Capital market research in taxation:Do it in China!☆,☆☆

2011-06-26OliverZhenLiNingCai

Oliver Zhen Li*,Ning Cai

aSchool Department of Accounting,National University of Singapore,NUS Business,Mochtar Riady Building,BIZ 1-53,15 Kent Ridge Drive, Singapore 119245 Singapore

bDepartment of Accounting,School of Management,Xiamen University,No.422,Siming South Road,Siming,Xiamen,Fujian Province,PR China

Capital market research in taxation:Do it in China!☆,☆☆

Oliver Zhen Lia,*,Ning Caib

aSchool Department of Accounting,National University of Singapore,NUS Business,Mochtar Riady Building,BIZ 1-53,15 Kent Ridge Drive, Singapore 119245 Singapore

bDepartment of Accounting,School of Management,Xiamen University,No.422,Siming South Road,Siming,Xiamen,Fujian Province,PR China

A R T I C L EI N F O

Article history:

Accepted 5 May 2011

Available online 9 June 2011

JEL classification:

H20

G10

G30

Starting from MM's theories,we discuss some important topics in capital market research in taxation.We use this article to introduce intuitions and techniques of capital market research in taxation to Chinese researchers.While it is apparent that many Chinese researchers have already mastered these techniques,we hope that more researchers will be interested in this line of research.We believe that China provides fertile ground for capital market research in taxation.

Ⓒ2011 China Journal of Accounting Research.Founded by Sun Yat-sen University and City University of Hong Kong.Production and hosting by Elsevier B.V.All rights reserved.

1.From MM with Inspirations

Many inspirations for capital market research in taxation come from Miller and Modigliani(1961)and Modigliani and Miller(1958,1963).These articles form the two pillars of modern corporate finance research.In these articles,Miller and Modigliani argue that in a perfect market and in the absence of taxes,a firm's payout policy and capital structure do not affect its value.However,they acknowledge that taxes can make a firm's payout policy and capital structure value-relevant. This naturally establishes taxes as an important topic in capital market research.

1.1.Tax and dividend policy

Miller and Modigliani(1961)show that in a perfect market and without taxes,dividend policy does not affect firm value. They also acknowledge that there are many factors that can make a firm's dividend policy value-relevant and that an important one is tax.They state that‘‘Of all the market imperfections that might be detailed,the only one that would seem to be even remotely capable of producing such a concentration is the substantial advantage accorded to capital gains as compared with dividends under the personal income tax.''Apparently,in maintaining their dividend irrelevancy story,they try to discount the role of taxes.

Subsequent researchers have incorporated the differential taxation of dividends versus capital gains in stock return models,such as Brennan(1970)and Litzenberger and Ramaswamy(1979,1980,1982).If dividends are taxed at a higher rate than capital gains,such as in the United States,then stock returns should increase with dividend yield.This is the concept of dividend tax capitalization.That is,in equilibrium,investors will have to be compensated for investing in an asset or a stream of income that is more heavily taxed.

1.2.Tax and capital structure

Modigliani and Miller(1958)show that without taxes,a firm's capital structure does not affect its value but there is an equity risk premium associated with leverage.In their attempt to incorporate corporate taxes,they make a mistake by taking it for granted that corporate taxes just affect firm value and therefore stock returns proportionately.This is not the case. Modigliani and Miller(1963)correct this oversight.This episode,however,should help us better appreciate the importance of taxes in capital market research.They show that with corporate taxes and the tax deductibility of interest expense,firm value increases and the leverage-induced risk premium decreases.

Miller(1977)further introduces personal level taxes for both debt income and equity income and shows that they also affect firm value through financial leverage.Modigliani and Miller(1958,1963)and Miller(1977)predict that with a corporate tax,financial leverage increases firm value.However,when debt income is taxed at a relatively higher rate than equity income,the value enhancing role of financial leverage is mitigated.If we invert Miller(1977)into a cost of equity capital model,then we have three predictions.First,a firm's cost of equity capital increases with financial leverage.Second,the leverage induced equity premium is negatively associated with the corporate tax rate.Third,the leverage induced equity premium increases with the relative taxation of debt income versus equity income.

