THE MOTOR REVS ON

2011-10-14ByHUYUE

By HU YUE

THE MOTOR REVS ON

By HU YUE

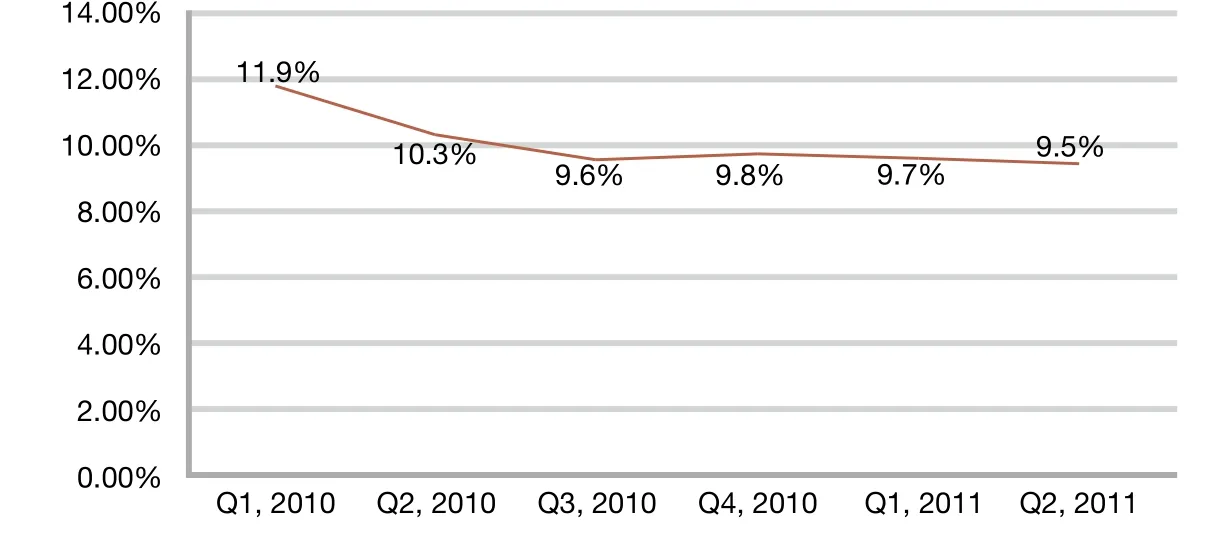

Although inflation remains a stumbling block, China’s economy edges toward healthier growth

