Launching Plan B: Biomass Energy

2011-10-14ByLIUXINLIAN

By LIU XINLIAN

Launching Plan B: Biomass Energy

By LIU XINLIAN

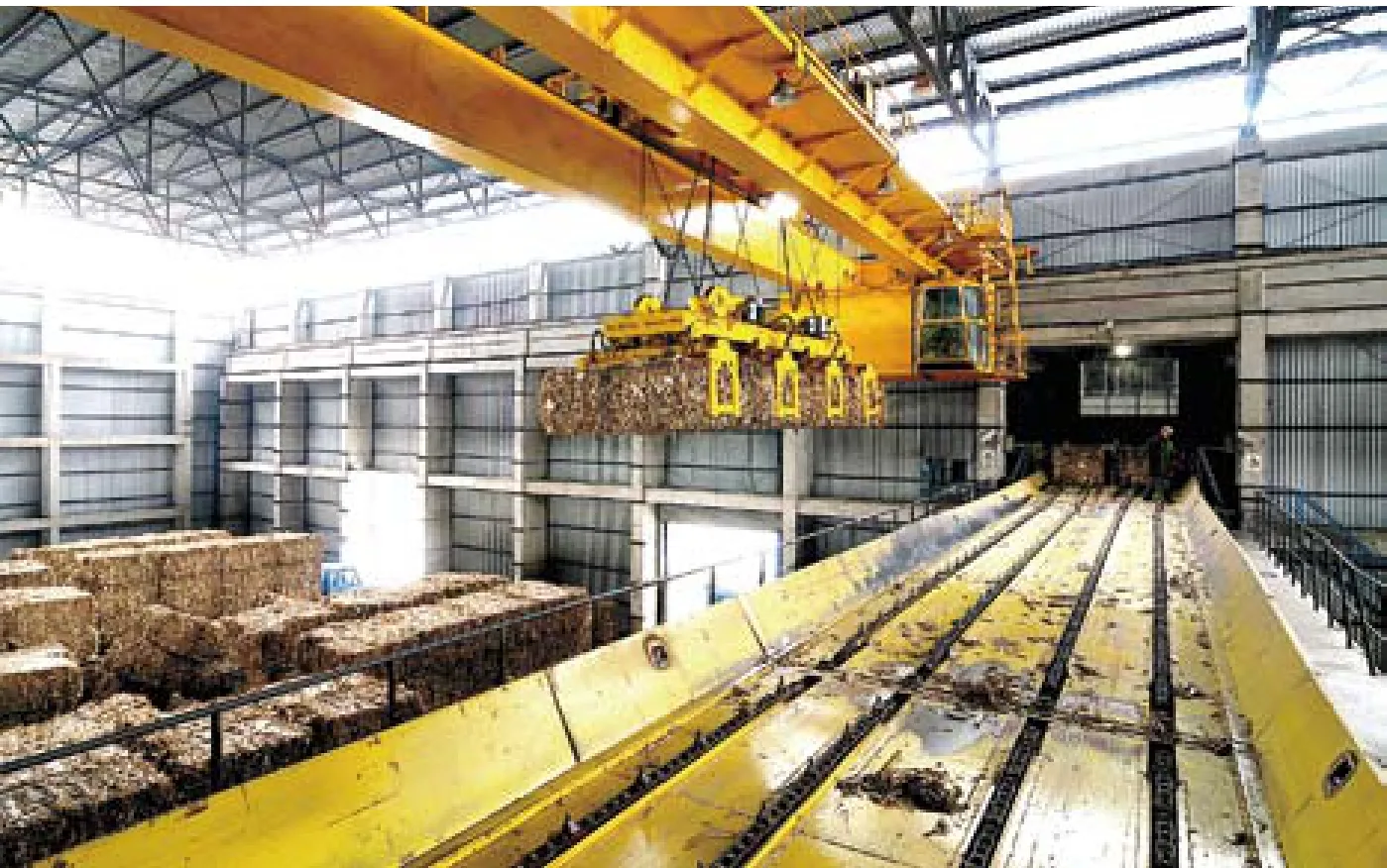

China’s first biomass electricity company focuses on helping farmers as it strives to expand

In April 2011, the world’s largest biomass power company, China National Bio Energy Co. Ltd. (NBE), began building a biomass power plant in Shangcai County of central China’s Henan Province. The new plant, due to reach completion next July, will generate 210 million kwh of electricity annually. It will also fll local farmers’ pockets with a little extra cash—80 million yuan ($12.3 million) to be exact, said NBE Chairman Kai Johan Jiang.

“Out of every 100 yuan ($15.4) NBE uses on production, 60 yuan ($9.26) will go to buying straw from farmers. The ash from the power plant can then be used as fertilizer,” Jiang said.

Since its frst biomass power plant was launched in 2006 in Shanxian County of Shandong Province, NBE has built 26 additional facilities. Ten are currently under construction.

To date, NBE has paid farmers more than 3.2 billion yuan ($492.3 million) to procure straw. The company has also created more than 50,000 jobs in rural areas, said Jiang.

“Farmers are in the very fabric of our company,” said Jiang.

Diverse resources

With the introduction of natural gas in recent years, straw has fallen from a highpriority crop to one that farmers have little time to spare producing. Many farmers have resorted to burning the straw in the felds where it grows instead of harvesting it, which inevitably leads to environmental concerns from the ensuing smoke and fres. The caloric value of the amount of straw burned each year is equivalent to 350 million tons of standard coal and the annual power generation of eight Three Gorges Power Station, the world’s largest of its kind, said Shi Yuanchun, an academician with the Chinese Academy of Engineering and Chinese Academy of Sciences.

