CREATING OPPORTUNITIES IN AFRICA

2011-10-14ByDINGYING

By DING YING

CREATING OPPORTUNITIES IN AFRICA

By DING YING

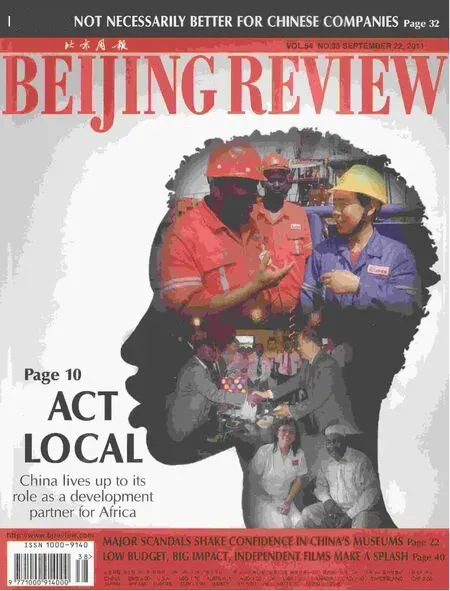

Chinese enterprises generate jobs for Africans while exploring the vast potential of the continent

Driving from the Johannesburg International Airport in South Africa to the city’s downtown area, you can find almost every world-famous company.In Dar es Salaam, Tanzania,huge billboards of foreign companies dot the landscape of the coastal city.

With a population of 900 million and untouched natural resources, Africa has enormous economic potential. Like many other countries, China has worked to promote business connections in Africa. Chinese companies have provided a much-needed economic boost and employment opportunities for many African countries.

Shared interests underground

In May, Zhang Qiyin, General Manager of the Johannesburg-based South Africa Jin Chuan Resources Ltd., a branch of the Jinchuan Group Ltd. (JNMC), added a new title to his business card: executive director of the Wesizwe Platinum Ltd.

JNMC is a large nonferrous metallurgical and chemical engineering enterprise based in China’s Gansu Province. It produces nickel,copper, cobalt, rare and precious metals,chemical products and processed nonferrous metal products. Its output of nickel and platinum group metals accounts for more than 90 percent of the total in China.

JNMC owns nickel reserves of 5.5 million tons, the third biggest in the world. It also has the second biggest copper reserves in China with 3.43 million tons. In recent years, JNMC has conducted several successful purchases in Australia and Africa,including the one with South African mining company Wesizwe.

In May 2010, JNMC, the China-Africa Development Fund and Wesizwe signed an agreement, in which JNMC would buy 45 percent of Wesizwe’s total shares for $227 million. The China Development Bank also promised to invest $650 million in Wesizwe for mineral product exploration. One year later, the purchase deal was completed and JNMC became the biggest shareholder of Wesizwe.

During the process of purchasing Wesizwe, JNMC discovered Africa’s giant development potential, and began to target Africa as its key development area. Since the beginning of 2011, JNMC and Brazilian mineral giant Vale S.A. have been wrestling over South Africa’s copper-cobalt producer Metorex Ltd. On August 2, Metorex formally recommended JNMC’s $1.36-billion offer at its shareholders’ conference. Zhang said once the Metorex’s shareholders approved the purchase agreement, government agencies could fi nish approval procedures within the following three months.

Zhang said Metorex has had long-term cooperation with JNMC. As early as in 2007,JNMC signed long-term exclusive sales contracts for Metorex’s cobalt hydroxide and cobalt carbonate products. “We have cultivated mutual trust through our cooperation,”Zhang said.

He believed another reason Metorex chose JNMC was its confidence in the Chinese market. China has unchallengeable advantages in fi nancing and technology, and JNMC possesses leading technology in mineral exploration. “The most important thing is we can realize common development in this way,” he said.

Once the purchase of Metorex succeeds,JNMC’s total investment in Africa will reach$2.237 billion, making Africa its top overseas investment destination.

“Actually, we are a little late for entering this market. Many American and European mineral giants have occupied the best resources,” he said.

JNMC and Wesizwe focus more on environmental protection and highly processed mineral products, he added. The Chinese Government has set strict regulations on overseas investment, banning all projects that might cause environmental problems.

Before the Wesizwe purchase, Zhang had only two Chinese staff members in the JNMC’s South African branch. Now most of his employees are still locals. JNMC has kept all former Wesizwe employees except four leading positions for JNMC officials.And Zhang plans to recruit more local em-ployees for the company.

FIELD OF DREAMS:Kids play football in front of a China-sponsored stadium in Dakar,Senegal, on August 21

He said once Wesizwe starts mining,it will create at least 3,200 jobs for local residents. Unemployment remains a pressing challenge for South Africa. Every South African president in recent decades has tried to boost employment. In 2010, the country’s unemployment rate for black youths was as high as 39 percent. “Our investment bene fi ts local people as we provide more job opportunities for them,” he said.

CHINESE FESTIVAL IN AFRICA: A Chinese worker with his Kenyan colleagues on a geothermal site in Nairobi on September 12, the date of China’s traditional Mid-Autumn Festival

Wesizwe has signed an employment commitment and social and labor plan with the South African Government to create more jobs. “We are trying our best to shoulder social responsibility here. And we hope to set a good example for all Chinese enterprises in Africa,” Zhang said.

“Coopetition” in banking

Only with good financial support can Chinese enterprises like JNMC better develop their business in Africa. In response,Chinese bankers are rapidly expanding services in Africa.