2.Empirical implications and test settings

2.1.Dividend policy

Differential taxation of dividends versus capital gains affects a firm's dividend policy.For example,high dividend yield firms attract investors with a low tax rate on dividend income and low dividend yield firms attract investors with a high tax rate on dividend income.This relation can also go the other way around.Investors with a low tax rate on dividend income induce firms to pay more dividends and investors with a high tax rate on dividend income induce firms to pay less dividends.This is called the dividend tax clientele effect.Elton and Gruber(1970),Grullon and Michaely(2002)and Grinstein and Michaely(2005)and many others find evidence supporting this clientele effect.

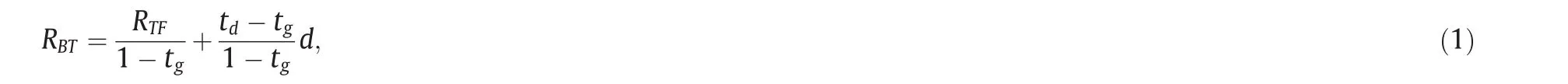

More importantly,in equilibrium,a firm's dividend policy affects its value or expected return when dividend income and capital gains are taxed at different rates.Let RBT be the expected return of a dividend-paying stock,RTF be the expected return of a tax-free security of the same risk class,d be the dividend-paying firm's dividend yield,td be the tax rate on dividend income and tgbe the tax rate on capital gains income,we have

where the second part of the equation is the equity risk premium associated with dividend yield if td>tg.

Researchers can test if equity returns are positively associated with dividend yield when td>tg,negatively associated with dividend yield when td<tg,or unassociated with dividend yield when td=tg.In fact,many studies have been conducted testing a positive association between stock returns and dividend yield in the US.While earlier studies find mixed evidence, more recent studies generally support a positive association.For examine,Dhaliwal et al.(2005)find that a firm's cost of equity capital increases in tax penalized dividend yield relative to capital gains in the US.This positive association is mitigated when the level of institutional investors who are less likely to be tax penalized on dividend versus capital gains income increases.

Another way to determine whether there is an equity risk premium associated with dividend yield is to examine the stock price movement on ex-dividend days.Without taxes,stock prices should drop on average by the amount of the dividend on the ex-dividend day.However,researchers generally find that on average stock prices drop by an amount that is lower than that of the dividend(Elton and Gruber,1970).There is a simple tax explanation that is reflected in the following equation when a seller is indifferent between selling shares before and after the ex-dividend day:

where PCUMis the cum-dividend stock price,PEXis the ex-dividend stock price and D is the dividend per share.

With td>tg,which is historically the case in the US,the price drop to dividend ratio is predicted to be lower than 1.This explains why and how the price drop on ex-dividend days is lower than the amount of the dividend.This ratio of less than 1 also easily translates into an abnormally high stock return on the ex-dividend day of(td-tg)/(1-tg)d in Eq.(1).

Ex-dividend day stock price movements or abnormal stock returns are a major corporate finance research topic with more than 100 papers published in top journals since Elton and Gruber(1970).Even though researchers have attempted non-tax explanations,such as Frank and Jagannathan(1998)and Bali and Hite(1998),the current consensus appears to support the tax explanation.It is important to note that Frank and Jaganathan(1998)is based on Hong Kong,China,a jurisdiction with no taxes on dividends or capital gains.

The ex-dividend setting also easily lends itself to trading volume studies.Trading volume is important because it reflects investors'trading behavior and differential preferences and therefore clienteles.Volume increases around ex-dividend days due to the fact that different investors have different tax rates on dividends and capital gains,that is,their tax preferences for dividends versus capital gains are different.We call this tax-induced investor heterogeneity(Michaely and Vila,1995).If investors can trade with each other properly around the ex-dividend days,they can reduce their tax burdens.For example, investors with a high tax rate on dividends can sell shares before the ex-dividend days and/or buy shares after the ex-dividend days in order to avoid the dividend;investors with a high tax rate on capital gains can buy shares before the ex-dividend days and/or sell shares after the ex-dividend days in order to capture the dividend.This process induced by tax heterogeneity drives up trading volume and can be summarized in the following equation(Michaely and Vila,1995):

where D is the amount of the dividend per share,Kiis the level of risk tolerance for investor i,αiis the tax-induced preference for dividends versus capital gains for investor i,¯αis the average preference for dividends versus capital gains in the economy, weighted by investors'levels of risk tolerance Ki,σ2eis the total risk of a stock and N is the total number of investors in the economy.

