PRAISE AND CONCERN AT BOAO

2013-03-05ByZhouXiaoyan

By Zhou Xiaoyan

PRAISE AND CONCERN AT BOAO

By Zhou Xiaoyan

China’s plans for further economic development and reform were highly lauded, but its challenges were not overlooked

Keynote Speech Highlights

Difficulties and challenges that face Asia:

—Transforming and upgrading its development model in keeping with the trend of the times;

—Making a concerted effort to resolve major difficulties to ensure stability in the region;

—Building on past success and forming new progress in promoting cooperation in Asia.

Measures to ensure that development in Asia and the rest of the world reaches new highs:

—Working together to uphold peace,

—Boosting cooperation as an effective vehicle for enhancing common development;

—Remaining open and inclusive.

(Source: Xinhua News Agency)

The just concluded Boao Forum for Asia (BFA) Annual Conference 2013 was probably the busiest one in its history, with over 2,500 political and economic leaders from 43 countries and regions from around the world discussing or debating topics such as the global economic recovery, Asian integration and the accomplishments and risks of the upbeat Chinese economy.

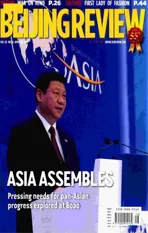

During his keynote speech at the opening ceremony of the 2013 BFA on April 7, Chinese President Xi Jinping emphasized the important role that Asian countries, China in particular, have played in a lackluster global economic recovery.

Asia is one of the most dynamic and most promising regions in the world, and its development is closely connected with the development of other continents, said Xi. In recent years, Asia has contributed to over 50 percent of global growth, instilling much-needed confidence in the world. What is more, Asia’s cooperation with other regions of the world at regional and sub-regional levels has great vitality and promising prospects, said Xi.

Xi also emphasized that a growing China will benefit Asia and the world.

“The bigger the growth China achieves, the more opportunities the whole world can get,”he said.

China is expected to make overseas investments of $500 billion and import goods worth $10 trillion in the next five years, and its people will make 400 million trips abroad, Xi said. China outperformed many countries amid the global slowdown, despite its economic expansion hitting a 13-year low of 7.8 percent in 2012, as the European debt crisis dealt a heavy blow to the country’s exports. The nation set a growth target of 7.5 percent for 2013. The best, Xi emphasized, is yet to come. China pledged to double its GDP and per-capita income by 2020 from 2010 levels.

China’s development during the past decade won global applause at the forum. Cambodian Prime Minister Hun Sen said that China’s economic rise and rapid growth have helped the Association of Southeast Asian Nations emerge from its own economic slump.“China’s economic growth benefits other regions and countries worldwide,” he said.

International Monetary Fund (IMF) Managing Director Christine Lagarde spoke highly of Asia’s economic development, especially China.

“I dare not imagine where the world economy might be today without Asia. This region has been the consistent global growth leader—driving an astonishing two thirds of total growth in the five years since the crisis hit,” she said during the forum.

She also said that China plays a crucial role in the world economy, as it has maintained rapid growth momentum, adding that the IMF attaches great importance to China and expects further cooperation.

Despite promising prospects, the way ahead is riddled with challenges.

“China is still the largest developing country, and it is faced with several difficulties. Longterm efforts are needed to overcome them,”said President Xi.

China’s future development depends on its ability to tackle daunting tasks, including how to further prompt domestic consumption to realize a transformation of the country’s growth model, how to deal with the hollowing-out of the manufacturing sector and how to carry out financial reforms to inject vitality into the economy, said experts at the BFA.

Boao Forum for AsiaThe Boao Forum for Asia (BFA) Annual Conference 2013 was held between April 6-8 in Boao, south China’s Hainan Province.

Under the theme Asia Seeking Development for All: Restructuring, Responsibility and Cooperation, this year’s forum focused on topics related to “restructuring” as economists from home and abroad were invited to discuss China’s past and future economic reforms.

A total of 54 panel discussions were held during the three-day event on topics including the global economic recovery, Asian integration, financial market deregulation, small and medium-sizes enterprises, the relationship between market and government, shale gas, expanding domestic consumption and property sector regulation.

