ECONOMY

2013-12-06

Financing Innovation

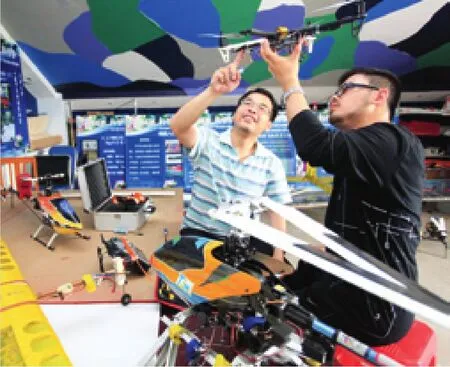

Two students from Tianjin University tested remote controlled planes in a lab on May 15.

On that day, four hi-tech companies inked an agreement with Tianjin University, pledging to help students start their own businesses. The four companies donated 760,000 yuan($123,576) toward programs to help foster innovation amongst college students.

Global Investment

Seventeen years from now, half the global stock of capital, totaling $158 trillion (in 2010 dollars), will reside in the developing world, compared to less than one third today, with countries in East Asia and Latin America accounting for the largest shares of this stock, says the latest edition of the World Bank’s Global Development Horizons (GDH)report, which explores patterns of investment, saving and capital flows as they are likely to evolve over the next two decades.

Developing countries’ share in global investment is projected to triple by 2030 to three fifths, from one fifth in 2000, says the report,titled Capital for the Future: Saving and Investment in an Interdependent World. With world population set to rise from 7 billion in 2010 to 8.5 billion 2030 and rapid aging in the advanced countries, demographic changes will profoundly influence these structural shifts.

“GDH is one of the finest efforts at peering into the distant future. It does this by marshaling an amazing amount of statistical information,”said Kaushik Basu, the World Bank’s Senior Vice President and Chief Economist. “We know from the experience of countries as diverse as South Korea, Indonesia, Brazil,Turkey and South Africa the pivotal role investment plays in driving long-term growth. In less than a generation, global investment will be dominated by the developing countries. And among the developing countries, China and India are expected to be the largest investors,with the two countries together accounting for 38 percent of the global gross investment in 2030. All this will change the landscape of the global economy, and GDH analyzes how.”

MARITIME FAIR

Visitors observe a China-made surfboard and motorboat during the 2013 China International Marine, Port and Shipbuilding Fair in Nanjing,capital of east China’s Jiangsu Province, on May 15

Shanghai Free Trade Zone

City planners in Shanghai have set aside 28 square km in Shanghai’s Pudong District for a free trade zone,including the Waigaoqiao Free Trade Zone, Yangshan Free Trade Port Area and Pudong Airport Comprehensive Free Trade Zone.

The area is almost the same size as Macao, and its trade volume already topped $100 billion last year, the highest on the mainland.

A new economic order will be established in the area with its own set of rules for commerce and finance. Authorities believe the tentatively named Shanghai Free Trade Zone will have even more of an impact than other such entities found in Shenzhen, southern Guangdong Province, and Tianjin.

The free trade zone is expected to begin its first phase of operations later this year.

Tencent’s Outperformance

Tencent Holdings Ltd., China’s largest Internet company by revenue,released strong first-quarter results on May 15 and posted high growth in app subscriber numbers.

Net income rose 37.1 percent to 4.04 billion yuan ($657.9 million) at the end of March this year compared to the same period in 2012, while it showed a 16.8 percent increase from 3.46 billion yuan ($562.9 million)at the end of last year, said the Shenzhen-based company.

Tencent is known for QQ,China’s most popular instant messenger, and WeChat, a free instant messaging app for smartphones.

“We are integrating new services into Wechat to explore emerging business opportunities on the mobile Internet. In addition, we will continue investing in user acquisition activities for WeChat in international markets,”the company said on May 15.

Record-High Bad Loans

Bad loans from Chinese banks reached their highest level in four years by the end of March, according to data released by the China Banking Regulatory Commission(CBRC), the country’s banking sector regulator, on May 15, while their total assets rose by 17 percent.

Outstanding non-performing loans, or NPLs, stood at 526.5 billion yuan ($85.67 billion), up by 33.6 billion yuan ($5.47 million) from the end of 2012, while the ratio of bad loans to total lending rose by 0.01 percentage points to 0.96 percent,during the first quarter of the year.

Bad loans have now increased for a sixth straight quarter—the longest deterioration streak in at least nine years.

Total assets of the banking sector stood at 141.3 trillion yuan ($22.99 billion), meaning total banking assets have increased fivefold in the past decade.

Shang Fulin, CBRC Chairman,warned the bad loan levels are likely to continue rising.

The soured-loan increases were reported across all categories, in cluding among state-owned lenders,joint stock banks and regional banks in cities and rural areas.

Major state-owned banks experienced the biggest jump, as their NPLs rose by 14.6 billion yuan ($2.38 billion) during the quarter. Their ratio of such loans to total lending dropped by 0.01 percent to 0.98 percent.

Joint stock banks reported the biggest increase in their NPL ratio, by 0.05 percent to 0.77 percent, while the amount of their bad loans went up by 9.9 billion yuan ($1.61 billion).

“The rise in non-performing loans is a natural result of an economic slowdown, with increasing defaults among companies,especially small and medium-sized enterprises,” said Guo Tianyong,Director of the Research Center of the Chinese Banking Industry at the Central University of Finance and Economics.

However, he suggested the current increase in soured loans was still mild, and the amount may decrease in the following months, as the economy stabilizes.

POWER CONSUMPTION

A power transmission tower and wind turbines in Jiuquan, Gansu Province, on May 14.April’s electricity consumption totaled 416.5 billion kw nationwide, surging 6.8 percent year on year

Fiscal Revenue Drops

The Central Government fiscal revenue fell in April as business tax income dropped but booming home transactions lifted local government coffers, the Ministry of Finance said on May 13.

The Central Government’s revenue fell 2.2 percent to 535.7 billion yuan ($87.1 billion) from a year earlier, after slipping 0.2 percent in March. lt is the first time that the Central Government has seen its revenue shrink for two consecutive months since September.

The ministry attributed the decline to a “very slow” increase in corporate tax and a decline in tariffs from imports.

The ministry cautioned that fiscal revenue will be under pressure this year due to a likely slower industrial output growth, worsening corporate pro fits and structural taxcutting measures.

However, the local government revenue rose 14.7 percent to 607.4 billion yuan ($98 billion),1 percentage point faster than in March, as housing transactions rose and tax revenue boosted,according to the ministry.

Ripe and Ready

Workers from the Fuyuan Cooperative in Ninghe County,Tianjin, load fresh peaches in a greenhouse.

The Fuyuan Cooperative uses organic fertilizer to grow peaches that are better tasting and healthier to eat.