A practical way of examining the effect of tax-induced heterogeneity on ex-dividend trading volume is to assume that there are roughly two types of investors in the market,individual investors and institutional investors.In the US setting, institutional investors are more likely than individual investors to prefer dividends over capital gains.In fact,as long as institutional investors and individual investors differ in their tax preferences for dividends versus capital gains,they can trade in a certain fashion to reduce their tax burdens and therefore drive up trading volume.The intuition is rather simple.When the level of institutional ownership is relatively low,tax induced tax heterogeneity is low(everyone is an individual investor) and trading volume will be low.When the level of institutional ownership is relatively high,tax induced heterogeneity is again low(everyone is an institutional investor)and trading volume will be low.When the level of institutional ownership is in between these extremes,tax induced heterogeneity is high(a combination of individual and institutional investors)and trading volume will be high.Therefore,trading volume is an increasing and concave function of institutional ownership (Dhaliwal and Li,2006)as reflected in the following equation:

where N=n1+n2is the total number of investors in the economy for the underlying stock,and n1and n2are the number of Category 1 and Category 2 investors.Dhaliwal and Li(2006)find that ex-dividend day trading volume first increases and then decreases in the level of institutional ownership or the ratio of the number of large trades to the number of all trades (a dynamic proxy for the presence of institutional investors).

Further,the ex-dividend setting is particularly conducive for studying directional trading volume since the theory would predict how a specific group of investors would trade in a certain fashion to mitigate their tax liabilities.Li(2010)is an attempt to determine whether institutional investors,who are taxed less on dividend income relative to capital gains income, buy shares before they go ex-dividend.Using high frequency data and estimating the directions of trades and the identities of traders,he finds that institutional investors are more likely to capture dividends by buying shares before they go ex-dividend than individual investors.This kind of trading behavior is consistent with investors'differential tax preferences for dividends versus capital gains.

2.2.Capital structure

Based on Modigliani and Miller(1958,1963)and Miller(1977),corporate and personal level taxes affect firm value,expected return(cost of equity capital)and financial leverage.Graham(1996a,b)shows that firms increase their debt levelswhen the corporate marginal tax rate is high,suggesting the benefit of using debt in the presence of a corporate tax.Graham (1999,2000)further identifies a negative personal level tax effect on firms'use of debt.When personal level tax rate on interest income is high relative to that on equity income,firms reduce their debt use.

Dhaliwal et al.(2006)examine the effect of leverage and taxes on firms'cost of equity capital.They show that a firm's cost of equity capital is a function of its financial leverage,corporate taxes and personal level taxes for shareholders and bondholders in the following manner:

where KLis the cost of equity capital for a levered firm,KUis the cost of equity capital for an unlevered firm,r is the interest rate on bonds,tcis the corporate tax rate,tpsis the tax rate on equity income for shareholders,tpbis the tax rate on interest income for bondholders,BL is the levered firm's borrowings and SL is the levered firm's market value of equity.

This equation suggests that a firm's cost of equity capital increases with its financial leverage,and that this leverage induced equity premium decreases with corporate taxes and increases with the personal level tax penalty of interest income versus equity income defined as(1-tps)/(1-tpb).Dhaliwal et al.(2006)find evidence supporting these predictions.

2.3.Capital gains lock-in

Capital gains tax has its own unique research implications.Capital gains tax is only levied when investors sell an asset and on the realized appreciation of the asset.A mere appreciation in value of an asset in an investor's investment portfolio does not trigger capital gains taxes.When an investor considers the selling of an asset,he has to take into account the tax cost of selling the asset.Selling will accelerate the realization of capital gains taxes making the investor reluctant to sell.This causes a reduction in the supply of that asset in the market and an increase in its price(Klein,1999;Viard,2000).This is called the lock-in effect of capital gains taxes.

Of course,with perfect tax capitalization when the investor initially acquires the asset,lock-in need not happen.However, when we have unexpected price appreciations(George and Hwang,2007),unexpected capital gains tax rate changes(Dai et al.,2008),transitions from short-term capital gains to long-term capital gains(Reese,1998),or incomplete initial capitalization,lock-in can happen when an investor considers the sale of an asset.Evidence on the lock-in effect would demonstrate that tax is an important cost of holding an asset.

