M andatory IFRS adoption and executive com pensation:Evidence from China

2014-02-22QingchuanHouQingluJinLanfangang

Qingchuan Hou,Qinglu Jin,Lanfang W ang

ShanghaiUniversity of Finance and Economics,China

M andatory IFRS adoption and executive com pensation:Evidence from China

Qingchuan Hou,Qinglu Jin*,Lanfang W ang

ShanghaiUniversity of Finance and Economics,China

A R T IC L E I N F O

Article history:

Received 23 January 2013

A ccep ted 6 Sep tem ber 2013

Availab le online 3 January 2014

JEL classif cation:

J33

M 41

M 48

IFRS adop tion

This study investigates how themandatory adop tion o f International Financial Reporting Standards(IFRS)afects the contractual benef ts of using accounting in formation to determ ine executive com pensation in China.A fter controlling for f rm and corporate governance characteristics,we f nd strong evidence supporting the positive ro le o f mandatory IFRS adop tion on the accounting-based performance sensitivity o f executive com pensation.Subsample analysissuggests that imp rovements in accounting-based performance sensitivity after IFRS adop tion dif er across regions w ith various levels of institutional quality and across f rm s that are af ected to a dif erent extent by the adop tion.Additional analysis supports the argument that the positive ef ects o f IFRS adop tion on the use of accounting performance in executive compensation are driven by the reduction in accounting conservatism associated with IFRS adop tion.

©2013 Production and hosting by Elsevier B.V.on behalf o f China Journalof Accounting Research.Founded by Sun Yat-sen University and City University o f Hong Kong.

1.Introduction

A single set of high quality,globally accep ted accounting standards isneeded to support the grow ing globalization ofmarkets.According to Deloitte and Touche,as of the end o f 2010,123 of theworld’s 154 juris-dictions where stock m arkets exist either perm it or require dom estic listed com panies to repo rt acco rding to International FinancialReporting Standards(IFRS).Furthermore,95 of theworld’s totalo f 173 jurisdictions either perm itor requireun listed com panies to reportaccording to IFRS.A largebody o f academ ic studieshas been devoted to exam ine the benef tso f IFRSadop tion for accounting quality in termso f conservatism,earningsmanagem ent,value-relevance,market reaction,Tobin’s Q,analyst forecast accuracy and foreign investments.A lthough the resu lts of these studiesarem ixed,m any researchers f nd the ef ectso f IFRS adop tion to bemainly positive(Lang et al.,2003;Covrig et al.,2007;Barth et al.,2008;Chen et al.,2010).

Recent studieshavestarted paying attention to the contractualbenef tsof IFRSadoption for internalinformation users.As G jesdal(1981),Wattsand Zimmerman(1986),Ball(2001)and O’Connell(2007)point out, the contractual exp lanation or stewardship perspective is essen tial for accounting in form ation.Ifm anagers’efo rts are ref ected in accoun ting perform ance,then accounting perfo rm ance w ill be used m ore frequen tly in executive com pensation contracts,and this in turn can m itigate agency problem s between m anagers and shareholders(Ho lmstrom,1979;Lambert and Larcker,1987;Bushman and Sm ith,2001).Wu and Zhang (2009)analyze the benef ts o f voluntary IFRS adop tion for internal performance evaluation in terms o f CEO turnover and employee layof s.Using a sample o f European Union(EU)companies,these authors f nd that thevo luntary adoption of IFRS isassociated w ith an increased sensitivity of CEO turnover and employee layof s to accounting earnings.Ozkan etal.(2012)investigatehow themandatory adop tion o f IFRSin the EU afects the use o f accounting in formation in executive compensation.Their resu lts suggest that aftermandatory IFRSadop tion there are improvem ents in accounting-based performance sensitivity and the relativeperformance evaluation of executive compensation based on accounting earnings.We enrich these studies by investigating a single em erging country,China,as this focus allow s us to exam ine facto rs and tensions that are m issing in m ost EU-based studies.G iven the diverse nature o f China’s econom y,this country is also a good setting to exp lore the variation in incentives across both regions and f rms.

Asam ilestoneo f international convergence for f nancial reporting,China formally announced the issuance of itsnew Chinese Accounting Standardson February 15,2006.The new standardsbecame efective from January 1,2007 for all listed f rms.Nearly all topics o f IFRS are covered in the new standards,which are substantially in line w ith IFRS,excep t for a few modif cations made for China’s unique environment.For simp licity hereafter,we refer to the new standards as“IFRS”and the old standards as“Chinese GAAP”. An essential characteristic diferentiating IFRSasadopted in China from thatadop ted in the EU is the import of fair value(Deloitte Touche Tohmatsu,2006).Fair value accounting involves a fundamental change and a severe challenge fo r China’s accounting practices.Before m andato ry IFRS adoption in 2007,accounting in form ation in China wasm ain ly based on historical cost instead o f fair value.However,m any countries in the EU had already app lied fair value accounting even before their m andatory adoption o f IFRS in 2005.1Statisticsin M u lleretal.(2011)show thatduring thepre-IFRSadoption period in European countries,111 observations contained fair values of investment properties and only 27 observations did not.He et al.(2012)f nd that fair value accounting hasbeen associated w ith signif cant earningsmanagement since mandatory IFRS adoption in China.Further evidence documents a signif cant reduction in accounting conservatism after IFRS adop tion.2U ntabulated results based on both the Basu(1997)model and the Khan and W atts(2009)m odel suggest a signif can t reduction in accounting conservatism after IFRS adoption.However,these increases in earnings managem ent and decreases in accounting conservatism can have opposite efects on the use of accounting perform ance for determ ining executive compensation.Earningsmanagement can help in w indow-dressing or decoratingmanagers’efortand conservatism can p rovide biased accounting information or increaseestimation error.On the one hand,if theboard o f directors can detectearningsmanagem entactivitieswhen evaluating accounting performance,then increases in earningsmanagementassociated w ith theadoption of IFRSshou ld reduce the role of accoun ting perfo rm ance in determ ining executive com pensation.On the other hand,the reduction in accounting conservatism after IFRS adoption shou ld increase theweigh t o f accounting perfo rm ance in determ ining executive com pensation,because tim ely recognition of both good new s and bad new sm akes accoun ting in formation a better and more natural indicator of managers’efort.In this study,we aim to supp ly empirical evidence concerning these efects.

U sing a sam p le of 6787 f rm-year observations for A-share f rm s in China from the 2004–2009 period,we investigate the ef ecto fmandatory IFRSadoption on the use of accounting performance in determ ining executive com pensation.Using a changemodel,we document evidence supporting the fo llow ing empirical questions:(1)whethermandatory IFRSadop tion in China af ects theaccounting-based performance sensitivity o f executive compensation;(2)if so,whether the ef ect ofmandatory IFRS adop tion on accounting-based performancesensitivity difersacross regionsw ith varying levelsof institutionalquality;and(3)if so,whether the efect ofmandatory IFRS adop tion on accounting-based performance sensitivity dif ersacross f rms that are afected by the adoption to diferent degrees.

A fter contro lling for f rm and corporate governance characteristics,we f nd strong evidence that IFRS adoption has a positive ro le in the accoun ting-based perfo rm ance sensitivity o f executive com pensation.Specif cally,com pared w ith the pre-IFRSadoption period,f rm shave signif can tly increased the accoun ting-based perform ance sensitivity of executive com pensation during the post-IFRS adoption period.To answer the second and third questions,we conduct the same analysis,but use subsamp les based on cross-regional institutional quality(as measured by levels of marketization)and subsamp les based on the in fuence o f IFRS across f rm s(asmeasured by IFRS ad justments in 2006).The resu lts suggest that the positive ef ect of IFRS adoption on accounting-based perform ance sensitivity occurson ly in regionsw ith higher institutional quality and in f rms that arem ore af ected by the adop tion.

We also provide evidence on the possible channels through which IFRS af ects the use o f accounting performance in determ ining executive compensation.W e perform additional subsample analyses based on the income from changes in fair value and on changes in accounting conservatism in China.The resu lts indicate that the positive ef ects o f IFRS adoption on the accounting-based perform ance sensitivity o f execu tive compensation are driven by a reduction in accoun ting conservatism that is associated w ith IFRS adoption.

This study contributes to the literature on IFRS adop tion in severalways,which distinguish our research from two closely related studiesbyW u and Zhang(2009)and Ozkan et al.(2012).First,we comp rehensively discuss themechanism through which IFRS adop tion afects the use o f accounting performance in determ ining executive compensation.W ealso providedirectevidenceo f the reduction in accounting conservatism after IFRSadop tion.Combined w ith evidence from prior studies indicating increases in earningsmanagementassociated w ith IFRS adop tion,our research investigates whether the changes in earningsmanagem ent and in accounting conservatism play dif erent roles in theweighting o f accounting performance in executive compensation.Additional analysis suggests that in China,the positive efect o f IFRS adoption on the accountingbased perfo rm ance sensitivity of executive com pensation is driven by the associated reduction in accounting conservatism.The second con tribution of this study is to extend the literature on the ef ect of IFRS adoption on execu tive com pensation to the case o f China,which is substan tially diferen t from m aturem arkets.As an emergingmarket,China has relatively immature capitalmarkets,weak legal enforcement,weak auditor independence andmore concentrated ownership.A ll of these factors in fuence the incentives involved in f nancial reporting.The lack of ef ciently functioning capitalmarkets also means that the process o f adop ting and imp lementing fair value accounting isespecially challenging,and this situation leads to considerable accounting in formation noise.So far,there isvery littleempiricalevidencedocumenting theeconom ic consequenceso f IFRS adop tion in emerging econom ies.It is widely suggested,however,that emerging markets are substantially diferent from developed markets in m any dimensions,including institutional,organizational and m arket aspectso f the economy and society.Our f ndings suggest that accounting-based performancesensitivity in China is signif cantly im p roved after IFRS adop tion.A third con tribution of ou r study is that our exp lo ration o f a single country,China,allow s us to en rich our understanding on a range of factors that are generally no t considered in m ost EU-based studies.W e p rovide em piricalevidence on the signif cant variation in incen tives across both regions and f rms.In particular,we fnd that the positive efect o f IFRS adop tion on the use o f accounting performance information in executive compensation occurs on ly in regions with higher institutional quality and in f rmsmore afected by IFRS adop tion.