In addition, the annual conference offered a chance for young leaders, CEOs of multinational companies, private sector executives and female leaders to meet face to face.

As a non-government, non-profit international organization, the BFA is the most prestigious and premier forum for leaders in government, business and academia in Asia and other continents to share their vision on the most pressing regional and global issues.

Initiated in 1998 by Fidel V. Ramos, former President of the Philippines, Bob Hawke, former Prime Minister of Australia, and Morihiro Hosokawa, former Prime Minister of Japan, the BFA was inaugurated in February 2001.

Boao is now the BFA’s permanent site. It covers an area of 86 square km and has a population of about 27,000 people. Since 2002, the BFA has held its annual conference in Boao every April.

(Source: www.boaoforum.org)

The need to spend

There has been a growing outcry for China to further tilt the nation toward domestic consumption in order to help a sluggish global economy recover. In its 12th Five-Year Plan (2011-15), China vowed to shift its growth model toward boosting domestic consumption, as shrinking world demand for Chinese goods hurts exports. Domestic consumption only accounts for 48 percent of China’s GDP, much less than the global average of 80 percent. This means a huge market is begging to be tapped.

“China is one of our biggest markets in the world, with an enormous growth prospect,” said Carlos Brito, CEO of the Anheuser-Busch InBev, a leading global brewer, at the panel discussion.“Right now the beer consumption is quite low, and we see this as a great opportunity. Also, we noticed that China is a vast nation with huge regional differences. Right now, most of our business happens in coastal cities. In the future, we will focus more on inland cities and the western part of the nation.”

Zein Abdalla, President of PepsiCo, echoed Brito, noting that Pepsi has performed well in China.

“We expand our presence in the Chinese market by customizing to the unique needs of Chinese consumers. For instance, by developing relatively light-tasting chips like the cucumber potato chips,” he said, adding that the company will continue to develop product portfolios catering to local stomachs.

“We have a long commitment to and confidence in the Chinese market.”

Lai Xiaomin, Chairman of China Huarong Asset Management Co. Ltd., said at the BFA that China should establish a long-term plan to shore up consumption.

First, China should make more effort to better distribute its wealth by increasing residents’income. Second, a better social welfare and security system should be built to make people feel secure enough to spend. Finally, more incentives should be given to consumption in rural areas. “Without stirring up consumption of the country’s 740 million rural residents, China’s domestic consumption can never be a pillar for economic growth,” he said.

Online shopping and credit consumption have become two driving forces to increase spending at home, said experts. There had been about 242 million online shoppers in China by the end of 2012, an increase of 25 percent over the previous year, according to the China Internet Network Information Center.

Emarket, a U.S. research company, said online sales in China were worth $181.6 billion last year.

In China’s first-tier cities such as Beijing and Shanghai, the yearly spending of each online shopper averaged 6,819 yuan ($1,101), accounting for 18 percent of the person’s total disposable income, according to a report by McKinsey Global Institute, the research arm of global management consulting firm McKinsey & Co. China’s e-tailing market may reach $420 billion to $650 billion in sales by 2020, according to the report.

Online shopping has a clear incremental effect on overall consumption, and could raise private consumption by an extra 4 to 7 percent by 2020, said Chen Yougang, one of the authors of the report.

“China’s young generation is quite familiar with digital products and has been fully exposed to the Internet world since they were born. We should provide more e-commerce channels for them to get to know our brand and then purchase our products online,” said Pepsi President Abdalla.

Another means to boost consumption is the credit card. Ma Weihua, President and CEO of the China Merchants Bank, said that credit consumption will play a pivotal role in shoring up spending.

“China now has 330 million credit cards, with an annual increase of 20 percent. China Merchants Banks has issued 40 million to 50 million of them, and the credit card business is spiraling up,” he said.

“When I first considered developing the credit card business, many people wanted to talk me out of it. Luckily, I didn’t listen to them. We estimated that it would take eight years before the business turned a profit. It turns out it only took four,” Ma added.

GATHERING OF MINDS: National leaders and heads of international organizations pose for photos at the Boao conference

Manufacturing hollowing-out?