2.4.Tax aggressiveness

Tax aggressiveness is a line of literature that has gained a lot of attention lately.In the US,firm managers prepare financial statements based on GAAP(Generally Accepted Accounting Principles)and tax returns based on the IRC(Internal Revenue Code).GAAP and the IRC are often different from each other,causing a divergence between income based on GAAP and income based on the IRC(a book-tax difference).Firm managers also actively manage GAAP income upward and taxable income downward,further widening this divergence or book-tax difference.Therefore,a firm's tax aggressiveness is reflected in its magnitude of book-tax difference or effective tax rate(Dyreng et al.,2008).It can also be reflected in its use of tax shelters(Wilson,2009).

Hanlon(2002)shows that firms with large book-tax differences have less persistent earnings.Tax aggressiveness also affects firm value.Desai and Dharmapala(2006,2009)argue that tax aggressiveness is associated with agency costs.In firms with poor corporate governance,tax aggressiveness destroys firm value.Chen et al.(2010)show that a unique agency conflict between dominant and small shareholders in family firms causes them to be less tax aggressive.Graham and Tucker (2006)show that tax aggressiveness(use of tax shelters),as a form of non-debt tax shield,also reduces firms'borrowing.

3.China topics

3.1.Following MM

A lot of China-related tax research has focused on how changes in tax policies affect firms'capital structure.For a period of time,Chinese firms'capital structure has been thought to be set exogenously and constrained largely by ideology and government control.This is especially true at the time a firm is established and publicly listed.However,with the development of China's reforms and capital markets,more and more firms are using market mechanisms to compete for resources.Therefore,the formation of firms'capital structures has evolved into an endogenous process.A few important tax policy changes have provided great settings for tax research in China.

In 2000,the central government rescinded the so-called‘‘tax-and-refund''preferential tax treatment to listed firms.The rescission started in 2002.‘‘Tax-and-refund''means that while the central taxing authorities will tax firms at 33%,local governments will refund 18%of the taxes to firms.A purpose of this policy is to assist local firms'competitiveness when they do not receive preferential tax treatment from the central government.The rescission of this policy effectively increases many firms'corporate tax rates.Based on Modigliani and Miller(1958,1963), firms will increase their reliance on debt in order toutilize the debt tax shield when corporate tax rate is high.Wu and Yue(2006)find that while before the rescission of‘‘taxand-refund'',there is no significant difference in financial leverage between firms that enjoy this tax benefit and firms that do not enjoy this tax benefit,after the rescission,firms that formerly enjoy this benefit start to increase their financial leverage.

The new 2008 Corporate Tax Act unifies tax rates for domestic and foreign firms in China.Before 2008,domestic firms were taxed at 33%while foreign firms and others that received preferential tax treatment were taxed at 15%.After 2008, tax rates for these firms gradually converge to 25%.In other words,the tax rate for domestic firms formerly not receiving preferential tax treatment decreases while that for foreign firms or firms formerly receiving preferential tax treatment increases.Therefore,financial leverage should decrease for firms formerly not receiving preferential tax treatment and it should increase for foreign firms and firms formerly receiving preferential tax treatment.Wang et al.(2010)find results supporting these predictions.

In examining the effect of tax regime changes on capital structure,Chinese firms'ownership structure offers a special twist.State ownership affects firm behavior and value and therefore the effect of tax regime changes differently from non-state-owned firms.Firms with high state ownership tend to have a closer relationship with the government and therefore tend to shoulder more social responsibilities,including paying more corporate taxes(Wu,2009).Further,these firms are less likely to incorporate firm value maximization in their decision making process when pursuing social responsibilities.In fact,to the government,both the profits of state-owned firms and the taxes that they pay represent increases in government wealth.Therefore,state-owned firms have lower incentives to managing their tax bills than non-state-owned firms.Wang et al.(2010)find that after the 2008 tax act,state-owned firms are less sensitive to the change in the debt tax shield than non-state-owned firms.

3.2.Unique topics in China

Of course,the above examples are largely based on MM theories.It is important to keep in mind that China is very different and unique from more developed western economies.Reasoning based on western economies often does not work properly in China.However,this only adds glamour to China research.