The remainder of this paper is organized as follows.Section 2 p resents a literature review and raises our research questions.Section 3 describes the data,variab les and methodology.Section 4 p rovides empirical resultsand analysis.Section 5 app liesadditional tests.Section 6 conductsextensive robustness checksand Section 7 concludes the paper.

2.Literature review and research questions

2.1.Pay-performance sensitivity

A tremendous amount o f research has been devoted to exp loring the relationship between executive compensation and f rm performance,which isknown aspay-performancesensitivity.Theessential theoretical linkage between f rm performance and executive com pensation is proposed in the principal-agent model as developed by Jensen and M eckling(1976),Holmstrom(1979),Shavell(1979)and Fama(1980).Thismodel emphasizes thatmanagersare self-serving and that formalmechanisms,such asmonitoring and reward structu res,arem ean t to align the incen tives o f top m anagersw ith the interests of shareho lders.Prior studies have im p lied that accoun ting and fnance regu lation can in fuence pay-perfo rm ance sensitivity.Perry and Zenner (2001)suggest that pay-perform ance sensitivity,asm easu red by to tal annual com pensation o r f rm-related CEO wealth,has increased for f rm s that are likely to be afected by section 162(m)of the Internal Revenue Code.Consistentw ith the rent-extraction hypothesis,Paligorova(2008)shows that pay-performance sensitivity strengthened after the adoption of the Sarbanes–Oxley Act(SOX)in f rmswhose corporate boardswere less independent prior to SOX.

Findings from severalstudiesshow that executive com pensation in China ispositively related to accounting perform ance(G roves et al.,1995;M engistae and Xu,2004),shareholder value(Buck et al.,2008)and sales grow th(Kato and Long,2006).Other studies suggest that a f rm’s ownership structure also has signif cant efects on the compensation schemes of Chinese executives(D ing et al.,2006;Firth et al.,2006).

2.2.Role ofmandatory IFRS adoption in accounting quality3For the efectsof vo luntary IFRS adoption,please refer to Barth et al.(2008),Hung and Subramanyam(2007),Bartov et al.(2005), Ashbaugh and Pincus(2001)and Covrig et al.(2007).Vo luntary IFRS adoption is found to have a positive role in accounting quality and overall comparability according to the existing literature.

A rm strong et al.(2010)docum ent a positive m arket reaction to IFRS in f rm s w ith lower pre-adoption in form ation quality and in f rm s that are dom iciled in comm on law coun tries.Daske et al.(2008)f nd that mandatory IFRS adop tion is associated w ith increases in market liquidity,but the ef ects on cost of capital and Tobin’s Q arem ixed.Chen et al.(2010)suggest that themajority o f accounting quality indicatorshave imp roved after mandatory IFRS adop tion.By investigating 1146 f rm-year observations from Australia, France and the UK during 2005 and 2006,Jeanjean and Stolowy(2008)fnd that earningsmanagem ent in these countries did not decline signif cantly after themandatory adoption o f IFRS,and that in France earningsmanagementactually increased.Horton and Serafeim(2010)conduct an event study in the UK to investigate whether there is any market reaction to or value-relevance of the information contained in the transitional report required by IFRS 1,the First Time Adoption of InternationalFinancialReporting Standards. Their resu lts show that there are signif cant negative abno rm al returns fo r f rm s reporting a negative reconciliation ad justm ent to UK GAAP earnings.These f nd ings suggest that IFRS is changing investo rs’beliefs about stock p rices.

In general,p revious studies o f developed market econom ies have generated m ixed resu lts.These diverse results cou ld be due to the dif erent samples,in formation environm entsor institutional settings.Resu lts from developed econom ies,however,cannot be readily extended to the developing and transitional economy o f China,because of its unique econom ic system and itsweaker institutions.

By using theuniquenesso f the f nancial reports from B-share companiesin China,som estudieshave shown that the application IFRShashadm ixed consequences for accounting quality even prior to 2007(Zhou et al., 2010;Eccher and Healy,2003;Chen and Zhang,2010).4In China,some public companies are allowed to issue two kinds of shares simultaneously—A-shares to domestic investors and B-shares to foreign investors.A-share companiesare required to prepare fnancial reportsbased on Chinese GAAP and B-share companies are required to prepare fnancial reports based on IFRS.Hence,even before it becamem andatory for all listed com panies to adopt IFRS in 2007,B-share companies in China were already required to app ly IFRS.A fter the adop tion o fmandatory IFRSin 2007,studieso f its efects in China have been extended to A-share f rms.Xue et al.(2008),Luo et al.(2008)and Zhangand Zhang(2008)fnd an im p rovem en t in the value-relevance o f accounting in form ation under IFRS compared to the situation under China GAAP.Zhang and Zhu(2010)suggest that there has been a reduction in accounting conservatism after mandatory IFRS adoption and that this reduction did not arise from increases in earningsmanagement.Evidenceo f earningsmanagementassociated w ith IFRSadoption isshown by Zhang et al.(2007),Wang et al.(2009),Ye et al.(2009)and He et al.(2012).In general,there is no consistent conclusion about the econom ic consequences ofmandatory IFRS adop tion in China.

2.3.Development of research questions

Our study is related to the contractual ro leo f accounting in formation,which hasbeen recognized as important by researchers such asG jesdal(1981),Watts and Zimmerman(1986),Ball(2001)and O’Connell(2007). W e are interested in the contractual benef t o f mandatory IFRS adop tion for executive compensation in China,i.e.,theef ecto fmandatory IFRSadop tion on the use of accounting performance in determ ining executive compensation.The two studies by Wu and Zhang(2009)and Ozkan et al.(2012)investigate sim ilar research questions to ours in EU countries.However,Wu and Zhang(2009)emphasize the roleo f accounting conservatism in CEO turnover,and Ozkan et al.(2012)document the role o f general accounting quality in execu tive com pensation.

W u and Zhang(2009)suggest that vo luntary IFRS adop tion has afected the ro le of accounting conservatism in CEO turnover and em p loyee layof s.These autho rs fnd an overall im provem en t in accoun ting conservatism fo llow ing voluntary IFRS adop tion in EU countries.IFRS adop tion can be a particularly powerful tool in discip lining poor perform ingmanagers,because it speedsup the recognition of losses.IFRS adoption p rovides the board and shareho ldersw ith a reason to investigate lossesand,if necessary,to dism iss themanager.CEO turnover refectson ly themost extreme penalizing aspect of the compensation contract.Executive compensation,however,refects both the reward and punishment sideso f the com pensation contract.Ozkan et al.(2012)argue that having high quality accounting information under IFRS increases the weight o f accounting performance in executive compensation contracts.Exam ining executive compensation in EU countries,these authors conclude that there hasbeen increm ental use of accounting-based performance sensitivity and relative perform ance evaluation in executive com pensation sincem andato ry IFRS adoption.

In China,the ef ect o fm andatory IFRS adoption on accounting quality is quite d if erent from that in EU countries.Asan emergingmarket,China has relatively immature capitalmarkets,weaker legal enforcement, lessauditor independence andmore concentrated ownership.A llo f these factors inf uence the incentives concerned in fnancial reporting.The lack o f ef ciently functioning capitalmarketsalsomeans that the processo f adopting and implementing fair value accounting isespecially challenging,which leads to a great dealo f noise in accounting in formation.Fair value outcomes can serve as signals for managerial efort that are not fully captured by stock returns in the period when the efort is exerted.Fair value,therefore,can p rovide amore timely signalw ith respect to unobserved efort than traditional historic accounting measures of income and exposure.For examp le,it can be argued that changes in themarket value o f investment securities are due to luck.However,m anagers have som e discretion over which secu rities to pu rchase,how long to hold them and the tim ing o f trades.In m aking these choices,m anagersm ay be p redicting changes in them arket value o f certain assets.

The recent study by Heet al.(2012)exam inesearningsmanagementactivities thatare induced by fair value accounting and associated w ith mandatory IFRSadop tion in 2007.The evidence presented in this study suggests that f rmsaremore likely to sellavailab le for sale securities for gains if their fair value changes in trading securitiesare negativeand that such earningsmanagement ismorep ronounced among f rmsw ith extra incentives to avoid reporting losses.He et al.also f nd that f rms take advantage of the new fair value accounting ru les for debt restructuring by using the gainson restructuring to cover losses.Further analysis shows thatall o f these earningsmanagem ent activities aremore severe among f rmsw ith poorer corporate governance and among f rms in regionsw ith weaker institutions.

