Effective Cooling Measures?

2010-10-14ByLANXINZHEN

By LAN XINZHEN

Effective Cooling Measures?

By LAN XINZHEN

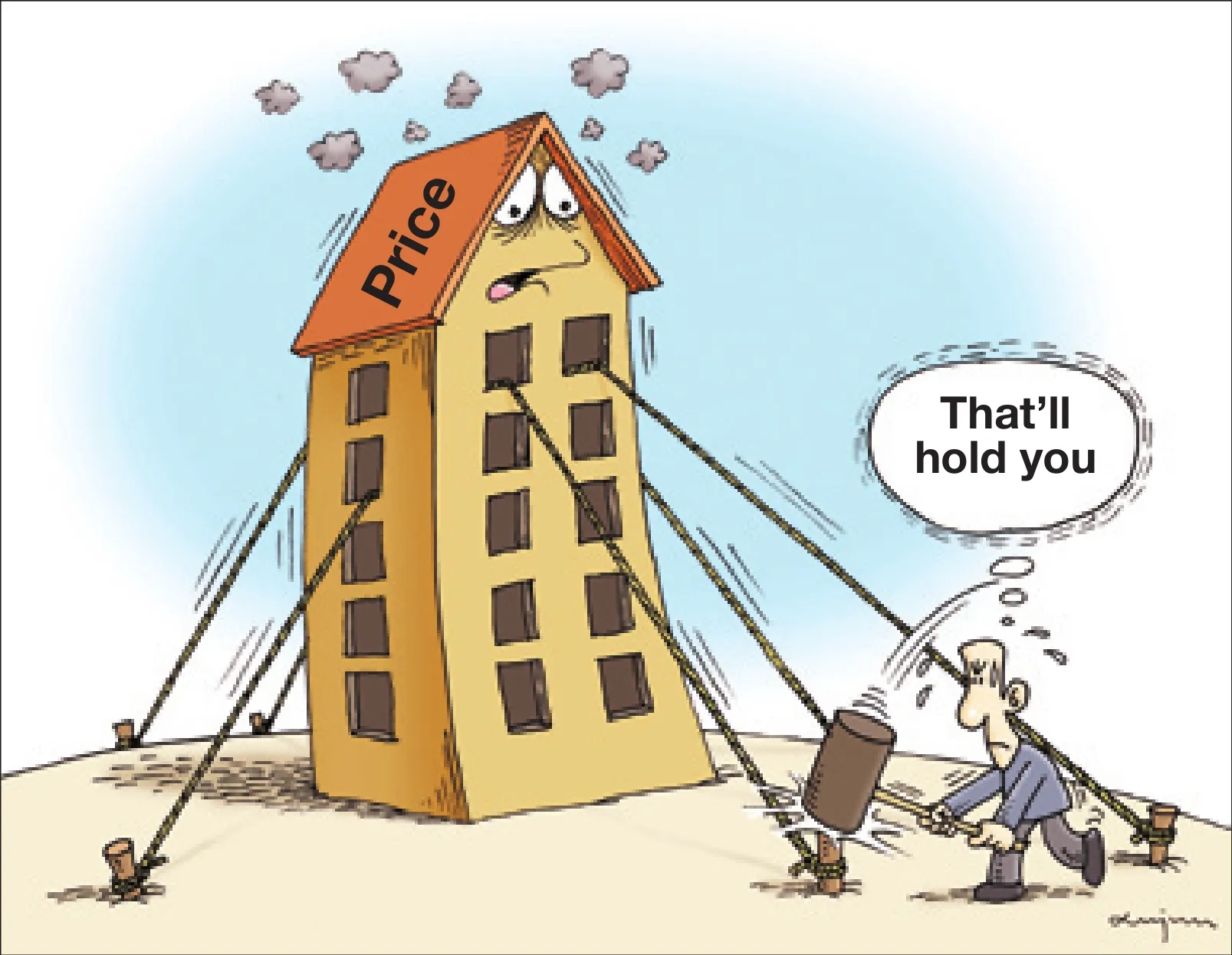

Questions arise over policies meant to decrease housing prices in China and the overall future of the property market

Astring of policies aimed at cooling the housing market are taking effect, as galloping house prices have slowed to a saunter. The policies introduced in April, cover land supply, taxes, credit and property transactions.

“Home sales dropped as prices stagnated and the housing market will hopefully go through new rounds of adjustment in the next three months to bring further decreases to house prices,” said Xu Shaoshi, Minister of Land and Resources, on July 4 while attending a meeting in Dalian for heads of land and resources bureaus.

But potential homebuyers remain idle, watching and waiting for the situation to play out and, more importantly, hoping for price decreases to sweep China’s housing market.

Market stalemate

Residents in Beijing,

Shanghai and other Chinese cities saw home prices skyrocket during the past two years. The supply of new homes also increased. In Beijing alone, 21 housing projects were launched in June, of which nine were completely new projects not affiliated with other housing developments.This was the largest supply of new projects in Beijing after the Central Government started taking measures to cool off the market this year.