For example,taxation in China is sometimes not directly dependent on a firm's income or revenue.Every year,tax will increase by a predetermined percentage set at the beginning of the year regardless of a firm's performance.Miraculously, this target is often met.It would be an extremely interesting topic to examine how firms negotiate their tax liabilities with the government.

Further,during the last three decades,China went through many regulatory and law changes,a lot of which involved tax laws and financial reporting.China used to have almost perfect book-tax conformity.However,with convergence towards IFRS(International Financial Reporting Standards)and the 2000 Corporate Income Tax Act,book-tax differences have increased.Earnings and tax management further increases the gap between book income and taxable income.Managers have to balance financial reporting costs and tax costs in their decision making process.For example,China's tax law does not allow a deduction for inventory devaluation.When a firm decides to increase earnings through a reduction in the allowance for inventory devaluation,taxable income is unchanged.Therefore,firms may manage non-taxable items to reduce the tax costs of earnings management.This phenomenon is more pronounced for firms in high tax brackets than for firms receiving preferential tax treatment(Ye,2006).Large book-tax differences may also suggest that firms have low accounting quality. Wu and Li(2007)find that earnings persistence is lower for firms with large book-tax differences.

Large tax law changes also provide opportunities for examining tax-induced earnings management.Using the 2008 Tax Act as an example,tax rate changes affect different firms differently.Firms whose tax rates are expected to decrease may delay earnings recognition.The case for firms whose tax rates are expected to increase may not be that obvious.Because tax rates increase gradually,these firms have to balance the benefit of a lower tax rate now and time discounted tax liabilities in the future.The incentive to accelerate earnings recognition is less pronounced.Wang et al.(2009)find results supporting these predictions.

From a different angle,Chan et al.(2010)investigate whether departure from a tax-based accounting system towards IFRS convergence in China encourages tax noncompliance and whether weakened book-tax conformity affects the informativeness of book-tax differences for tax noncompliance.They find that as book-tax conformity decreases,tax noncompliance increases and that the informativeness of book-tax differences on tax noncompliance attenuates as book-tax conformity weakens.This is an excellent study that utilizes regime changes in taxation and financial reporting.

China's recent reform on wage deductions for tax purposes can also provide a lot of research opportunities.This reform can haveadeepimpactonfirm'scostofcapital,financialleverage,laborcosts,etc.While wages are always deductible in the US and other western economies,the lack of a regime change makes empirical analysis difficult to perform in these countries.

3.3.Techniques

As reflected inthe examples that we use above,eventstudiesareimportant to taxresearch.There are basically two typesof events,firm-specific events and common events.Firm-specific events include earnings announcements,ex-dividend days, management earnings guidance,etc.Common events include reporting and disclosure rule changes,tax regime changes,etc. Tax regimes changes are natural experiments that often provide great opportunities for studying tax issues.Recent successful papersareWuandYue(2006),Wangetal.(2009,2010),etc.Dopayattentiontotaxregimechangesandconducteventstudies.

In all research,it is important tell a cogent story.You can tell a story at least in two ways:use some algebra to tell the story,or use words to tell your story.Either can work.However,often,a little math can help.So,do your algebra properly.

4.Use imagination in research

For every phenomenon in life,there is a tax explanation!This is perhaps an exaggeration but of course we do not ask you to take this literally.But if tax takes away 30%of our earnings,it is going to have a major impact on our behavior and attitudes.In many situations,its impact is likely big.By keeping the effect of taxes in mind,we can potentially find answers to many of life's persistent questions.

There are many examples.Elton and Gruber(1970)provide a tax answer to why stock prices do not drop by the amount of dividends.We already know that the debt tax shield increase firm value.However,the presence of non-debt tax shields can crowd out the effect of debt,making it less effective in enhancing firm value.Graham and Tucker(2006)show that tax shelters can be a non-debt tax shield that can reduce debt usage and explain why firms sometimes use debt sparingly.In fact,any deduction can be a non-debt tax shield,wages,stock options,etc.If it is large,it can affect firms'debt usage and value.Taxes can even explain long-term reversals in stock returns.George and Hwang(2007)show that investors'rational reactions to locked-in capital gains better explain long-term reversals in US stock returns than irrational overreaction to news.In Hong Kong where capital gains are not taxed,reversals are nonexistent.

