Auto Alternatives

2010-10-14DINGWENLEI

Auto Alternatives

China counts on developing new-energy vehicles to maintain its auto-market leadership

While it remains to be seen what kind of progress will be made following the UN Climate Conference in Cancun, Mexico,one thing is certain: China is taking great strides to honor its emission reduction commitments.

Already, the country has beefed up energy conservation, environmental protection and new-energy development. Targets have been outlined, measures adopted and favorable policies enacted—these, while winning international recognition, have allowed China to gain a foothold in the global low-carbon race.

And China, already the world’s largest automaker as of 2009, now looks to overtake developed countries in producing newenergy vehicles.

New-energy vehicles were listed as one of China’s strategically important emerging industries during the 12th Five-Year Plan period (2011-15), and the subsequent plan for the auto industry also makes developing new-energy vehicles the industry’s top priority. The plan also proposes selling 1 million new-energy vehicles by 2015.

The Ministry of Industry and Information Technology (MIIT) will soon announce a roadmap for energy-efficient and newenergy vehicle industries for the next decade.China will invest more than 100 billion yuan($15 billion) in forging a complete industrial chain for new-energy vehicle development and make itself the world’s largest producer of such vehicles within 10 years.

“China’s new-energy vehicle market will progress at full speed, and as a key component to upgrading the industry will provide a reliable guarantee that China ful fi ll its emission reduction targets in the next 10 to 15 years,” said Lu Xi, Deputy Director of the Industrial Policy Department of the MIIT.

On the consumer front, Beijing won approval on November 24 to launch a scheme of subsidizing individual purchasers of plugin hybrids or all-electric cars, in efforts to realize sales of 30,000 new-energy vehicles by 2012. To facilitate sales, Beijing will build 36,000 charging poles and 100 fastcharging stations in the next two years.

This has made Beijing the sixth Chinese city to launch similar schemes. More cities such as Chongqing and Wuhan will likely join the campaign.

Despite all these favorable policies and tempting subsidies, the sales of new-energy vehicles nationwide, however, are not that encouraging. For instance, only Shenzhenbased BYD Auto and Hangzhou-based Zotye Auto have sold one all-electric car each to individual buyers, and several hundred to corporate or utility buyers.

“Auto makers, industrial associations, as well as the government have to overcome a number of obstacles in order to make newenergy vehicles a popular choice for average Chinese consumers,” said Luo Lei, Vice Secretary General of the China Automobile Dealers Association.

Roadmap for the future

According to the ambitious roadmap for China’s new-energy vehicle sector,China will strive to become the world’s top new-energy vehicle player in terms of its industrial output and market size by 2020.

While China should have 5 million newenergy vehicles by then, the country will also have an annual production and sales volume of 15 million energy-efficient vehicles,mainly micro-hybrids.

The new-energy vehicle as de fi ned in the roadmap mainly refers to all-electric cars,including plug-in hybrids that use an internal combustion engine to charge the battery as a range-extender, fuel cell vehicles and other alternative fuel vehicles, said Ye Shengji,Associate Secretary General of the China Association of Automobile Manufacturers.

“While all-electric cars and plug-in hybrids are two options for China’s new-energy vehicle development, we’ll also promote micro-hybrid technologies in order to boost energy ef fi ciency of fossil fuel vehicles,” Ye said.

Fuel consumption per 100 km by new passenger cars will be cut to 5.9 liters with more than 500,000 new-energy vehicles by 2015, and to 4.5 liters by 2020.

“A total of 500,000 new-energy vehicles will account for about 2.5 percent of China’s total auto possession by 2015. That means hybrid technologies will still be widely applied in order to effectively cut auto fuel consumption,” said Ye.

The roadmap proposes to invest 50 billion yuan ($7.5 billion) in establishing a special fund for research and development and commercial use of key technologies, 30 billion yuan ($4.5 billion) in related demonstration and promotion efforts, and 20 billion yuan ($3 billion) in promoting micro-hybrid vehicles.

Promoting new energy

In the absence of a convenient charging facility network, major electric-car makers such as BYD, Chery and Zotye have all set out to raise consumer awareness to their electric cars or plug-in hybrids through cooperation with taxi and bus companies or leasing programs.

“New-energy vehicle makers will have to count on average consumers to achieve sales targets, that’s why they should rev up marketing and allow individual consumers to experience advantages of such vehicles,” said Luo.

