MARKET WATCH

2013-12-06

OPINION

In a Dilemma

Local governments should be allowed to take a larger share of fiscal revenue, such as valueadded tax and consumption tax.

Since the newly appointed Minister of Finance Lou Jiwei said that local government debt totaled 11 trillion yuan ($1.77 trillion) at the China Development Forum 2013 held in Beijing from March 23 to 25, the Ministry of Finance has been devoted to figuring out how to curb its expansion.

The amount is equal to the country’s total fiscal revenue, or one quarter of its GDP. Even worse, the ability of local governments to repay their debt is rather weak.

Most local government debt has been invested in public construction, and the benefits can only be reaped in the long term. Generally speaking, such investments cannot directly generate profits in a short period of time. For this reason, it is almost impossible to pay down debt through public projects.

Confronted with the debt arising from investments in public goods and projects, local governments are supposed to put aside money toward debt repayment. However,amid changes in China’s economic development model, growth in fiscal income is bound to slow down, along with local government revenues.

Given the real estate craze in recent years,land income accounts for nearly half of the fiscal revenue for local governments. Nevertheless,China maintains its tight grip on the housing market as it has done in the past years. Local governments have witnessed a slump in land income. Despite a possible rebound in the future, land income will not be a “gold mine” for future revenue.

Borrowing to pay old debt is commonplace in public financing around the world, but the Chinese Government has decided to strictly regulate local government financing vehicles in order to keep local government debt under control. As a result, local governments have been thrown into a dilemma.

Public construction efforts should be carried forward, such as social security, low-income housing as well as urbanization projects.

However, all these things cost money.

On the one hand, the financing channels once available for local governments to repay debt are no longer there, and there is no sign that the control over these channels will be loosened. On the other hand, local governments are in urgent need of money, and the most ef ficient way is to issue new bonds.

Now that the Central Government has restricted “image projects” and regulated land and other types of financing, leaving local governments in dire need of funds, reforms on fiscal revenue allocation should be implemented. For instance, local governments should receive revenue more from value-added and consumption taxes for projects that aim to promote social security and urbanization, and those in turn will expand tax sources. ■

This is an edited excerpt of an article by Yu Muzhan,an economic scholar from Shanghai, published in The Beijing News