As there is stillno direct evidence in the literatu re on the consequencesof accounting conservatism after the m andato ry IFRS adop tion in China,we conduct such an exp loration.In particu lar,we app ly the Basu(1997) and K han and W atts(2009)m odels.Un repo rted results from thesem odels suggest that there is a signif can t decrease in accounting conservatism after IFRSadop tion.Results from the Basu(1997)model further indicatethat the reduction in accoun ting conservatism arises from the increased sensitivity of earnings to good new s fo llow ing IFRS adoption.However,there isno signif cant change in the sensitivity of earnings to bad news fo llow ing IFRS adoption.Such fndings are consistentw ith the adop tion o f fair value accounting.The purpose o f fair value accounting is to make accounting information more natural and more in linew ith market value.Unlike the historical cost ru le under Chinese GAAP,the fair value ru le ismore relaxed toward theverif cation of good newsand perm itsmore recognition o f gains.M u ller et al.(2011)demonstrate that themandatory adop tion of fair value accounting in reporting values o f investment p roperty results in reduced in formation asymm etry among market participants.As suggested by W ier(2009),there is a potential trade-o f between fair value accounting and conservatism in revenue recognition.5A lthough evidence suggests an overall imp rovement in accounting conservatism due to voluntary IFRS adoption in European countries(Lang et al.,2003;Barth et al.,2008),recent studies have p rovided some evidence indicating a reduction in timely loss recognition due to m andato ry IFRS adoption in European countries(Sa´nchez et al.,2009;Chen et al.,2010;Gebhardb and N ovotny-Farkas,2010).

However,the increases in earningsm anagem en tand decreases in accounting conservatism can af ect the use of accounting perfo rm ance in execu tive com pensation in either o f two directions.The po tentially negative role of earningsm anagem en t is easy to understand.M anagers d ressup their perfo rm ance such that the accounting in formation does not tru ly ref ect their ef ort.Peng(2011)p rovides direct evidence for the ef ect o f accruals quality on theusefulnessof earnings in incentive contracting.Her evidence indicates thatbetter accrualsquality isassociated w ith a higher weight on company earnings in compensation contracts.The increases in earningsmanagem ent after IFRS adoption in China imply that accounting performance has greater deviation from manager’s ef ort.A ll things being equal,performance tends to be noisier w ith regard to evaluation o f the executive’s efort choice.Therefore,compensation comm ittees shou ld place less reliance on earnings follow ing IFRS adoption.

The reduction in accounting conservatism could play a positive ro le in theuseo faccounting performance in execu tive com pensation.Tim ely recognition of both good new sand bad new s ishelp ful in ref ectingm anagers’efo rt,and in m itigating the inform ation asymm etry and agency contradiction between execu tives and shareholders.Watts(2003)argues thataccounting conservatism isattributed to theuseo f accounting statements in compensation contracts.However thisargument isbased on theview thatmanagers’incentives for overinvestment dom inate their incentives for underinvestment,which seemsp roblematic and doesnot f twellw ithin the econom ics fram ework.The literature has documented a tendency o fmanagerswith short horizons to either underinvest or overinvest.If losses are not recognized in a timely manner,managersw ill not be ab le to discontinuepoor perform ing pro jects in time(Balland Shivakumar,2005).If gainsarenot recognized in a timely manner,managersw illm iss opportunities to invest in p rof t-making p rojects(Leuz,2001;Watts,2003;Guay and Verrecchia,2006).The recent study by Bushman etal.(2011)indicates that the speed w ith whichmanagers increase investm en t fow s in response to im p roved investm en t oppo rtunities varies asm uch as the speed w ith which they decrease investm ent f ow s in response to deterio rating investm en t oppo rtunities.This com parison suggests that providing incen tives form anagers to invest in positive net presen t value(NPV)pro jects is as important as providing incentives formanagers to shut down negative NPV p rojects(Guay and Verrecchia, 2006).

Hence,the accounting information under fair value accounting could bemore ref ective of an executive’s efort than that under historical cost accounting,even though fair value accounting is less conservative.Bandyopadhyay et al.(2010)provide empirical evidence that increasing accounting conservatism over the past 30 years in the U.S.has contributed to the decline in earnings usefulness,due to its divergent ef ects on the possibility o f using current earnings to p redict(1)future cash fowsand(2)future earnings.M ore timely recognition o f gains and losses could be help fu l in reducing the degree o f underestimation in f rm value,in m itigating the estim ation errors from conservatism and in verifying a m anager’s efo rt m ore accu rately.Such recognition could in tu rn increase the use o f accounting perfo rm ance in determ ining executive com pensation.

Considering the ef ectso f IFRS adoption arising from the changes in earningsm anagem en t and accounting conservatism,and considering theways these factors inf uence theuse of accounting performance in executive compensation,wenow raise the f rstempiricalquestion about theef ecto fmandatory IFRSadop tion on executive compensation.

Question 1.Doesm andatory IFRS adoption afect the accounting-based perform ance sensitivity o f executive compensation?

It isw idely accep ted that cross-country institutional factors signif cantly contribute to the econom ic consequences o f IFRS adoption(Chen et al.,2010;Jeanjean and Stolowy,2008;Daske et al.,2008;A rmstrong et al.,2010).These institutional factors include legal enforcement,government regim es,business environm ents and regu lation imp lementation.Ball(2006)mentions that“there inevitably w ill be substantial diferences among countries in imp lementation o f IFRS,which now risk being concealed by a veneer o f uniform ity.The notion that uniform standards alone w ill p roduce uniform f nancial reporting seems naive.”

As a large and em erging m arket,China has great variations in institutional quality com pared w ith other regions,due to its com p licated history and po licy reasons.Such an uneven institu tional developm en t across regions o f China allow s us to exam ine the efects o f institutions on IFRS im p lem en tation w ithin a single country.For examp le,better investor p rotection and a stronger legal environm entmay increase the supp ly and demand for high quality f nancial reports.W ell-estab lished,market-oriented ru les that are associated w ith better corporate governance practices tend to alleviate expropriation-related transactionsand tunneling activities.A lso,the development of private business tends to avert severe po litical burdens and to increase m anagement orientation toward value maxim ization.W e can sense intuitively that a better institutional environmentmakes performance statisticsmore important for the compensation and valuation assessment o f executives.

If them andatory IFRS adop tion in China increases the accounting-based performance sensitivity of execu tive com pensation,then we p redict that such an efect difers across regions w ith diferen t levels o f institutional quality.In particu lar,the efect o f m andatory IFRS adoption on accoun ting-based perfo rm ance sensitivity should be greater in areasw ith highermarketization than in areasw ith lower marketization.W e m ake useo f themarketization index(M Index)provided by Fan etal.(2007)to capture thisef ect.The M Index isa comprehensive index that p roxies for the institutionalquality of each province in China.H igher valueso f this index indicate a better institutional environment.6The index coversm any institutional aspects,including(1)the relationship between governm ent and m arket,such as the role o f the m arket in allocating resources and a f rm’spo licy bu rden in addition to taxes;(2)developm ent of non-state businesses in term sof the ratio o f industrial output by the private sector to total industrial output;(3)development of productmarkets in term sof the scale of regional tradebarriers;(4)developmentof factormarkets captured by foreign direct investmentand labormobility;and(5)developmentofmarket interm ediaries and the legal environmen t.Som e specif c aspects of the index also im p ly the variance of labo r markets across regions in Ch ina,such as the levels of labor m obility.The M Index hasbeen w idely accepted asameasure o f institutional heterogeneity in China by researchers such asWang et al.(2009),Jiang et al.(2010)and He etal. (2012).Therefore,our second research question is as fo llows:

Question 2.Does theef ectofmandatory IFRSadop tion on accounting-based performancesensitivity dif er across regionsw ith dif erent levels o f institutional quality?

If IFRS adoption hasany ef ect on accoun ting-based perform ance sensitivity,then we can sense in tuitively that the degree o f this ef ectw ill vary fo r d if erent f rm s.In other words,f rm s them selves react diferen tly to the adop tion of IFRS due to the heterogeneous properties o f their investm ents,operations o r m anagem ent. A fter the adop tion of IFRS,therem ight be great changes in some f rm s’accounting in formation,but on ly sm all changes in other f rms’information.Normally,it is dif cult to measure such cross-f rm diferences in the ef ectsof IFRS,becausewe do not have two setsof accounting inform ation for the same f scal year(w ith one set prepared under IFRS and another under local GAAP).However,the China Securities Regu latory Comm ission(CSRC)required all listed f rms to disclose their adjustments in f nancial in formation based on IFRS for fscal 2006.Therefore,for 2006,the year imm ediately p rior to themandatory adoption of IFRS, each f rm did prepare one set of fnancial reportsbased on Chinese GAAP and another based on IFRS.The changes in theway each f rm reports accounting information directly indicate the inf uence of IFRS on that f rm.As such an infuence ref ects the in ternal characteristicso f the f rm and is external to the im p lem en tation o f IFRS,we predict that such changes are consistent in the years fo llow ing IFRS adoption.Fo r each f rm,we can m easu re the in fuence of IFRS by com paring the net incom e under Chinese GAAP and under IFRS in 2006.

If accoun ting-based perfo rm ance sensitivity isafected by them andatory adop tion o f IFRS,we p redict that such an efect shou ld be greater for the f rmsmore af ected by IFRS,asmeasured by the IFRS adjustments in 2006.Hence,our third research question is as follows:

Question 3.Does theefect ofmandatory IFRSadoption on accounting-based performancesensitivity vary across f rms that are af ected diferently by the adop tion?

Questions2 and 3 arebased on the p rediction of Question 1,and they should provide further evidence of a f rm’s use o f its own accounting performance in executive compensation.

