New Circumstances for China’s Investment in Central and Eastern Europe

2012-12-11

During his trip to Central and Eastern Europe (CEE) in April 2012, Chinese Premier Wen Jiabao put forward 12 proposals to promote China-CEE friendship and cooperation.On September 6, 2012, the Inaugural Conference of the Secretariat for Cooperation between China and Central and Eastern European Countries (CEECs) was held in Beijing, marking a new important phase of China-CEE relations.With the fast growth of economic and trade cooperation between China and CEE,flourishing Chinese investment in CEE has helped stimulate further development of bilateral relations.

I.A “Window of Opportunity” for China’s Investment in CEE

The improvement of a country’s investment environment can greatly boost the inflow of foreign direct investment (FDI) into that country.However, important investment opportunities often appear when a country or region is undergoing a significant transformation or period of reform, or when a country with rich resources is undergoing transitions due to social instability,such as the post-war redesigning of the energy infrastructure in Libya, orchestrated by Western countries.

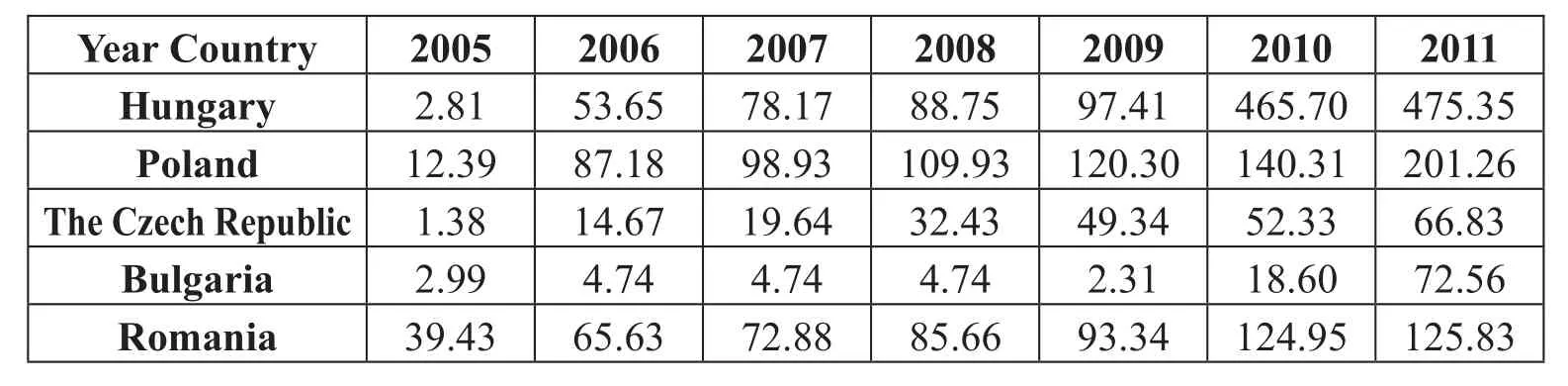

After the drastic fracturing of the Soviet Union and subsequent changes in Eastern Europe, CEE offered China comparatively big investment opportunities - the transformation period in the 1990s, when all countries in CEE were carrying out privatization reforms and market opening policies, offering preferential policies to foreign investors and encouraging the private economy to various extents.Later, with the acceleration of integration into the EU, these opportunities gradually disappeared.Unfortunately, restricted by its investment capacity, China failed to issue relevant investment strategies at the time.It only encouraged Chinese emigrants to actively participate in the market development of CEECs, mainly through short-term investment.From 2005 to 2011, although the investment stock of China in some CEECs was rising (see table 1), the base number was comparatively low, and China has yet to fully exploit the investment potential of CEE.