yushujun@bjreview.com

NUMBERS

709.2bln yuan

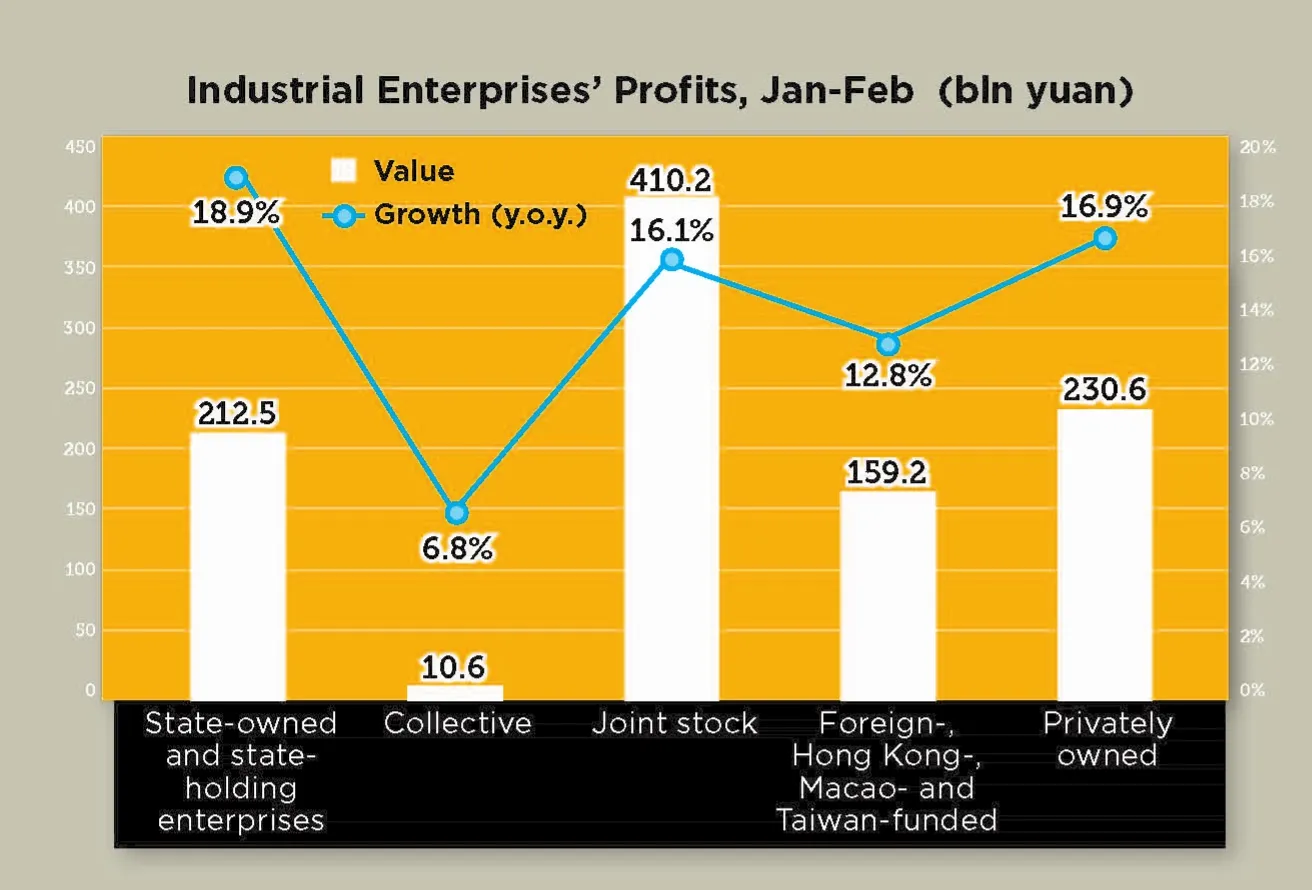

The profits of industrial enterprises above the designated size—annual sales revenue of more than 20 million yuan ($3.15 million)—from January to February, a 17.2-percent year-onyear increase

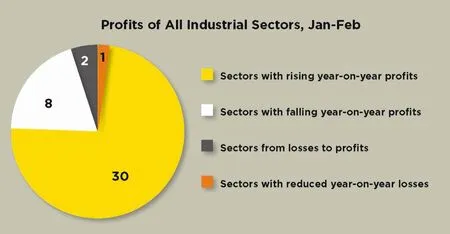

30

The number of industrial sectors that witnessed higher year-onyear profits from January to February