So keep tax in mind when looking for answers.If family ownership affects tax aggressiveness,then maybe organized labor can also affect tax aggressiveness.If tax aggressiveness affects equity value,then maybe it also affects debt pricing and covenant restrictions.If tax law changes affect earnings management incentives,then maybe they also affect employment and labor costs.

5.Do China research,do tax research,and be successful

According to a recent IMF report,the size of China's economy is expected to surpass that of the US by 2016 due to economic growth and exchange rate adjustment.This,if it comes to reality,will certainly add to the legitimacy of economic, financial and accounting research of the world's currently second largest economy and the most populous nation,China.

Currently,much of the accounting research revolves around the US.For example,theories are formulated based on US institutional settings and empirical analysis is based on US data.Recently,China researchers have certainly eked out a niche of China research following paradigms developed in western economies such as the US.However,we believe that the view that China research has to be based on western theories and provides a setting that is not available in the west but is conducive to testing westerns theories is perhaps wrong.If this is the case,then China research serves only to provide external validity for western theories and we lack legitimacy for our own research.China's success and failure stories are different from those from more developed economies.Or,researchers have not developed a theory general enough to explain all phenomena in all economies,developed or developing.If we do not have that theory,then we will have to tell China stories, which would suggest that China research is unique and important in its own right.

Having said that,we have to admit that this article is written largely based on theories developed in western economies. What we want to argue is that if these theories cannot explain China,do not panic as this is perhaps a good thing.We should not be shy about telling our own stories and developing our own theories.

Finally,do China research,do tax research,and you will be successful.

Bali,R.,Hite,G.L.,1998.Ex-dividend day stock price behavior:discreteness or tax-induced clienteles?Journal of Financial Economics 47,127-159.

Brennan,M.J.,1970.Taxes,market valuation and corporate financial policy.National Tax Journal 23,417-427.

Chan,K.H.,Lin,K.Z.,Mo,P.L.L.,2010.Will a departure from tax-based accounting encourage tax noncompliance?Archival evidence from a transition economy.Journal of Accounting and Economics 50,58-73.

Chen,S.,Chen,X.,Cheng,Q.,Shevlin,T.,2010.Are family firms more tax aggressive than non-family firms?Journal of Financial Economics 95,41-61.

Dai,Z.,Maydew,E.,Shackelford,D.A.,Zhang,H.H.,2008.Capital gains taxes and asset prices:capitalization or lock-in?Journal of Finance 63,709-742.

Desai,M.,Dharmapala,D.,2006.Corporate tax avoidance and high-powered incentives.Journal of Financial Economics 79,145-179.

Desai,M.,Dharmapala,D.,2009.Corporate tax avoidance and firm value.The Review of Economics and Statistics 91,537-546.

Dhaliwal,D.,Li,O.Z.,2006.Investor tax heterogeneity and ex-dividend day trading volume.Journal of Finance 61,463-490.

Dhaliwal,D.,Krull,L.,Li,O.Z.,Moser,W.,2005.Dividend taxes and implied cost of equity capital.Journal of Accounting Research 43,675-708.

Dhaliwal,D.,Heitzman,S.,Li,O.Z.,2006.Taxes,leverage,and the cost of equity capital.Journal of Accounting Research 44,691-723.

Dyreng,S.,Hanlon,M.,Maydew,E.,2008.Long-run corporate tax avoidance.The Accounting Review 83,61-82.

Elton,E.J.,Gruber,M.J.,1970.Marginal stockholder tax rates and the clientele effect.Review of Economics and Statistics 52,68-74.

Frank,M.,Jagannathan,R.,1998.Why do stock prices drop by less than the value of the dividend?Evidence from a country without taxes.Journal of Financial Economics 47,161-188.

George,T.J.,Hwang,C.,2007.Long-term return reversals:overreaction or taxes?Journal of Finance 62,2865-2896.

Graham,J.R.,1996a.Debt and the marginal tax rate.Journal of Financial Economics 41,41-73.

Graham,J.R.,1996b.Proxies for the corporate marginal tax rate.Journal of Financial Economics 42,187-221.

Graham,J.R.,1999.Do personal taxes affect corporate financing decisions?Journal of Public Economics 73,147-185.