Table 1:The Investment Stock of China in Major CEECs from 2005-2011(Unit: Million US Dollar)

With China’s opening-up policy in full swing and the launch of the “Going Global” strategy in the 10th Five-Year Plan period (2000-2005), China began to seek more investment opportunities in global markets.This said, CEECs always regarded EU countries as their main prospective investors.Due to China’s unfamiliarity with the rules of the large EU market and the ambiguous strategic and trade positioning of CEECs, it was difficult for China to find suitable investment opportunities in the region.However, in the 11th Five-Year Plan period (2006-2010), China’s investment regions were clearly transferred from Hong Kong, Macao, North America, and Western Europe to Asia Pacific, Africa, Latin America, and CEE.Chinese investors began to realize the investment potential of the CEE region.

In 2010, the Greek sovereign debt crisis triggered continuous turmoil in the Euro zone and exerted significant influences on the economic development of CEE.In terms of investment opportunities, CEE began to offer China a “window of opportunity.” The details are as follows:

Firstly, the debt crisis has contributed to the change of the investment environment in CEECs.In 2010, the debt crisis in the Euro zone took a heavy toll on CEE, leading to a slowdown in the economic growth of the countries in the region.The World Investment Report 2012, released by the United Nations Conference on Trade and Development (UNCTAD), noted that against the backdrop of sustained economic development uncertainty in Europe, continued instability in global financial markets and the economic slowdown in most emerging economies, many countries adopted FDI as a way to promote economic growth, making the investment environment of some countries in 2011 very conducive to foreign investors.

According to statistics, the proportion of countries adopting restrictive policies to FDI decreased from about 32% in 2010 to 22% in 2011, and the policies for investment liberalization and promotion are increasingly becoming aimed at specific industries, such as electric power, gas and water supply,transportation and communications.CEECs in particular are using investment promotion as a means to stimulate economic growth.Influenced by such trends, foreign investors have shown a growing interest in investing in the region.A 2012 survey of multinational corporations conducted by UNCTAD showed that the new EU-12 countries (10 CEECs plus Cyprus and Malta)have become some of the world’s top investment destinations,immediately following Southeast Asia, the EU-15, North America and Latin America, and followed by Southeastern Europe and members of the Commonwealth of Independent States, which include six CEECs that have not joined the EU.The new EU-12 countries are ahead of West Asia, North Africa, sub-Saharan Africa, as well as other developing countries.

Secondly, under the impact of the debt crisis, Euro zone countries such as Greece and Italy struggled to maintain their investments in CEECs, resulting in a large number of poorly managed assets, which provided opportunities for foreign investors to step in.Meanwhile, the spillover of the Euro zone crisis has seriously affected the economic growth and social stability of CEECs, which used to mainly “go westward”for investment but are now “looking both eastward and westward,” seeking closer cooperation with countries such as Russia and China to promote economic growth.CEECs have managed to improve transportation infrastructure, promote the construction of energy facilities, vigorously develop information and communications technology, and many of these industries are adopting preferential policies to attract investment.In light of China’s good investment foundation in these industries, its advantage of investing earlier than others, and its abundant foreign exchange reserves, some CEECs are vying to attract investment from China.Various investment forums and investment promotion activities were held in China and CEE that were geared towards this development.Such investment interactions have reached an unprecedented level.

It should be emphasized that the major factor affecting changes in the investment environment in CEE is the European debt crisis.As such, the future and outlook of the crisis will directly affect Chinese investment in the region.In fact, the crisis does not pose a fundamental challenge to the capitalist system; it is just a structural crisis within the Euro zone.Despite the ongoing crisis, the grimness of the situation is expected to ease in the near future due to the internal structural adjustments between different members within the Euro zone.If the situation improves, the interaction with and even control over CEE by Euro zone countries will be restored again, CEE’s dependence on the Euro zone will increase again correspondingly, and investment opportunities for external countries will gradually disappear.Therefore we can say that this round of investment in CEE is a “window of opportunity” against the backdrop of the European debt crisis.