Statistics from the Beijing real estate transaction administration website said 4,241 apartments were sold in June, for a total area of 415,000 square meters, decreasing 24.9 percent and 20.4 percent, respectively, from the previous month.

But home prices have yet to make any substantial decline. Houses were sold at an average price of 18,000 yuan ($2,635.4)per square meter in the fi rst half of June in Beijing, increasing 7.5 percent from May,according to statistics from Beijing-based Yahao Real Estate Brokerage Co. Ltd.

Statistics released on July 2 by China’s housing industry website, sofang.com,said, compared with May, the average price in June increased in 32 of 52 cities nationwide, and dipped slightly in only 19 cities.

“The number of home deals shrank while home prices didn’t fall noticeably,”said Deputy Manager of Yahao Ren Qixin.“This just indicates home buyers and sellers are continuing to wait patiently for further developments.”

Either property developers decreasing the prices to an acceptable level or the government lifting administrative measures to curb speculative property purchases will help break China’s stalemate-enveloping housing market, Ren said. But neither of these two scenarios should be expected in the near future.

“Property developers have enough cash to withstand sales drops and will not hastily cut the prices, while the government will continue current housing market regulation policies for stability,” Ren stated. “Anemic home sales will be the main feature of the housing market in the short run.”

Stringent measures

Measures to curb speculative home purchases have proven effective, especially in the land supply and purchase market where excessive investments have been in retreat.

But the Ministry of Land and Resources will not slack off regulation and supervision over land supply and utilization activities just yet, said Xu.

The ministry is working to identify and dispose of unused land for property development purposes and promises to increase oversight on land supply and land use for property development, Xu said.

In the second half of this year, the ministry will actively regulate the housing market and guarantee land supply for social security housing projects. It will also increase land supply information transparency, Xu added.

Management and regulation of land for property development purposes, Xu said, is and will remain a priority for the ministry.

“Local functions relating to land and resources must never be allowed to slack off. It should show the residents the government’s determination and con fi dence in curbing rising prices and improving living conditions for the people,” the ministry toldPeople’s Dailyon June 21.

But since the property industry is a major contributor to local economies, some local governments are hesitant to regulate the housing market at the cost of steady GDP growth.

Now, many market observers consider recent statements from the Ministry of Land and Resources and the Ministry of Housing and Urban-Rural Development as indicative of a second round of regulations later this year.

The two ministries are essentially telling the market that the government will not falter in its efforts to cool the property market, despite speculation that the government could ease up its tough measures and break the stalemate now facing property developers and homebuyers, said Chen Guoqiang, Vice Chairman of the China Real Estate Society.

Inevitable price drops

Ren Zhiqiang, Chairman of Huayuan Property Co. Ltd., an outspoken real estate tycoon, has reaped many a benefit from housing price hikes in recent years. Now, he said it’s only a matter of time before home prices start to decline.

“Under the government’s stern measures, price decreases will become a major feature of the housing market this year,” Ren said.

The housing market has become polarized, Ren added. Home prices have fl uctuated and inventories increased in fi rsttier cities where the already high housing prices are rising too fast. But in some second-tier and most third- and fourth-tier cities,where the low prices have left ample room for increases, prices are soaring along with increases in demand, Ren declared.

Steven Chen, Executive Director of the National Real Estate Manager Alliance,predicted housing prices in China would decrease noticeably in the second half of this year.

And a last-minute change of heart by the Central Government toward housing market regulations this year is all but impossible.Speci fi c measures, Chen said, will be implemented and strike a heavy blow to housing prices in the second half of this year.

Land value-added taxes and tougher punishments on land hoarding could help increase land supplies in the second half of this year, Chen said.

Housing supplies will also increase as completed housing projects that were kept off the market by developers waiting for prices to reach more profitable levels are made available to the public.

In addition, the decrease in real demand and stagnant transactions will weigh on inventories, possibly reversing the supplydemand balance and affecting the negative buyer sentiment in the housing market.

Price prediction

While experts agree a dip in prices will occur by this year’s end, the question few can answer is: To what extent will the prices stumble?

“It’s hard to predict, because the housing prices will decrease at varied degrees in different cities,” Xu said.

The trickiest part of the problem, Ren Zhiqiang said, is that none of China’s property developers knows how to cut the prices,or what an appropriate decrease would be.

Chen warned against the possibility of home prices rebounding when low interest rates are adopted to mitigate inflation. The central bank has postponed raising interest rates several times, doing nothing concerning rising in fl ationary expectations, which have fueled investor expectations for asset price hikes and made property developers and speculative investors reluctant to offer lower prices, Chen said.

The fact that inflationary expectations and low interest rates have propelled asset prices has counteracted the effects of certain regulative measures and will help home prices rebound, Chen said.

WANG DINGCHANG