Forex Reserve Puzzle

2011-10-14ByLANXINZHEN

By LAN XINZHEN

Forex Reserve Puzzle

By LAN XINZHEN

China faces pressure of preserving the value of its $3 trillion foreign exchange reserves

While already under pressure to revalue its currency, the yuan,against the U.S. dollar, China also faces the challenge of stifling vast losses to its foreign exchange reserve, mostly denominated in U.S. dollars. These losses to foreign exchange(forex) reserves totaled $271.1 billion from 2003 to the end of 2010 due to an appreciating Chinese currency, according to Zhang Anyuan, a research fellow with the Academy of Macroeconomic Research under the National Development and Reform Commission, in an article toSecurities Dailypublished on May 5,2011.

In response, the State Foreign Exchange Administration (SAFE) said the yuan’s appreciation will not lead to losses of China’s forex reserves. This stance alone cannot dispel economists’ worries as most agree that China should focus on ways to guarantee the value of its reserves.

Whether to preserve or increase the value of the assets, Zhang said China’s most urgent task at hand is diversifying its forex reserves.

Losing or not

A popular assumption is that China’s forex reserve investment yields are doing considerably well at about 3 percent a year.The level of management is among the top of various sovereign wealth funds worldwide.

But considering exchange rate costs between the yuan and the U.S. dollar, by the end of 2010, newly increased forex reserve since 2003 had lost $271.1 billion.If the exchange rate of the yuan hits $1 for every 6 yuan, which may quickly become a reality, losses will reach $578.6 billion,Zhang said. A financial hit like that certainly can’t be made up with investment yields from the forex reserves.

To date, the yuan has appreciated nearly 5 percent against the U.S. dollar since June 2010 when China restarted the exchange rate regime reform. Taking inflation into account, the yuan’s real appreciation against the U.S. dollar has surpassed 10 percent.

Admittedly, the losses are only rough estimates, Zhang said, but a detailed analysis won’t change the fact that large sums of money are vanishing.

Worrying or not

To counter Zhang’s article, SAFE issued a statement of its own.

To begin with, the statement said an appreciating yuan won’t lead to losses in China’s forex reserves because these reserves are denominated in U.S. dollars.Any exchange rate fl uctuations will lead to changes in book values, but not losses or gains in real terms. This will not affect the direct purchasing power of the reserves,only re fl ecting different book values. Real losses or gains will be realized only when the forex reserves are converted into the yuan. For the time being China does not need to convert large reserve sums into the yuan. Moreover, after the yuan appreciates companies also have the bene fi t of reducing import costs.

Forex reserve book losses caused by the currency appreciation are also far less than the surplus of China’s financial assets. Corresponding to the book losses of converting U.S. dollar-denominated reserves into the yuan is the book surplus of converting the yuan-denominated fi nancial assets held by Chinese citizens into the U.S. dollar. By the end of March 2011, the balance of China’s forex reserves stood at$3.04 trillion. According to the exchange rate at the end of March, China’s yuandenominated financial assets, including corporate and individual deposits, stocks,treasury bonds and insurance assets, were more than five times the country’s forex reserves. This means that as the yuan appreciates, the book surplus of these financial assets will be more than fi ve times the book losses of China’s forex reserves.Considering the scale of other financial assets held by Chinese residents in stocks and bonds the book income of these assets will be much higher. Also, the above losses or incomes are both in book value and won’t be realized without actual convertibility.

Also important, the actual purchasing power of the forex reserves is decided by their yielding rate and the in fl ation rate of the country where the investment is going.Over the years China’s forex reserves have maintained stable yields with the yield rates much higher than the in fl ation rates of the United States, Europe and Japan.Therefore, the actual purchasing power of China’s forex reserves is guaranteed. From 2000 to 2010, the average annual growth of consumer price index was 2.4 percent,2.1 percent and -0.2 percent in the United States, Europe and Japan, respectively,all of which were lower than the average annual yielding rate of China’s forex reserves.

Forex in excess

The losses may be debatable, but most economists and of fi cials agree that China’s forex reserves are “excessive.”

Central bank Governor Zhou Xiaochuan said at a financial forum on April 18, 2011, the forex reserves surpassed the reasonable level China needs.Excessive reserves have led to increased liquidity in the market and placed a hedging burden on the central bank.

