MARKET WATCH

2013-12-06

OPINION

Keeping Government Intervention in Check

According to media reports, the nationwide audit of all government debt, which was initiated in August 1, has come to an end. Government debt at all levels has surpassed 14 trillion yuan($2.29 trillion), much more than that revealed during the previous round of audits. The piling up of local government debt may result in macroeconomic and financial uncertainties.

The root of the mounting government debt, to some extent, lies in governmental intervention in market operation. Therefore,measures should be taken to rein in administrative forces and set up a healthy long-term mechanism for local debt.

The market together with the government has contributed jointly to the rapid economic growth of China during the past three decades.In particular, during the global financial crisis, it was the economic stimulus package launched by the government that propelled China to take the lead during the recovery.

Apparently, excessive intervention from local governments has not only hindered market efficiency, but also sped up the accumulation of government debt. In the wake of the financial crisis, weak external demand pushed China to rely mainly on governmentdriven investment. Such a solution, however,cannot completely resolve the remaining deep-seated contradictions.

What’s worse, in the pursuit of better performance, some government leaders tend to consider investment as the only driver of economic growth, increasing the strain on fiscal expenditure. As a result,government debt has become commonplace across the country.

During the audit of local governments by the Nation Audit Office this year, 36 of the local governments inspected were found to have a weak ability to repay their accumulated debts. Nine provincial capitals witnessed their debt ratios climb to at least 100 percent, with the highest hitting 219.57 percent; 13 saw their debt servicing ratios exceeding 20 percent, with the highest reaching 67.69 percent; two witnessed overdue debt ratios rising above 10 percent, with the more severe one hitting 16.36 percent.

Finding themselves under pressure caused by debt, local governments tend to sell land as their primary source of generating funds for repayment. In the first nine months of 2013,land transactions stood at 608.2 billion yuan($99 billion), up 14.6 percent year on year, and a 9.4-percent increase compared to that in the first eight months.

Housing prices are rising in line with land prices. During the first three quarters, housing prices increased throughout the country.According the National Bureau of Statistics, 65 out of 70 large and medium-sized cities saw price increases in their new commercial residential buildings in September.

Only by making a transition in local government functions, from administrative to servicebased, can the dangers of local government debt be effectively null ified. A main purpose of modern government is to provide public services that offset faults in market mechanisms.Development of the local economy is also undoubtedly the responsibility of local governments, but this still requires effective restraints on their powers.

For instance, when it comes to large-scale infrastructure projects, consideration should be given to both economic and social demands as well as fiscal burdens, rather than growth targets alone.

The existing methods of assessing local governments should be reformed and amended to restrain local government functions,appropriately reducing the importance of GDP results and stressing the significance of ecological preservation and public services. When the necessity for examination and approval is lessened, administrative intervention will decline correspondingly. ■

This is an edited excerpt by Xiang Zheng, a financial commentator, published in Securities Times

