INFLATION ON THE PEOPLE ’S MINDS

2011-11-17ByLANXINZHEN

By LAN XINZHEN

INFLATION ON THE PEOPLE ’S MINDS

By LAN XINZHEN

CFP

Stabilizing prices and preventing rampant inflation are the Chinese Government’s biggest challenges this year

An overwhelming sense of helplessness is sweeping China, from common people to well-off entrepreneurs and everyone in between, as the country’s consumer price index (CPI) soars.

Data of the National Bureau of Statistics(NBS) show the country’s consumer price index (CPI), a broad measure of inflation,grew 5.3 percent in April, after recording a 32-month-high growth of 5.4 percent in March.

A recently released blue book on the Chinese economy issued by the Chinese Academy of Social Sciences (CASS) estimates that price hikes of international bulk commodities will cause China’s CPI to increase by 4.3 percent over the previous year,surpassing the government-set target of 4 percent.

Lives affected

Wang Tao and his wife both work at the International Trade Center in Beijing, where many foreign companies are located. They are both managers of their respective companies and could previously afford to drive two separate cars to work.

Having to pay 2,000 yuan ($307) in parking costs a month, the equivalent of monthly salaries for some people, and even more for gas, have put an end to that luxury.The couple now drives one car to work.

Wang said many people in his office have started bringing their lunch to work instead of dining out. Many people have started car pooling with colleagues to cut down on driving expenses.

Besides changing consuming habits,some people are changing their attitudes toward their savings in the bank, as the higher CPI means the money people have on hand or in the bank will be less valuable.

Zhang Hongwei, an employee at Beijing Public Transport Holdings Ltd., recently withdrew all his deposits from the bank and wanted to convert them into real assets.

Earlier this year, Zhang bought gold bars. Now he is planning to buy two curio chairs made of rosewood, whose prices have increased rapidly in recent years.

“Five years ago my wife bought a gold bracelet for 2,000 yuan ($307),” Zhang said.“Now that same bracelet is worth more than 6,000 yuan ($920).”

Sojump.com, a professional online survey and voting platform, recently conducted a survey of more than 100 company employees, corporate managers, service sector employees, students and self-employed persons. The result showed 58 percent changed their consumer habits as inflation becomes an increasing burden; 14 percent reduced the amount of money they put in the bank each month; 8 percent chose to stock up on commodities.

Corporate reactions

To combat inflation, the People’s Bank of China, the central bank, has adopted a tight monetary policy. Already the bank has raised the interest rate and the reserve requirement ratio several times this year.Guo Tianyong, a professor at the Central University of Finance and Economics, said the central bank’s current policy will put pressure on companies, especially in terms of acquiring loans, and impose financial pressures that will only raise company costs.

As if financial difficulties weren’t enough, increasing production costs have also hindered many companies’ ambitions to expand or reap greater pro fi ts. In the fi rst quarter this year, workers’ salaries increased 10-20 percent, and the purchasing prices of raw materials by industrial producers increased 10.2 percent. According to Ministry of Industry and Information Technology fi gures, prices of some important raw materials have been increasing, supplies of raw materials are scarce and the costs of land, labor and capital are increasing, imposing previously unforeseen burdens on business operations.

Price hikes of raw materials has brought marked changes to corporate behaviors—in some instances companies have been hesitant to accept new orders. In an extreme case,some Chinese exporters have rejected orders from mega store Walmart and other foreign retail chains because their selling prices are too low, as are the Chinese companies’ profits in these sales.

Facing long-term in fl ation expectations,some companies are simply raising product prices. According to NBS fi gures, in the fi rst quarter the producer price index (PPI) rose 7.1 percent year on year and in April the index rose 6.8 percent.

However, both economists and consumers are questioning these price increases.CASS Vice President Chen Jiagui said enterprises should shoulder their responsibilities, continue to promote stable and fast consumption growth and stimulate domestic demand. For now, companies should appropriately reduce their expectations of pro fi ts.Large state-owned enterprises, in particular,should stabilize their prices.

Labor-intensive companies in China’s coastal areas have moved their factories to underdeveloped areas in central and west China to reduce production costs.According to the figures released by the Fujian Provincial Development and Reform Commission, the province’s textile companies have been busy establishing factories in Henan Province and Chongqing Municipality. By making the move inland but keeping its headquarters in Fujian, the company has been able to save 10-20 percent on production costs.

Government actions

With controlling price hikes at the top of its list, the Chinese Government has adopted various measures to act quickly and efficiently against in fl ation.

On May 18, the central bank raised the reserve requirement ratio, the fifth this year. The reserve requirement ratio for large banks now sits at 21 percent, a record high.On April 6, the central bank also raised the interest rate for the second time this year,intensifying market expectations for tighter

monetary supplies. Industrial insiders expect

these rates to be increased further if in flation is not alleviated soon.

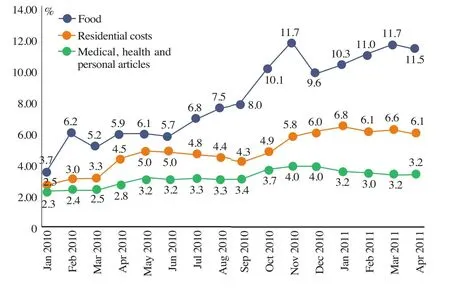

CPI, PPI Growth Rates (y.o.y.)

(Source:National Bureau of Statistics)

The National Development and Reform Commission (NDRC) has also started asking companies and industrial associations to stabilize product prices. At the end of March market rumors abounded that four major cleaning and household producers—P&G, Unilever, Liby Group and Nice Group—were planning to raise prices of their products as of April 1. The NDRC was quick to act, summoning heads of the companies and requesting them to refrain from such increases. On March 31,NDRC’s Department of Price criticized both the China National Association for Liquor and Spirits Circulation and China Alcoholic Drinks Industry Association for increasing liquor prices and requested the liquor industry to stabilize prices for the fi rst half of this year.

The Ministry of Commerce (MOFCOM)has strengthened efforts to increase effective market supplies. At a press conference on April 19, MOFCOM spokesman Yao Jian said that while in fl ation expectations do exist, the major task of the ministry is to secure market supplies.

To ensure supplies, MOFCOM has adopted three measures. It has strengthened market supervision by monitoring key commodities in 36 large and medium-sized cities and real-time monitoring on 139 large-scale wholesale markets.

“Through market monitoring MOFCOM is providing the public with valuable information and is also guiding the logistics sector to replenish supplies,” Yao said.

MOFCOM has also strengthened effective market regulations, timely ensuring market supplies in accordance with market monitoring information. Yao said the ministry has formulated emergency plans to ensure supplies for the whole logistics sector and established effective commodity reserves on pork and vegetables. Local governments have also increased the varieties of reserves.

Additionally, MOFCOM has effective channels for supplying reserve commodities. The ministry has established a database of more than 1,600 enterprises to ensure effective market supplies. It has also set up emergency supplying points all over the country.

Key Prices Gro wth Rates (y.o.y.)