3.Research design

3.1.Sample

Our primary sample consists of A-share companies listed on the Shanghaior Shenzhen stock exchanges from 2004 to 2009,excluding companies in the fnancial industry.For each f rm-year observation,we co llect in formation on executive compensation and corporate governance from the CCER database developed by Sino fn Financial In formation Service,and in formation on f nancial accounting from the W ind database. Excluding special treatment(ST)com paniesand observations forwhich we do not have the data to calcu late changes in executive compensation or other variables required in our regressions,we are leftw ith 6787 f rmyear observations.Panel A o f Table 1 p resents the samp le selection process.

In Table1,Panel B reports the sample distribution by year and by industry.The samp le is distributed quite even ly across the six years from 2004 to 2009.The sam p le covers 12 industries based on CSRC’s industry classif cation.Them ajority of our sam p le belongs to them anufactu ring secto r,which constitutes about 59%o f f rms in our sample.Only 44 observations for the communication and cultural industry are availab le,constituting about 0.65%o f our sam ple.This industry distribution isquite sim ilar to the population o f listed companies in China.

Table 1 Sam p le selection p rocess and samp le distribution.

3.2.M ethodology

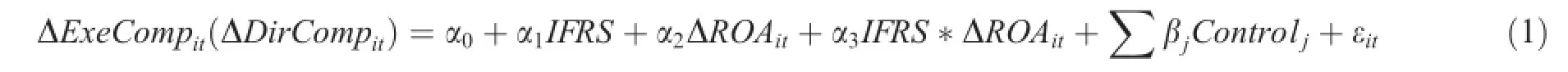

We app ly an OLS changemodel to analyze the inf uence o f IFRS adop tion on executive compensation.7Com pared w ith the levelmodel,the changemodel can better mitigate the infuence o fmissing factors and self-selection concerns. Furthermore,as there are some diferences in the infuence of IFRS adoption on total assets and net income,the levels o f accounting perform ance(ROA)from the pre-to post-IFRS adoption periods lack com parability.These diferences should increase the estimation noise in the levelmodel.The changemodel can m itigate such noise by using the two sets of fnancial information for 2006 based on ChineseGAAP and IFRS.Specif cally,the change in ROA for2006 iscalculated as ROA in 2006 based on Chinese GAAPminus ROA in 2005 based on Chinese GAAP.Sim ilarly,the change in ROA for 2007 is calculated as ROA in 2007 based on IFRSm inus ROA in 2006 based on IFRS.Specif cally,the regression model to exam ine accounting-based perform ance sensitivity can be stated as fo llows:

The coef cient o f interest isα3,which captures the change in the accounting-based performance sensitivity o f executive compensation from the pre-to post-IFRS adoption periods.8Previous studies by G roves et al.(1995)and M engistae and Xu(2004)have already provided som e evidence that in China executive com pensation and retention p racticesare shaped by accounting outcomes.To alleviate doubt thataccounting performance is considered when deciding executive com pensation in China,we further collect by hand the compensation contracts voluntarily disclosed by listed f rm s from the ShanghaiStock Exchange(www.sse.com.cn),the Shenzhen Stock Exchange(www.szse.cn)and theW ind database,among o ther sources.W e obtain a totalof 109 compensation contracts corresponding to 104 f rm s(about 6.5%of all listed com panies)during the 2004–2009 period.By thoroughly investigating these 109 compensation contracts,we fnd that allo f them take accounting earnings as a criterion for executive compensation.Some of them use additionalaccounting information such as salesgrow th or asset turnover.Yearly d istribution and logistics analyses suggest that after them andato ry IFRS adoption,the num ber o f disclosed com pensation contracts has signif cantly increased.As fo r the com pensation structure,m ost of these contracts(100 out of 109)are com binations of cash and bonus, and only 9 contracts include equity incentives that consist of cash,bonusand equity.To ru le out the possible inf uence o f ou tliers,we w insorize the top and bottom f ve percen tiles fo r each continuous variable in all regression m odels.

As IFRS adoption afects all Chinese A-share f rm s,it is no t possible to app ly a“d iference-in-diference”design to distinguish the pureef ectso f IFRSadoption from those of other general changesduring thesam ple period.Hence,we p rovide an association analysis rather than a causality test.Even though such analysis is inherently a data p rob lem and isused in many studieson the ef ectso f IFRSon company behavior,we have triedmany additionalsubsamp leanalyses,whichm itigate the concern that our f ndingsare driven by contemporaneous changes.9For exam ple,the subsam ple analysis based on IFRS ad justments(Tab le 5)suggests that the efects of IFRS adoption on payperform ance sensitivity are stronger am ong f rm s that arem ost likely to be afected by IFRS.A lso,the exam ination of B-and H-share com panies(Table 7)provides some evidence on the causality between IFRS adoption and executive com pensation.

3.3.Variables

3.3.1.Executive compensation,accounting performance and IFRS adoption

W e app ly an OLS changem odel to estim ate the efect o fm andato ry IFRS adoption on executive com pensation.Considering thatm any directors are actually execu tives in China and to be consisten t w ith p revious domestic research(Fang,2009;Tan and Xin,2009),we choose two alternativemeasuresof executive compensation—the combined compensation of the top three executives(ΔExeComp),and the combined compensation o f the top three directors(ΔDirComp).W e take logarithms to measure compensation,so that ΔExeComp(ΔDirComp)is the logarithm o f the combined compensation o f the top three executives(directors) in year t,m inus the logarithm of the combined compensation of the top three executives(directors)in year t-1.Accounting performance is measured by the change in ROA from the previous year(ΔROA).W e use an indicator variable,IFRS,to indicate whether IFRS ismandatorily adop ted.This variable takes the value 1 for the post-IFRS adoption 2007–2009 period,and 0 for the p re-IFRS adoption 2004–2006 period. H ence,in ou r prim ary regression m odel,the dependen t variab le isΔExeComp orΔD irComp,and the independent variab les includeΔROA,IFRS and the interaction term IFRS*ΔROA.

3.3.2.Control variables

To be consistent with prior research on executive com pensation(Leone et al.,2006)and to take China’s unique situation into account(Firth et al.,2006;Fang,2009;Tan and Xin,2009),we further contro l for f rm and corporate governance characteristics.

(1)Firm characteristics.W e include nine variab les to control for f rm characteristics.Specif cally,we include lagged yearΔROA(ΔROA_1)to control for p revious accounting performance,market-ad justed stock return(Return)to contro l for market perform ance,the interaction term of IFRS and Return (IFRS*Return)to control for changes in the sensitivity of executive compensation to a f rm’smarket perform ance from the pre-to post-IFRS adop tion periods,total assets(Assets)to contro l for f rm size, the ratio of total debt to to tal assets(Leverage)to con tro l fo r overall fnancial risk,the grow th rate of sales(Grow th)to con trol for grow th opportunities,stock retu rn vo latility(Volatility)to control for risks associated w ith stocks,and other indicators show ing whether a f rm exhibitsa loss in a year(Loss)and whether a f rm is a SOE(SOE).

(2)Corporate governance.It isw idely suggested that the form o f corporate governance has an in fuence on executive compensation.To account for this in fuence,we include the size o f the board o f directors (BoardSize)and the ratio o f independent directors on the board o f directors(IndDir)to control for board independence.We also include several variab les indicating whether a f rm has experienced a CEO turnover(CEOTurnover)or a board chairman turnover(ChairTurnover)in the given year,and whether a CEO is also the chairm an o f the board(Duality).