That China seizes this “window of opportunity” is very important for China and China-EU economic and trade relations.Currently, investing in CEE is an important opportunity for China to upgrade export products and extend its investment value chain.If China loses such a chance, it will miss not only the opportunity to occupy the CEE markets but also the opportunity to realize the transformation of its industrial development model and the upgrading of its value chain with the help of the European market.The European debt crisis has led to the shrinking of the real economies of EU countries and the decline in import demand.These trends have directly affected the EU’s imports from China.Since mid-2010, the growth rate of Chinese exports to the EU has continued to decline.What is even worse, such exports registered negative growth in 2012 - down 1.8% in the first quarter and down 0.8% in the second quarter year on year, according to China’s Ministry of Commerce.In the first quarter of 2012, the non-energy product import growth of the EU was 0.8%, while the growth of China’s non-energy product exports to the EU was -2.28%.The decline in the share of non-energy product exports from China in the EU market is the main reason for the negative growth in China’s exports to the EU in the first quarter.Miscellaneous products(labor-intensive products such as furniture, garments and accessories, and footwear) as well as machinery and equipment are the two major categories of Chinese exports to the EU.Growth in these two export categories began to decline between 2004 and 2005, and the absolute value of the market share of miscellaneous products from China began to decline in 2011.Despite the fact that the absolute value of the market share of Chinese machinery and equipment products is still growing slowly, the growth rate has been close to zero, according to EU statistics.

All of these statistics show that the slowdown in the growth rate of China’s exports to the EU has accumulated over some time, and it is the result of a declining competitive advantage for China’s exports.The competitiveness of labor-intensive exports in the EU market has long been in decline, and even the competitive advantage of capital-intensive machinery and equipment exports barely exists now.To buck this downward trend, China cannot expect or wait for the recovery of the EU economy in order to compensate this loss.On the contrary, it should focus on enhancing the competitiveness of its exports to the EU and moving its products further upstream on the value chain.Speeding up the upgrading of the export industry in order to increase investment in Europe has become a new way to compensate for the negative growth of China’s largest export market, as well as to drive China’s economic growth.With its good investment foundation in terms of labor, capital and industry and convenience to access the EU technology and market, CEE is quite a good investment destination that can produce lots of added value.

II.Main Characteristics of Chinese Investment in CEE

1.China underlines the integrity of investment distribution and strengthens the overall transfer of the chain of production, processing and marketing.

Currently, more and more Chinese investors can be seen working in construction sectors that range from transportation(ports, airports, and roads) to local assembly and distribution networks (the construction of industrial parks), and even to logistics facilities (investment in sea transportation and the construction of container companies and telecommunications networks) in CEECs.Chinese investment in CEE can already be characterized by integrity.It has been developed from trade towns and trade centers, focusing only on the concentration of labor and on fixed stall sales to the diversification of investment industries and the development of the value chain.With the increase of green field investment, mergers and acquisitions,and joint ventures in CEE, Chinese enterprises have sought to introduce specific production models, such as infrastructure construction, machinery manufacturing, information and service industries as well as the development of chemical and agricultural products.They regard CEE as a center to upgrade,sell and distribute products to realize the localization and even “Europeanization” of the production, circulation, sales and branding of Chinese products.They can also use CEE as a springboard to enter the vast markets in the EU, Russia and Turkey.This is one of the main characteristics of Chinese investment in CEE at present, and it will remain so in the foreseeable future.

2.Characteristic investment industries have gradually emerged.

Currently, China’s characteristic investment industries in CEE are gradually emerging.Largely centering on China’s comparative advantages in technology and human capital, as well as its early-bird advantage, Chinese investment is implemented in keeping with the actual investment needs of CEECs.Investment industries mainly include infrastructure construction, the development of information and communications technology,clean energy (mainly technological investment) and machinery processing and manufacturing.

