MARKET WATCH

2013-12-06

OPINION

Out of Step With the Economy

China’s macroeconomy has shown signs of cooling down as opposed to the soaring financing market. First-quarter GDP growth was slower than expected. In April, the purchasing managers’ index (PMI) fell by 0.3 percentage points compared with March and the non-manufacturing PMI was also down 1.1 percentage points month on month,suggesting that funds have not been fully employed, which may undermine the quality and efficiency of the macroeconomic and financial development. But during the first four months, social financing grew by 3.06 trillion yuan ($499 billion) compared with the same period last year, with broad money supply (M2) hitting 103.26 trillion yuan($16.85 trillion).

The correlation between capital and material flow is a key indicator of financial deepening. Capital flow accompanies material flow in the opposite direction. Actually capital flow and material flow interact with each other in a more complex way. Anyhow,capital flow, by and large, keeps pace with material flow.

The independence of capital flow from material flow is a major sign of financial deepening, which may lead to arbitrage behaviors, asset price bubbles, and potential inflationary pressures. Therefore, a major task for macroeconomic governance is to prevent monetary capital from idling.

The independence of monetary capital flow from the real economy can be perceived in the following three aspects.

First, the efficiency of capital allocation continues declining. In the first quarter, the ratio of social financing against GDP is 51.8 percent, up 16 percentage points compared with the same period of last year. On most occasions, gross output decides the demand of money. However, by the end of April, M2 had increased by 16.1 percent year on year,indicating that money supply exceeded the demand of real economy.

Second, in a loose monetary environment, enterprises still face a shortage of funds. In April, the producer price index(PPI) fell by 2.6 percent year on year and 0.6 percent month on month, indicating that it’s difficult for enterprises to remarkably improve profitability. At the same time, the slump of corporate profits greatly affected the quality of commercial bank credit assets. By the end of March, non-performing loans of commercial banks had risen for six consecutive quarters, accounting for 0.96 percent of total loans, higher than that of the end of last year.

Third, arbitrage behaviors thrive. Social funds flooded into the real estate market,jacking up housing prices. From January to April, housing sales rose 65.2 percent, 24.1 percentage points higher than the growth of floor space sales. Since the release of new real estate market control policies, housing prices in major cities have experienced a boom rather than a slump, which, apparently, has not been spurred by rigid demand,but because of arbitrage behavior.

In 2009, to cope with the international financial crisis, China shifted from moderately tight monetary policies to moderately easy ones. As a result, credit began to experience an abnormal growth, and money lay idle. But now, the case is different, for the idling of funds is caused by the virtualization of the housing market, and the mutual binding of the real estate market, local government debts and the quality of commercial bank credit assets.

Such a situation will undermine the stability and quality of macroeconomic growth and exert a negative influence on macrofinancial stability.

Therefore, financial markets should facilitate macroeconomic development.Enterprises should be guided to engage in real operations rather than arbitrage transactions. Efforts should also be made in deepening regulations in the housing market, optimizing the real estate tax system and promoting the pilot program of real estate tax to further improve tax collection and management of the real estate market. ■

This is an edited excerpt of an article by Xiang Zheng, a financial commentator, published in Shanghai Securities News

