Stuck in the Middle

2011-10-14ByYINPUMIN

By YIN PUMIN

Stuck in the Middle

By YIN PUMIN

Better-paid urban residents aren’t enjoying the life they have expected

CFP

Sun Lijun works as a software engineer at a Beijing-based IT company and earns around 8,000 yuan ($1,254)a month. His relatively high income means his friends and colleagues, as well as China’s statistical agencies, regard him as middle class. Sun, however, does not think he is worthy of being included in a category that is traditionally associated with security and comfort.

At the age of 28, Sun is single and rents a small apartment outside the East Fourth Ring Road in Chaoyang District.

“Although many of my friends think I have a good job and therefore don’t have to worry too much about my daily life, I still feel insecure in such a large, competitive and expensive city,” Sun said.

He isn’t alone. Many more Chinese like Sun, regardless of seemingly respectable salaries, refuse to consider themselves part of the middle class. Government figures,however, show an exponential increase in China’s middle-class population.

According to a report released by the Chinese Academy of Social Sciences (CASS)on August 3, China had 230 million middleclass residents in 2009, making up about 37 percent of the country’s city dwellers.In Beijing, the proportion is estimated at 46 percent.

The middle class is defined by the amount of money a person spends on food as a percentage of total spending in the report.

A survey conducted by the National Bureau of Statistics (NBS) in 2005 showed the urban middle class should have an annual income between 60,000 yuan ($9,405) and 500,000 yuan ($78,376).

“I have been technically placed in the middle class by the CASS,” Sun said. He said those with an annual income of 60,000 yuan may be middle class in western provinces such as Qinghai and Gansu, but in Beijing or Shanghai, 60,000 yuan remains a basic wage.

“But, I still don’t have the means to buy a home or get married,” he said.

Paying for his life

Inflation, marked by escalating food prices, has caught up with many young people, who are technically classi fi ed as belonging to the middle class.

According to the NBS, China’s consumer price index (CPI), a main gauge of in fl ation, hit 6.5 percent in July, up from 3.3 percent a year earlier and from a three-year high of 6.4 percent in June. This marked the highest level for the index since it reached 7.1 percent in June 2008. Food prices soared 14.8 percent compared to last year.

Pork prices in July, for example, were 56.7 percent higher than they were 12 months ago. Food prices make up about a third of China’s CPI basket.

Facing rising consumer prices, many so-called middle-class residents have started taking measures to cut back on their spending.

“I spend as little as possible because the consumer prices keep rising, but my salary does not,” said Zhang Cheng, a 28-year-old office worker who works in a foreign-funded company in Beijing and earns about 6,000 yuan ($941) a month. “I spend less on clothing and take buses or the subway more than taxis. I only eat cheaper fruits, such as watermelon and apples now,whereas I didn’t care about the price of fruit before.”

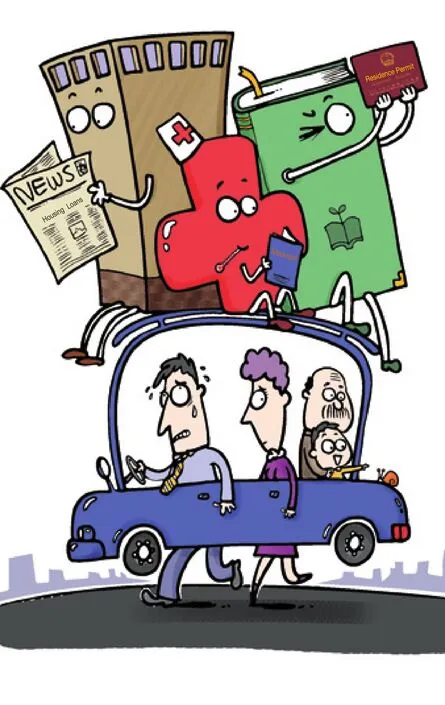

For many young people who are categorized in the middle class, rising food prices are just a part of their expenditure-related worries. They also fi nd themselves burdened by the surging cost of accommodations,transportation, cosmetics and consumer goods, according to a recent report by Xinhua News Agency.

For example, taxi fares in Shanghai and Shenzhen, a boomtown in southern Guangdong Province, increased sharply in May, and the rent in Guangzhou had jumped 13.3 percent over the past year,the report said.

Price increases are also affecting essential services such as health care and education. Of fi cial data showed the price of health care rose 4.2 percent in Guangdong in May, while the average personal expenditure on education and training reached 653 yuan($102), an increase of 11.6 percent from the previous year.

These soaring prices not only inhibit middle-class residents’ ability to consume but also reduce people’s general sense of well-being.

Unfortunately, inflation will remain high in the third quarter as food prices and labor costs continue to surge, warned Cao Yuanzheng, chief economist of BOC International (China) Ltd. He also predicted the whole year’s CPI might amount to 5 percent, which is considerably higher than the 4-percent target set by the government at the beginning of the year.

Heart-broken homes

Rising property prices, in particular, have had a crippling effect on China’s middleclass population. For most young people in major cities, owning a home is increasingly dif fi cult.