Over the past several years, some China-based manufacturers have shifted production to regions with cheaper labor and land costs, like Southeast Asia. Meanwhile, developed countries like the United States have called on their companies to bring manufacturing jobs back home. As a result, concerns are rampant over the hollowing-out of China’s manufacturing sector.

In the eyes of Justin Yifu Lin, former World Bank chief economist, industrial transfer is a common phenomenon.

In the 1960s when Japan was in the midst of its economic ascent, the Japanese moved labor-intensive industries to the four Asian Tigers—Singapore, South Korea, Taiwan and Hong Kong—and helped them realize industrialization. In the 1980s, the “tigers” followed suit and moved industries to the Chinese mainland. Now, it is China’s turn, Lin said.

Dong Mingzhu, Board Chairman of Gree Electric Appliances, Inc. of Zhuhai, said that the fundamental reason for the hollowing-out of the manufacturing sector is a lack of core technology.

“Companies that were hit most from the 2008 financial crisis were original equipment manufacturers. They don’t have a brand, or any key technology in what they produce. When those companies were built in the first place, their founders were too short-sighted to make any long-term plans,” said Dong, during a roundtable on the hollowing-out of China’s manufacturing sector.

“As long as you have core technology, you’ll be fine,” she said, noting that Gree is now Brazil’s largest air conditioner producer after founding a factory using refined technology 10 years ago.

Lin Zuoming, Board Chairman of Aviation Industry Corp., agreed.

“Economic globalization itself is a process whereby industrial chains break into fragments and are scattered in different regions,” said Lin.

“Some lower-end manufacturing businesses transferring out of China is a positive change, as long as we keep higher-end manufacturing businesses and their core technologies.”

Hu Zhenyu, Vice President of the China Fortune Land Development Co. Ltd., an expert in investment and the operation of industrial parks in China, said that local governments are quite cautious and rational when selecting which industries to develop. Lower value-added industries are not welcome in most regions, he said.

“As the resources in coastal regions are more and more scarce, it’s totally understandable that some industries will shift to China’s inland regions, or even to other countries. Doing so can prepare the way for industrial upgrade along the coast,” he said.

The upgrading process could bring massive layoffs.

“That’s when the government should step up and re-educate workers for their next employment opportunities,” he said.

Regulate or let loose?

A debate over whether to deregulate China’s financial sector was put into the limelight at the 2013 BFA.

Deregulating the financial sector will spur innovation, which is badly needed for the country’s budding financial market. However, it may also bring risks, similar to what caused the 2008 financial crisis, said panelists at the BFA.

“Generally speaking, China’s financial sector is a developing, emerging and fledging one, which on the one hand requires less government regulation to stir innovation, and on the other calls for risk control,” said Wang Yincheng, President of PICC Life Insurance Co. Ltd., one of China’s largest insurers.

Zhang Dongning, deputy head of the Bank of Beijing, said that it’s all about finding the right balance between deregulation and risk control.

“The government should step back from things that it shouldn’t regulate,” he said.

“Specifically speaking, the government should be responsible for three things: establishing a fair market environment, stipulating financial market regulations in line with the rule of economic development instead of out of the will of leaders, and finally awarding regulationabiding enterprises and diminishing those that don’t respect rules.”

Rodney Ward, Chairman of Asia Pacific Global Corporate and Investment Banking with the Bank of America Merrill Lynch, called for more room for foreign banks in China’s financial market.

“I’d like to see a much more dynamic financial market with the participation of foreign players,” he said.

“I think private capital can play a more active role in the process of China’s financial reform, if major international banks are allowed to collaborate with local banks in small and micro lending businesses, which China needs to promote,” Ward toldBeijing Reviewduring an interview.

In terms of simmering risks, Ward expressed his optimism.

“I am absolutely overwhelmed by the extraordinary progress that China has made in reforming its banking market during the past decades,” said Ward. “China has made remarkable progress by creating the current financial system from nothing. I believe in China’s ability to adapt, and adapt fast.

“If anybody is going to find the right balance, it’s got to be China.”

zhouxiaoyan@bjreview.com