op inions because this type o f opinion lacks num erical in form ation.Fo rm s of address can be identif ed in 13,217 o f the observationsw ith com p lete fnancial data and returns data.Deleting observationsw ith m issing data gives 12,064 observations that can be used to test the research hypotheses.The sample size is smaller when the expectedmarket return isbased on themarketmodel,because observationsw ith a negativeadjusted R2from the CAPM are deleted.Data on most of the research variables are availab le from the China Stock M arket Accounting Research(CSMAR)database.I use 10,101 observations to test the audit-fee model. Approximately 2000 f rm-year audit-fee observations arem issing from the CSM AR database.The data on add ress form sare collected manually from annual reports.

Finally,Iw insorize each continuous variab le by year in the top and bottom 1%to remove the ef ect o f potential outliers.The outlier-ad justed descriptive statistics are p rovided in Tab le 4.

As shown in Table 4,them ean value of ARF is 0.637,which indicates that over 60%o f the com panies are add ressed by their realnam es in aud it opinions.In add ition,them ean value of SP is0.13,ind icating thatm o re than 10%of Chinese f rm sm ake a sm all p rof t.

4.Empirical results

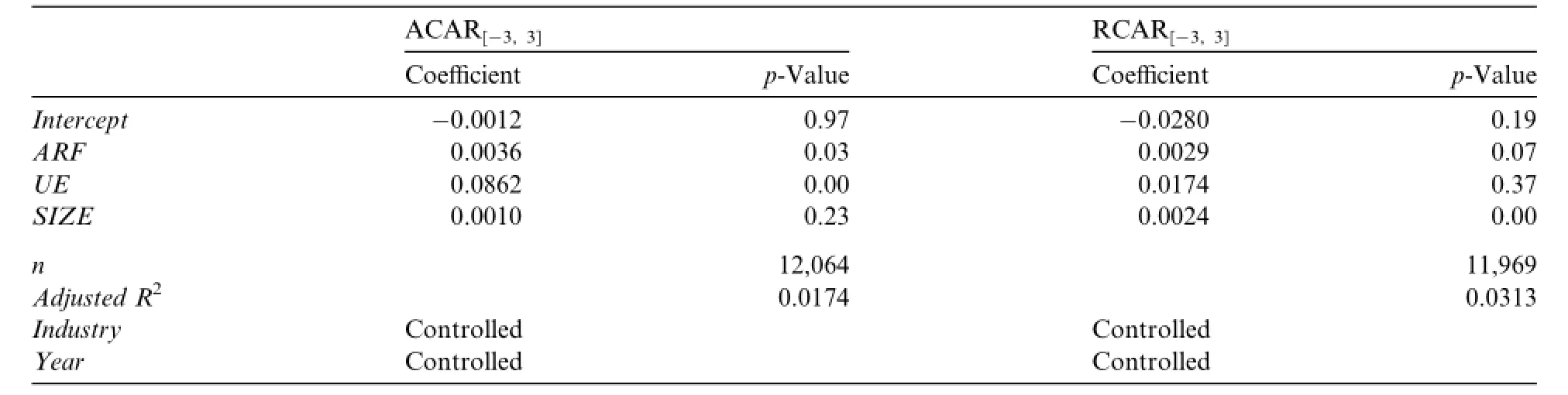

4.1.Consequences of forms of address

The observed m arket responses to d iferen t form s of add ress are presen ted in Tab le 5.The results ind icate that ARF is positively related to both types o f cum u lative abnorm al returns,suggesting that the m arket returns to audit opinions that address companiesby their real namesare higher than those that use honorif cadd resses.This result also indicates thata portfolio based on the formsof add ressused in clean opinionsw ill obtain a cumu lative abnormal return o f 0.3%in the[-3,3]eventw indow.Thisevidence isconsistentw ith the power-so lidarity ef ect rather than the politeness princip le.

Table 4 D escriptive statistics.

Table 5 Econom ic consequencesof forms of address in audit opinions.

Table 6 Treatm ent-efectm odel.

To dealw ith the poten tial endogeneity o f ARF,I construct a treatm en t-efectm odel to determ ine whether the resu lts disp layed in Table 5 are robust.As shown by the selection m odel of ARF in Tab le 6,ARF is positively related to TO and RSB,which suggests that f rm s arem ore likely to be add ressed by their real nam es when they change their auditorsor their auditorsare small CPA f rms.This result also suggests that auditor characteristics are related to forms of add ress.For instance,a client ismore likely to be add ressed by its real namewhen the fo llow ing conditionsapply:(1)the client’s return on assets ishigher;(2)the client hasa larger inventory;(3)the client is a non-state-owned listed f rm;and(4)the client is smaller.A fter contro lling for endogeneity,ARF isstillsignif cantly positive in the returnsmodel,indicating that the resultsshown in Tab le 5 are robust.