China Road and Bridge Corp.signed the Zemun-Borca Danube River Bridge project contract with the Serbian government in Belgrade in April 2010.This was a landmark project for bilateral cooperation.Although a Chinese company withdrew from Poland’s A2 highway project after incurring heavy losses,China’s investment in infrastructure construction in CEE has a sound momentum of development and has covered many countries and regions in CEE.Chinese information and communications technology companies such as Huawei and ZTE have invested across CEE.With a wide business scope,many Chinese companies have exerted a relatively large impact.China has also made achievements in clean energy investment in CEECs, and it has accelerated capital and technological investment in hydropower stations, nuclear power plants and thermal power stations.In terms of machinery processing and manufacturing, China has invested in the production lines of electrical appliances, automobiles and heavy machinery in many CEECs including Hungary, Poland, Bulgaria and Serbia.For example, at the end of January 2012, Liuzhou-based Liugong Machinery Corp.acquired the Polish construction machinery enterprise HSW, one of the largest construction machinery manufacturers in CEE with a highly respected international position in the heavy engineering equipment sector, exporting to more than 80 countries.After acquiring HSW, Liugong can obtain all of the company’s intellectual property rights and trademarks, and it can establish a manufacturing as well as research and development base in Poland.Based on its operations in Poland, Liugong can radiate its influence to the whole European market.As part of its efforts to integrate the above-mentioned competitive industries, China has also strengthened the construction of industrial parks in CEE so as to encourage and attract investors from China and expand the influence of Chinese investment in CEE.

3.China focuses on cooperation with major CEECs and expands investment from key countries to the whole region.

China does not invest in all CEECs indiscriminately; it pays more attention to countries that have prominent investment advantages and that hold more balanced composite indicators,especially CEECs that have advantages in geography, industrial bases, resource endowment and labor force quality.What China values most is the fact that some CEECs can serve as springboards and bridgeheads.For example, Hungary and Poland have become important choices for China.Hungary has attracted more Chinese-funded institutions and Chinese businessmen than any other country in CEE.Chinese investment in Hungary covers industries such as trade, finance,aviation, chemicals, logistics, real estate, consulting services,communications and electronics manufacturing.In 2010 and 2011, Wanhua Industrial Group Co.Ltd., the controlling shareholder of Yantai Wanhua Polyurethanes Co.Ltd., invested a total amount of 1.263 billion euros in two consecutive years to acquire a 96% stake in the Hungarian chemical company BorsodChem.This is the largest Chinese investment in CEE.China’s direct investment in Poland remained small for years until 2007 when Chinese investors began to notice the Polish economy’s strong development trends.Chinese investment in Poland has since experienced rapid growth, involving areas such as machinery manufacturing, communications technology,mineral exploration, real estate, and infrastructure construction.Chinese government statistics show that China’s investment in CEE primarily went to Hungary, Poland, Romania, Bulgaria and the Czech Republic in 2010 and 2011.Hungary attracted the highest investment stocks, which were US$465.7 million in 2010 and US$475.35 million in 2011.This was followed by Poland, with US$140.31 million in 2010 and US$201.26 million in 2011; Romania, with US$124.95 million in 2010 and US$125.83 million in 2011; Bulgaria, with US$18.60 million in 2010 and US$72.56 million in 2011; and the Czech Republic,with US$52.33 million in 2010 and US$66.83 million in 2011.To a certain extent, investment in these countries will drive investment in the entire CEE region.

4.The soft environment for investment in CEE has improved.

The Chinese government vigorously promotes cultural exchanges between China and CEE, holds various investment forums, dispatches “investment promotion delegations” to CEECs to promote investment, and strengthens the exchange of information.China has especially sought to invite officials in charge of foreign investment in CEECs to China for exchanges and training, so as to help them understand China’s economic situation and investment policies in CEE.On top of this, China has set up a cultural exchange mechanism between China and CEE and created a research fund to promote mutual understanding.

III.Main Challenges to Chinese Investment in CEE

China’s main investment approach in CEE is to move the whole industrial chain to the region and build it into a product upgrading center as well as a sales center, so as to realize the localization of production, flow and sales of Chinese goods, and further to enter EU, Russian and Turkish markets.However,there remain certain investment risks.Some EU member states have realized China’s investment tendencies.Some members of the European Parliament clearly express that China will be welcomed if its investment can provide employment opportunities and bring profits, but that it will be met with strong opposition if it only wants to use CEECs as its export base and sales centers.Competition between China and some CEECs caused by the convergence of some industries cannot be ignored either.For example, both Poland and Hungary feature processing industries to meet the demand of the European market and they are regarded as the miniatures of China in the EU market.

