Still Strong

2011-10-14ByHUYUE

By HU YUE

Still Strong

By HU YUE

China’s economic prospect remains slick, though monetary tightening has slowed growth

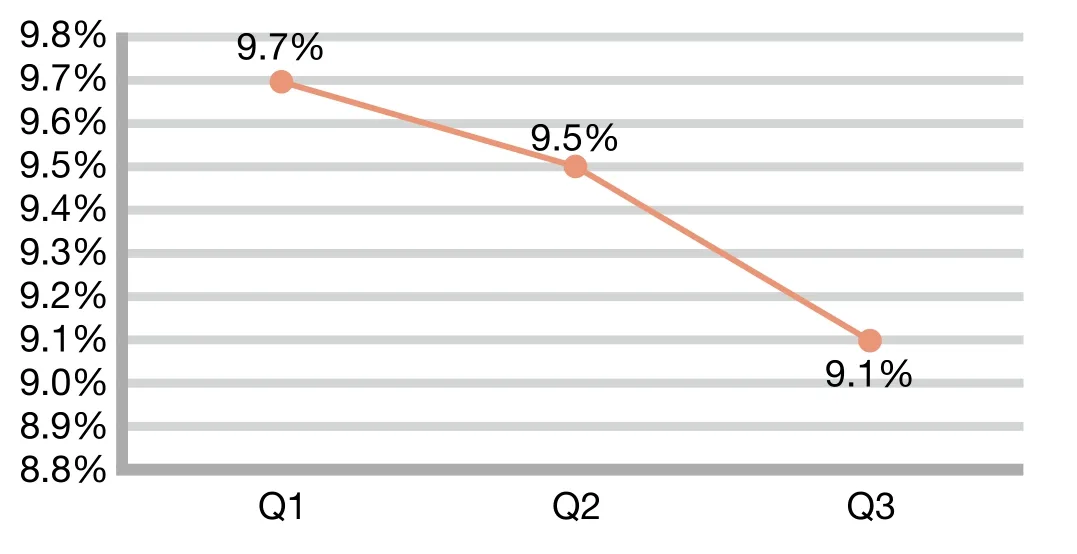

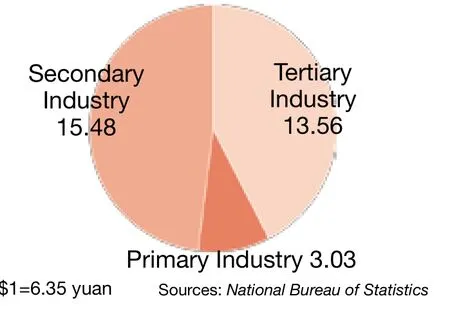

The Chinese economy is steering a stable course, though uncertainties are gathering over the growth outlook. China’s GDP in the first three quarters of 2011 grew 9.4 percent year on year to 32 trillion yuan ($5.05 trillion). The GDP growth for the third quarter slowed to 9.1 percent from 9.7 percent in the frst quarter and 9.5 percent in the second quarter, said the National Bureau of Statistics (NBS).

Despite complications on the international stage, such as the European and U.S. debt woes, the Chinese economy has been relatively healthy and is likely to continue growing steadily, said NBS spokesman Sheng Laiyun.

Moreover, the quality of the growth is improving, as reflected by rising industrial profits and residents’ incomes, as well as a better welfare system, he said.

A second dip in the economy, as was feared earlier this year, is less likely given buoyant investment across the nation and vibrant consumer spending.

The ongoing unwinding of monetary stimulus and the scaling back of incentives for property and auto markets are behind the economic slowdown. More disturbing, though, is weakening exports as demand from the West has dropped.

Lu Ting, an economist with the Bank of America-Merrill Lynch, attributed the“inevitable slowdown” to two major factors: diminishing gain from institutional reforms and loss of demographic dividends.

“But two drivers also help buck the slowing trend: innovation as a result of rising research and development spending within the country, and industrial relocation to poorer inland areas,” Lu said.

The Chinese Academy of Social Sciences (CASS) expected China’s economy to grow 9.4 percent in 2011, down from 10.3 percent last year. It attributed the slowdown partly to the country’s intense economic restructuring that allows the economy to depend less on government stimulus.

CASS also predicted that China’s GDP would grow 9.2 percent in 2012, conditional on both domestic and international economic environments stabilizing frst.

“Under the current global situation, if China can maintain its robust economic growth, it will be the biggest contribution China can make to the world economy,” said Justin Yifu Lin, chief economist at the World Bank.

The world’s second largest economy is able to continue bursting with vitality due to a high household savings rate and great potential for industrial upgrading, new infrastructure projects and rural development, he said.

Lingering uncertainties

As policymakers twist harder on credit screws to quell stubborn infation, the tightening measures have taken a painful toll on growth. Worries abounded that the government might overshoot its tightening goal and sap growth momentum too much, especially if conditions in Europe and the United States continue to deteriorate.

Signs are emerging that the effects of credit tightening is cooling industrial activities. The output value of industrial enterprises with annual sales of more than 20 million yuan ($3 million)—grew 14.2 percent year on year in the January-September period, 0.1 percentage point lower than the frst six months.

But bearing the brunt of the heavy blow were smaller frms due to their vulnerability to capital shortages and labor cost infation. Newspapers have been constantly filled with reports of massive factory closures in Wenzhou, east coastal Zhejiang Province, or bankrupt entrepreneurs disappearing to avoid enormous debts.

