BRINGING DEBT DOWN

2014-02-12ByZhouXiaoyan

By+Zhou+Xiaoyan

If you ask China watchers to list threats to the countrys economy, you would probably get this one item on everyones list—hefty local government debt.

China released the results of a long-awaited nationwide audit on government debts in an attempt to ease mounting market concerns over the amount of debt and its possible impact.

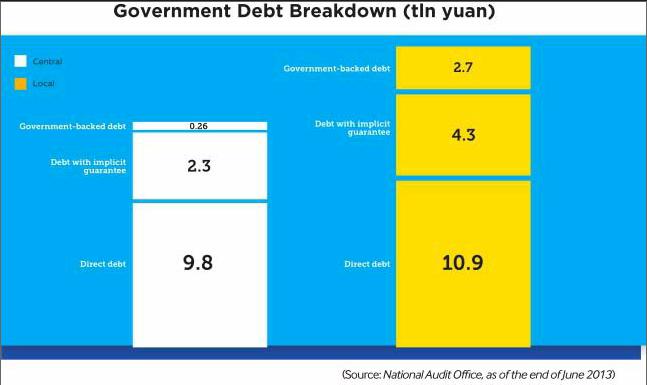

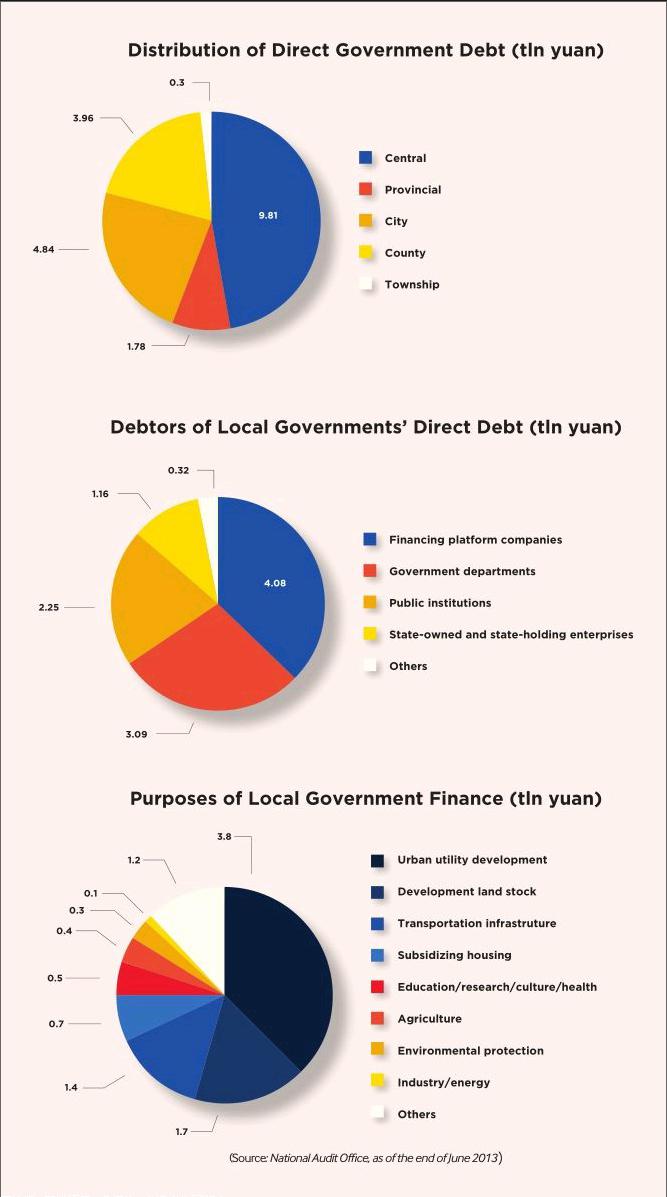

Local governments direct debts—debt that will be repaid by the governments fiscal revenue—reached 10.9 trillion yuan ($1.79 trillion) by the end of June 2013, with the government holding another 7 trillion yuan($1.16 trillion) in contingent debts, according to the National Audit Office (NAO) on December 30, 2013. The contingent debt includes debt for which local governments issued official guarantees (2.7 trillion yuan, or$450 billion) and debt with implicit government guarantees (4.3 trillion yuan, or $710 billion). Chinas local government debt and contingent liabilities grew 67 percent from a previous audit result at the end of 2010, which calculated it to be 10.7 trillion yuan($1.77 trillion) .

Combined with another 9.8 trillion yuan in direct central government debt, 260 billion yuan ($42.95 billion) in central governmentbacked debt and 2.3 trillion yuan ($370.1 billion) in debt with implicit central government guarantee, Chinas total government debt as of June 2013 stands at 30.27 trillion yuan ($5 trillion).

Chinas new leaders are aiming for a stable growth of the economy as they aim to transform it into one driven by consumption rather than a reliance on investment and exports. But they face a series of challenges, among which the rise of debt at all levels of government is seen as the biggest threat to the countrys financial stability.

Under Chinas laws, local governments are barred from borrowing directly from banks or investors, even though they are responsible for most public spending while receiving around half of the fiscal income. The funding shortfall has forced local authorities to take on debts to pay for public works.

There had been no official update on the extent of the local government debt since 2011. Market fears that Chinas banking system will be compromised if a portion of the government debt is not repaid were amplified by a dearth of information.

As investors have long viewed Chinas pile of local government debt as one of the biggest threats to its economy, the new leadership which took office in March 2013 pledged to keep a close eye on the issue and ordered a comprehensive review of all government balance sheets in August 2013, the first such audit since June 2011.endprint