Chinese investors have long been concerned about the investment value and the market capacities of CEECs.Most of the high-quality assets of CEECs have been absorbed by Western countries due to privatization that occurred during the transformation period of the 1990s.As a result, most of the high-quality assets are currently still being controlled by those early birds.What Chinese enterprises gained from CEECs are mainly poorly managed businesses.Meanwhile, most of CEECs’market capacities are comparatively limited, which makes it difficult for Chinese investors to reap high profits.Besides,the integration of the market rules of CEECs with the EU also makes it more difficult for Chinese enterprises to establish themselves in the region.Worse still, in some CEECs, especially in Southeastern European countries, grey economies and corruption are rampant, and sometimes laws and regulations cannot be put in place, all of which bring risks for Chinese investors.

Stakeholders, including some influential commercial interest groups in the EU, Russia and CEE, are concerned about China’s entry into the CEE market and are thus trying to curb it.Since the outbreak of the European debt crisis, China’s involvement in CEE has triggered serious concerns from EU institutions,Germany and other EU members, which speculate that China is trying to divide the EU and establish a “CEE group.” In 2012,the joint communiqué to be publicized during a meeting between China and CEE was submitted to EU institutions for advanced review.The EU strongly opposed the proposal to develop longterm China-CEE relations and institutionalize these relations.German Chancellor Angela Merkel expressed her concern about closed, exclusive discussions between China and CEECs.As their cooperation deepens, EU institutions and member states concerned may set up new obstacles.Russia, another great power keeping close relations with CEECs, is also suspicious of China, worrying that the Chinese will gradually enter its“backyard” and take over its trade opportunities and political clout.Apart from this, commercial interest groups in CEECs are important forces that hinder China’s efforts to step in the CEE market.Due to competitive relations in purchasing and bidding with China, these groups will certainly be threatened if Chinese enterprises enter their dominated territories.Therefore, they often ask their governments to impose various restrictions regarding market access, terms of tender, visas,residencies, etc.with the excuse of protecting their domestic enterprises.

Moreover, negative campaigning by the media and think tanks poses other pressures on Chinese investment.When entering CEE, China was criticized by some local media of abusing fair trade rules and dumping products at low prices to compete unfairly.Some think tanks suggest that CEECs need to unite to conduct economic diplomacy and bargain with China so as to prevent China from gaining more profits by virtue of the conflicts among CEECs.These organizations claim that only by working together can CEECs properly cope with China’s economic “invasion.” Some think tanks believe that Chinese investment policies are driven by political interests.China needs the support of CEECs to exert its clout on the great powers in the EU, they argue, adding that the formation of a CEE alliance may push the EU to make decisions beneficial to China.Some other think tanks even posit that China adopts different diplomatic criteria toward CEECs based on their economic potential and political attitudes.For example, Poland and the Czech Republic, whose state leaders often meet with the Dalai Lama and criticize China’s human rights records,usually get Chinese investment disproportionate to their economic scale.While Hungary, Romania and Bulgaria, thanks to their full support of China, get much Chinese investment in return.The negative campaigning by the media, the ignorance of China among people in CEECs, and their non-recognition of China’s political system all lead to an unfavorable public opinion regarding Chinese investment in some CEECs.

Finally, China is not familiar with CEECs after their political transitions.Since the early 1990s, the priority of CEECs has been to consolidate democracy, integrate with the West and join the EU.China is mainly engaged in developing its economy and maintaining social stability.China and CEECs used to be close with each other; however, they became estranged from one another due to their different strategic development orientations since the end of the Cold War.There are different kinds of languages, cultures, ethnic groups, religions and histories in CEE.CEECs are geographically far from China and have undergone considerable change.All of these factors make them more difficult for China to understand.