3.4.Summary statistics

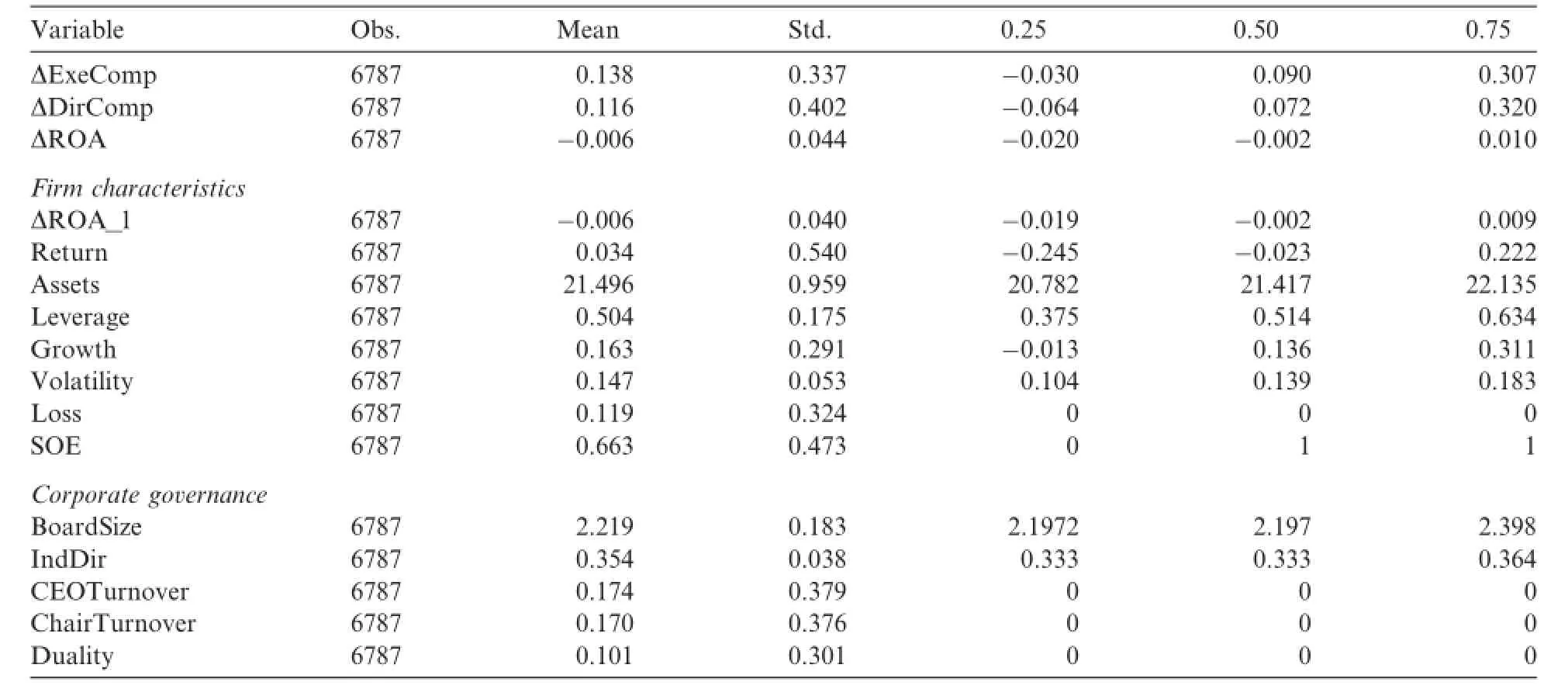

Table 2 presen ts the summ ary statistics fo r all variables,includ ing quartiles,m eans,standard deviations and the numbers of observations.As indicated,ΔExeComp andΔDirComp exhibit sim ilar trends duringthe sam p le period.Them ean ofΔExeComp(ΔD irComp)is 0.138(0.116)w ith a standard deviation o f 0.337 (0.402).On average,there isa 13.8%increase in the combined compensation o f a f rm’s top three executives and an 11.6%increase in the combined compensation o f a f rm’s top three directors over the p revious year’s compensation levels.Thediferencebetween the 0.75 quartileand the 0.25 quartileo fΔExeComp(ΔDirComp) is0.337(0.384).Themeans(medians)ofΔROA andΔROA_1 are-0.0061(-0.0016)and-0.0060(-0.0024), respectively,which suggest that the accounting performance o f the sample f rms decreased slightly during the 2004–2009 samp le period.

Table 2 Summary statistics.

Concerning the contro l variables,Table 2 shows that about 12%o f the sam ple f rms experienced a loss, 66%were SOEs,17%(17%)experienced CEO(chairman of the board)turnover,and the CEOs of 10.1%o f the sam p le f rm s were also the chairm en of the board.As reported in the table,them ean(m ed ian)o f stock retu rn(Return),assets(Assets),leverage ratio(Leverage),sales grow th rate(Grow th)and stock retu rn volatility(Volatility)is 0.034(-0.023),21.496(21.417),0.504(0.514),0.163(0.136)and 0.147(0.139),respectively.One third of the directors on the boards are independent,w ith very slight diferences in the variab le IndD ir.

In general,themeansandm ediansof thedependent,contro land test variab lesaresim ilar,and thestandard deviationsarew ithin an acceptab le range,which suggests that the distributionso f these variablesare not very skewed.

Unreported Pearson correlations among all o f the variab les show that neither the correlations among the contro l variables nor those between the test and contro l variablesare strong.These correlations suggest that our regression model does not su fer from serious multico llinearity.A lso,there is a positive correlation betweenΔExeComp(o rΔD irComp)andΔROA,which hin ts at the use o f the f rm s’own accoun ting perfo rm ance in their execu tive com pensation con tracts.

4.Empirical results and analysis

4.1.Accounting-based performance sensitivity in executive compensation

In this section,we investigate the ef ect ofmandatory IFRS adoption on accounting-based performance sensitivity.Tab le 3 reports the OLS regression results of equation(1).A ll t-statistics(in parentheses)are adjusted for heteroskedasticity(W hite,1980)and clustered by f rm(Petersen,2009)to account for time series correlations.W e f rst relateΔExeComp toΔROA,IFRS,IFRS*ΔROA,ΔROA_1,Return and IFRS*Return w ithout contro lling for other variab les in M odel1.W e then add all of the other control variables in M odel 2. As shown,the coef cient o fΔROA is positive at a signif cance level of less than 1%,which suggests that accoun ting-based perfo rm ance sensitivity is positive in the pre-IFRS adoption period.This f nd ing is consisten t w ith p rior studies by Du and W ang(2007)and Fang(2009).W e fu rther f nd a positive and signif can t coef cien t on the interaction term IFRS*ΔROA.Specif cally,the results in M odel 2 suggest that accoun ting-based performancesensitivity increasesafter IFRSadop tion.In econom ic terms,a one standard deviation increase inΔROA isassociated w ith a 2.91%increase in the grow th rate of the top three executives’combined compensation in the pre-IFRSadop tion period.For the post-IFRSadoption period,a one standard deviation increase inΔROA is associated w ith 5.21%increase in the grow th rate of the top three executives’combined compensation.10The econom ic m agnitudes are calculated as exp(0.652*0.044)-1=2.91%,exp((0.652+0.502)*0.044)-1=5.21%.We f nd sim ilar results from M odels3–4,takingΔDirComp as thedependent variable.In particu lar,the grow th rate o f combined compensation for the top three directors that is associated w ith a one standard deviation increase inΔROA imp roves from 2.76%in the p re-IFRS adop tion period to 5.28%in the post-IFRS adop tion period.

Asexpected,we fnd that a change in executive com pensation(ΔExeComp orΔD irComp)is positively associated w ith a lagged change in accounting perfo rm ance(ΔROA_1).That is,the higher the p revious year’s ROA improvement,the higher the rate of grow th o f executive or director compensation.The coef cient o f stock return(Return)is very small in allmodels.When all contro l variablesare included,the variable Return isonly signif cant in M odel2,whereΔExeComp is thedependent variab le,and Return is insignif cant in M odel4,whereΔDirComp is the dependent variable.11This f nding suggests that executives in China are paid much less for market performance than for accounting performance,which is consistent w ith the lim ited ro le of stock returns in executive com pensation,as documented by Firth et al.(2006)and Du and W ang(2007). The coef cient of the interaction term(IFRS*Return)is negative in M odels1–4.In M odel 2,the coef cient is just shy of the 10%signif cance level.In M odel4,which includesall controlvariab les,the coef cient is insignif cant.The evidence suggests that after m andatory IFRS adop tion there is even som e reduction in the sensitivity o f executive com pensation to stock returns.If the increase in accounting-based perform ance sensitivity after IFRSadop tion is due to a general trend o f increasing ef ciency in com pensation contracts(instead of due to the IFRS adop tion itself)we should see a sim ilar increase in the sensitivity of executive com pensation to stock returns.Accordingly,the negative coef cient of IFRS*Return ensures the reliability o f our f ndings. The coef cient of IFRS*Return is also consistentw ith our expectation.On the one hand,IFRS adop tion, as an accounting standard-based rule,is believed to havemore direct in fuence on accounting performance

than on stock retu rns.On the o ther hand,stock perform ance in China m oved away from f rm fundam en tals under the extremely vo latilemarket environm ent during 2006–2008,so itmakes sense to reduce theweighto f stock returns in executive compensation.

Table 3 Analysis of accounting-based perform ance sensitivity in executive compensation.

Asshown in M odels2 and 4,thesalesgrow th rate(Growth)and stock return volatility(Volatility)are positively associated w ith executive compensation.The higher the sales grow th rate and the greater the stock return risk,the higher the grow th rate o f executive or director compensation.There isa negative relationship between the change in executive compensation(ΔExeComp orΔDirComp)and the loss-making f rm indicator (Loss)or the CEO or chairman turnover indicator(CEOTurnover or ChairTurnover),which suggestsa smaller increase in executive compensation for a f rm experiencing a loss or an executive turnover in that year.

Firm size(Assets)is signif can tly negatively related to changes in the com bined com pensation o f the top th ree directors,bu t Assets is insignif can tly associated w ith changes in the com bined com pensation o f the top th ree execu tives.SOEs generally seem o re increases in the top three execu tives’com bined com pensation than non-SOEs,but they show almost no corresponding change in the top three directors’combined compensation.The coef cients o f board size(BoardSize)and board independence(IndDir)are signif cant on ly in M odel 4,whereΔDirComp is the dependent variab le.W hen the CEO of a f rm is also the chairman o f the board,there is a signif cant increase in the top three executives’combined compensation,but no signif cant change in the top three directors’combined compensation.

In summary,our analysis on accounting-based performance sensitivity follow ing the mandatory IFRS adoption in 2007 indicates that executivesare increasingly being paid based on accounting performance.That is,accounting performance has become a more powerfu l predictor o f executive compensation since the adoption.

4.2.Subsample analysis based on cross-region institutional quality

In this subsection,we testwhether IFRS adoption has d if erent efects across regions o f China in term s o f the sensitivity o f execu tive com pensation to accounting-based perfo rm ance.W em easure diferences in institutional quality by the level of marketization by partitioning our fu ll samp le into two subsam ples,based on themarketization index(M Index)of the region where a f rm is registered as of 2006.Specif cally,we calculate themedian o f M Index,pooling all f rmsby region,and p lace f rmsw ith an M Index less than or equal to themedian in the Low M Index Sample,and f rmsw ith an M Index greater than themedian in the H igh M Index Sample.