yushujun@bjreview.com

NUMBERS

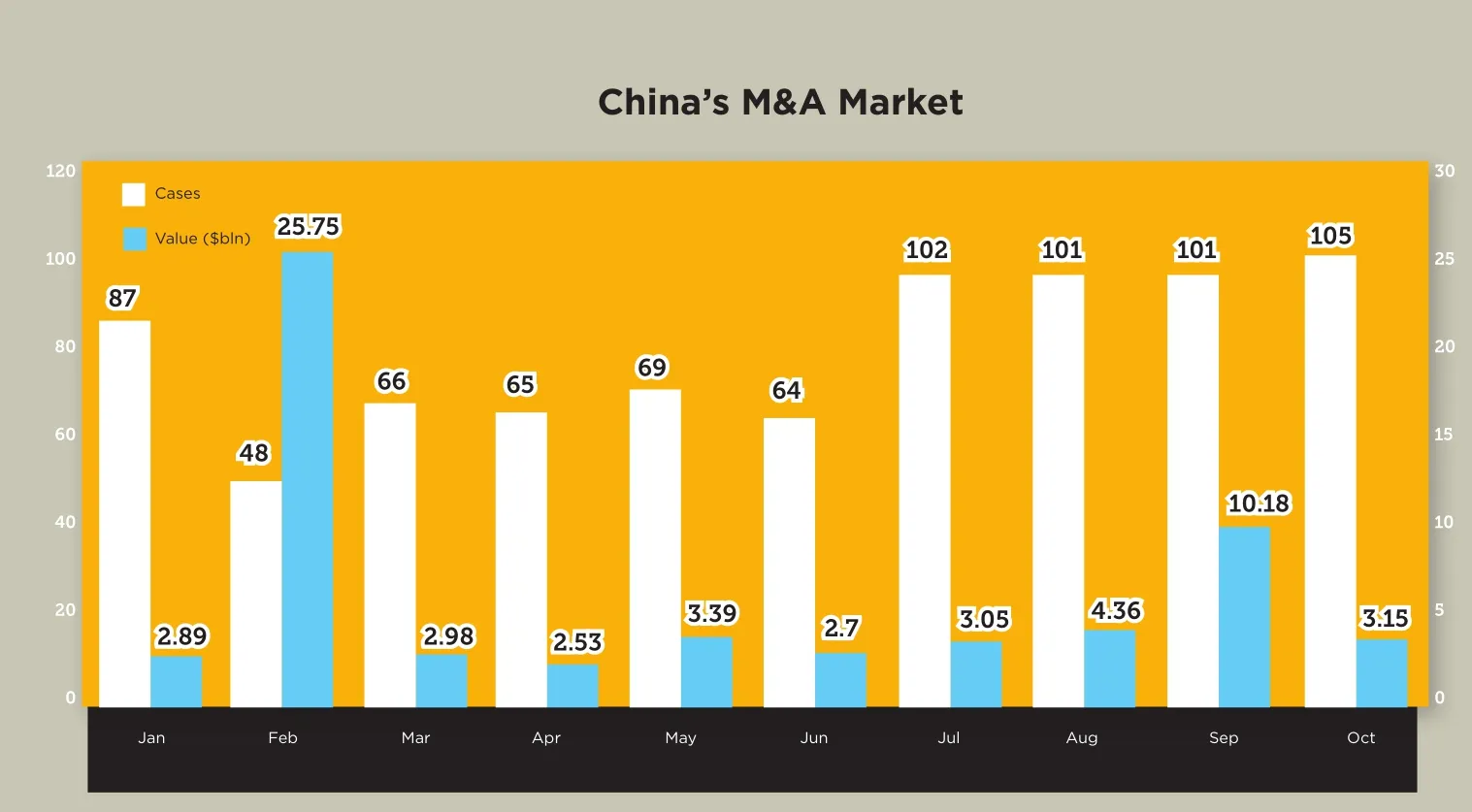

105

Number of mergers and acquisitions(M&As) in the Chinese market in October. All but seven revealed their transaction’s values, which altogether totaled $3.15 billion

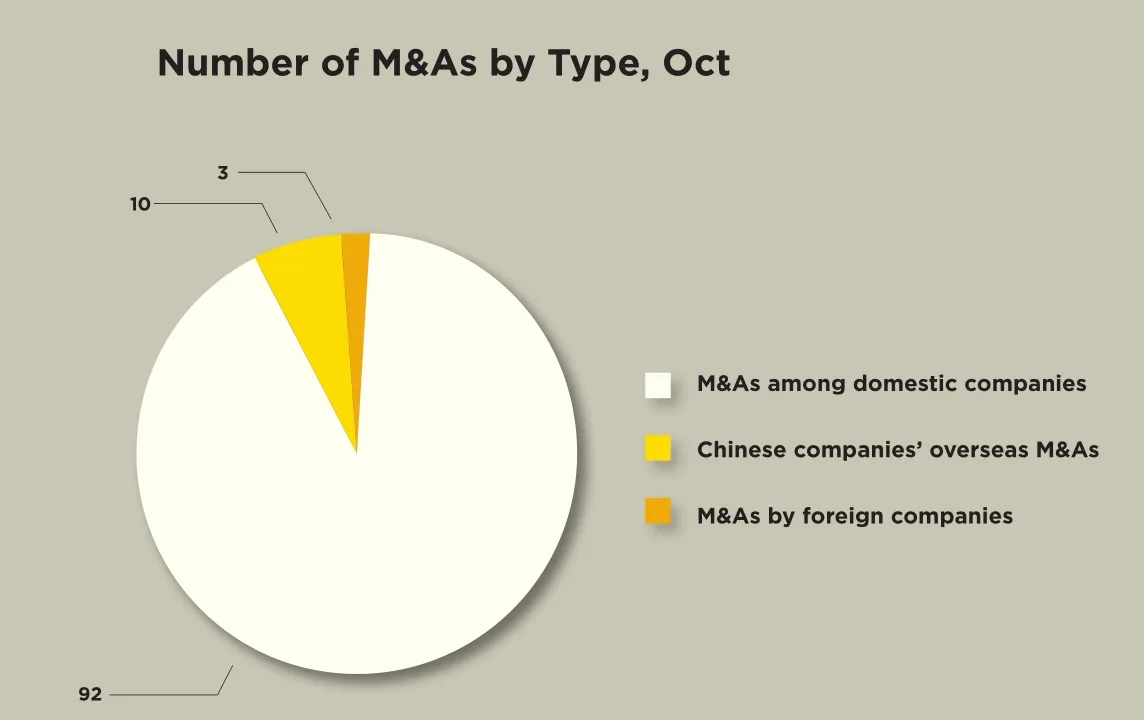

92

Number of M&As between domestic companies in October. All but six revealed their transaction values,totaling $1.87 billion