Source: State Administration of Foreign Exchange

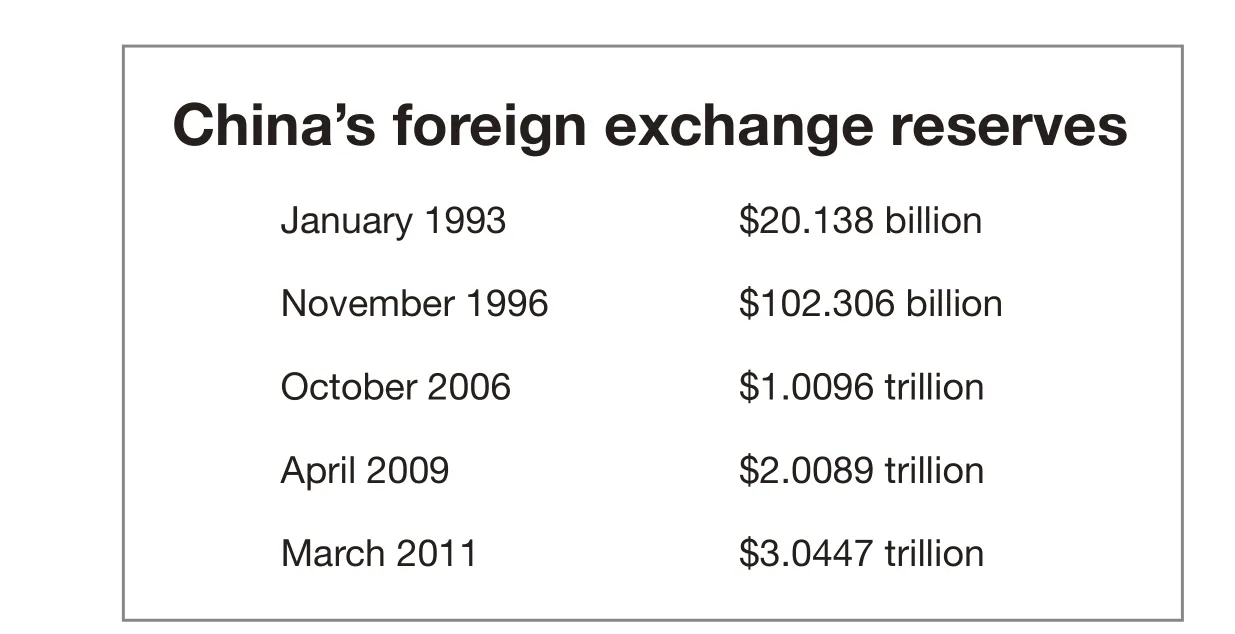

Such a large forex stockpile was never the Central Government’s intention, but rather the result of various mutually affected factors. In 1978 China’s forex reserves totaled $1.67 billion. From 1979 to 1989 the forex reserve balance did not surpass $20 billion. After further reform measures in 1992 China began to adopt policies to encourage exports and attract foreign direct investment with preferential policies. Since then China’s forex reserves have grown rapidly, surpassing $1 trillion in October 2006 and breaking the $3 trillion mark in March 2011.

Larger forex reserves, Zhou said, are conducive to avoiding out fl ows of capital and maintaining stable exchange rates. It can also be used to cope with future uncertainties with international payments and ensure normal imports and expenditure in repaying debts. Moreover, suf fi cient forex reserves will ensure a country can effectively cope with fi nancial risks caused by external impact. Excess reserves, however,will have an adverse impact on various parts of the macro-economy.

According to Zhou, under the present mechanism for exchange sales and settlements, the central bank has to issue more money to purchase the newly increased foreign exchange balance, thus pushing up circulation of basic currency and compressing the space for monetary policy control. Excessive liquidity has also added fuel to in fl ation and induced an in fl ow of international capital that will ultimately be accumulated in the country’s forex reserves.

Now, public comment on the matter is focused on the following aspects.

First, the scale of China’s forex reserves is excessively large. Keeping the yuan exchange rate at its current level will cause these reserves to continue to increase and, more importantly, it will also bring expectations and actual pressure of further yuan appreciation.

Second, diversified assets are needed since most of China’s forex reserves are in U.S. dollars. Although exact fi gures are not made public, it can be estimated from Bank for International Settlements reports that around 70 percent of China’s reserves are in dollars, 10 percent in yen and 20 percent in British pounds.

Third, despite the large holdings of U.S. treasury bonds, substantial reductions in these holdings could cause turbulences in the global fi nancial market.

“Transferring U.S.dollar assets into assets denominated with other currencies will be conducive to increasing the safety and profitability of China’s reserve assets.”

—Guo Tianyong, Director of China Banking Industry Research Center of Central University

Preserving the value

Economists are considering China’s options—let the forex reserves stay at the central bank or make overseas investments—to increase or at least preserve the reserves.

Guo Tianyong, Director of China Banking Industry Research Center of Central University of Finance and Economics, said China can try to gradually reduce its holdings of U.S. dollars or purchase treasury bonds from other less risky countries with better liquidity, gold reserves or energies and resources China lacks.

From the capital composition, transferring U.S. dollar assets into assets denominated with other currencies will be conducive to increasing the safety and profitability of China’s reserve assets,Guo said. But if the scale of the transfer is too big, the U.S. dollar will be inevitably depreciate and China will suffer losses of asset devaluation.

According to an analysis report released by the Beijing-based research company Anbound Group, China’s excessive forex reserve holdings are rooted in its economic and trade structure. To avoid reserve asset losses, economic restructuring will be necessary. China should gradually reduce and abolish subsidies to exporting companies and those outdated and inefficient exporting companies. Cuts like this are the price China must pay to improve the overall competitiveness of its economy.

To manage the $3 trillion in forex reserves, revisions are needed to the foreign exchange administration rules, said Xia Bin, Director of the Research Institute of Finance of Development Research Center of the State Council. First, the government must maintain necessary liquidity of foreign exchange in order to satisfy the demand of balanced international payments. Second, the government should use some foreign exchange to intervene in the foreign exchange market to satisfy the demand of regulating the exchange rate.Third, the use of forex reserves must serve sustainable economic growth and obtain strategic benefits. Fourth, spare reserves can be used for financial investment of higher yields.

Xia also suggested relaxing controls on foreign assets held by residents and eliminating restrictions on investment in foreign financial products. China should also actively participate in rebuilding the international monetary system and making the yuan an international currency. This is an effective way to solve the forex reserve problem, release Chinese wealth from the bonds of its U.S. dollar assets and ensure Chinese fi nancial security.