In addition to enriching the literature on textual disclosure,the fndings have imp lications for audit standard setting.For instance,the Pub lic Com pany Accounting Oversight Board(PCAOB)is now facing a dilemm a:shou ld auditors d isclose m ore info rm ation in audit opinions?4PCAOB Release N o.‘Concept releaseon possible revisions to PCAOB standards related to reportson audited fnancialstatem en tsand related amendm ents to PCAOB standards’(2011).It could be argued that greater disclosure is good fo r investors;however,it m ay also im pose huge costs on auditors.The cu rrent study sheds ligh t on this debate by show ing that aud ito rs have an incen tive to reveal info rm ation in textual diferences, which is consistentw ith amendments to audit standards in European auditmarkets that requiremore information to be disclosed in audit opinions.

Table 7 Form s of address and board quality.

4.2.Efects of corporate governance on themarket response to real-name forms of address

Em pirical evidence suggests that in em ergingmarkets,independent audits and corporate governance substitute for each other as investor-p rotection mechanisms.For instance,Choiand Wong(2007)f nd that f rms in weak legal environm ents have an incentive to hire high-quality auditors.Sim ilarly,Fan and Wong(2005) show that f rms facing serious agency problems due to ultimate-ownership structure aremore likely to hire Big-5 auditors.In this section,Iaim to determ inewhether themarket response to real-name form so f add ress isgreater in f rmsw ithweak corporategovernance.If so,it can beassum ed that formsof add ressconvey inform ation about aud it quality.Iuse board quality as a m easu re o f corporate governance because it concerns all stakeholders in China’s stock m arket.As shown in Tab le 7,both D INDEP*ARF and COM*ARF are significantly negative,suggesting that them arket response to real-nam e form s of add ress is greater when there are fewer independent directors or board comm ittees.