IV.Chinese Investment in CEE: A Case Study and Lessons Learned

In September 2009, Poland’s A2 highway opened invitation for bidding.Directly connecting Warsaw and Berlin, the highway was an important project for the Euro 2012 Football Championship, which was jointly hosted by Poland and Ukraine.China Overseas Engineering Group Co.Ltd.(COVEC),a subsidiary of China Railway Group Ltd., responded to the tender quickly.Ultimately, the bidding consortium headed by COVEC won the contract with 1.3 billion zlotys (US$472 million, RMB3.049 billion) to build sections A and C.The highway project marked the first time for Chinese companies to engage in such large-scale infrastructure construction in any EU country.COVEC had been trying to enter the European infrastructure market, and undoubtedly the A2 highway project provided a good opportunity for the company to prove itself.However, this project eventually ended with the Polish government terminating its contract with COVEC in June 2011,and as a result, Chinese infrastructure companies’ “first bid” in CEE ended in failure.For COVEC’s investment in Poland, the domestic media concluded that COVEC got clobbered due to its blind entry.In fact, we should analyze COVEC’s investment in an objective and balanced way.Only by doing this can the case provide comprehensive references for future Chinese investment in CEE.

1.Some unpredictable risks should be considered in COVEC’s investment in Poland.

(1) COVEC’s project happened to coincide with the financial crisis in 2009, when raw material prices were relatively low.After winning the bid, the schedule was put off due to cold weather.Meanwhile, the Polish economy recovered quickly and Poland began to extensively build infrastructure projects for Euro 2012.Prices of various raw materials for infrastructure rose so sharply that the rental prices of some raw materials and excavating equipment went up more than five times in just one year.Given soaring costs of infrastructure construction,the Chinese investors suffered losses at the very start.

(2) China gained explicit support from Polish authorities to invest in the project.On the one hand, the Polish Peasants’Party, one of the ruling parties, was eager to create achievements and strongly believed in the speed of Chinese enterprises.On the other hand, European and American contractors were charging way too much.In order to drive down prices, the Polish government tended to have Chinese companies involved, and the Polish Peasants’ Party representatives were sent to China to lobby.The Chinese took it for granted that they could win the contract first and then ask the Polish government for help when troubles occurred.So they proposed an extremely low offer,which didn’t arouse suspicions from Polish government officials.In fact, things did not work out as expected when the Chinese contractors encountered difficulties.In June 2011, Polish Prime Minister Donald Tusk firmly refused China’s request to adjust the bid and terminated the contract with China.

(3) Poland’s highway authority operated irregularly in the bidding process and deliberately concealed some construction difficulties.In addition, the bidding procedure was neither fair nor transparent.Given all the above-mentioned factors, there were particular reasons for the failure of COVEC’s investment in Poland.

2.COVEC’s own carelessness and ill preparedness should not go unnoticed.

(1) COVEC was unfamiliar with the situation and invested recklessly.In the early stages of investment, the Chinese side relied too heavily on the opinions of several Polish experts.It did not fully examine the particular local situations for infrastructure, nor did it know the special provisions of the EU, such as provisions that mandated passages for protecting wildlife along the highway and the employment of local workers.Worse still, the Chinese side was not familiar with local suppliers of raw materials.All these resulted in COVEC seriously overshooting its budget.

(2) Slack technical checks were another problem.The Chinese contractors did not realize that the functional specification provided by Poland was unclear, nor did they comprehend the complex geological conditions of the sections they had been contracted to build.The Chinese technical staff made the decision in a hurry without undergoing sufficient preparations before bidding.

(3) Poor internal management.With many disputes existing in the consortium and the working relationship not straightened out, the work efficiency of the Chinese side was seriously affected.

3.Chinese companies must seriously improve crisisprevention awareness and public relations capabilities.

When evaluating COVEC’s investment against the larger background of China’s “Going Global” strategy, we can find more in-depth problems that Chinese companies will face when investing overseas, such as unsound supplementary measures for investment.As a highway for Euro 2012, the most widely watched sporting event in all of Europe, COVEC’s “unfinished project” in Poland was scrutinized by people of all walks of life, ranging from prime ministers and royal families to regular civilians, resulting in a negative impact that the Chinese side was unprepared for.It showed that Chinese companies are seriously in lack of crisis-prevention awareness, public relations capabilities as well as sound supplementary measures when investing.