COURTESY OF NBE

The former senior executive for Volvo Truck Corp. in Sweden, Jiang vows to turn the leftover straw into money for farmers.

“Biomass energy has the most potential among energy sources. There is an extensive supply of this fuel, including leftover straw, cotton stalks, shrubs, bark and peanut shells. In addition, biomass energy is much more stable and easier to control than wind and solar energy,” Jiang said.

He said, 1mu(666.67 square meters) of land produces around 300 kg of straw, and the current purchase price is roughly 260 yuan ($40.1) a ton. The biomass power business directly increases the income of farmers by 80 yuan ($12.30) permu. A typical 30-mw power plant consumes between 25 million and 30 million tons of biomass and its total procurement costs are around 70 million yuan ($10.8 million).

After the NBE’s biomass power plant was established in Kenli County of Shandong Province in 2007, a new occupation was created: brokers who pay farmers and collect cotton stalks to sell to the power plant. Local broker Wang Wenli hired several workers and earned 80,000 yuan ($12,346) in 2008.

The plants employ around 130 people, and each plant needs 10 straw logistics bases, which in turn require 50 people and a large number of brokers.

Biomass energy will promote urbanization in rural areas and create jobs, said Shi.

“Biomass energy can raise farmers’incomes, encourage land reclamation and increase farmers’ enthusiasm for growing grain,” Jiang said.

Business on the way

Biomass energy, the energy from plants and plant-derived materials, receives less attention than solar or other types of alternative energy in China.

COURTESY OF NBE

While solar energy provider Suntech Power in Wuxi of Jiangsu Province and wind turbine manufacturer Goldwind Science & Technology based in the Xinjiang Uygur Autonomous Region are listed in Hong Kong and New York, NBE is still a little known company, despite the fact that it supplies 60 percent of the country’s biomass electricity.

More than two decades of working and living overseas allowed Jiang to learn about biomass energy and its proftability.

“Twelve percent of Danish energy consumption is covered by the use of residual products such as straw, wood chips and slurry. Denmark’s farming area is only 5 percent of that of China. If China develops its biomass energy, you cannot imagine how big the industry will be,” said Jiang.

Jiang founded NBE’s parent company Dragon Power in Beijing in 2004 and obtained a license for using its technology from world’s leading biomass boiler manufacturer Bioener of Denmark. In December 2006, NBE’s frst straw biomass-powered plant was set up in Shandong Province, the frst of its kind in China.

So far, with 26 power plants in operation mainly in northeast China and 10 under construction, NBE is expected to have a generation capacity of 1,000 mw by 2014. By the end of 2009, NBE had provided 5.2 billion kwh of green power and reduced CO2 emissions by 4.36 million tons.

In a bid to lower production costs and localize the imported technology, Dragon Power decided to stretch its business upward to boiler manufacturing and research. In the past, NBE needed to pay Bioener a technology transfer fee of $500,000 a power plant for using its technology. In September 2009, Dragon Power acquired Bioener, making it one of the world’s largest suppliers of biomass-fred boilers.

“The acquisition has allowed NBE to use Bioener’s technology for free and localize the international advanced technology, making the plants burn a variety of crop stalks and forestry waste to improve the adaptability of biomass fuels. This made our combustion effciency 30 percent higher than that of our domestic counterparts,” Jiang said.

In addition, Dragon Power acquired its boiler maker Jinan Boiler Factory in Shandong. “The acquisition cut the construction costs of a 30-mw power plant from 330 million yuan ($50.9 million) to 250 million yuan ($38.6 million),” Jiang said.

As the call for combating global warming becomes louder and louder, incentives for cutting greenhouse gas emissions will surely benefit from the shift in political climate.

In October 2006, the trading arm of Electricité de France (EDF), one of the world’s largest energy frms, signed a letter of intent with China NBE to purchase carbon credits from three of its biomass power projects, equivalent to 1.5 million tons of CO2 under the Kyoto Protocol’s carbon-trading scheme, known as the Clean Development Mechanism (CDM). The CDM allows industrialized countries with a greenhouse gas reduction commitment to invest in projects that reduce emissions in developing countries. It is considered an alternative to more expensive emission reductions in industrialized countries.

COURTESY OF NBE

“The carbon credit trade is an irresistible trend and I believe NBE, as a green power creator, will beneft from the trend,”said Jiang.

As China comes under increasing international pressure to help curb greenhouse gas emissions, the prospects look much brighter for Jiang.

China will start a pilot carbon emissions trading project and gradually set up a market for carbon emissions trading, said Xie Zhenhua, Vice Minister of the National Development and Reform Commission, on July 16 at the 2011 Eco-Forum Global held in Guiyang, capital of Guizhou Province.

Less than favorable market

Today Dragon Power is the only company in the world to incorporate the entire biomass energy production chain, from equipment manufacturing to power plant operation to providing a whole range of proprietary technology.

Despite the ambitious and rapid expansion in recent years, the huge investment has not yet put Jiang’s company in the black. Jiang said, some of the 12-mw power plants suffer losses because of limited installed capacity. “The years of experience proved the 30-mw power plant is most investment efficient and profitable,” said Jiang.

A lack of capital has always haunted Jiang.

“Biomass energy is a totally new industry in China and we still cannot produce ideal financial numbers. Getting loans is still pretty diffcult,” he said.

NBE will introduce some large enterprises as strategic partners and start preparing for an initial public offering in the domestic A-share market, Jiang said.

But the low-margin biomass power generation still could not cover the high fnancial cost, such as lending interests.

When asked if NBE will lower the straw procuring price to make a profit, Jiang said “no.”

“We will never lower the procuring price to discourage the farmers. My company will be the country’s biggest support network for farmers,” said Jiang.

a cent from the carbon credit trade, Jiang feels optimistic about the prospects.