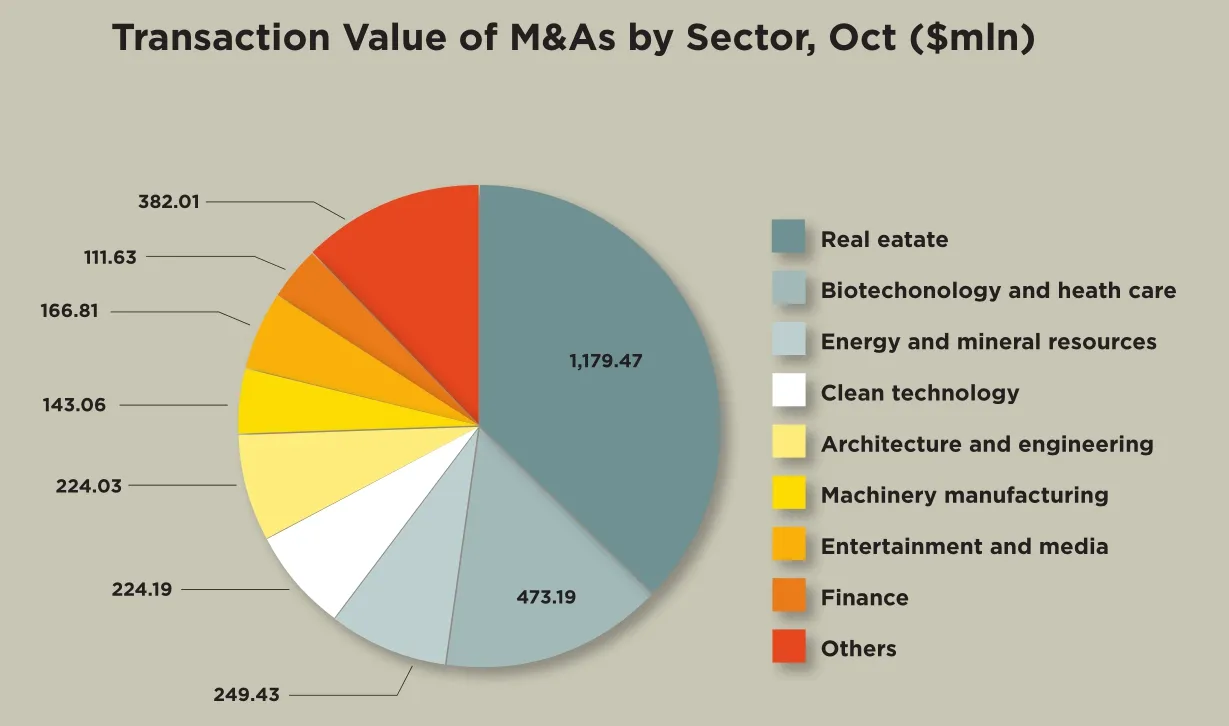

$1.18billion

Transaction value of M&As in the real estate sector during October

(Source: Zero2IPO)

THE MARKETS

NASDAQ Debut

China’s travel search engine Qunar has been listed on the Nasdaq, at $15 a share, as of November 1.

The Beijing-based company, under the ticker symbol of QUNR, saw its share price skyrocket 107.93 percent to $31.19 shortly after it began trading on that day.

Qunar, founded in May 2005 and registered in the Cayman Islands, plans to raise about $167 million by offering about 11.11 million American depositary shares (ADSs). Capital raised from the initial public offering will be used to scale up the company’s investment in technology,infrastructure, and research and development,as well as to strengthen its marketing input, in order to meet future demands for mergers and acquisitions, the company said at a press briefing held in New York.

The company, which has China’s search engine Baidu as its biggest shareholder, reported$58.46 million in revenue from January to June,up 75 percent year on year, with 88 percent of revenue generated by the pay-per-click model.

Rising Gold Output

China is set to maintain its position as the world’s top bullion producer for the seventh consecutive year in the face of estimations that it will produce a record-high 430 tons of gold this year, according to China Gold Group Corp.

Gold output in China could rise 6.7 percent from the 403 tons produced in 2012, according to Du Haiqing, the group’s vice general manager. During a mining conference in Tianjin on November 4, he said that production during the first eight months of the year had already reached 270 tons.

Gold consumption in China has also been growing and is expected to exceed 1,000 tons this year, an increase of 20 percent from 2012,according to Du. ■