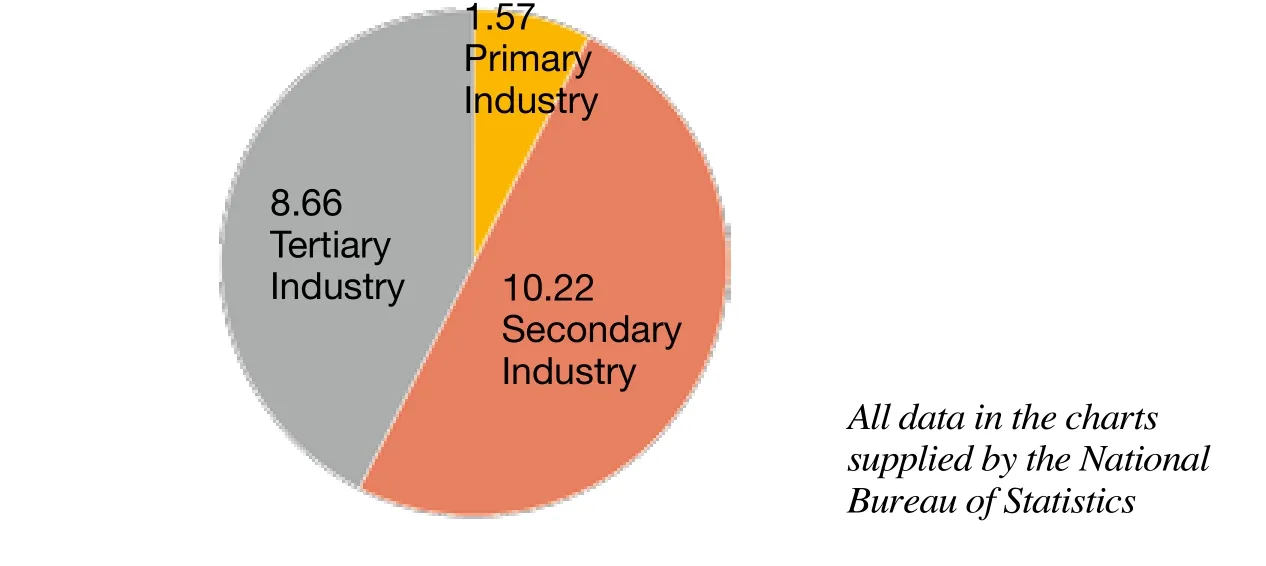

China’s growth engine continues to roar, but clouds of uncertainty lie ahead for the booming Asian nation. China’s GDP in the fi rst half of 2011 grew 9.6 percent year on year to 20.45 trillion yuan ($3.14 trillion). The GDP growth for the second quarter slowed to 9.5 percent from 9.7 percent in the fi rst quarter and 9.8 percent in the October-to-December period of 2010, said the National Bureau of Statistics (NBS).

Of the 9.6-percent GDP growth, 4.6 percentage points came from consumption and 5.1 percentage points from investment, while the contribution from exports was minus 0.1 percentage point.

The Chinese economy remains on a stable and relatively fast track of growth, said Sheng Laiyun, spokesman of the NBS, at a press conference on July 13.

“Some economic indicators experienced modest corrections in the second quarter because policymakers initiated structural adjustments and scaled back some policy incentives, such as favorable purchase taxes for small cars,” he said. “The government clampdown on the property markets was also a drag on growth.”

But con fi dence in China’s economic future remains high due to its growth potential,he said.

Sheng said the biggest challenge facing the country is walking the fi ne line between maintaining growth and managing in fl ation.

“It would also be an arduous task to rebalance the economy and press ahead with energy conservation and emission reduction,”he added.

Controllable risks

Fears of a hard landing for the economy have gained traction as a slowdown in GDP growth indicates China’s turbo-charged economy is beginning to cool. But many economists don’t believe the current slowdown will amount to a slump akin to that seen during the global fi nancial crisis.

INNOVATIVE STRENGTH: High-speed steel rails are assembled atChinese steelmaker Baosteel’s manufacturing plant in Baotou, Inner Mongolia Autonomous Region

“As China transforms the economy to rely more on domestic demand, a mild slowdown is inevitable,” said Yu Yongding,a renowned researcher with the Chinese Academy of Social Sciences (CASS).“Slower growth is acceptable since the country has actually put greater emphasis on quality, instead of the quantity of growth.”

As part of its 12th Five-Year Plan (2011-15), China has vowed to make vigorous efforts to propel consumption, develop the service sector and eliminate polluting and energy-guzzling businesses. The government’s annual economic growth target for the next fi ve years sits at 7 percent.

“Achieving this target won’t be too problematic,” said Yu, “But the country needs to remain vigilant to combat external shocks from the European debt crisis and uncertainties surrounding the U.S. dollar.”

Chen Dongqi, Deputy Director of the Academy of Macroeconomic Research under the National Development and Reform Commission, said the economy is still steering a steady course of growth.

THE LINE BEGINS TO SLOW: Employees of 361 Degrees (China) Co. Ltd., a manufacturer of sports goods based in Fujian Province, assemble shoes

“Investments remain buoyant, enabling the economy to gain a solid footing,” said Chen. “Chinese consumers are also opening up their wallets, fi lling the gap left by tepid exports.”

The economy may rebound in the third quarter if companies stop drawing down inventories and overall demands recover, he said.

Dong Tao, an economist at Credit Suisse,believes the central bank is in no rush to relax its policies for fear of fueling further property price increases. The government, he said, will unleash its spending power to prevent growth from slowing too much.

“Should the threat of a hard landing emerge, we can expect fiscal stimulus packages to come to the rescue, instead of monetary easing,” he said.

“The economy is set up for growth.You’ve still got urbanization and industrialization to come and all the incentives at local government levels are aimed at encouraging growth,” said Stephen Green, an economist at Standard Chartered Bank in Hong Kong.