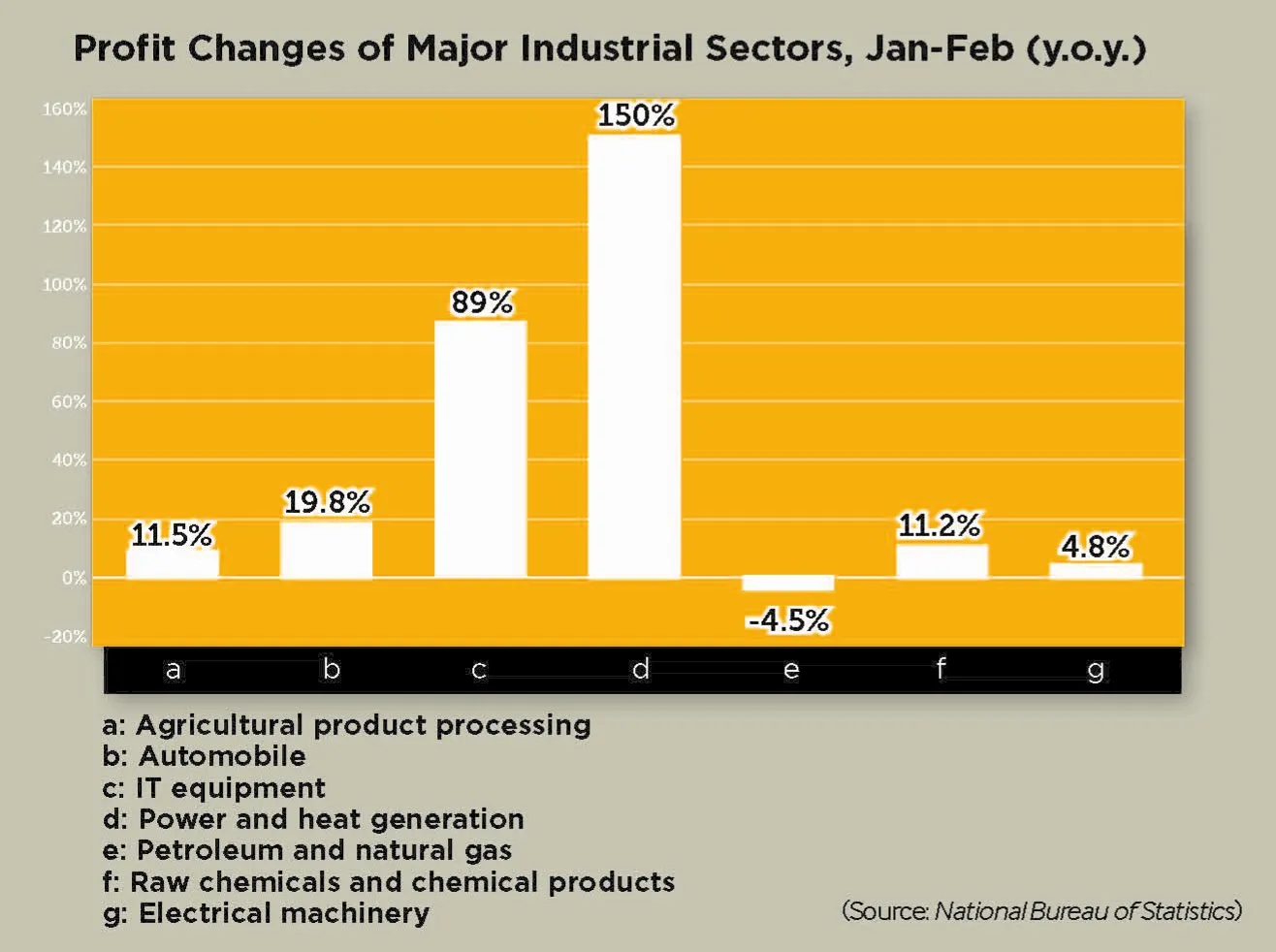

1,700%

Year-on-year increase in profits of the ferrous metal processing sector from January to February

THE MARKETS

New U.S. Branch

The Bank of China (BOC) opened a new branch for business in downtown Chicago on March 22, the fourth in the United States.

The BOC Chicago branch will offer such services as working capital loans, supply chain financing, trade financing, trade settlement,commercial property mortgage, cash control,foreign exchange and foreign exchange derivatives to enterprises in 17 U.S. states around Illinois.

BOC entered the United States in 1981 and has so far opened three branches. With the Chicago branch, BOC has extended its business to the Midwest, thus building up a business network strengthening from coast to coast.

Profit Plunge

Chinese electric car and battery maker BYD announced on March 25 that its 2012 profits tumbled 94.12 percent year on year amid a bleak solar market.

The Shenzhen-based company specializing in electric vehicles, rechargeable batteries and photovoltaic (Pv) cells reaped 81.38 million yuan ($13 million) in net pro fits in 2012, according to its annual report filed with the Shenzhen Stock Exchange.

The company attributed last year’s contraction in profits mainly to its lackluster solar energy business, calling 2012 “an extremely tough year for the Chinese solar Pv industry” in its statement.

Its revenues from selling both electric- and fossil fuel-powered vehicles rose steadily in 2012, while its cell phone parts manufacturing and assembling were dented by the narrowing market shares of its major clients, the company said. ■