Many cash-strained small firms in Wenzhou are turning to underground banks.

“As profit margins of those companies are mostly below 10 percent, borrowing from the black market at interest rates of more than 100 percent means fnancial suicide,” said Guo Tianyong, Director of the Research Center of China’s Banking Industry under the Central University of Finance and Economics.

“The situation seems even worse than in 2008 when the fnancial crisis rippled through China,” he added. “If no actions are taken, the ailment may spread to the entire nation.”

The exporters will continue to feel the pinch of tepid new orders, but that is less likely to become a signifcant drag on growth. Zuo Xiaolei, chief economist with the China Galaxy Securities Co. Ltd., said foreign trade would have a neutral impact on the broader economy.

“The economy has relied less on net exports as a driving force for growth,” said Qu.“In addition, imports may also moderate, allowing the country to maintain trade surplus.”

Stable track

Although it is facing some chilly headwinds, the Chinese economy is surely nowhere near a hard landing.

The purchasing managers index, a barometer of manufacturing activities, has rebounded for two straight months after four consecutive months of decline.

CPI Growth, 2011 (y. o. y.)

GDP Growth, 2011

“That’s a nice break in a grossly bearish environment,” Tao Dong, a Hong Kongbased economist at Credit Suisse. “I don’t think that the Chinese economy is out of the woods, but any good news is great news.”

Lian Ping, chief economist with Communications Bank of China, said the slowdown was inevitable as the country seeks to rebalance the economy toward more sustainable growth.

“Concerns over a sharper slump are overblown, and the slowdown remains within a reasonable range,” he said.

In a recent report, the HSBC pointed to four reasons for limited downside risks.

First, the tightening cycle is coming to a close since the CPI peaked in July. Stable monetary policy is expected for the coming month. Plus, the current credit growth of 15-16 percent is still sufficient to support around 9-percent GDP growth.

Second, external demand is set to cool, but not collapse.

Third, investment growth is bound to slow as the tightening effect continues to flter through. But the negative impact is offset by the acceleration of public housing construction and robust consumption, which supports consumer-related investment.

Fourth, domestic consumption has been vibrant thanks to a tightened labor market and rapid economic growth. The recent personal income tax adjustment will also boost household income.

Huang Yiping, chief economist for Emerging Asia at Barclays Capital, said China’s solid balance sheet, backed by $3.2 trillion in foreign exchange reserves, current account surplus and a strong currency, will give the government enough room to adjust policies and prevent a deeper downturn.

Wang Tao, chief China economist with the UBS, agreed. “The economy glitters with a promising long-term prospect thanks to prolonged urbanization and improving industrial productivity,” she said.

“Investment will remain a powerful driver as enterprises increasingly upgrade their businesses and move up the value chain,”added Wang.

GDP Composition, Jan.-Sep., 2011 (trillion yuan)

IHENG

As fears over infation take hold, economists believe policymakers are less likely to loosen their monetary stance, but they will tread more cautiously so they don’t drain any more life out of the economy.

Li Yang, CASS Vice President, said it is still too early to ease monetary policies given the magnitude of infation.

But the government is likely to replenish liquidity on a selective basis, perhaps by instructing banks to extend more loans to some priority sectors like agriculture and smaller businesses, Li Yang said.

Li Daokui, a member of the Monetary Policy Committee of the People’s Bank of China and Director of the Center for China in the World Economy at Tsinghua University, said the country would take a wait-and-see mode regarding monetary stance.

China has largely controlled excess liquidity, but the problem of negative interest rates in real terms is yet to be solved, he added.

Inflation conundrum

China’s inflation ailment has showed signs of moderating, but the country still faces an uphill battle to contain consumer price surges.

The consumer price index (CPI), a barometer of inflation, grew 6.1 percent in September year on year and was 0.1 percentage point down from August. This was the second straight month of decline.

The biggest driver of the CPI was still food prices, up 13.4 percent in September over the same month last year. Pork prices, in particular, skyrocketed 43.5 percent. Residential costs climbed 5.1 percent, down 0.4 percentage points from July.

The producer price index (PPI), an effective gauge of infation at the wholesale level, rose 6.5 percent in September, compared with 7.3 percent in the previous month.

It seems that the economy is still reeling from side effects of the massive monetary expansion two years ago. Moreover, the United States has the possibility open for yet another round of quantitative easing, threatening to complicate China’s infation headache.

Chinese policymakers have been pushing all the buttons to tame infation. The People’s Bank of China, the central bank, has ordered interest rate hikes three times, and the reserve requirement ratio has increased six times this year.

The CPI will continue heading lower for the rest of the year due to continued tightening policies, the bumper harvest of summer grain, as well as overcapacity in some industrial sectors, said Yao Jingyuan, chief economist with the NBS.

A more permanent solution is to underpin the foundation of agriculture and strengthen supervision over markets of agricultural products, he added.

“Food inflation in China is becoming more structural than cyclical, especially given the rising costs of farming materials and labor,” said Shen Minggao, chief economist for Greater China, Citigroup.

Although the CPI is expected to fall more significantly in the fourth quarter, average infation this year will almost certainly exceed 5 percent, overshooting the government comfort range of 4-5 percent, he said.

Liu Yuanchun, Associate Dean of the School of Economics at the Renmin University of China, expected the CPI to average at 5.2 percent this year.

He suggested the government avoid overusing administrative measures, such as bank loan quotas, and allow the markets to play a bigger role in combating infation.