yushujun@bjreview.com

NUMBERS

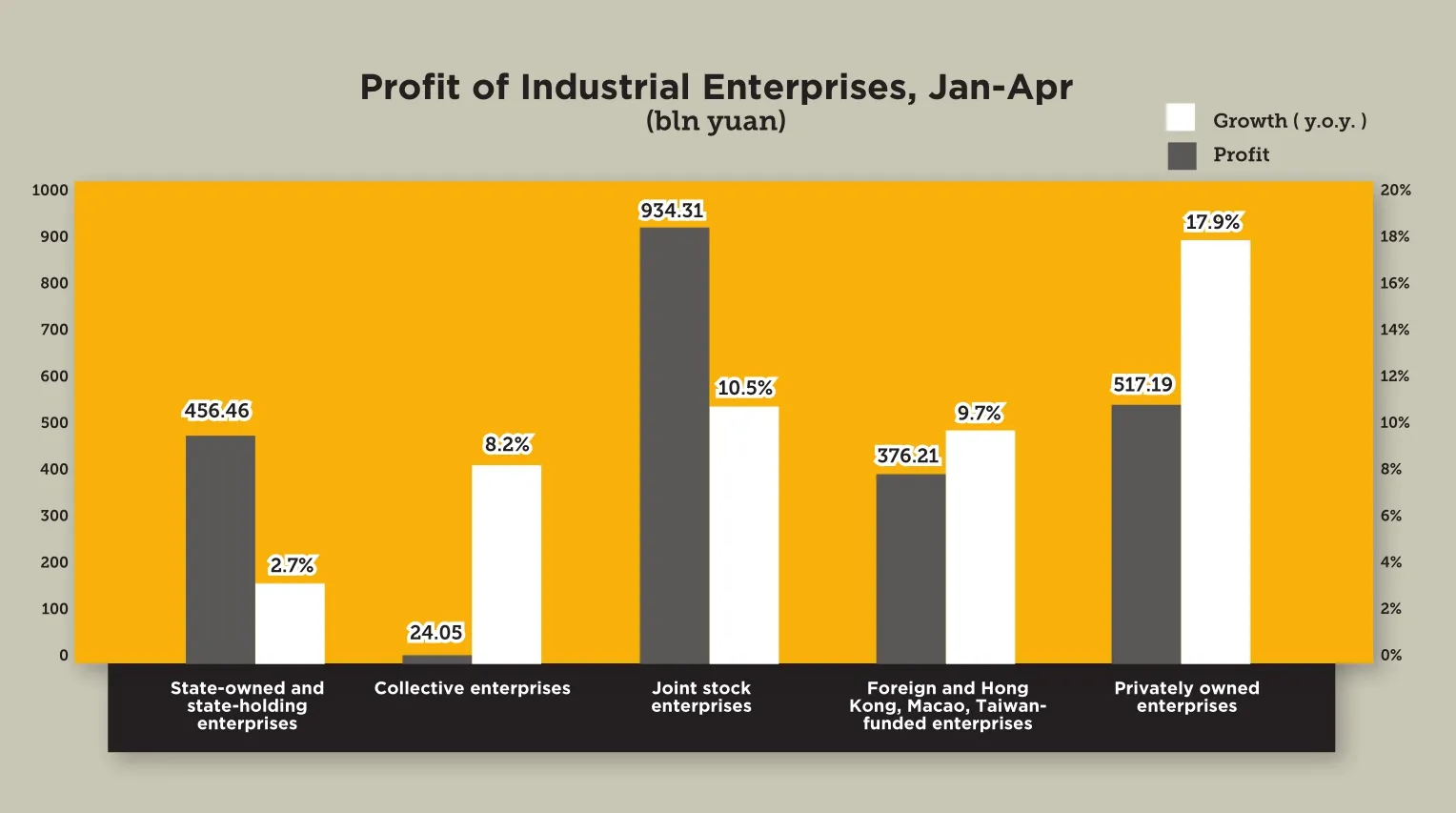

1.61tln yuan

Profits of industrial enterprises with an annual sales revenue of more than 20 million yuan ($3.15 million) from January to April, a 11.4-percent year-on-year increase

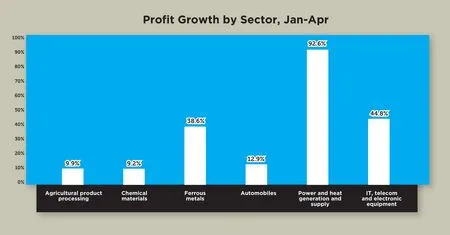

92.6%

Year-on-year increase in profits of the power and heat generation and supply sector from January to April

30

Number of industrial sectors that witnessed higher year-on-year profits from January to April

(Source: National Bureau of Statistics)

THE MARKETS

Logistics Network

Alibaba Group, parent company of China’s largest consumer-to-consumer portal, Taobao,joined hands with several partners to kick off a logistics network program on May 28 in Shenzhen, south China’s Guangdong Province.

The program, which will have a full investment of 300 billion yuan ($48 billion), will build up logistics facilities nationwide to enable parcels in some 2,000 Chinese cities to be delivered within 24 hours of online purchasing,according to Alibaba founder Jack Ma.

The China Smart Logistics Network will be run by Rookie Network Technology Co. Ltd.,which was jointly established by Alibaba, Intime Department Store Group Co. Ltd., as well as the country’s major delivery companies such as Shentong Express, ZTO Express and YTO Express, and other investors.

According to Ma, there are currently about 25 million parcels delivered every day in China,and that figure is expected to rise to 200 million in 10 years.

Offshore Yuan Center

The Industrial and Commercial Bank of China (ICBC)plans to create a yuan cross-border business center in Luxembourg to serve Europe, said the bank on May 28.

ICBC Europe’s cross-border trade financing in yuan amounted to 10.8 billion yuan ($1.7 billion) in 2012, and its cross-border transactions reached a total of 25.9 billion yuan ($4.23 billion), according to Xu Zhi, head of ICBC Europe’s financial markets department.

During the first four months, ICBC Europe was more dynamic in its yuan business, recording 17.5 billion yuan ($2.86 billion) on the financing of crossborder trade and 16.4 billion yuan ($2.68 billion) on cross-border transactions.

ICBC launched its yuan cross-border business in 2009. Its yuan compensation network now covers nearly 70 countries and regions, and its yuan cross-border business has reached a total amount of 3 trillion yuan ($489.6 billion). ■