Table 4 reports thesubsample regression resu ltsusing the Low M Index Sample and the H igh M Index Sample,based on Eq.(1).A llof the controlvariab les in Tab le4 are included.Asshown,the coef ciento f IFRS*-ΔROA has statistical signif cance only in the H igh M Index Sample,which suggests that the increase in accoun ting-based perform ance sensitivity in the post-IFRS adop tion period(com pared to the pre-IFRS adoption period)occu rs only in regions w ith higher institu tional quality.This resu lt is consisten tw ith our expectation that high institutional quality increases the enforcement quality of IFRS.Hence,the in fuence o f IFRS on the use of accounting-based performance in executive compensation ishighest in regionswith higher institutional quality.The coef cients o f the control variables are quite sim ilar to those in Table 3.

4.3.Subsample analysis based on the infuence of IFRS across f rms

To analyzewhether the ef ect of IFRS adoption on accounting-based perform ance sensitivity in executive compensation varies across f rms that are afected to dif erent degrees by the adoption itself,wemake use o f the IFRS adjustm ents in 2006.W e defne the variab le IFRS_Adjustment as the ratio of the absolute value o f the dif erence between the net income based on IFRS and that based on Chinese GAAP in 2006 to the net income based on Chinese GAAP in 2006.Then we split thewho le samp le into two subsam ples,w ith one subsample being the Small IFRS_Adjustment Sample for f rmsw ith an IFRS_Adjustment less than the industry m edian,and the o ther being the Big IFRS_Adjustment Sam ple for f rm sw ith an IFRS_Adjustment greater than the industry m ed ian.Tab le 5 repo rts the regression results using the Small IFRS_Adjustment Samp le and the Big IFRS_Ad justment Samp le,based on equation(1).As shown,the coef cient o f IFRS*ΔROA is only signif can tly positive in the H igh IFRS_Adjustment Samp le,which suggests that the increase in accoun ting-basedperform ancesensitivity in thepost-IFRSadoption period(compared to thepre-IFRSadop tion period)occurs only in f rms that aremore afected by the adoption.Again,the resu lts for the contro l variab lesare very similar to those in Table 3.

Table 4 Subsamp le regression results based on marketization.

5.Additional analysis

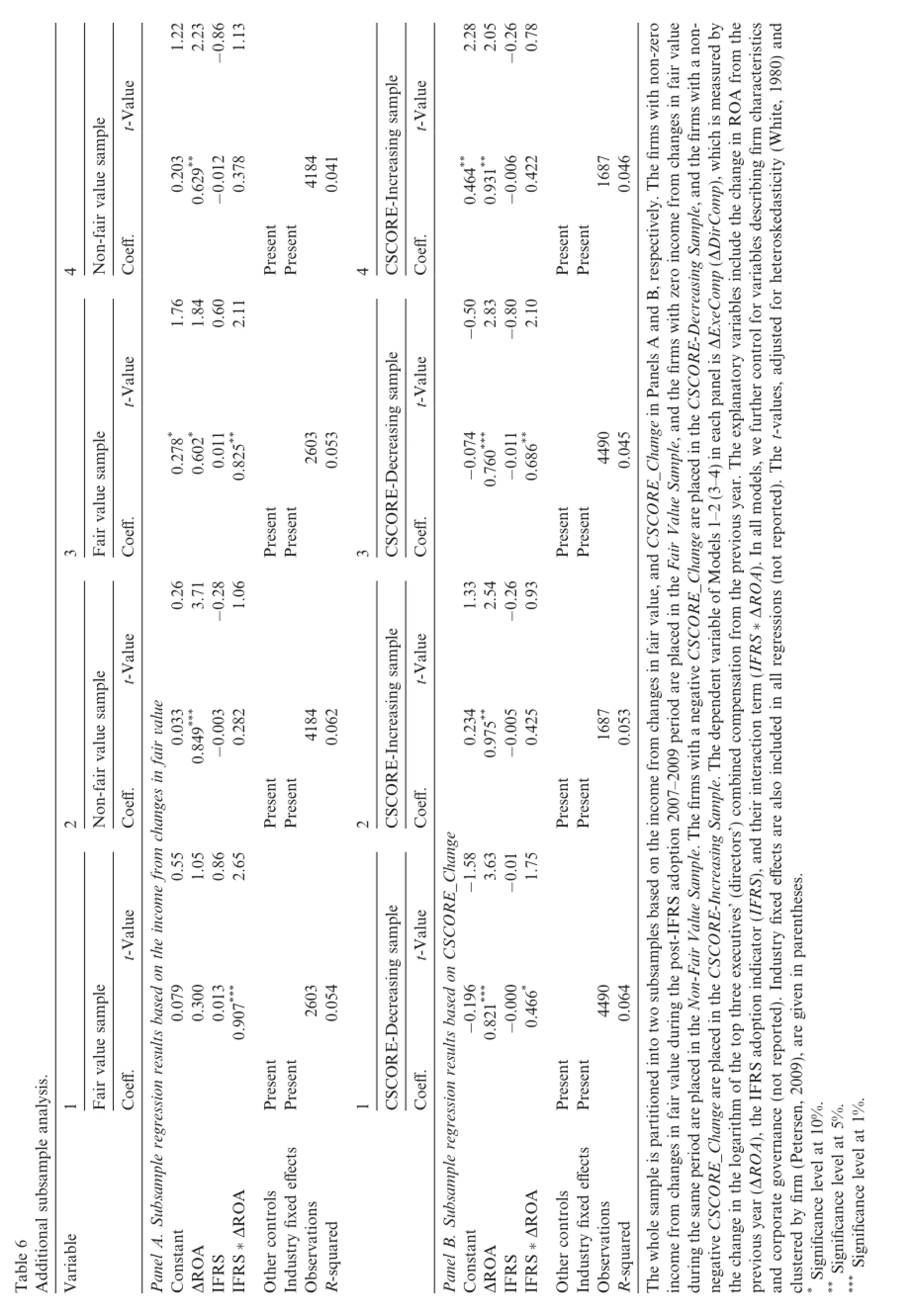

As argued in Section 2.3,the increase in earningsmanagement and decrease in accounting conservatism after IFRSadoption should haveoppositeef ectson theaccounting-based performancesensitivity o f executive compensation.We predict that the positive efect of IFRSadoption suggested in the p rior section is d riven by the reduction in accounting conservatism that is associated w ith IFRS adop tion.In this section,we p rovide add itional evidence for this pred iction by conducting subsam p le analyses based on som e key ind icators. Table 6 p resents the results from using Eq.(1).

First,we consider a fair value-related accounting item,nam ely incom e from changes in fair value.Asm entioned earlier,the essen tial characteristic o fm andato ry IFRS adoption in China is the change from historicalcost basis to fair value basis.The im po rt o f fair value is expected to be closely associated w ith the change in earningsmanagement and accounting conservatism after IFRS adoption.Since IFRS adoption,f rms are required to report income from changes in fair value.W e classify thewho lesample into two subsamp les,w ith one subsam plebeing the Fair Value Sample(for f rmsw ith non-zero income from changes in fair valueduring the post-IFRS adop tion period),and the other being the Non-Fair Value Sample(for f rmsw ith zero income from changes in fair value during the same period).If our p rimary results are driven by the reduction in accounting conservatism associated w ith IFRS adop tion,the inf uence of accounting conservatism shou ld be greater for the Fair Value Sample than for the Non-Fair Value Sample.As shown in Panel A of Table 6, the coef cient of IFRS*ΔROA isonly signif cantly positive in the Fair Value Sample,which isconsistentw ith ou r expectation.

W e also consider a d irect accounting conservatism-related indicato r,the C-Score,based on the K han and W atts(2009)m odel(CSCORE).W e f rst calcu late CSCORE_Change fo r each f rm as the average value of CSCORE during the post-IFRS adop tion 2007–2009 period,m inus the average value o f CSCORE during the pre-IFRS adop tion 2004–2006 period.Then we place those f rms w ith a negative CSCORE_Change in the CSCORE_Decreasing Sample,and those f rms w ith a non-negative CSCORE_Change in the CSCORE_Increasing Sample.If our primary results are driven by the reduction in accounting conservatism that is associated w ith IFRS adop tion,then the infuence o f accounting conservatism should be greater for the CSCORE_Decreasing Sample than for the CSCORE_Increasing Sample.As shown in Panel B o f Table 6, the coef cient o f IFRS*ΔROA is only signif cantly positive in the CSCORE_Decreasing Sample,which is consistentw ith our argument.A ll o f the resu lts in Table 6 support our argument that the positive efects o f IFRS adoption on the use of accounting perform ance in execu tive com pensation are largely determ ined by the reduction in accoun ting conservatism associated w ith IFRS adoption.

6.Robustness tests

In this section,we conduct a series of robustness tests to check the reliability o f our results.For brevity,we on ly report the resu ltsof the tests thatweredesigned to ru le out the inf uenceo f thenon-tradableshare reform on changes in the top three executives’combined compensation(ΔExeComp)as shown in Tab le 7.A ll of the other regression resu lts are qualitatively the same as previous resu lts.The regression resu lts are availab le on request.

6.1.Inf uence of the non-tradable share reform

Our sample period of 2004–2009 largely overlapsw ith anotherm ilestone event for the Chinese stockmarket,namely,the non-tradab le share reform,which started in 2005 and was almost f nished by 2008.This reform aimed to unlock non-tradab le shares,allow ing them to be freely traded in exchangemarkets.Prior studies have p rovided empirical evidence that the non-tradab le share reform played a ro le in corporate governance and stock m arket valuation.