The win-win strategy is reflected through cooperation between China’s biggest commercial bank—the Industrial and Commercial Bank of China (ICBC)—and South Africa’s Standard Bank Group (SBG).ICBC purchased 20 percent of SBG for $5.5 billion in early 2008. Now when an ICBC client in China expands its business in South Africa, the bank sends the client to SBG, and SBG directs South African companies doing business in China to ICBC.

As the biggest bank of South Africa and Africa as a whole, SBG has more than 1,500 branches throughout the continent.ICBC has over 4 million corporate customers, 490 of which are among China’s top 500 companies.

Africa is a great potential market for banks, because about 50 percent of Africans don’t yet have a bank accounts, said Liu Yagan, Chief Representative of ICBC Africa, in an interview withBeijing Reviewin Johannesburg. “We are not afraid of competition. Competition only makes us stronger,” he said.

By cooperating with SBG, ICBC can successfully enter the mainstream market in Africa, and gain a competitive edge. “ICBC now faces a strategic opportunity to expand its business in Africa,” Liu said.

To SBG, ICBC had adequate capital,which was of special importance for a bank,said Jacko Maree, the SBG’s CEO. Maree also pointed out some of SBG’s actual business profits were from Chinese enterprises investing in Africa.

Since the purchase, SBG shares have brought ICBC a pro fi t of over 2 billion rand($299.85 million) every year, and over half of the pro fi ts are reinvested in SBG for further development, Liu said.

“The rate of return from the investment is much higher than our normal loan rate,which stands at 3-4 percent,” Liu said.

Through SBG, ICBC had granted loans totaling $8 billion by the end of June 2011.ICBC’s successful investment in SBG has helped dispel misperceptions about Chinese enterprises in Africa. “We come here for in-vestment, not for grabbing local resources,”Liu said.

Their cooperation also opens markets for both sides. ICBC and SBG agreed in August that ICBC will purchase 80 percent of the Standard Bank Argentina. Argentina and Africa don’t have a big trade volume.But China currently is Argentina’s second biggest trade partner. Plus, there are many Chinese enterprises in this South American nation. If the purchase gets approved,ICBC will be the fi rst Chinese bank to enter Argentina and it will own 103 branches in the country.

While making profits, ICBC attaches great importance to the interests of its clients and employees as well as the communities where it operates, he said.

In China, ICBC pays great attention to the government’s environmental protection policies. It prefers green loans, and has dropped all projects that might bring highenergy consumption and high pollution. In South Africa, ICBC and SBG also follow environmental protection principles when granting loans.

SBG has over 50,000 employees in Africa,and over 50 percent of its managerial staff is from the local black population. ICBC and SBG have jointly created many job opportunities throughout Africa. They have also offered preferential loans for small and medium-sized enterprises to improve their fi nancial conditions.

As the biggest shareholder of SBG,ICBC supports SBG to spend millions of dollars sponsoring young artists, singers, actors and actresses, while donating to AIDS-patients and orphans every year.

Building a future

Bakari Omari, a 21-year-old man from Tanga, the second biggest city in Tanzania,is among the numerous Africans that have bene fi ted from Chinese investment.

Omari grew up in a poor family with several kids, and only fi nished seventh grade.It was hard for him to get a job in his hometown. In February when he heard there was a Chinese enterprise in Zanzibar recruiting workers, he went there and got his fi rst job.

He now earns 4,500 shillings ($3) for one day’s work. Normally, local enterprises only pay 4,000 shillings ($2.7) per day for workers. “I hope I can work here all along, and make 5,000 shillings ($3.3) for a day,” he said.

His goal is to make some money and then go back for further education. “I hope I can live better than people in my neighborhood,” he said.

Omari is working on a project for the Beijing Construction Engineering Group Ltd.(BCEG)—a new terminal building for the Zanzibar International Airport. The Chinese Government provided a 30-year preferential loan of 480 million yuan ($73.85 million).The whole project will cost $704 million.

CRAMPED STYLE: The waiting hall of the Zanzibar International Airport. A Chinese construction project will help alleviate crowding at the airport

ROOM TO GROW: This drawing shows the new terminal of the Zanzibar Airport currently under construction. It will have an expanded capacity to accommodate three planes simultaneously. The airport can now handle only one

The project started in February, and will be finished by January 31, 2014, according to BCEG. The whole project includes a 17,000-square-meter terminal building,a small power station, and a bigger apron.When the new project is fi nished, the airport will have the ability to hold three airplanes,and will be able to service 3 million passengers every year. “The new terminal will be a landmark of the Zanzibar region and the whole of Tanzania,” said Wu Qing, a BCEG representative.

“We needed at least 120 workers every day for underground works. Now that those works have fi nished, we need only 60. All the workers are Tanzanian citizens,” he said. “Our supervisors are mostly local people, too. They can get 10,000 shillings ($6.6) per day, which is a pretty high income in the country.”

The Zanzibar Airport is only one of the many projects BCEG has contracted in Africa.From 2004 to 2010, its contract volume in Tanzania alone reached $2.39 trillion. “Our techniques and quality are as good as U.S. and European companies. But our cost is much lower than those companies,” Wu said.

“It is not fair to say Chinese enterprises hire only workers from China,” he said. “Our projects bring a lot of job opportunities for local people, not just in Africa. In Mongolia,at lease half of our employees are local. In Malaysia, all employees must be Malaysian or Indonesian, due to local regulations.”

By conducting overseas projects, BCEG can make a pro fi t while helping local people,Wu said. BCEG also trains its local employees during project construction. “Our young workers may hopefully become outstanding experts in construction in their country in 20 years’ time. Some of them are very industrious,” he said.

(Reporting from Johannesburg, South Africa, and Zanzibar, Tanzania)