Hou Jie, a 34-year-old senior consultant with APTech, a well-known computer education provider in China, said his nightmare began with his purchase of an apartment.

Hou earns 12,000 yuan ($1,881) a month. Before purchasing his apartment,Hou was able to afford a car, regular meals,luxury goods and lots of travel around China with his girlfriend.

In preparation for marriage, Hou started looking to buy an apartment in 2007. As he wanted enough space to live with his parents, spouse and future offspring, he was keen to buy a medium-sized home. But Hou’s savings of 300,000 yuan ($47,026)were not enough for the down payment on a 100-square-meter apartment in downtown Beijing at the time.

According to the NBS, housing prices in 70 cities rose 7.6 percent from 2006 to 2007.Inside Beijing’s Fourth Ring Road, the price for apartments reached 20,000 yuan ($3,135)per square meter. In just one month in 2007,housing prices soared 3,000 yuan ($470) per square meter.

“Facing the surging prices, I thought no matter how much I earned, I wouldn’t be able to afford a home,” Hou said, adding he decided to wait.

At the end of 2008, Hou bought a 120-square-meter apartment outside Beijing’s North Fifth Ring Road for 2.2 million yuan($345,000). He had to borrow 200,000 yuan($31,350) from his father to make the down payment.

But his problem had just begun. He now pays 80 percent of his monthly salary to make his mortgage payments. He will need to spend more than 9,300 yuan ($1,458) a month in the next 25 years to pay off the debt on his home.

To cut daily costs, Hou said he and his wife had given up on elements of their previously comfortable lifestyle. He sold his car. The couple’s discretionary spending is now limited to 1,000 yuan ($157)a month. “Now I have to try my best to avoid going out for social activities with friends after work or during the weekend,”Hou said.

However, the surging in fl ation in the past two years has increased his burden. Hou said he and his wife had also stopped shopping for food at the neighborhood supermarket and started searching for cheaper farmers’markets on the outskirts of the city.

The Hou family’s austerity program is so severe that they no longer consume pork and expensive vegetables. “We have forgotten the taste of pork,” he joked.

An uncertain future

The Beijing-basedChina Newsweekmagazine conducted a survey among 1,658 residents in 10 cities in 2009. It found 61.6 percent of homeowners paid 30 percent or more of their income to make mortgage payments and 20.5 percent spent more than half of their income for this purpose. Among the respondents, 43.8 percent were extremely worried about loan defaults.

According to accepted international standards, a reasonable mortgage should consume about 20 to 30 percent of a family’s income. The price of a house should be three to six times a family’s annual income yet housing prices in China cost more than 10 times the average family’s income, according to the2010 China Statistical Yearbook. In Beijing, prices are 15 times more than average wages.

And these prices are continuing to increase. Statistics show housing prices in China’s cities rose more than 30 percent in 2010. In Beijing, the price of many apartments rose by more than 50 percent.

Li Kaifa, Executive Director of China Enterprise Reform and Development Society,said buying an apartment could destroy a middle-class family’s lifestyle.

The middle class in China is worried about mounting home prices and the high cost of living, hectic work schedules and uncertainties about the future, said thePeople’s Daily, a leading newspaper in China.

“They will be immediately kicked out of the middle class category if they have any problems with their employment, health care or children’s education,” it said.

The overall mindset of China’s middle class is one of massive anxiety and fear. A stratum that is generally believed to function as a social stabilizer is fi nding itself in an unstable position.

Li Shi, a scholar at Beijing Normal University, said China’s growing economy alone was not sufficient to defuse anxieties of the middle class, as surging in fl ation and unfair income distribution had made it even harder for people to maintain their lifestyles.

Facing the burdens of income taxation,rising housing prices and expensive health care and education, some Chinese middleclass citizens are choosing to migrate to developed countries.

Zhou Yuan works at aFortune500 company based in Beijing and earns 500,000($78,100) yuan a year. She is applying to migrate to Singapore.

According to Zhou, long-term security and high-quality education for her children are the two main motivators driving her decision.

“In Singapore, any children I have will enjoy at least 10 years of free education in public schools,” she said.

With increasing rates of emigration,China has lost many of its most able middleclass citizens. “China cannot provide adequate opportunities for them to realize their values,” said Zhou Xiaohong, Dean of the School of Social Sciences of Nanjing University.

For decades, the foremost goal of China’s economic development was to increase the nation’s wealth as quickly as possible. But most of the wealth went to emerging elites, eroding the soil for a middle class to grow.

“Streamlining the flow of people between different strata is the ultimate solution to this problem,” Zhou said.

Some other scholars said their anxieties are related to “money worship,” a growing over-reliance in China on money, which is tied to the GDP-oriented development in society.

As a consequence, members of the Chinese middle class have not yet obtained the power to serve as a stabilizing force in society and act as buffer between the rich and the poor.

“To build a happy middle class and a harmonious society, a fair income distribution system and an efficient social security system have to be established,” Li said.