In this section,we conduct th ree robustness tests to contro l fo r the possib le inf uence of the non-tradable share reform on our fndings.First,we include a dumm y variable indicating whether the p lan of the non-tradable share reform wasapproved by the holdersof tradable shares in the given year(Reform),and an interaction term(Reform*ΔROA)to control for the efect of the non-tradable share reform on accounting-based perform ance sensitivity.M odels 1 and 2 in Tab le 7 suggest that the coef cient of Reform*ΔROA is insignificant.A lso,we still fnd a signif cant positive coef cient o f IFRS*ΔROA.For the second robustness test,we re-run allour regressions in thep re-IFRSadoption period of 2004–2006.Weexclude IFRS and the interaction term IFRS*ΔROA,but include Reform and the interaction term Reform*ΔROA.As suggested by M odel 3 in Tab le 7,the coef cient of Reform*ΔROA is comp letely insignif cant,which indicates that thenon-tradable share reform had no signif cantef ecton accounting-based perform ancesensitivity even before the IFRSadoption.Lastly,we re-run all o f our regressions using a subsam p le of f rm s issuing B-or H-shares,which had already adop ted IFRS befo re 2007.If the non-tradab le share refo rm p layed a ro le in accoun ting-based perfo rm ance sensitivity,we should see an even stronger association between executive com pensation and accounting perform ance in the post-refo rm period com pared to the pre-refo rm period.As shown by M odel4 in Tab le 7,the coef cient of the interaction term Reform*ΔROA isnot statistically signif cant,which suggests that ou r results are not driven by the inf uence o f the non-tradable share reform.M odel5 ind icates that the coef cient o f IFRS*ΔROA is insignif can t for B-and H-share com panies,as these com panies are no t likely to be infuenced by IFRS adop tion.The results fo r B-and H-share com paniesm ake ou r f ndingsm o re convincing and provide in formative evidence concerning the causality between IFRS adoption and executive compensation.

Table 7 Robustness tests.

6.2.Other robustness checks

We also conduct several other robustness tests.

First,we conduct a sim ilar analysisusing an alternativemeasure of executive compensation,namely CEO compensation,and two alternativemeasureso f accounting performance,namely return on equity(ROE)and return on sales(ROS).The results are sim ilar to those from p rio r estim ations.

Second,we test another alternative exp lanation of ou r f nd ings,the learning ef ect.If the learning ef ect is a factor in previous results,then the increase in accounting-based performance sensitivity wou ld be simp ly the efect of time trends.To ru leout thisexplanation,we expand the samp le to 2002,and lim itour analysis to the pre-IFRSadoption 2002–2006 period.We seta variable,Post,to indicate the time trend,which takes thevalue 1 for 2005–2006,and 0 otherw ise.Then we re-run all our regressions,taking Post,ΔROA and the interaction term Post*ΔROA as explanatory variables.The coef cient of the interaction term Post*ΔROA shows no signif cance,which suggests thatourmain f ndingsarenot due to the learning efect.Ifwe set thevariab le Post to 1 during 2004–2006,and 0 otherw ise,we obtain very sim ilar fndings.

Third,to consider the possib le in fuence of the recent fnancial crisis,we re-run all our regressionsusing a subsam p le excluding 2008,which is the year when the in fuence of the fnancial crisis wasm ost serious in China.As the in fuence of this business cycle cou ld be generally ref ected by industry trends,we also try to rem ove the inf uence of the recen t crisis using the alternative m easure o f the change in industry-ad justed ROA.Our fndings remain unaltered.A lso,we include each year’sGDP grow th rateasan additional controlling factor of themacroeconom ic conditions in all of the regressions.W e f nd resu lts very sim ilar to the p revious results.

Fourth,to avoid the efects of noise at the f rm-year level,we conduct another test at the industry level.W e identify IFRS inf uence in each industry as themedian value o f the f rm s’IFRS_Adjustment w ithin the industry.Untabulated results suggest that the relative increase in accounting-based performance sensitivity in the post-IFRS adop tion period occurs on ly in industriesw ith IFRS in fuence greater than themedian,which is quite consistentw ith Tab le 5.

Finally,we re-run all our regressions after w insorizing the top and bottom 1%,2.5%,7.5%and 10%for each continuous variab le.The results are still highly signif cant at w insorization levels o f 2.5%,7.5%and 10%,and close to being signif cant at the 1%w insorization level.

7.Conclusion

As a princip le-based standard,IFRS,and in particular fair value accoun ting,b rings challenges to lessdeveloped em ergingmarkets.Since IFRS adop tion in China,managers’incentives to make use of discretion and respond to themore symmetric refection of both good newsand bad newshave given rise to an increase in earningsmanagem ent and a decrease in accounting conservatism.Increased earningsmanagement po lishes accounting performance,whichmakesmanagers’efortmore opaque to investorsand boards,and reduces the weight of accounting performance in executive compensation.However,decreasing accounting conservatism m akes accounting earningsmore natural and timely,recognizing both good news and bad news,which can imp rove internal evaluation based on accounting performance.This study p rovides evidence on these joint efects o f IFRS adop tion concerning the sensitivity of executive compensation to accounting performance.

U sing a sam p le o f 6787 f rm-year observations fo r A-share f rm s in China from 2004 to 2009,we f nd strong evidence supporting the positive efects of IFRS adoption on accoun ting-based perfo rm ance sensitivity,after contro lling for f rm and corporate governance characteristics.Furthermore,based on subsample analysis,we f nd that the positive efects o f IFRS adoption on the accounting-based performance sensitivity o f executive compensation occur on ly in regionsw ith higher institutional quality(asmeasured by the level ofmarketization)and in f rms thataremoreaf ected by theadop tion(asmeasured by IFRSad justments in 2006).Through subsample analyses based on income from changes in fair value and on changes in C-Score,we f nd that the positiveef ectof IFRSadop tion on theaccounting-based performancesensitivity of executive compensation is signif cantonly for f rmsw ith non-zero income from changes in fair value during thepost-IFRSadop tion period and for f rmsw ith negative changes in C-Score after IFRSadop tion.These f ndingssupport our argument that in China,the positive ef ect of IFRS adoption on the use of accounting perfo rm ance in executive compensation is driven by the reduction in accoun ting conservatism associated w ith IFRS adoption.

This study en richesour understanding of how m andato ry adoption of IFRS af ectsexecu tive com pensation in emerging markets.The fndings have policy implications,especially in terms o f internal contract benef ts. W e provide a thorough exam ination of the factors inf uencing the efects o f IFRS adop tion w ithin a single country,China,which is generally m issing in EU-based studies.

Acknowledgements

This p ro ject was sponsored by the National Natural Science Foundation of China(Nos.71072036, 71102134 and 71272012)and theMOE Pro ject for Key Research Instituteso f Hum anitiesand Social Science in U niversities(N o.00JJD 630006).A ll errors are ou r own.

Armstrong,C.,Barth,M.,Jagolinzer,A.,Riedl,E.,2010.M arket reaction to the adoption of IFRS in Europe.Accounting Review 85(1), 31–61.

Ashbaugh,H.,Pincus,M.,2001.Dom estic accounting standards,internationalaccounting standards,and the predictability of earnings. Journal of Accounting Research 39(3),417–434.

Ball,R.,2001.In frastructure requirements for an econom ically ef cient system of public fnancial reporting and disclosure.In:Litan,R., Herring,R.(Eds.),Brookings–W harton Papers on Financial Services.Brookings Institution Press,W ashington,DC.

Ball,R.,2006.International Financial Repo rting Standards(IFRS):Pros and Cos for Investors.A ccounting and Business Research International A ccounting Policy Forum 5-27.

Ball,R.,Sh ivakum ar,L.,2005.Earn ingsquality in UK private f rm s:com parative loss recognition tim eliness.Journalof A ccounting and Econom ics 39(1),83–128.

Bandyopadhyay,S.,Chen,C.,Huang,A.,Jha,R.,2010.Accounting conservatism and the tem poral trends in currentearnings’ability to p redict future cash fowsversus futureearnings:evidence on the trade-of between relevance and reliability.Contem porary Accounting Research 27(2),413–460.

Barth,M.,Landsm an,W.,Lang,M.,2008.International accounting standards and accounting quality.Journal of A ccounting Research 46(3),467–498.

Bartov,E.,Goldberg,S.,K im,M.,2005.Comparative value relevance among German,U.S.and international accounting standards:a German stock m arket perspective.Journal of A ccoun ting,Auditing and F inance 20(2),95–119.

Basu,S.,1997.The conservatism princip le and theasymm etric tim elinesso f earnings.Journalof A ccounting and Econom ics 24(1),3–37.

Buck,T.,Liu,X.,Skovoroda,R.,2008.Top executive pay and f rm performance in China.Journal of International Business Studies39 (5),833–850.

Bushm an,R.,Sm ith,A.,2001.Financialaccounting inform ation and corporate governance.Journalof Accounting and Econom ics32(1–3),237–333.

Bushman,R.,Piotroski,J.,Sm ith,A.,2011.Capitalallocation and timely accounting recognition of economic losses.Journalof Business, Finance and Accounting 38(1&2),1–33.

Chen,J.,Zhang,H.,2010.The im pact of regu latory enforcement and audit upon IFRS com pliance:evidence from China.European A ccounting Review 19(4),665–692.

Chen,H.,Tang,Q.,Jiang,Q.,Lin,Z.,2010.The roleof International FinancialReporting Standards in accounting quality:evidence from the European Union.Journal of International FinancialM anagement&Accounting 21(3),220–278.

Covrig,V.,Defond,M.,Hung,M.,2007.Home bias,foreign mutual fund holdings,and the voluntary adoption of international accounting standards.Journal of A ccoun ting Research 45(1),41–70.