V.Recommendations on China’s Investment Policy in CEE

1.China must clarify its strategic intentions when investing in CEE, namely further promoting cooperation between China and the EU via cooperation with CEE.

When investing in CEE, China has the intention of upgrading its place on the industrial chain and localizing production in the region, which is basically a form of economic behavior.It needs to clarify to the EU via policy interpretation that Chinese investors always pursue the principles of mutual benefit and win-win outcomes; it must also clarify that it will comply with EU laws and regulations.China’s investment plays an important role in the promotion of economic development in CEE and the promotion of balanced development between Eastern Europe and Western Europe within the EU.This will be a great opportunity to deepen the comprehensive strategic partnership between China and the EU.

Considering the close relationship between CEE and the EU,the role and the function of the EU need to be included in the process of promoting bilateral cooperation between China and CEE.This will be an effective way to make the EU hold more comprehensive understanding and fewer groundless suspicions to China.On condition that cooperation between China and CEE is not diluted, China ought to partially create conditions for EU institutions and member states to participate in this process,transforming the China-CEE cooperation into a moderately open and inclusive multilateral cooperation platform.

2.China should properly address the issues of risk aversion and crisis management when investing in CEE.

The support of local governments and non-governmental organizations is indispensable to investing in the economic development of CEECs.As a result, sound supplementary work will be necessary, and China ought to make use of investment opportunities to extensively contact local institutions for deeper understanding and cooperation.For the purpose of risk aversion and improving its crisis management capabilities, China needs to create conditions for the establishment of investment risk analysis teams and foundations formed by local elites and relevant agencies.The main purpose of the risk analysis teams is to gather information, conduct in-depth investigations into investment risks, and avoid walking into unfamiliar territories blindly.The principal objective of establishing local foundations is to help with crisis prevention and crisis management.At first, enterprises ought to engage some local elites in their investment activities.Once Chinese enterprises suffer losses or obstructions when investing in host countries, the foundations can come forward to do public relations work to help defuse the crisis.

3.The Chinese government ought to strengthen the guidance and support of investment behavior.

The government needs to guide enterprises to flexibly choose the right model of investment according to the specific characteristics of a given project.In addition to green field investment, enterprises can explore and adopt models like joint ventures, mergers and acquisitions and participating in privatization.They may also pursue the possibility of cooperating with multinational companies on projects that call for huge investment and draw public attention.

The government ought to take the initiative in resolving specific technical barriers set by some CEECs.Firstly, it is difficult for Chinese workers to get labor visas, work permits, and legal residencies, factors that hurt the expansion of investment in CEE.Secondly, social security poses a problem.There are no social security agreements between China and CEECs.Chinese workers need to pay pensions and unemployment insurance in CEECs.However, when they return to China, the insurance premiums paid cannot be returned and this poses an additional burden to Chinese enterprises.Thirdly, in order to attract investment, CEECs generally promise to provide some preferential policies; nevertheless, it is difficult to put them into practice due to systemic constraints in the actual implementation process.The Chinese government ought to come forward and urge the governments of CEECs to strengthen policy implementation on these issues.

4.China needs to explore a new model on developing relations with CEECs.

The 12 initiatives proposed by the Chinese government need to be implemented as a core policy for deepening bilateral cooperation.Meanwhile China ought to actively summarize its experiences and amend some existing problems within the 12 measures.Drawing on its practices in other regions, China needs to explore a new model on developing relations CEECs.Alongside China-African cooperation, China-CEE cooperation can serve as another good example of country-to-region cooperation.To this end, the research fund on relations between China and CEECs proposed by the Chinese government ought to concentrate upon this dimension for some useful exploration.It must work to absorb the opinions of political, academic and business elites to agree on a new model of cooperation between China and CEE and help make this model prevail.

杂志排行

China International Studies的其它文章

- Four Things to Be Done to Promote Future China-U.S.Relations

- The Meandering China-U.S. Relationship

- The Trend of the United States’China Policy in the Next Four Years and China’s Response

- Building a New Type of Relations Between Major Countries

- An Analysis on Myanmar Government’s Reforms

- Singapore’s Economic Diplomacy