Price Hiking Concerns

2011-12-24ByYUSHUJUN

By YU SHUJUN

Price Hiking Concerns

By YU SHUJUN

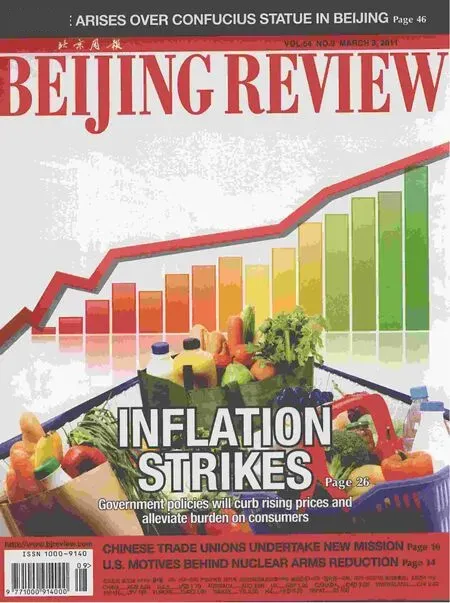

For the average Chinese consumer, in fl ation has become a real concern rather than just an expectation.

In January, consumer prices continued their fast-growing trend,rising 4.9 percent over the same month last year. The growth indicates a slight slowdown compared with the 28-month high of 5.1 percent last November and is also less than the widely expected 5 percent or more, but it still exceeded the government’s target of 4 percent set for the whole year, suggesting in fl ationary pressures are mounting.

Food prices, after rising 7.2 percent last year, remain the main driver, which leapt 10.3 percent in January. Soaring housing prices also pushed up residential costs including rents, construction materials, and power, water and gas prices, which rose 4.5 percent last year and 6.8 percent in January. Medical treatment and health care are another important expense for people, prices of which increased 3.2 percent both for the whole of last year and in January alone.

In fact, ordinary Chinese, especially the low-income group, are very sensitive about the price mounting. The consumer price index(CPI) for low-income Beijing residents grew 4 percent last year,1.6 percentage points higher than the city’s average level for 2010.The Beijing Municipal Statistics Bureau calculated the CPI for lowincome group separately, since they think the index for low-income people can better re fl ect in fl ation’s impact on ordinary residents and may provide a better picture of the economic and social conditions.

Both central and local governments have put combating in fl ation atop their agendas and have issued a series of policies to curb prices and raise individual’s income since late 2010.

The State Council announced 16 measures in November 2010 to stabilize consumer prices, including boosting agricultural product supply and enhancing price supervision.

The central bank has also taken step to drain excess liquidity from the market. From November 2010 to February 2011, it ordered fi ve hikes of the reserve requirement ratio. Since in fl ation has made the deposit interest rate fall into negative territory, the central bank also raised interest rates three times since last October, when it raised the rate for the fi rst time in more than three years.

To alleviate consumers’ burden brought by in fl ation, more than 10 provinces, municipalities and autonomous regions have raised the minimum wages by more than 10 percent since the middle of last year.

So far, the effect of these measures hasn’t fully shown up, as indicated in the alarming January fi gures. It’s also widely believed that prices may continue to rise in the near term and in fl ationary pressures will remain strong in the fi rst half of this year. But many economists predict more upcoming measures with the hope that in fl ation will be eased in the second half of 2011.