The Battle Never Ends

2012-10-14InflationeasesbutdramaticmonetarylooseningisunlikelyByLanXinzhen

Inflation eases, but a dramatic monetary loosening is unlikely By Lan Xinzhen

The Battle Never Ends

Inflation eases, but a dramatic monetary loosening is unlikely By Lan Xinzhen

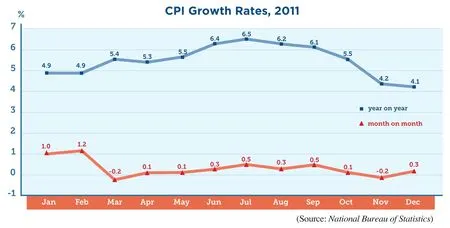

After reaching a record high of 6.5 percent in July 2011, China’s consumer price index (CPI) began to decline.According to the National Bureau of Statistics(NBS), the CPI rose 4.1 percent in December 2011 from a year earlier, which was 0.1 percentage point lower than the growth in November. It was the fifth month the yearon-year CPI growth dropped, indicating that China’s anti-inflation measures have taken effect.

Although in fl ation’s impact on the macroeconomy continues decreasing, China still faces serious pressure from price hikes.

Frequent measures

To cope with the inflation, the Chinese Government implemented a number of measures. During the fi rst seven months of 2011,the central bank increased the reserve requirement ratio six times and raised the interest rate three times.

After these measures, the anti-in fl ation campaign achieved some effect: The CPI growth began to slow down since August last year.

Zhou Jingtong, senior economic administrator of the Institute of International Finance of the Bank of China, said three factors pushed up prices in 2011: The capital injection used to cope with the global financial crisis have pushed up prices since 2010; U.S.quantitative easing caused increases of commodities prices in the international market;and the rise of domestic labor costs.

Zhou said decreasing prices are the result of both the market and macro-control. At present commodities prices in the international market are dropping, fears over imported inflation are dying and growth of non-food prices in China is dropping slightly.

A report released by the Financial Research Center with the Bank of Communications said based on the judgment that domestic and international raw material costs will continue to drop, the economic growth speed will slow, monetary policy will be dif fi cult to control, grain prices will remain stable and pork prices will drop. It expects that China’s pressure of price growth this year will be eased compared to 2011.

Lu Zhengwei, chief economist of the Industrial Bank Co. Ltd., said the CPI in January this year will remain unchanged or increase slightly from last December.Expectations hold that it will drop after February.

When analyzing CPI figures, people should pay more attention to the PPI, because this index is decreasing faster than the CPI, said Li Chang’an, associate professor at School of Public Administration of the University of International Business and Economics. In December 2011 the PPI rose 1.7 percent year on year and decreased 0.3 percent than the previous month. This indicates the transmission of price hikes has been signi fi cantly weakened.

No turning point

“Temporarily alleviated CPI growth is related to a slowdown of the Chinese economy, but the inflation that does exist in the Chinese economy has remained relatively unchanged,”said Zheng Chaoyu, professor at the School of Economics of Renmin University of China.“A downturn of the CPI for several months doesn’t mean the turning point for inflation has come.”

He Qiang, Director of the Institute of Securities and Futures of the Central University of Finance and Economics, said everyone should further observe the price level. Prices of farm products are easily in fl uenced by winter weather and are susceptible to increases around holidays. In the middle and long term, factors pushing up price hikes still exist, such as rising labor and resource costs as well as limited availability of land as urbanization sweeps the country.

Although the year-on-year increase of the CPI in December 2011 dropped to 4.1 percent, the CPI for 2011 rose by 5.4 percent,much higher than the goal of 4 percent set by the government at the outset of the year.

“Because of this, we can’t really say that we’ve solved the in fl ation problem,” He said.

FINDING THE CHEAPEST: A customer selects goods at a supermarket in Hangzhou, Zhejiang Province

Tan Yaling, Director of the China Foreign Exchange Investment Research Institute, said although CPI growth is dropping, people should not think in fl ation has been controlled.First, most people don’t believe prices are dropping. Second, the root cause of this round of inflation is speculation and now both investment and speculation in the market are declining.

Wang Tongsan, Director of the Institute of Quantitative and Technical Economics,said quantitative easing, cost in fl ation and the large amount of currency in circulation increase the likelihood that in fl ation will pick up in 2012. Although the central bank adopted a prudent monetary policy in 2011, it only controlled the rapid increase of newly added money supply, with the big monetary stock still in the market. This will impose some pressure to the price level and need some time to be alleviated.

Sun Lijian, Deputy Director of the School of Economics of Fudan University, worried once the European debt crisis becomes stable and liquidity panics disappear, the currencies put into circulation to remedy the European debt crisis will push up international commodities prices and cause in fl ation to return.

Loosening unlikely

As CPI growth rates dropped in late 2011,argument has arisen about whether the monetary policy should be loosened this year.Most experts think in 2012 it is not suitable to completely change the prudent monetary policy.

Wei Jie, a professor at the School of Economics and Management of Tsinghua University, said inflation pressure has determined that the monetary policy in 2012 should be prudent, but considering the risks of slowdown in economic growth in 2012, the central bank may lower the reserve requirement ratio several times.

The Bank of Communications’ report also said when inflation pressure alleviates this year, the economic growth will also slow down, the monetary policy won’t be further tightened. But considering the mid- and longterm inflation pressure and possibility of an economic “hard landing,” the monetary policy is not likely to be loosened.

The report estimates that in 2012 the benchmark interest rate will remain stable,but possibility cannot be excluded that the interest rate is reduced once for 0.25 percentage points for severe external impact. The reserve requirement ratio may be lowered two to four times, 0.5 percentage points each time.Possibility also cannot be excluded that the reserve requirement ratio will be lowered more frequently because of massive withdrawal of capital from China.

Zheng Xinli, Permanent Vice President of China Center for International Economic Exchange, said to curb prices and stabilize economic growth, China must change the measures of curbing inflation by merely tightening money supplies in the first three quarters of 2011. Instead, the government should curb inflation by increasing supplies,especially to balance the production and demand.

Ding Maozhan, Deputy Director of the Research Of fi ce of the Chinese Academy of Governance, suggested China adopt several measures this year to curb inflation. First,a prudent monetary policy should continue and money supply should never be loosened.With this keynote, micro adjustments can be made at a proper time to stabilize economic growth. Second, agricultural production should be stressed to ensure stable growth of output of grain and other farm and sideline products. Third, preparations should be made to cope with serious natural disasters in order to prevent short supplies caused by disasters.Fourth, when issuing reform measures, the government should prevent steep rise of resource prices and labor costs that may push up in fl ation.

Central bank governor Zhou Xiaochuan told the media that price pressure will ease this year, but the regulation against rapid price hike should never be relaxed and in fl ation expectations should be reasonably managed.