A recent Deutsche Bank report also said China now faces fi ve major downside risks—power shortages, slowing car sales, lackluster manufacturing industry demonstrated by the falling purchasing managers index, real estate market downturn, as well as monetary policy tightening.

“But those risks are not dif fi cult to control and they are expected to subside after the summer,” said the report.

Inflation conundrum

“Taming in fl ation remains a top priority for the government, even though economic growth continues to slow down,” said central bank governor Zhou Xiaochuan.

“The vibrant Chinese economy is able to tolerate a degree of inflation,” he said. “The central bank will further fi ne-tune its monetary policy tools to control in fl ation, maintain economic growth, ensure high employment and maintain its international balance of payments.”

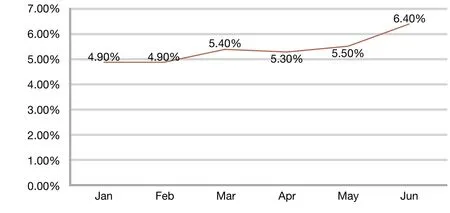

The consumer price index (CPI), a barometer of inflation, soared 6.4 percent in June from a year ago, hitting a 35-month record. In the fi rst half of the year, the CPI went up 5.4 percent. Both fi gures were well above the government-set target ceiling of 4-percent in fl ation for the entire year.

The biggest driver of the skyrocketing CPI was food prices including grain, meat,eggs and vegetables, which increased 11.8 percent in the fi rst half of the year over the same period last year. Residential costs went up 6.3 percent.

The producer price index (PPI), a major measure of inflation at the wholesale level,rose 7.1 percent in June and 7 percent in the fi rst half of the year.

Lagging effect of the credit binge two years ago continues to fl ood the economy with excess liquidity and fuel in fl ation. Meanwhile,price surges in international commodities translate into higher PPI in China through trade links, which in turn feed into consumer in fl ation. More stubborn and persistent contributors to inflation are growing domestic land and labor costs.

Policymakers have been pushing all the buttons to tame inflation. The government has taken a prudent monetary stance this year, bidding farewell to the moderately loose policy adopted to counter the fi nancial crisis.The People’s Bank of China, the central bank,has ordered interest rate hikes three times and the reserve requirement ratio increases six times this year.

“There’s no need to panic about the June CPI fi gure,” said Zhang Liqun, a researcher with the Development Research Center of the State Council. “The in fl ation situation is not worsening in China, because the June CPI growth was in part due to carryover effect of last year’s price increases.”

Liu Shucheng, Director of Institute of Economics of the CASS, expects CPI growth to taper off in the latter half of the year due to the government’s supply-side measures,tighter market liquidity and falling commodity prices in global markets.

Compared with other emerging economies, China’s in fl ation situation is much less severe, said Yao Jingyuan, chief economist of the NBS. In May, India reported a 9-percent in fl ation rate.

“China is able to hold serious in fl ation at bay thanks to deep reserves of grain,” he said.

Li Daokui, member of the Monetary Policy Committee of the People’s Bank of China and Director of the Center for China in the World Economy at Tsinghua University, is also optimistic about in fl ation prospect in China.

BUILDING SPREE: A crane lifts girders at a subway construction site in Zhengzhou, capital of Henan Province, on July 12

BOUNTIFUL HARVEST: A combine harvester reaps wheat in Chengtou Village, Shandong Province, on June 14

“Thanks to industrial overcapacity, the country is less likely to experience the double-digit in fl ation rate it did in the late 1980s,”he said.

“If international crude prices stabilize,China’s CPI may ease back to 4-5 percent later this year and stay at 3-5 percent over the next few years,” said Li.

“Government measures to curb inflation are already taking effect,” said Guo Tianyong, Director of the Research Center of China’s Banking Industry under the Central University of Finance and Economics.

Given that food prices are pushing up CPI, supply-side measures should be more effective to fi ght in fl ation, he said. “But it is necessary to avoid the over-use of administrative price control measures, and allow the markets to play a bigger role.”

Zhuang Jian, chief China economist with the Asian Development Bank, said it would also help if China accelerates the yuan’s appreciation and makes imported goods more affordable for domestic consumers.

Sheng Laiyun, spokesman of the NBS,expected in fl ation fears to ease in the remainder of the year.