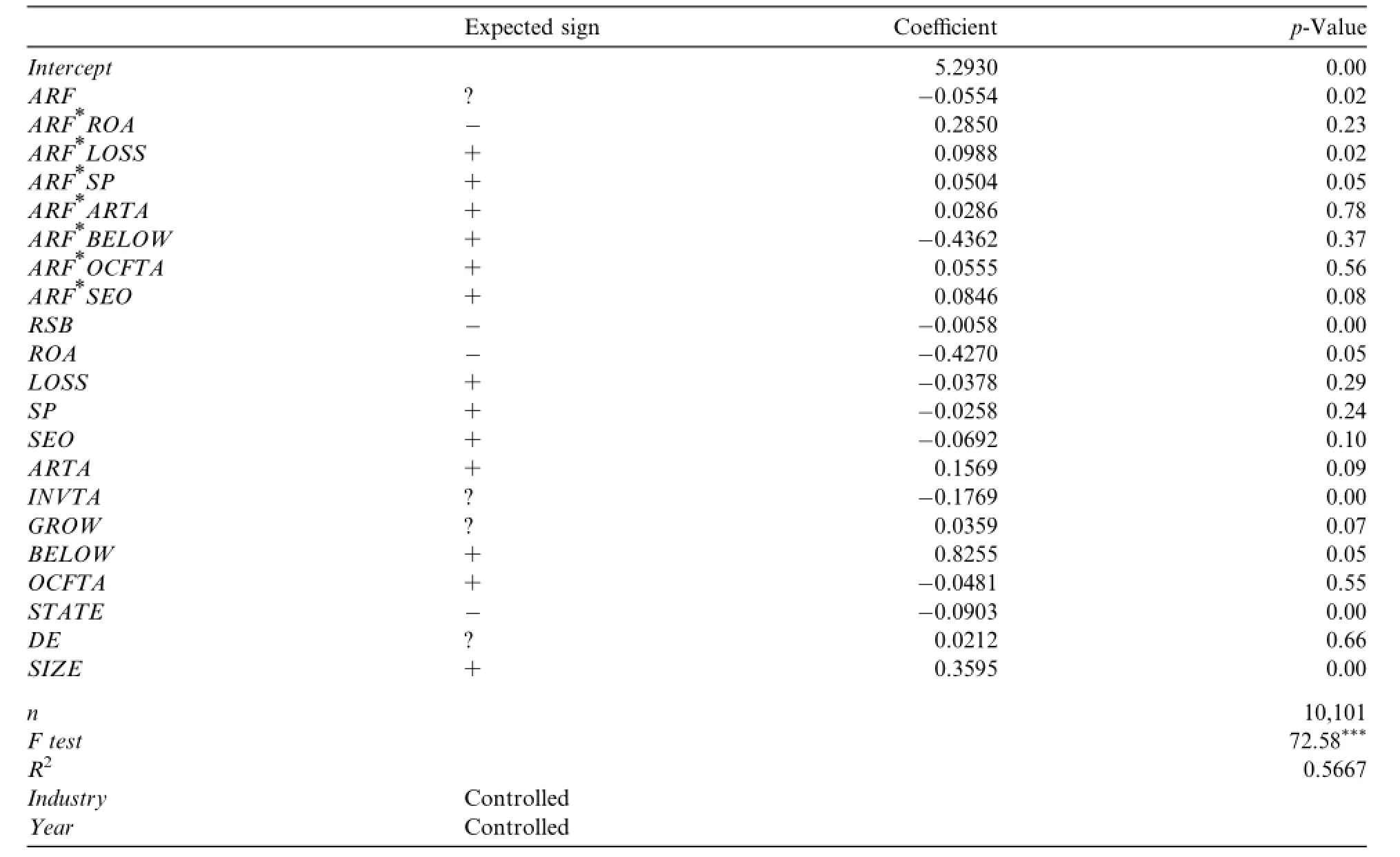

4.3.Efects of forms of address on the relationship between audit risk factors and audit fees

In this section,Iattemp t to determ inewhether forms of address afect the association between audit risk factorsand audit fees.Simunic(1980)posits that audit feesare positively related to audit risk factorsbecause auditors suf er the litigation costs associated w ith audit failure.Iexpect the coef cients of the interaction o f ARF and the audit risk factors to be signif cantly positive,in accordance w ith the power-so lidarity efect. As shown in Table 8,the coef cien ts of ARF*LOSS,ARF*SP and ARF*SEO suppo rt m y conjectu re.SP and SEO captu re the risk that them anager has an incen tive to engage in earningsm anagem en t to m eet the incom e target of the listing and seasoned equity o fering regu lations.Therefore,the resu lts suggest that auditors that add ress clients by their real names aremore concerned about earningsmanagement.

4.4.Test of the role of signing auditors’habits in determining forms of address

As shown in Table 4,some auditorsuse dif erent formsof add ress during the research period,while others do not.Therefore,some form sof add ressmay be driven by habit instead o f choice.Idef ne DUM asa dummy variab le denoting the ef ect o f habit.DUM is equal to 1 if the f rst-signing auditor uses dif erent forms o f add ress during the research period,and 0 otherw ise.Iexpect the coef cient of DUM*ARF to be signif cantly positive,because the market response to a real-name add ress w ill be strong if forms of address are not determ ined by habit.The resu lts are shown in Table 9.Un fortunately,bo th DUM and DUM*ARF are insignif cant,indicating that DUM does not cap ture the efect o f habit.

Table 8 Test of audit fees.

Table 9Test of the role of auditors’customary behavior in determ ining form so f address.

4.5.Tests using shorter eventwindows around audit-opinion announcements

The most commonly used window in event studies is[-1,1].If the event is particular,the research window is extended.For examp le,Sikes et al.(2014)use[-2,2]as a test w indow in which to investigatethe consequences o f poison p ills.In the em ergingm arket of China,this even tw indow could be extended fu rther,for two reasons.First,in formation leakage is possible in this environment.Second,all listed f rms are subject to a daily price lim it on trading of 10%.To address these characteristics of the Chinese market, Chen et al.(2009)usemultiple testw indows,such as[-1,1],[-2,2]and[-5,5].Li(1999)and Chen and Zhang(1999)all conduct testsw ith larger eventw indows.In this paper,Iuse[-3,3]as themain testw indow, because thesamp le iscomposed solely o f clean opinions,and thediferencesbetween formso f addressaresubtle.However,to fully capture themarket reaction to diferent formsof add ress,Ialso use thew indows[-1,1] and[-2,2]in additional tests.The resultsare presented in Tab le 10.As shown in the table,shorterw indows givesmaller coef cientso f ARF.W hen CAR isbased onmarket-ad justed returns,the coef ciento f ARF d rops from 0.0031 to 0.0025 as thew indow sh rinks from[-2,2]to[-1,1].The resultsof tests using RCAR[-2,2]and RCAR[-1,1]show sim ilar trends.Som ewhat unexpected ly,however,the test of RCAR[-1,1]produces a significantly positive coef cien t o f ARF(one-tailed test;p-value=0.12),indicating that the evidence is weaker fo r the[-1,1]w indow.