Daske,H.,Hail,L.,Leuz,C.,Verdi,R.,2008.M andatory IFRS reporting around the world:early evidence on the economic consequences.Journalo f Accounting Research 46(5),1085–1142.

Ding,D.,Akhtar,S.,Ge,G.,2006.Organizational diferences in managerial com pensation and benef ts in Chinese f rms.International Journal of H uman Resource M anagem ent 17(4),693–715.

Du,X.,Wang,L.,2007.Empirical research on correlation between compensation schemesofmanagementand the change of performance o f public listed com panies.Accounting Research 1,58–65,in Chinese.

Eccher,E.,Healy,P.,2003.The Ro leo f InternationalAccounting Standardsin Transitional Economies:A Study of the Peop le’sRepublic o f China.W orking Paper,M assachusetts Institu te of Technology.

Fama,E.,1980.Agency problems and the theory of the f rm.Journal of Political Economy 88(2),288–307.

Fan,G.,Wang,X.,Zhu,H.,2007.Neri Index of M arketization of China’s Provinces2006 Report.Econom ic Science Press,Beijing(in Chinese).

Fang,J.,2009.Top m anagem ent compensation of Chinese public com panies sticky?Journal of Econom ic Research 3,110–124(in Chinese).

Firth,P.,Fung,P.,Rui,O.,2006.Corporate performance and CEO com pensation in China.Journalof Corporate Finance 12(4),693–714.

Gebhardb,G.,N ovo tny-Farkas,Z.,2010.The Efects of IFRS Adoption on the Financial Reporting Quality of European Banks. W ork ing Paper,Goethe U niversity,Frank furt.

Gjesdal,F.,1981.Accounting for stewardship.Journal of Accounting Research 19(1),208–231.

Groves,T.,Hong,Y.,M cM illan,J.,Naughton,B.,1995.China’sevolvingmanagerial labormarket.Journalof Po litical Econom y 103(4), 873–892.

Guay,W.,Verrecchia,R.,2006.D iscussion o f an econom ic framework for conservative accounting and Bushm an and Piotroski(2006). Journal of Accounting and Econom ics 42(1–2),149–165.

He,X.,W ong,T.,Young,D.,2012.Challenges for im plementation of fair value accounting in emergingmarkets:evidence from China. Con tem porary A ccounting Research 29(2),538–562.

Ho lm strom,B.,1979.M oral hazard and observability.Bell Journal of Econom ics 10(1),74–91.

Horton,J.,Serafeim,G.,2010.M arket reaction&valuation of IFRS reconciliation adjustments:f rst evidence from the UK.Review of Accounting Studies 15(4),725–751.

Hung,M.,Sub ram anyam,K.,2007.Financial statem ent efects of adop ting international accounting standards:the case of Germ any. Review of A ccounting Studies 12(4),623–658.

Jeanjean,T.,Stolowy,H.,2008.Do accounting standardsmatter?An exploratory analysiso fearningsmanagementbeforeand after IFRS adoption.Journal of Accounting and Public Policy 27(6),480–494.

Jensen,M.,M eck ling,W.,1976.Theory o f the f rm,m anagerial behavior,agency costs and ownership structu re.Journal of Financial Econom ics 3(4),305–360.

Jiang,G.,Lee,C.,Yue,H.,2010.Tunneling through intercorporate loans:theChina experience.Journalof FinancialEconomics98(1),1–20.

Kato,T.,Long,C.,2006.Executive com pensation,f rm performance,and corporate governance in China:evidence from f rm s listed in the Shanghai and Shenzhen stock exchanges.Econom ic Development and Cultural Change 54(4),945–983.

Khan,M.,W atts,R.,2009.Estimation and em pirical p roperties of a f rm-year measure of accounting conservatism.Journal of Accounting and Econom ics 48(2–3),132–150.

Lam bert,R.,Larcker,D.,1987.An analysis of the use of accounting and marketm easures o f perfo rm ance in executive compensation contracts.Journal of A ccoun ting Research 25,85–125.

Lang,M.,Raedy,J.,Yetman,M.,2003.How representativeare f rm s thatare cross-listed in theUnited States?An analysisof accounting quality.Journal of Accounting Research 41(2),363–396.

Leone,A.,W u,J.,Zimm erm an,J.,2006.Asymmetric sensitivity of CEO cash com pensation to stock retu rns.Journalof A ccounting and Econom ics 42(1–2),167–192.

Leuz,C.,2001.Commenton infrastructure requirements for an econom ically ef cient system of public fnancial reporting and disclosure. In:Litan,R.,Herring,R.(Eds.),Brookings–Wharton Papers on Financial Services.Brookings Institution Press,Washington,DC.

Luo,T.,Xue,J.,Zhang,H.,2008.The efect of the new accoun ting standards on value relevance of accounting inform ation.China A ccounting Review 6(2),129–140(in Chinese).

M engistae,T.,Xu,L.,2004.Agency theory and executive compensation:the case o f Chinese state-owned enterprises.Journal of Labor Econom ics 22(3),615–637.

M uller,K.,Ried l,E.,Sellhorn,T.,2011.M andatory fair valueaccounting and inform ation asymm etry:evidence from the Europeans real estate industry.M anagem ent Science 57(6),1138–1153.

O’Connell,V.,2007.Refections on stewardship reporting.Accounting Horizons 21(2),215–227.

Ozkan,N.,Singer,Z.,You,H.,2012.M andatory IFRSadop tion and the contractualusefulness of accounting information in executive compensation.Journal of Accounting Research 50(4),1077–1107.

Paligorova,T.,2008.The Efect of the Sarbanes-Oxley Act on CEO Pay for Luck.W orking Paper,Bank of Canada.

Peng,E.,2011.Accrualsquality and the incentive contracting role o f earnings.Journalo f Accounting and Public Policy 30(5),460–480.

Perry,T.,Zenner,M.,2001.Pay for performance?Government regulation and the structure of com pensation contracts.Journal of Financial Econom ics62(3),453–488.

Petersen,M.,2009.Estimating standard errors in fnance panel data sets:com paring approaches.Review o f F inancialStudies 22(1),435–480.

Sa´nchez,M.,Pineda,J.,Pardo,D.,2009.Quantifying EfectsofM andatory Adop tion of IFRS:A Dynam ic Accounting M odel.Working Paper,CEU Cardenal Herrera University.

Shavell,S.,1979.Risk sharing and incentives in the principal and agent relationsh ip.Bell Journal of Econom ics 10(1),55–73.

Tan,W.,Xin,Q.,2009.M arket-oriented reform,f rm performance and executive com pensation in Chinese state-owned enterp rises. Journal of Economic Research 11,68–81(in Chinese).

Wang,Y.,Xue,J.,Chen,X.,2009.Accounting choiceand earningsmanagement:an analysison the im plementation of thenew accounting standard.China A ccounting Review 7(3),255–269(in Ch inese).

Watts,R.,2003.Conservatism in accounting,Part I:explanations and im plications.Accounting Horizons 17,207–221.

Watts,R.,Zimmerman,J.,1986.Positive Accounting Theory.Prentice-Hall Press,London.

White,H.,1980.A heteroskedasticity-consistent covariancematrix estimator and a direct test for heteroskedasticity.Econometrica 48(4), 817–838.

W ier,H.,2009.Fair value or conservatism:the case o f the go ld industry.Contem porary A ccoun ting Research 26(4),1207–1233.

Wu,Y.,W u,S.,2010.Inf uential factorson executives’self-interested behavior:evidence from thepublic listed companies’equity incentive p rogram s.M anagementWorld 5,141–149,in Chinese.

W u,J.,Zhang,I.,2009.The vo luntary adoption of internationally recognized accounting standards and f rm internal perform ance evaluation.A ccounting Review 84(4),1281–1309.

Xue,S.,Zhao,L.,Xiao,Z.,Cheng,X.,2008.Does international convergence o f accounting standards im prove the value relevance of accounting information?Finance&Trade Econom ics9,62–67(in Chinese).

Ye,J.,Zhou,L.,L i,D.,Guo,L.,2009.M anagem ent m otivation,accoun ting policy op tions and earningsm anagement—an emp irical study on the classif cation of fnancialassets for listed com pan ies under the new accounting standards.Accounting Research 3,25–30 (in Chinese).

Zhang,R.,Zhang,H.,2008.Economic consequences of the change on consolidated fnancial statement theory in the new accounting standards.A ccounting Research 12,39–46(in Chinese).

Zhang,X.,Zhu,S.,2010.N ew A ccounting Standards,Fair ValueM easu rem ent and A ccounting Conservatism.W orking Paper,Tsinghua University(in Chinese).

Zhang,R.,Lu,Z.,Ye,K.,2007.The changesof accounting standardsand thew rite-down of long-lived assets.M anagementWorld 8,77–84(in Chinese).

Zhou,H.,X iong,Y.,Ganguli,G.,2010.A ccounting Standards and EarningsM anagem ent:Evidence from an Em erging M arket.W orking Paper,University of Texas.

*Corresponding autho r.Add ress:Schoo l of A ccountancy,Shanghai U niversity of Finance and Econom ics,777 Guoding Road, Shanghai,China.Tel.:+86 21 65908982;fax:+86 21 65106924.

E-mail address:acjql@m ail.shufe.edu.cn(Q.Jin).

Production and hos ting by Elsevier

1755-3091/$-see frontmatter©2013 Production and hosting by Elsevier B.V.on behalf of China Journal of Accounting Research. Founded by Sun Yat-sen U niversity and City U niversity of H ong Kong.

h ttp://dx.doi.org/10.1016/j.cjar.2013.09.003

Executive com pensation

Accounting-based performance sensitivity