Solar Industry’s Critical Juncture

2012-04-29ByLanXinzhen

By Lan Xinzhen

“Yingli wont be daunted by the anti-dumping and countervailing duty investigations, or give up the American market. In the future, Yingli will focus on intensifying technological innovation and diversifying its business to improve profitability,” said Wang Zhixin, News Director for Yingli Green Energy, in response to the decision made by the United States International Trade Commission (ITC) to impose tariffs on photovoltaic (PV) products imported from China.

Since Yingli Group entered the PV power generation market in 1998, it has expanded its presence across 12 countries, including the United States, Germany, Italy and Spain. With total assets of 36.6 billion yuan ($5.55 billion) and 26,000 staff members, Yingli ranks among the top five globally, producing PV products of nearly 3 gigawatts (GW).

Since the United States and the EU are the major destinations for most of Yinglis output, and the prices there for PV products cannot be reduced any further, the U.S. market is now off limits to Yingli after the ITC announced an anti-dumping duty of 249.96 percent and an anti-subsidy duty of 15.97 percent on Chinese-made PV products on November 7. Controversial debate has ignited at Yingli over whether to abandon the U.S. market.

Yingli is not the only victim, as 500 Chinese PV manufacturers face the same plight. On November 20, Guangdong Macro Co. Ltd. declared a retreat from the new energy industry, fearing that the American market may no longer be accessible.

Following on the heels of the United States, the EU has just launched a similar but more extensive investigation into Chinas PV products, which could be catastrophic for the Chinese PV industry. As 80 percent of Chinas PV products go to EU countries, once the EU imposes heavy tariffs like the United States, Chinese PV makers will be driven into a corner.

The major tasks ahead for the Yingli Group are to improve internal management, cut costs and intensify independent innovation, exploring downstream business like PV power stations to improve profitability, said Wang.

“If our products remain competitive with anti-dumping and countervailing duties, we will be free from concerns over these protectionist behaviors.”

Heavy losses

As early as in the 1990s, the Chinese Government placed emphasis on energy security and environmental protection, en-couraging the exploration of clean energy. As technologies in the PV industry edged toward maturity, private capital began to invest in the industry. So far, roughly 95 percent of Chinese PV producers are privately funded.

In 1991, the German Government launched a project to install 1,000 MW roofmounted solar panels, opening a new path for invigorating the PV market through government subsidies. A number of other EU countries followed suit.

As investments in the PV industry not only facilitate the development of clean energy, but also contribute to GDP growth and employment, many local governments in China also put forward similar programs. Subsidized by the government in the past decade, the PV industry has experienced a period of explosive expansion. Thats the context for the success story of Yingli.

Suntech, the global PV sales champion in 2011, grew even faster than Yingli. In 2000, with a laptop and a business plan, Shi Zhengrong, an overseas returnee, came to the new district of Wuxi in Jiangsu Province and set up the company. The local government offered all-round support, helping Suntech go through various formalities and raise $8 million as start-up capital. Shi once said, “Without the Wuxi local government, Suntech couldnt have been so successful.”

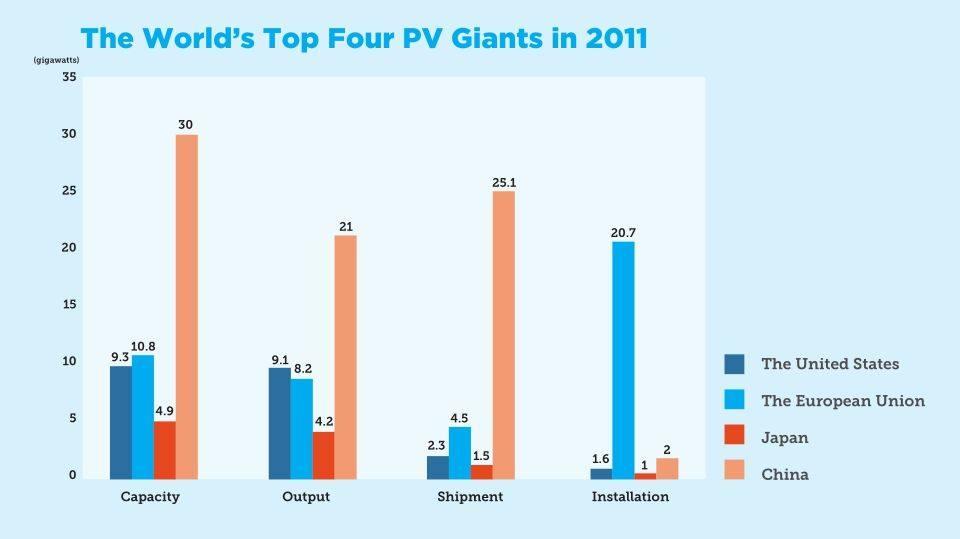

Support from local governments impelled Chinas PV industry to develop by leaps and bounds. By 2007, the production capacity of Chinas PV industry had taken the lead in the world. By 2011, China had 80 percent of the global PV production capacity, and in the list of the top-10 PV manufacturers Chinese makers hold the top five.