“China has reaped a bumper harvest of summer grain, and an economic slowdown would also cool demand and soothe upward pressure on consumer prices,” he said.“Globally, international commodity prices have been dropping, which helps curtail imported in fl ation.”

Sheng also said the government will enhance subsidies to low-income groups and cushion the impact of in fl ation.

Global effect

The Chinese economy is losing some momentum, sending ripples throughout the world.

The international credit rating agency Standard & Poor’s (S&P) even warned in June that a sudden slowdown in China may lead commodity prices to fall 50-75 percent from current levels.

Ivan Glasenberg, CEO of Glencore, a multinational mining and commodity trading company headquartered in Switzerland, said high consumer prices in China and the country’s moves to curb in fl ation had dampened global demand for commodities.

But Glasenberg still painted a positive medium-term outlook, stating that the effects of China’s monetary tightening would be short lived.

“These are short-time ebbs which we seefrom time to time,” he said. “We still believe in the underlying strong fundamentals, with demand continuing to grow in Asia, particularly China and India.”

GDP Growth Rates (y.o.y.)

GDP Composition H1, 2011(trillion yuan, $1=6.5 yuan)

EXPORT RECOVERY: Domestic-made vehicles are ready for export at the Lianyungang Port, Jiangsu Province on June 6

In fact, as China rebalances its economy toward slower but more sustainable growth,the shift is bene fi ting global economies.

The country is seeking to widen domestic demand and encourage imports, a remarkable boon for its trade partners. In the fi rst half of 2011, China’s imports totaled $829.37 billion, up 27.6 percent from a year ago. The trade surplus in the fi rst half of 2011 continued shrinking, and stood at $44.93 billion, a decrease of 18.2 percent from a year ago.

Despite the moderation in domesticgrowth, China still remains a powerful contributor to global economic growth, said Zheng Xinli, Vice Chairman of China Center for International Economic Exchanges.

CPI Growth Rates, 2011 (y.o.y.)

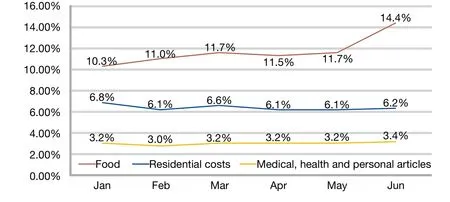

Prices Growth Rates, 2011 (y.o.y.)

China is embarking on a greener path of growth, presenting opportunities for overseas companies in the renewable energy and environmental protection sectors, said Zheng.

China’s massive urbanization will continue creating buoyant demand, injecting fresh life into the world economy, he said.

“Meanwhile, China has been the largest foreign holder of U.S. Treasury securities, which are vital for the United States to fund its increasing budget de fi cits,” he said.“Chinese companies are also quickening investments overseas, providing jobs and tax revenues for target countries.”

Road ahead

“China needs to strike a balance between maintaining growth and taming in fl ation,” said Ba Shusong, Deputy Director of the Research Institute of Finance at the Development Research Center of the State Council.

But for the rest of the year, will policymakers continue tightening the credit screws to combat in fl ation? Economists are divided over the issue.

Over-tightening, Ba said, would drain steam out of the already weakening economy for three reasons. First, a string of small and medium-sized enterprises are already struggling to make ends meet due to a lack of credit. Second, over-tightening may lead to a break in the cash fl ows of many infrastructure projects, worsening the debt risks of local governments. Third, property developers are also coming under intense fi nancial pressures as home sales nose-dive, curtailing real estate investments.

“With a coming decline in headline in fl ation and rising concern on growth, I believe the chance for further interest rate hikes this year is small,” said Lu Ting, an economist at the Bank of America Merrill Lynch. “We expect CPI growth to fall steadily after June to around 4-4.5 percent at year-end and then will stay there for a couple of years.”

“The battle against inflation is still on,although China’s tightening cycle is likely close to the end,” said Qu Hongbin, chief China economist at HSBC, forecasting in fl ation will start to slow in China in the second half of this year.

But Andy Xie, an independent economist and a director at Rosetta Stone Advisors Ltd.,disagreed.

“The government is less likely to relax its efforts to combat in fl ation, the biggest risk for the economy,” he said. “There will probably be two to three more interest rate hikes this year since the country’s benchmark one-year deposit rate remains negative in real terms.”