Graham,J.R.,2000.How big are the tax benefits of debt?Journal of Finance 55,1901-1941.

Graham,J.R.,2003.Taxes and corporate finance:a review.Review of Financial Studies 16,1074-1128.

Graham,J.R.,Tucker,A.L.,2006.Tax shelters and corporate debt policy.Journal of Financial Economics 81,563-594.

Grinstein,Y.,Michaely,R.,2005.Institutional holdings and payout policy.Journal of Finance 60,1389-1426.

Grullon,G.,Michaely,R.,2002.Dividends,share repurchases,and the substitution hypothesis.Journal of Finance 57,1649-1684.

Hanlon,M.,2002.The persistence and pricing of earnings,accruals and cash flows when firms have large book-tax differences.Accounting Review 80,137-166.

Hanlon,M.,Heitzman,S.,2010.A review of tax research.Journal of Accounting and Economics 50,127-178.

Klein,P.,1999.The lock-in effect and equilibrium returns.Journal of Public Economics 71,355-378.

Li,O.Z.,2010.Tax-induced dividend capturing.Journal of Business Finance and Accounting 37,866-904.

Litzenberger,R.H.,Ramaswamy,K.,1979.The effect of personal taxes and dividends on capital asset prices.Journal of Financial Economics 7,163-195.

Litzenberger,R.H.,Ramaswamy,K.,1980.Dividends,short selling restrictions,tax-induced investor clienteles and market equilibrium.Journal of Finance 35, 469-482.

Litzenberger,R.H.,Ramaswamy,K.,1982.The effects of dividends on common stock prices:tax effects or information effects?Journal of Finance 37,429-443.

Michaely,R.,Vila,J.,1995.Investors'heterogeneity,prices,and volume around the ex-dividend day.Journal of Financial and Quantitative Analysis 30,171-198.

Miller,M.H.,1977.Debt and taxes.Journal of Finance 32,261-275.

Miller,M.H.,Modigliani,F.,1961.Dividend policy,growth and the valuation of shares.Journal of Business 34,411-433.

Modigliani,F.,Miller,M.H.,1958.The cost of capital,corporate finance and the theory of investment.American Economic Review 48,261-297.

Modigliani,F.,Miller,M.H.,1963.Corporate income taxes and the cost of capital:a correction.American Economic Review 53,433-443.

Reese,W.,1998.Capital gains taxation and stock market activity:evidence from IPOs.Journal of Finance 53,1799-1820.

Shackelford,D.,Shevlin,T.,2001.Empirical tax research in accounting.Journal of Accounting and Economics 31,321-387.

Viard,A.,2000.Dynamic asset pricing effects and the incidence of realization-based capital gains taxes.Journal of Monetary Economics 46,465-488.

Wang,Y.T.,Wang,L.L.,Gong,C.P.,2009.Tax reform,earnings management and corresponding economic consequence.Economic Research 3,86-98.

Wang,Y.T.,Wang,L.L.,Yang,P.,2010.Nature of ownership,debt tax shield and capital structure.Economic Research 9,122-136.

Wilson,R.,2009.An examination of corporate tax shelter participants.The Accounting Review 84,969-999.

Wu,L.S.,2009.State ownership,preferential tax policy,and debt.Economic Research 10,109-120.

Wu,L.N.,Li,H.L.,2007.Can investors see through the gap between book income and taxable income?Management World 10,114-138.

Wu,L.S.,Yue,H.,2006.Unification of tax rates and change of capital structure:an investigation on the rescinding of‘‘tax-and-refund''preferential tax treatment.Management World 11,111-127.

Ye,K.T.,2006.Earnings management and taxation:an investigation on the gap between book income and taxable income.China Accounting Review 2,205-223.

27 April 2011

☆This article is not intended as a literature review of capital market research in taxation.For literature reviews,readers can consult Shackelford and Shevlin(2001),Graham(2003)and Hanlon and Heitzman(2010).Instead,this article is based on our own experience with research in capital markets and taxes.Therefore,it is biased and incomplete.

☆☆This paper has benefited from discussions with Professor Xijia Su of China-Europe International Business School and Professor Feng Liu of Xiamen University.

*Corresponding author.Tel.:+65-6516 7798.

E-mail address:bizzhenl@nus.edu.sg(O.Z.Li).

Tax

Capital markets

China