Nevertheless, under government subsidies, the development of the PV industry has not necessarily led to desired results. The production of silicon chips, solar cells and batteries is labor-intensive, which means anyone who has enough funds to purchase manufacturing equipment can establish production lines. For this reason, businessmen engaged in the trade of real estate, garment and feedstuff rushed to invest in the PV industry. In the past five years, the number of PV makers has quintupled to over 500.

Such reckless development has resulted in excess capacity and disorderly competition. Last year, the total production capacity of Chinese PV producers was 30 GW, which already exceeded the global market demand of 29 GW. To seize market share, manufacturers have fallen into virulent price competitions.

In 2011, Suntechs output reached 2.1 GW, ranking first in the world for two straight years, up 34 percent year on year, with its business revenue merely increasing 5 percent.

Zhang Shuguang, a research fellow with the Institute of Economics at the Chinese Academy of Social Sciences (CASS), noted that local governments, spurred by the need for economic growth, tended to provide a propitious environment for PV enterprises to expand. Blind production expansion and rising asset-liability ratios have put the PV industry on the verge of collapse.

Now, the anti-dumping and countervailing duty investigations initiated by the United States and the EU have inflicted a crushing blow to Chinas PV industry. Wang Bohua, Secretary-General of China Photovoltaic Industry Alliance, argued that despite being the largest PV producer, overdependence on foreign markets has made Chinas PV industry vulnerable to external factors. “This fatal weakness has haunted Chinas PV industry for years. Thats why the accusations put Chinese makers on tenterhooks.”

Self-rescue

Yingli is mulling plans to set up factories overseas and build its own PV power stations.“Diverting some investment abroad will improve flexibility,” said Wang.

Executives at Yingli agree that only companies that are persistent can survive. The crisis will come to an end in mid-2014, at which point the PV industry will achieve healthy and sustainable development.

Suntech is allegedly pondering a nationalization plan to gain state funds.

Some producers are shifting from overdependence on overseas demand to exploring domestic markets. On September 12, the National Energy Administration published the 12th Five-Year Plan (2011-15) for Solar Power Development, aiming to raise the total installed solar power capacity to 21 GW by 2015. Given the fact that the domestic installed capacity had only stood at 3.6 GW by the end of 2011, potential in the Chinese market remains huge.

Others chose to undergo transformations by shifting from the PV manufacturing industry to downstream businesses like PV power stations. On November 20, Hareon Solar announced it would invest 490 million yuan ($79 million) in building two PV power stations, following similar decisions made by Zhongli Sci-Tech Group and GCL-Poly Energy in late August.

The State Grid Corp. declared it would provide a free connection service for qualified solar power producers from November 1, allowing small and medium-sized producers (less than 6 megawatts of installed capacity) to apply to the local power grid company for connection to the national grid. The on-grid power operation can be completed within 45 working days, and state grid power generators will purchase surplus power generated by PV power generation programs at 1 yuan ($0.16) per kwh. The new policy is undoubtedly a boost to Chinas ailing solar industry.

The Ministry of Finance also plans to unveil subsidy policies for PV power generation. After being subsidized with 0.4-0.6 yuan($0.06-0.1) per kwh, solar power will be sold at the same price as traditionally produced electricity.

At the 2012 New Energy International Summit & Exposition in November, experts and entrepreneurs discussed the current problems and challenges faced by the PV industry, such as the consolidation of solar enterprises, the integration of solar power generation and storage, connecting solar power with a smart grid and micro-grid applications.

Suggestions

Zhang from the CASS Institute of Economics believes mergers and acquisitions will shield the PV industry from collapsing.

Qu Xiaohua, CEO of CSI Solar Power, contends that PV enterprises should focus on making breakthroughs in developing technology and cutting costs rather than getting trapped in the low-price competition.

“The development of the PV industry should be decided by market demand. Local governments should not blindly support the expansion of the PV industry,” said Zhou Junsheng, an independent financial commentator.

“The government should learn from the side effects of pushing economic growth with administrative power. Government bailouts can only help enterprises cope with a current emergency. The best approach is to take market factors into account,” Zhou said.