Table 10 Tests using[-1,1]and[-2,2].

Table 11 Consequences o f forms of address;p-valuesbased on Newey–West adjusted standard errors.

4.6.Statistics based on Newey–W est adjusted standard errors

The p-values in the p revious testsare based on standard errors clustered by f rm.However,heteroskedastic panel data may still lead to biased resu lts.To rule out this possibility,I conduct a sensitivity test using the m ethod of standard-error adjustment recommended by Newey and West(1987).As shown in Tab le 11, ARF is still signif cantly positive,indicating that the resultsare robust to diferently ad justed standard errors.

5.Conclusion

Thisstudy investigates the consequencesof auditors’useo f diferent formso fadd ress in theunique research setting provided by the Chinesemarket.From 2003 to 2011,about 60%o f the listed f rms under study were add ressed by their real names in audit opinions,while the others received audit opinions featuring honorif c formso f address.Based on a sample of Chineseauditopinions,Ireport the fo llowing f ndings.First,thereare greater short-term responses to the announcement of audit opinionsusing real names than to audit opinions featuring honorif cs.Second,themarket response to real-nameopinions is stronger for f rmsw ith weak board governance.Third,the association between audit fees and audit risk factors is stronger for f rms that receive aud it op inionsw ith real-nam e form so f address.The fndings of this study p rovide fu rther evidence on textual disclosure via form s o f add ress.

Asm any as2000 years ago,nuanced wo rds were used to convey p rofound m eanings in the classic Chinese text Ch¯un qi¯u.M ore specif cally,forms of address were used to convey the authors’political opinions.The results of the current study suggest that this traditional use of language has been preserved.This study also sheds light on the signif cance of the f exibility of the Chinese language in modern fnancial reports.

One lim itation o f this study is common to allstudiesof audit opinions.As the realp rocessof auditing cannot beobserved,Iwasunab le to test the possibility that auditorsmake ad justments to neutralize thenegative efectso f honorif c address.This paper isalso lim ited by the inability to identify items in the sample in which forms of address refect auditors’customary practice rather than their choice.In future research,this lim itation cou ld be add ressed by surveyingmore transparent formso f disclosure or through experimental research.

Acknowledgments

Iam gratefu l for the constructive suggestionsmade by the anonymous referee.Ialso appreciate the comments o f Professor Xijia Su from the China Europe International Business School and Pro fessor Qinchuan Hou from the Shanghai University of Finance and Econom ics.Assistance w ith data analysis provided by M s.JiaqiW u from the ShanghaiUniversity o f Finance and Econom ics issincerely app reciated.This research is sponsored by the National Natural Science Fund(G rant Nos.71102137 and 71402089)and theMOE Project run by the Key Research Institute of Humanities and Social Sciences in Universities(No.12JJD 790037).

Brown,R.,Ford,M.,1961.Address in Am erican English.J.Abno rm.Soc.Psychol.62,375–385.

Brown,R.,Gilman,A.,1960.Thep ronounsof power and solidarity.In:Sebeok,T.A.(Ed.),Style in Language.M IT Press,pp.253–276.

Brown,P.,Levinson,C.S.,1978.Universals in language usage:politeness phenomena.In:Goody,E.N.(Ed.),Questions and Po liteness: Strategies in Social Interaction.Cambridge U niversity Press,Cam bridge,pp.56–62.

Chen,X.,Li,M.,Rui,M.,X ia,L.,2009.Judiciary independenceand the enforcem ento f investor protection law s:m arket responses to the‘1/15’notice of the Supreme People’s Courto f China.China Econ.Quart.9(1),1–28(in Chinese).

Chen,X.,Zhang,T.,1999.M arket responses to capital restructure—empiricalstudy on capital restructure in the Shanghaistockmarket in 1997.Econ.Res.J.9,47–55(in Chinese).

Choi,J.H.,W ong,T.J.,2007.Auditors’governance functionsand legalenvironm ents:an international investigation.Contem p.A ccount. Res.24(1),13–46.

Davis,A.K.,Piger,J.M.,Sedor,L.M.,2012.Beyond the numbers:M anagers’use of optim istic and pessimistic tone in earnings p ress releases.Contem p.A ccoun t.Res.29(3),845–868.

DeAngelo,L.E.,1981.Auditor size and aud it quality.J.Account.Econ.3(3),183–199.

De Franco,G.,Hope,O.,Vyas,D.,Zhou,Y.,2011.Ambiguous Language in Analyst Reports.Working paper,University of Toronto.