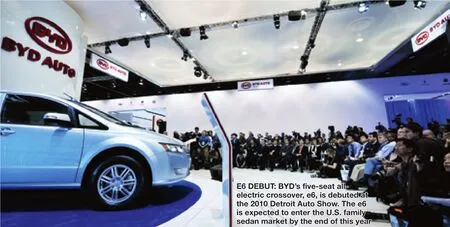

By the end of this year, BYD will in total introduce 100 e6 vehicles into Shenzhen’s taxi fl eet.

The e6 now runs at a range between 160 km and 220 km per day, and can meet the demand for taxi operators in Shenzhen—single-shift taxi drivers in Shenzhen generally drive no more than 250 km a day, Li Guanghan, Vice General Manager of Pengcheng Taxi toldChina Securities Journal.

Li, confident about electric vehicle’s market prospects, said the cost for electric taxi operation stands at less than 25 percent of that for gasoline-fueled taxis. This power efficiency will allow a taxi company to pro fi t from the e6, which costs 179,800 yuan($27,038) per unit—government subsidies at central and local levels will wipe 120,000 yuan ($18,045) off the original price—in the next three years, he said. Taxis in China usually cost around 80,000 yuan ($12,030).

The Shenzhen Municipal Government plans to have 24,000 new-energy vehicles and 200 charging stations by 2012.

While BYD targets utility buyers and hopes demonstrations through taxi operation in Shenzhen will help the e6 enter the U.S. family sedan market, Chery and Zotye encourage potential buyers to experience driving their electric cars through leasing programs.

Chery charges a daily rent at 90 yuan($13.5), while Zotye launched 100 allelectric cars at a monthly rate of 2,500 yuan($376) on January 21 of this year. Based on market recognition accumulated from the half-year trail operation, Zotye sold China’s fi rst all-electric car, the 5008EV, to an individual buyer, one of Zotye’s first group of lessees on July 26.

Unlike BYD’s plug-in hybrids and all-electric cars that rely on suf fi cient charging facilities,Zotye only sells vehicles and leases battery under a battery exchange system advocated by Better Place, a California-based company aiming to produce a market-based transportation infrastructure that supports electric vehicles.

Luo prefers leasing to utility buyers to promote new-energy vehicles. “Similar to overseas auto leasing financing services, new-energy vehicle leasing at cheap rents will bring consumers closer to being impressed by the performance and cost advantages of such vehicles,” he said.

Speed bumps

In addition to high prices and a shortage of sufficient charging facilities, the yet to be improved maximum range per charge of electric cars, the lifespan of storage battery and a lack of industrial standards have not only deterred individual buyers, but also prevented the industry from growing fast.

Electricity charging convenience and high-intensity batteries will be two solutions to the limited range of electric cars.

Shenzhen has built China’s most intensive charging network, which still fails to meet demands. The e6 taxi drivers in Shenzhen have turned down passengers who want to travel more than 70 km away and Pengcheng Electric Taxi, a joint venture between Pengcheng Taxi and BYD, has to operate on single shifts because Shenzhen has only two charging stations now, said Li.

The taxi company has built two charging stations themselves, but they cannot afford building more due to high land costs.

The government is expected to support and subsidize construction of charging stations. Large state-owned enterprises, such as CNOOC, National Grid and South Grid,have all participated in the planning and construction of charging stations nationwide.

In addition to facilitate construction,China has to make breakthroughs in key technologies for batteries, electric motors and electric control systems.

Efforts should be made to increase battery intensity and lifespan, cut its size and weight and slash its cost—batteries now usually account for half of an electric car’s cost.

At present, more batteries are needed in order to increase the range, which could add to a model’s weight and in turn consume more electricity and affect the extended range. The e6, for example, is as heavy as 2.35 tons, and its battery weighs nearly 1 ton.

Ouyang Minggao, an EV expert with Tsinghua University in Beijing, advocated lowering the threshold of electric vehicle development and developing small models to cut material and manufacturing costs. Zotye,for instance, introduced a model powered by lead-acid batteries, which is much cheaper than mainstream lithium battery. The model was priced between 40,000 yuan ($6,015) and 50,000 yuan ($7,519), targeting rural consumers.

Also, with an eye on facilitating battery exchanges at charging stations and national promotion of electric cars carrying different brands,it’s imperative to establish a set of uni fi ed standards for battery products and services such as charge couplers and battery recycling.

According to MIIT official Lu Xi, the ministry is cooperating with industrial associations to work on national standards on charging stations, charging poles and charge couplers. Charge couplers’ standards in particular are expected soon, he said.

JIANG HONGJING

ZHANG JUN