Demers,E.,Vega,C.,2011.Linguistic Tone in Earnings Announcements:News or Noise?Working Paper,INSEAD.

Dye,R.A.,1993.Auditing standards,legal liability,and auditor wealth.J.Polit.Econ.101(5),887–914.

Ervin-Tripp,S.M.,1972.On socio linguistic rule:alternation and co-occurrence.In:John,J.(Ed.),D irections in Sociolingu istics.Gum perz and Dell Hymes.Rinehart and W inston,New York,pp.213–250.

Fan,J.P.H.,Wong,T.J.,2005.Do externalauditors perform a corporate governance role in emergingmarkets?Evidence from East Asia. J.A ccount.Res.43(1),35–72.

Feldman,R.,Govindaraj,S.,Livnat,J.,Segal,B.,2009.M anagem en t’s tone change,post earnings announcem ent drift and accruals.Rev. Acc.Stud.15,915–953.

Henry,E.,2008.A re investors infuenced by how earnings p ress releases arew ritten?J.Bus.Commun.45,363–407.

Li,F.,2008.Annual report readability,current earnings,and earnings persistence.J.Account.Econ.45,221–247.

Li,F.,Lundholm,R.M innis,M.,2011.The impact of perceived competition on the prof tability of investm entsand future stock returns. W ork ing Paper,U niversity of M ichigan and University of British Columbia.

Li,Z.,1999.Em pirical study:information contents of audit opinions.Account.Res.8,16–22(in Chinese).

Loughran,T.,M cDonnald,B.,2011.W hen isa liability nota liability?Textualanalysis,dictionaries,and 10-K s.J.Finance 66(1),35–65.

M erk ley,K.J.,2011.N arrative D isclosure and Earnings Perform ance:Evidence from R&D D isclosures.W orking paper,Cornell U niversity.

Nelson,K.,Pritchard,A.,2007.Litigation Risk and Voluntary Disclosure:TheUseo fM eaningfulCautionary Language.W orking paper, Rice University.

Newey,W.,W est,K.,1987.A sim p le positive sem i-defnite,heteroskedasticity and autocorrelation consisten t covariance matrix. Econom etrica 55,703–708.

Scotton,C.M.,Zhu,W.,1983.Tongzhi in China:Language change and its conversational consequences.Lang.Soc.12(4),477–494.

Sikes,S.A.,Tian,X.,W ilson,R.,2014.Investors’reaction to the use of poison pillsasa tax loss preservation tool.J.Account.Econ.57, 132–148.

Sim unic,D.A.,1980.The p ricing of audit services:theory and evidence.J.Account.Res.18(1),161–190.

Simunic,D.A.,Wu,X.,2009.China-related research in auditing:a review and directions for future research.China J.Account.Res.2(2), 1–25.

Sun,Z.,Wang,Y.,1999.Empirical study on explanatory paragraphs and changing o f audit opinion.Intern.Audit.China 6,10–15(in Chinese).

Tama-Sweet,I.,2009.Domanagersalter the tone of theirearningsaround stock option grantsand exercises?D issertation,Departmentof Accounting and the Graduate Schoo l of the University of Oregon in California State University.

Wu,X.,2012.Corporate governance and audit fees:evidence from com panies listed on the ShanghaiStock Exchange.China J.Account. Res.5(4),321–342.

Xiong,Y.,2007.Spirito fChinesepeople in the Spring and Autumn:im perialpower and academ ia in traditionalcontextof China.Shanxi NormalUniversity General Publishing House Co.,Ltd,Xian,pp.105–111(in Chinese).

Zhang,S.,2009.Exploring the Originso f Bingcheng from theperspectiveo f language,literatureand culture.Soc.Sci.China 5,154–167(in Chinese).

Zhang,Q.,Zhang,M.,Dai,J.,2006.Review of research on audit pricing in China.Account.Res.6,87–93(in Chinese).

Zhao,Z.,2007.Small prof t,independent directorsand auditing.Account.Res.4,90–94(in Chinese).

Zhao,Z.,Zhou,J.,2013.Independentdirectorsw ith industrialexpertise,businesscom plexity and audit fees.China Account.FinanceRev. 1,39–79.

Zhu,K.,Sun,H.,2012.The reform of accounting standards and audit p ricing.China J.Account.Res.5(2),187–198.

http://dx.doi.org/10.1016/j.cjar.2014.11.001

1755-3091/©2014 Sun Yat-sen U niversity.Production and hosting by B.V.

This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/3.0/).

Audit independence

Power-so lidarity ef ect

Po liteness princip le